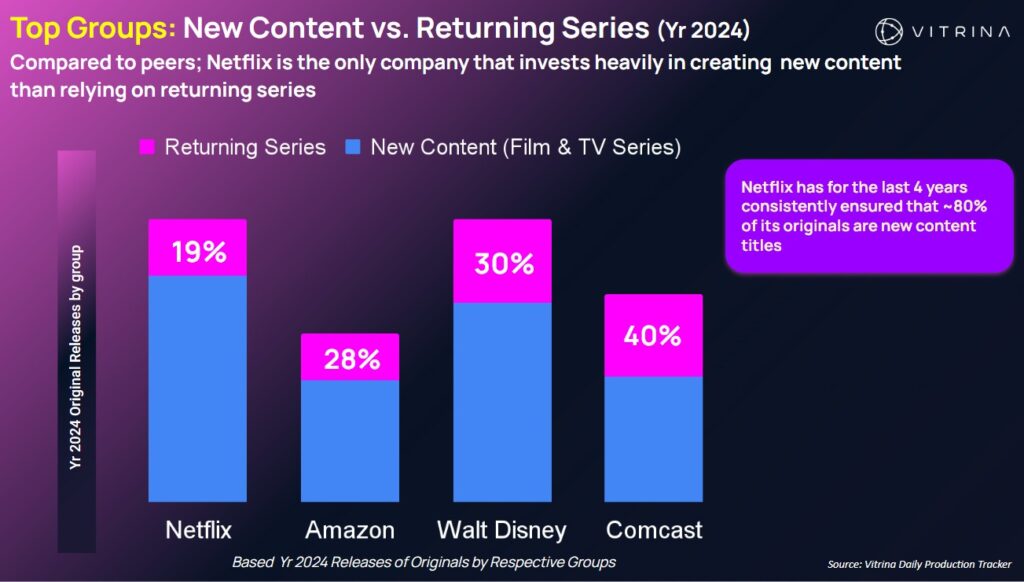

Vitrina’s latest data reveals just how much confidence the world’s biggest streamers have in their content slates—and Netflix stands apart.

In the high-stakes world of streaming, one of the clearest indicators of strategic confidence is how much of a platform’s slate is made up of new, untested content. It reflects how aggressively a company is investing in creative experimentation, IP development, and audience expansion.

Our latest analysis at Vitrina shows a sharp divergence in risk-taking across the major players:

The Numbers: New vs. Returning Titles

For the calendar year 2024 (films, series, documentaries):

| Company | % Returning Series | % New Titles |

| Netflix | 19% | 81% |

| Amazon Prime Video | 28% | 72% |

| Disney Group | 30% | 70% |

| Comcast/NBCU | 40% | 60% |

While Comcast plays it safe—leaning on known IPs and existing franchises—Netflix is aggressively doubling down on new, untested stories.

Why Is Netflix So Bold?

At Vitrina, we believe Netflix’s appetite for original concepts is not just a creative choice—it’s a strategic outcome of how the company is built and how its global supply-chain operates.

Here’s why Netflix can afford to take these risks:

1. Blockbuster Financials

With Q1 2025 revenue at $10.54 billion and an operating margin of 31.7%, Netflix is operating from a position of strength. It can afford to bet on bold, new content.

2. A High-Functioning Execution Machine

Netflix’s ability to produce 500+ Originals a year across 50 countries is unmatched in the industry.

3. Decentralized, Empowered Content Teams

Unlike traditional media giants with centralized greenlight bottlenecks, Netflix empowers regional content leads to make financing and production decisions quickly.

4. IP Sourcing That Starts at the Ground Level

Netflix has acquired IP pipelines across books (Roald Dahl), comics, and even gaming studios, giving it access to diverse, scalable story worlds.

5. Rock-Solid Subscriber Momentum

With consistent subscriber growth and high retention—even in competitive markets—Netflix can afford to lead with discovery rather than dependency on proven franchises.

What About the Rest?

While Netflix pushes forward with innovation, its competitors are still recalibrating.

- Amazon Prime Video is gaining scale but remains selective.

- Disney and Comcast rely heavily on their legacy IP and traditional television structures.

The Vitrina Perspective

The differences we see across platforms aren’t just about creative taste—they are about infrastructure, financial position, and operational philosophy.

At Vitrina, we track these shifts daily—across development pipelines, partner rotations, production markets, and supply-chain configurations. If you want to understand not just what’s being made, but why and how, that’s where we come in.

Want to understand content Strategy of Top Players?

Join Vitrina’s members-only network for access to live project data, partner tracking, and supply-chain analytics.