| Strategic Pillar | Executive Insight |

|---|---|

| The 20% Cash Rebate | Buenos Aires (BAPA) offers a 20% cash rebate on qualified local spend for international features and series. |

| Arbitrage Potential | The currency gap between the official and “Blue” rates can provide an effective 30-40% discount on BTL labor. |

| $500k Spend Floor | Productions must meet a minimum expenditure threshold to trigger the rebate, favoring high-end streaming slates. |

| Vitrina Relevance | Access the project tracker to identify Argentine service companies with a 100% success rate in cash-rebate audits. |

Table of Content

The Rebate Mechanics: Mastering the BAPA 20% Fund

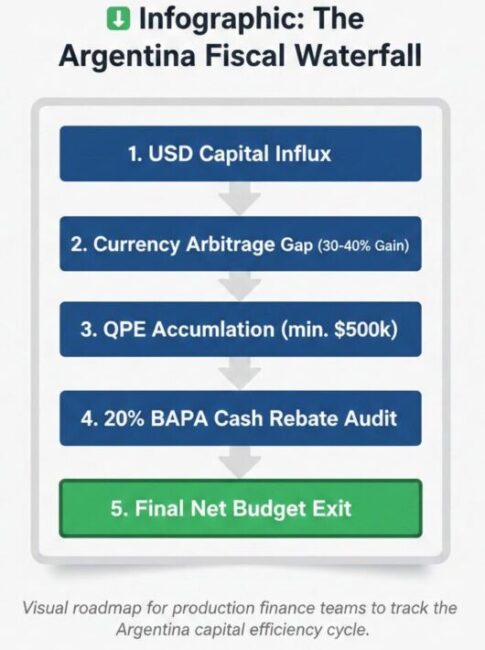

The Argentina Audiovisual Incentive is currently headlined by the Buenos Aires Cash Rebate (BAPA), a fund managed by the City of Buenos Aires (BA Audiovisual). Unlike traditional tax credits that require a local tax liability, this is a direct cash reimbursement. According to data from the BA Audiovisual Commission, the rebate covers up to 20% of qualified local expenditure (QPE) incurred within the city limits.

For finance executives, the strategic advantage lies in the cap. Projects can receive a maximum of approximately $1 million per project, depending on the fiscal year’s allocation. To qualify, a production must meet a minimum spend of roughly $500,000 (ARS equivalent). The qualified spend includes a wide array of services, from BTL crew labor and equipment rentals to catering and logistics.

However, the “Insider” reality is that the rebate is often used to offset the VAT (IVA) which stands at 21%. When structured correctly through a local service provider, the rebate effectively neutralizes the VAT burden, allowing the production to benefit from Argentina’s lower baseline costs without being penalized by the consumption tax.

Currency Arbitrage: Navigating the Official vs. Parallel Gap

The true “X-Factor” of Argentina Audiovisual Incentive planning is the currency strategy. Argentina operates a dual-exchange rate system: the Official Rate (set by the Central Bank) and various parallel rates (often called the “Blue Dollar” or MEP rate). According to reports from Bloomberg and local financial analysts, the gap between these rates has historically hovered between 30% and 100%.

For a foreign studio, this means that while their USD is converted at the official rate for the purposes of the “Qualified Spend” audit, the actual purchasing power of that dollar in the local market is significantly higher if managed through legal financial instruments like the MEP (Electronic Payment Market). This arbitrage effectively de-risks the production budget by lowering the real cost of labor and local services far below that of competing hubs like Colombia or Brazil.

Why does this matter? Because a project that appears to cost $5 million on a standard rate card can often be executed for $3.5 million net when the currency gap and the 20% cash rebate are factored into the waterfall. Executives should prioritize partners who demonstrate sophisticated treasury management to exploit these gaps legally.

Top 10 Argentine Production Service Leaders

To successfully exit an incentive audit in Argentina, partnering with a local entity that has “Hero Project” credibility is non-negotiable. Here are the top 10 leaders reshaping the Argentine supply chain in 2025.

1. K&S Films

Hero Project: Society of the Snow (Netflix)

Verdict: The gold standard for high-budget studio collaborations and incentive management.

2. Haddock Films

Hero Project: The Secret in Their Eyes (Oscar Winner)

Verdict: Premier partner for high-concept narrative features and international co-productions.

3. Patagonik Film Group

Hero Project: Zama

Verdict: Disney-backed powerhouse with unparalleled infrastructure and regional reach.

4. Pampa Films

Hero Project: Monzón (Netflix)

Verdict: Experts in episodic content and large-scale period production logistics.

5. Landia

Hero Project: Major Global Ad Slates

Verdict: Top-tier service for high-end commercials and visual-heavy content.

6. Rebolucion

Hero Project: Award-winning International Campaigns

Verdict: Led by Armando Bo; provides elite creative and technical production services.

7. Jacaranda Films

Hero Project: Operation Finale (Service)

Verdict: Specializes in providing seamless service for Hollywood and European studios.

8. Primo

Hero Project: Global Visual Campaigns

Verdict: Globally recognized for aesthetic excellence and technical production rigor.

9. The Lift (Argentina)

Hero Project: High-End Streaming Services

Verdict: International network that brings global standards to local Argentine shoots.

10. Pol-ka Producciones

Hero Project: El Lobista

Verdict: Historic leader in television slates with deep local crew connections.

Infrastructure and Labor: The “Society of the Snow” Effect

The recent success of Netflix’s Society of the Snow (partially shot in the Andes) has signaled a new era for Argentina’s technical crew. According to Omdia, Argentina currently boasts over 15,000 highly skilled audiovisual professionals, many of whom are multilingual and trained in the “Hollywood North” style of production management.

The infrastructure edge is particularly pronounced in post-production and VFX. Argentina has become a primary hub for localization and CGI due to its time-zone alignment with the US East Coast and its highly educated workforce. This allows productions to keep their Argentina Audiovisual Incentive qualified spend high by finishing the project in-country, rather than just using it for a location shoot.

Furthermore, the “Hero Project” track record of Argentine HODs (Heads of Department) in cinematography and art direction means that foreign productions do not need to fly in entire departments, further optimizing the budget and maximizing the 20% cash rebate on local hires.

Vitrina Intelligence: De-Risking the Argentina Greenlight

Argentina’s fiscal environment is a “high-alpha” play. To succeed, you must move from generic scouting to data-driven partner discovery. Vitrina surfaces the verified Argentine collaborators who understand the nuances of the 2025 cash rebate and the currency strategy required to protect your margins.

Accelerate with VIQI Intelligence

Strategic Conclusion

The Argentina Audiovisual Incentive is a sophisticated fiscal instrument that rewards productions willing to navigate its unique economic terrain. The combination of a 20% cash rebate and the significant currency arbitrage gap creates a capital efficiency that few other territories can match. For heads of production, the mandate is clear: Argentina is no longer just a place for “stunt locations,” but a structurally sound hub for high-end episodic and feature slates.

The path forward requires moving beyond manual networking toward verified discovery. As the 2024–2025 production cycle intensifies, the ability to partner with local service leaders who can manage both the creative vision and the complex fiscal exit is the ultimate competitive advantage. Vitrina provides the real-time data and executive-level connections necessary to transform Argentina’s fiscal promise into a tangible, high-ROI reality.

Strategic FAQ

What is the minimum spend for the Argentina (BAPA) cash rebate?

To qualify for the 20% BAPA cash rebate, productions typically must meet a minimum expenditure floor of approximately $500,000 (ARS equivalent) in qualified local spend within the City of Buenos Aires.

How does the currency arbitrage gap impact the production budget?

The gap between the official exchange rate and parallel rates (like the MEP or Blue Dollar) allows USD-funded productions to effectively increase their local purchasing power by 30-40%, significantly lowering BTL costs.

Is the Argentina incentive a tax credit or a cash rebate?

The BA Audiovisual incentive is a cash rebate, meaning it is a direct reimbursement of qualified expenses, rather than a tax credit that requires a prior local tax liability.

Can I use foreign heads of department (HODs) for Argentine shoots?

Yes, but only local labor qualifies for the 20% rebate. However, the high quality of Argentine HODs often removes the need for flying in entire departments, further optimizing the budget.