Deal Overview

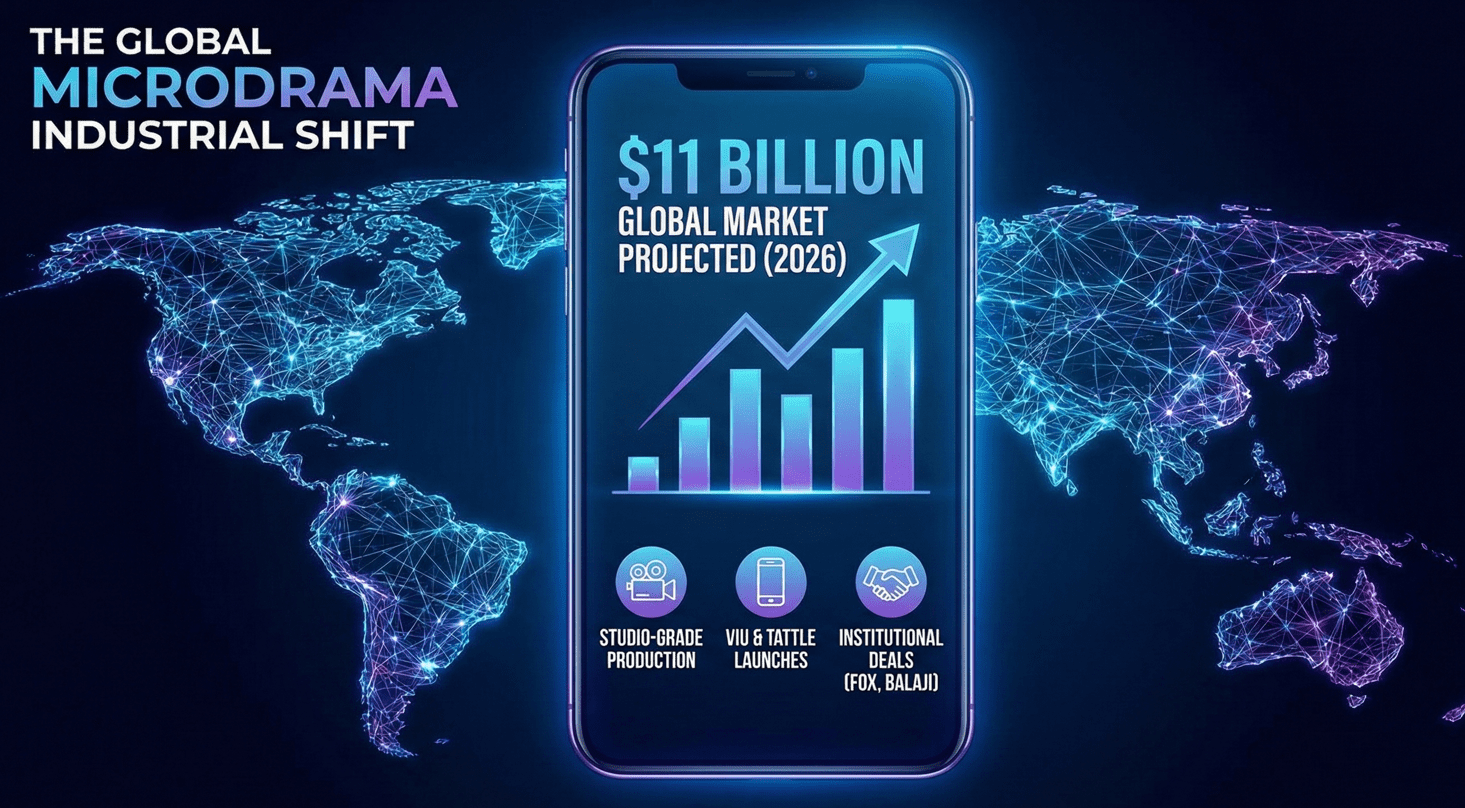

January 2026 has delivered a definitive signal: the vertical video market has ascended to a primary asset class. The launch of Viu Shorts in Asia and Tattle TV in the UK this month marks the entry of regional heavyweights into the platform wars, moving the sector beyond the initial phase of pure-play experimentation. However, these launches are just the visible tip of a much larger industrial shift that solidified in late 2025. Backed by a massive Fox Entertainment production deal, a pivot by India’s Balaji Telefilms, and state-level initiatives in China, the ecosystem has industrialized. With the market projected to hit $11 billion by 2026 and US revenues already clearing $350 million a quarter, the infrastructure is now in place for “Mobile Premium” to scale globally.

Parties & Dealmakers

-

Platform Leaders (Jan 2026): Janice Lee (CEO, Viu), Philip McGoldrick & Marina Elderton (Founders, Tattle TV).

-

Industrial Backers (Q4 2025): Fox Entertainment (Strategic Investor), Balaji Telefilms (Indian Studio), Jana Winograde (MicroCo), Kelly Luegenbiehl (Shorties Studios).

-

Ecosystem Validators: Procter & Gamble, SAG-AFTRA, NRTA (China

Strategic Mechanism 1: The New Frontline (Viu & Tattle)

The headline activity is defensive and territorial. Viu’s launch of “Viu Shorts” is a calculated move by CEO Janice Lee to ringfence Asian subscribers. By embedding a vertical feed directly into their premium OTT app (partnering with Rising Joy and KT Studiogenie), Viu is effectively establishing that vertical drama is now a retention requirement, not an ancillary feature. Simultaneously, Tattle TV is testing the “vertical niche” hypothesis in the UK. Founders Philip McGoldrick and Marina Elderton are betting that audiences will download a dedicated app for specific genres (like their reality title Dog Dates), challenging the “everything app” dominance of TikTok.

Strategic Mechanism 2: The Industrial Engine (Fox & Balaji)

While Viu and Tattle build the storefronts, the supply chain fueling them has been radically upgraded. The “unseen” momentum comes from Fox Entertainment’s October 2025 deal with Holywater, committing to a staggering 200-title slate over two years. This is the largest volume commitment by a US legacy studio to date, validating the “high-volume, studio-grade” thesis. Similarly, India’s powerhouse Balaji Telefilms has partnered with Story TV to adapt its soap-opera dominance for mobile screens. This involvement of legacy studios—along with new premium shops like MicroCo and Shorties—ensures that platforms like Viu will have access to broadcast-quality IP, not just user-generated content.

Strategic Mechanism 3: Institutional Scale ($11B Economy)

The capitalization of the sector is now undeniable. The market is tracking toward $11 billion by late 2026, driven not just by entertainment but by utility. China’s NRTA has launched the “Micro Drama Plus” initiative to fund 300+ tourism-focused dramas, effectively turning the format into a state economic tool. In the West, Procter & Gamble’s entry with branded IP (The Golden Pear Affair) and SAG-AFTRA’s labor protections provide the governance structures needed for global brands to invest safely.

Supply-Chain Impact

This shift unlocks significant opportunity across the production ecosystem. We are seeing a surge in demand for specialized talent—writers, directors, and editors who can translate narrative arcs into the vertical format. Traditional studios are rapidly adapting, creating hybrid workflows that blend broadcast-quality storytelling with agile production timelines. This volume—exemplified by Fox’s 200-title commitment—serves as a catalyst for innovation in post-production. Vendors that integrate automation and AI-driven editing tools are finding themselves uniquely positioned to manage these new industrial-scale slates, turning high-volume delivery into a sustainable, high-margin revenue stream.

Vitrina Perspective

The launch of Viu Shorts acts as a “definitive crossover event” for vertical drama—the point where the format moves from early adopters to the mass market establishment. We project that by Q4 2026, the distinction between “long-form” and “microdrama” will blur for the consumer. Vertical series will simply become the “mobile window” for major franchises, with studios using the format to incubate IP (like the Rags 2 Richmond feature adaptation) before greenlighting expensive theatrical runs.

Hong Kong

Hong Kong