Netflix Q3 2025 Financial Results

As the streaming wars evolve, Netflix continues to adapt with bold content choices, expansion into live events, and growing its ad-supported business. In Q3 2025, the company reported strong revenue growth and impressive subscriber gains—but fell short of earnings guidance due to a surprise tax expense in Brazil.

In this post, we break down the key financials, tailwinds, headwinds, strategic focus areas, and forward-looking statements from Netflix’s Q3 2025 earnings results—backed by executive commentary and official disclosures.

Netflix Q3 2025 – Earnings Summary & Analysis

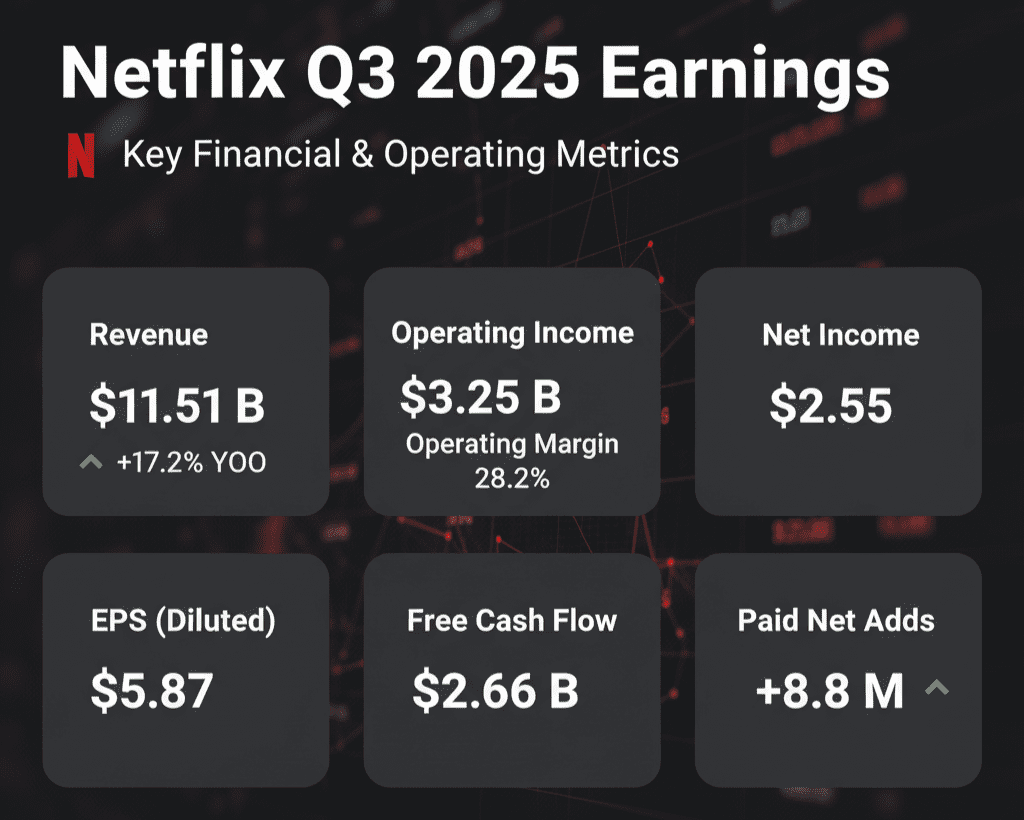

| Metric | Q3 2025 Actual | Q3 2025 Guidance | Beat / Miss | Q3 YoY (vs Q3’24) | Reason for Increase / Decrease |

| Revenue | $11.51 B | ~$11.5 B | ✅ In line | +17.2% (from $9.83B) | Growth driven by: strong paid net adds, higher ARM (average revenue per member), and scaling ad-tier performance. |

| Operating Income | $3.25 B | ~$3.6–3.7 B | ❌ Miss | +12% (from $2.91B) | Miss due to $329M tax provision related to Brazil; without this, Netflix would have beaten its margin target. |

| Operating Margin | 28.2% | 31.5% | ❌ Miss | ▼ Down from 30.0% | 330 bps impact from Brazil tax; normalized margin would have exceeded guidance. |

| Net Income | $2.55 B | No guidance | ❌ Miss vs street est. | +8% (from $2.36B) | Lower operating profit (due to tax hit) flowed through to net income despite revenue strength. |

| EPS (Diluted) | $5.87 | ~$6.90–7.00 (analyst est.) | ❌ Miss by ~15% | +9% (from $5.40) | EPS fell short due to Brazil tax charge, which reduced net income by approx. $0.75–0.80/share. |

| Free Cash Flow | $2.66 B | >$1.5 B | ✅ Beat | +21% (from $2.20B) | Strong content discipline, improved working capital, and continued margin efficiency despite tax hit. |

| Paid Net Adds | +8.8M | No specific guidance | ✅ Strong | +49% (from 5.9M) | Momentum from ad-tier, password sharing crackdown, and broader global growth. |

Tailwinds for Netflix in Q3 2025

-

Strong Revenue Growth Driven by Paid Net Adds and ARM: Revenue grew 17% YoY, fueled by growth in paid memberships and improved average revenue per member (ARM).

-

Record Performance in Advertising: Ad-supported tier posted its best quarter yet; ad revenue on track to more than double YoY.

-

Strong Member Growth and Engagement: Added 8.8M net new subscribers; achieved record share of TV time in the U.S. and U.K.

-

Content Hits Driving Franchises & Consumer Products: KPop Demon Hunters became Netflix’s most successful film ever and is being monetized via global licensing.

-

Netflix is gaining traction in live sports as a high-impact content category: The Canelo vs. Crawford boxing match delivered record-breaking engagement and proved Netflix’s live infrastructure capabilities.

-

Live events are becoming a key content pillar for real-time engagement: Netflix is using sports, reality, and comedy as formats to build appointment viewing, a key differentiator vs. VOD competitors.

Headwinds for Netflix in Q3 2025

-

Missed Operating Margin Guidance Due to Brazil Tax: A $329M tax accrual in Brazil dragged operating margin down to 28.2% vs. guided 31.5%.

-

Brazil Tax Exposure Raises Legal and Operational Risks: Management still evaluating the matter; potential for ongoing legal exposure or financial impact

-

Content Cost Pressures Persist: While not elevated this quarter, Netflix continues to manage inflationary pressure on content production.

[Supply-Chain Impact] Growth & Focus Areas Confirmed by Netflix in Q3 2025

-

Expansion of Advertising-Supported Tier: Ad-tier now accounts for ~40% of new sign-ups in ad markets, with ~70% QoQ growth in ad-tier memberships.

-

Investment in Live Programming (Sports, Events, Reality): Events like Canelo–Crawford are building the case for sports as a content and engagement engine

-

Gaming as a Long-Term Engagement & IP Extension Strategy: Launch of Netflix Game Controller and cloud gaming beta test reflect ongoing development.

-

Franchise IP Building via Animation, Merchandising & Spin-offs: Success of KPop Demon Hunters is a proof-point for Netflix’s animation and consumer products strategy.

-

Global Localized Content as a Scalable Growth Lever: Netflix continues to double down on content produced locally but consumed globally.

[Supply-Chain Impact] Expansion Avenues Hinted by Netflix in the Q3 2025 Investor Updates

-

Full-Year Free Cash Flow Revised Upward: Netflix now expects to generate ~$6.5B in free cash flow in FY25, up from previous >$5B guidance.

-

Long-Term View on Games Monetization: Netflix reiterated that gaming is an early-stage investment with long-term engagement goals.

-

Continued Expansion into Merchandising & Consumer Products: Netflix will scale its IP monetization strategy beyond the screen.

-

Emphasis on High-Quality Global Storytelling: Netflix will continue investing in premium content across regions to retain and grow global audiences.