⚡ Executive Summary & Takeaways

|

Strategic Roadmap

- The Macro Shift: Why Colombia’s CINA is Winning the Capital War

- Qualification Mechanics: Spend Thresholds and Local Compliance

- The Monetization Pathway: Liquidity via Secondary Markets

- Market Intelligence: Tracking Validated Colombian Partners

- Leveraging Vitrina for Colombian Supply-Chain Integration

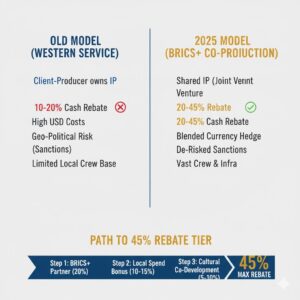

The Macro Shift: Why Colombia’s CINA is Winning the Capital War

The global content industry is currently undergoing a massive recalibration. As studios and streamers shift from “volume at all costs” to “strategic profitability,” the choice of production location is now driven by a territory’s ability to de-risk capital. According to recent reports from Proimágenes Colombia, the territory has successfully anchored over 165 international projects since 2012, generating more than USD $861 million in direct investment.

The signal coming from Bogotá is clear: the 2026 CINA quota has been boosted to a record-breaking COP 350 billion (USD $90 million). This is not merely an incremental increase; it is a 49% surge intended to capture high-budget global slates that might have previously looked to Europe or Oceania. For the executive persona, this indicates a mature, institutionalized commitment to maintaining one of the most competitive fiscal environments in Latin America.

Why does this matter now? Because the “pipeline of demand” is already thickening. The 2025 quota was fully allocated by September, reflecting a surge in activity from players like Netflix, Amazon MGM, and Zack Snyder’s The Stone Quarry. When a territory’s incentive is oversubscribed, the advantage goes to those who understand the mechanics of the supply chain and secure their local partners early.

Qualification Mechanics: Spend Thresholds and Local Compliance

To qualify for Colombia’s CINA Incentive, a project must meet precise financial and operational hurdles that ensure the investment benefits the local economy. The entry threshold is currently set at a minimum local expenditure of approximately USD $475,000 (COP 1.58 billion). For episodic content, the bar is set at an average per-episode spend of USD $114,000, with a minimum of four episodes required to qualify as a series.

However, the “Insider’s Secret” lies in the definition of “eligible spend.” All services—from catering and transport (logistics) to high-end VFX and post-production—must be provided by Colombian nationals or legally incorporated Colombian companies domiciled in the country. This creates a closed-loop economy that rewards local expertise and infrastructure.

Furthermore, the legal framework mandates the use of a local fiduciary account (Patrimonio Autónomo). This is a non-negotiable step that serves as the “trust engine” for the incentive. Every dollar spent must pass through this audited channel, ensuring that when the production wraps, the Ministry of Culture has a transparent data set to verify before issuing the CINA certificate.

Furthermore, the legal framework mandates the use of a local fiduciary account (Patrimonio Autónomo). This is a non-negotiable step that serves as the “trust engine” for the incentive. Every dollar spent must pass through this audited channel, ensuring that when the production wraps, the Ministry of Culture has a transparent data set to verify before issuing the CINA certificate.

The Monetization Pathway: Liquidity via Secondary Markets

One of the primary advantages of the CINA over traditional cash rebates is its negotiable security status.Cinema of Colombia Unlike the FFC (Colombia Film Fund), which is a direct cash payment but is capped at roughly USD $550k per project, the CINA has no project-specific ceiling. This makes it the vehicle of choice for high-budget international features.

The monetization process is highly efficient. Once the CINA is issued via the DECEVAL system (Colombia’s central securities depository), the foreign producer can sell the certificate on the secondary market. Large Colombian corporations—banks, insurers, and energy firms—buy these certificates to offset their own income tax liabilities. Because these companies have immediate tax needs, the secondary market is robust and liquid.

The bottom line is this: productions typically see cash in hand within 15 to 30 days of the certificate’s issuance. While brokerage firms facilitate the trade, the discount rate is relatively stable. After accounting for the 5% administrative fee paid to Proimágenes, producers can realistically expect a net cash yield of approximately 33.25% on their qualifying Colombian spend.

Market Intelligence: Tracking Validated Colombian Partners

In a market where the CINA budget is being snapped up faster every year, your choice of local Production Service Company (PSC) is your most critical strategic decision. The following leaders have proven their ability to handle the scale, complexity, and audit requirements of the CINA framework.

Leveraging Vitrina for Colombian Supply-Chain Integration

For the executive producer, the real challenge is not just identifying Colombia as a location, but identifying the current capacity of the local supply chain. In a territory where the 2026 budget has surged to COP 350 billion, local crews and stages will book out months in advance.

This is where Vitrina’s census-level data and VIQI AI Assistant reshape the discovery phase. Instead of relying on static spreadsheets or outdated directories, executives can use VIQI to surface partners based on real-time project movement and verified credits. Whether you need a co-production partner for a period drama in Cartagena or a post-production studio in Medellin that qualifies for the CINA, Vitrina provides the verified intelligence to de-risk those connections.

Run Your Own Live Intelligence Search

Tap a query below to launch VIQI and identify your next partner in seconds.

Conclusion: The Path Forward

The bottom line is this: Colombia’s CINA incentive has matured into one of the most reliable and high-yield financial instruments in the global film and TV supply chain. By aligning a 35% transferable credit with a massive USD $90 million budget for 2026, the territory has effectively positioned itself as the primary hub for international capital in Latin America.

The path forward for 2026/27 production cycles requires a transition from opportunistic filming to strategic supply-chain integration. Utilizing Vitrina and VIQI ensures that you are connecting with pre-vetted partners who possess the specific “Hero Project” history required to navigate the CINA’s rigorous compliance landscape. De-risk your next project by sourcing your Colombian supply chain through the world’s most advanced industry intelligence platform.

Strategic FAQ

What is the minimum spend for Colombia’s CINA incentive?

The minimum expenditure required is approximately USD $475,000 (COP 1.58 billion) for features. For series, the requirement is an average of USD $114,000 per episode with at least four episodes produced.

How do I monetize the CINA tax certificate?

The CINA is a transferable security sold on the Colombian secondary market to domestic companies seeking to offset income tax. This typically yields a net cash return of 33.25% within weeks of issuance.

Does the CINA incentive apply to post-production?

Yes, the 35% rebate applies to post-production, VFX, and animation services, even if the project was not filmed in Colombia, provided the services are rendered by a domiciled Colombian company.

Is there a cap on the CINA incentive for 2026?

While there is no cap per project, there is a total annual quota for the country. For 2026, the Colombian government has allocated a record-breaking COP 350 billion (approx. USD $90 million).