In this week’s edition of the Entertainment Supply Chain Digest. From Sony’s monumental $10 Billion Split with Zee to Fremantle’s strategic Boldprint Stake, and the grand reveal of India’s 500-Crore Film City with Virtual Production, the industry is undergoing a transformative phase.

Also join us this week in our LIVE session to explore the global landscape of Production Financing and Content Acquisition. Discover the learnings of 2023 and predictions for 2024.

We at Vitrina AI, the global marketplace for the entertainment industry, strive to keep you informed of the latest happenings in the industry, so you don’t have to spend countless hours researching and keeping up to date.

Know more about Vitrina’s partner and content discovery here.

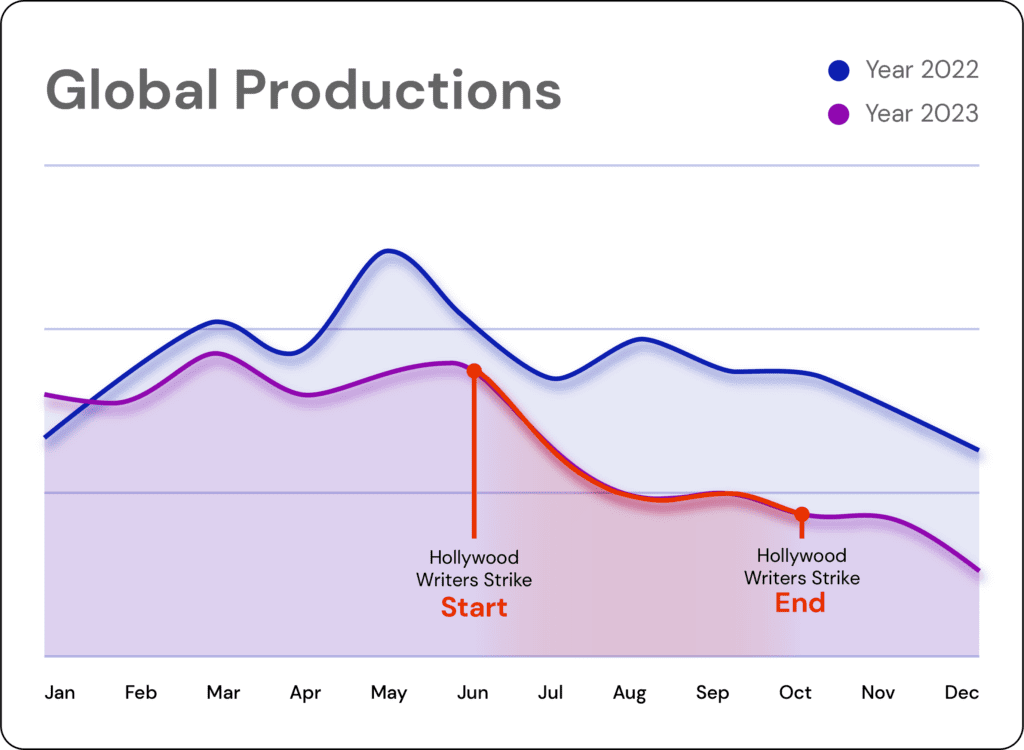

• In 2023, the M&E industry experienced a slowdown attributed to global market conditions, including the war in Europe.

• The Hollywood Writers and Actors strike, corporate restructuring in major groups like Warner Bros. Discovery and The Walt Disney Company, coupled with strategic shifts from linear to streaming for key players, significantly impacted the commissioning of new projects.

• Q4 continued to see a decline globally, with EMEA being the least impacted. BBC emerged positively, but overall, there was a decline in production across genres.

• Despite challenges with a series of cancellations, a higher share of season renewals within productions indicated a strategic focus on proven content.

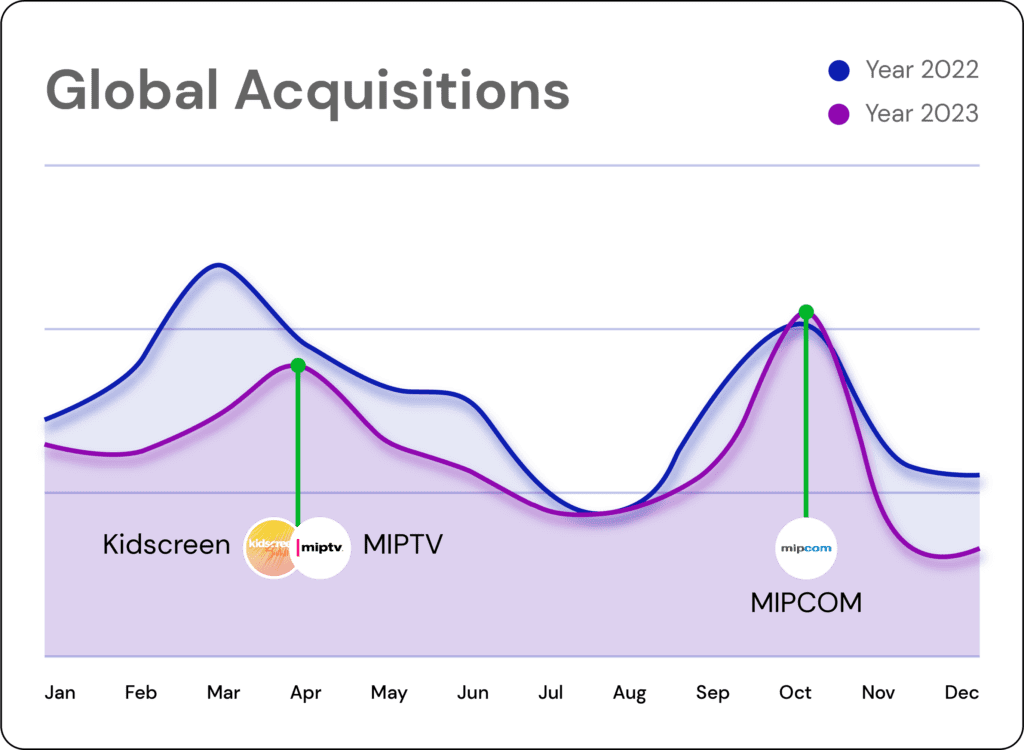

• Strikes in the USA impacting content production prompted a shift in the global content acquisition landscape.

• Companies, facing production slowdowns, strategically turned to acquiring existing content to meet platform and subscriber demands.

• Notable shift observed during industry events like Cannes and MIPCOM in both 2022 and 2023.

• Companies actively engaged in acquiring diverse and proven content during these international marketplaces.

• Acquiring existing content filled the gap resulting from strike-induced production delays.

• Enabled platforms to maintain a robust content offering for their subscribers.

• The spike in content acquisition reflected the industry’s adaptability and strategic maneuvering to navigate challenges.

• Industry’s commitment to ensuring a steady stream of engaging content for global audiences despite production challenges.

Contact the Helpdesk Team with your requirements

Assists you in your content and service sourcing needs and making relevant connections.Assistance in comparing & finding qualified vendors in VFX, Localization and all of Post Production. Get Started.

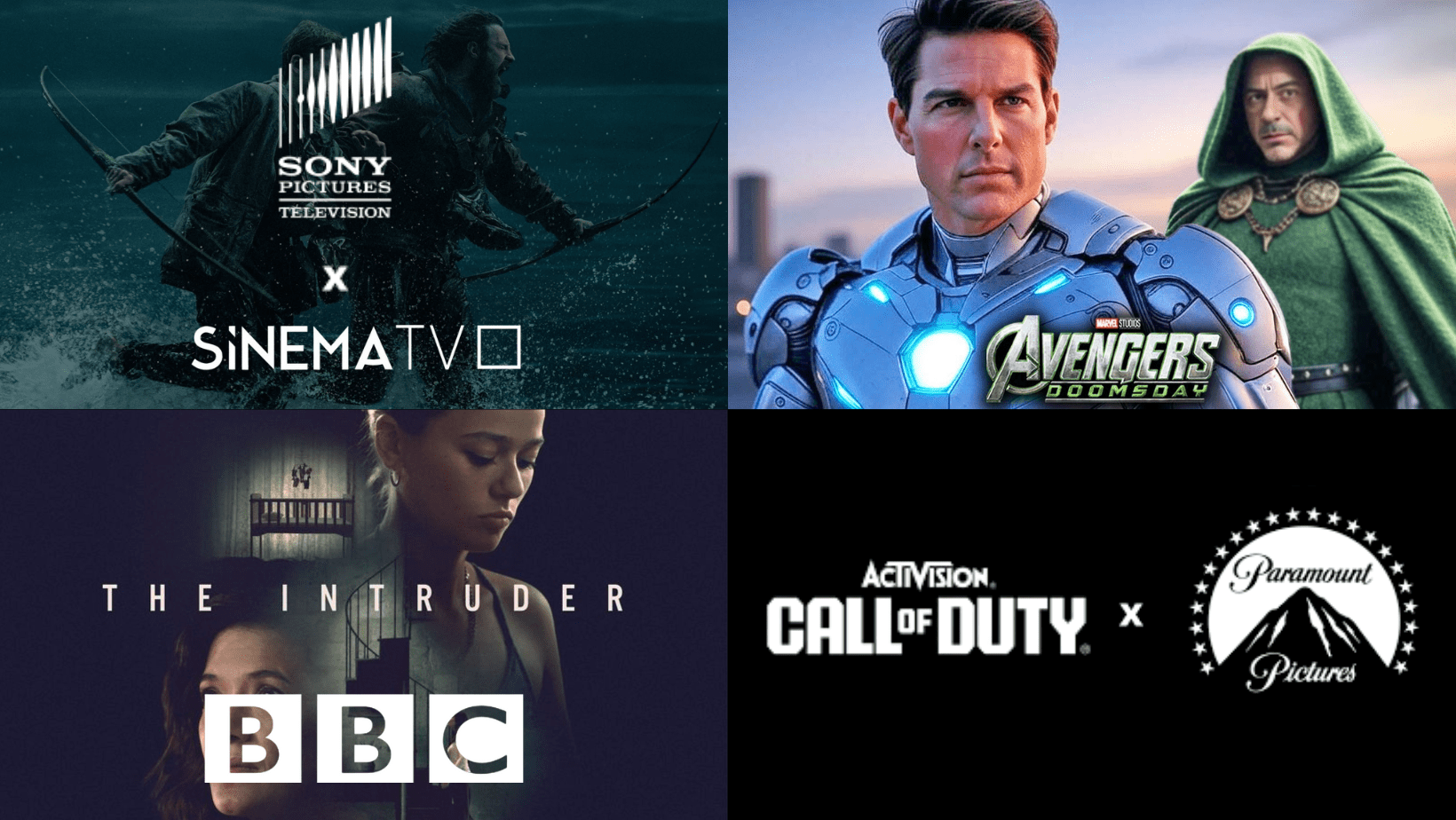

IP Deals

Hottest IP Stories, Formats, Books, Games, Podcasts to be turned into the next big blockbuster- Kate del Castillo Leads ‘Chavela’: A Bio-Series on Iconic Singer’s Life by Caracol TV and Miracol Media The life of iconic singer Chavela Vargas is explored in the an eight-episode bio-series “Chavela,” starring Kate del Castillo, currently in works. A co-production between Caracol TV and Miracol Media, the series is adapted from María Cortina’s acclaimed biography and directed by the Goya Award-winning Arantxa Echevarría. (🇨🇴)

- Dori Media’s ‘Yum Factor’: New Cooking Format Showcases Amateur Chefs at Content Americas Israeli prodco Dori Media is showcasing “Yum Factor” at Content Americas. This new cooking format features amateur chefs competing for a cash prize by winning over the palates of a regular jury. The pilot episode, produced by Fremantle-owned Abot Hameiri, has generated interest despite limited airtime. (🇮🇱)

- Hera Pictures to Bring ‘The Whalebone Theatre’ to TV: A Tale of Unconventional Paths and Espionage Hera Pictures, the prodco behind “Mary & George,” has secured the rights to adapt Joanna Quinn’s historical novel “The Whalebone Theatre” for television. This coming-of-age story follows a young woman’s unconventional path, from building a theater from whale bones to becoming a British secret agent during World War II.(🇬🇧)

- Disney+ Expands K-Drama Slate with ‘Light Shop’: A Mystery Series by ‘Moving’ Creator Kang Full Disney+ expands its K-drama slate with “Light Shop,” a new mystery series from “Moving” creator Kang Full. Adapted from his popular webtoon, the series explores themes of life, death, and humanity through the intertwined stories of strangers drawn to a mysterious shop holding potential answers to their traumatic pasts.(🌐)

- ITV Studios Acquires ‘Filthy Ritual’: True-Crime Podcast Uncovers Million-Pound Con in Hampstead ITV Studios’ Monumental Television acquires “Filthy Ritual,” a UK true-crime podcast exploring fraudster Juliette D’Souza’s million-pound con in Hampstead.(🇬🇧)

Production Deals

Sneak peak into recently announced production projects worldwide- Debut Film ‘The Boy With the Light Blue Eyes’ Explores Identity and Adolescence in a Traditional Greek Village Greek coming-of-age film “The Boy With the Light Blue Eyes” explores identity and adolescence through the story of Peter, a teenager with light blue eyes navigating a traditional village. A collaboration between WILLA, Astrakan Film, and Cold Iron Pictures, the film marks the debut of director Thanasis Neofotistos and boasts development through film institutes and Cannes Focus CoPro. (🇬🇷 🇺🇸 🇨🇾 🇷🇸 🇷🇴 🇭🇷)

- Ben Lobato Joins Thriller ‘Hot Sur’ from Fabula and Fremantle Mexico “Queen of the South” co-showrunner Ben Lobato joins “Hot Sur,” a fast-paced thriller from Fabula and Fremantle Mexico, bringing his expertise to this new project backed by the team behind USA Network’s hit series.(🇨🇱)

- Boneta and Higareda Star in Amazon’s ‘Follow’: Debut Project under Three Amigos Production Banner Diego Boneta and Martha Higareda will star in and produce Amazon Studios’ new erotic thriller “Follow,” the debut project under Boneta’s Three Amigos production banner’s overall deal with Amazon Prime. The film revolves around Sebastián, a charismatic scammer, and his final con involving the mysterious Carolina. (🌐)

- Movistar Plus+ Boosts Film Lineup with ‘Soy Nevenka’ and Top Director Collaborations Spanish streamer, Movistar Plus+, boosts film presence with co-productions from top directors, including Rodrigo Sorogoyen, Alberto Rodríguez, Óliver Laxe, and Ana Rujas. The first project is Iciar Bollaín’s “Soy Nevenka,” which is inspired by a landmark sexual abuse case. (🇪🇸)

- ZDF Studios and World Media Rights Partner for WWII Docu-Drama on British Female Spies ZDF Studios and World Media Rights are collaborating on “The Lost Women Spies,” a docu-drama about British female spies in World War II. It highlights Winston Churchill’s decision to defy laws and send women to the front lines in France. (🇩🇪🇬🇧)

Distribution Deals

Distributors securing worldwide content across different genres, languages and format types- FilmRise Secures Global Distribution Rights for Gripping Medical Docuseries ‘Untold Stories of the E.R. FilmRise acquires distribution rights for the gripping medical docuseries “Untold Stories of the E.R.” from GRB Media Ranch. Spanning 10 seasons with 120 episodes, the series vividly reenacts real-life emergency room stories. Rights have been acquired for U.S., Canada, the U.K., Australia, New Zealand, and all English-language territories will soon have access to this compelling content. (🌐)

- WildBrain Obtains Global Rights for ‘Louise Lives Large’: Cancer-Free Teen’s Journey Tailored for Young Audiences WildBrain acquires worldwide distribution rights for “Louise Lives Large,” an 8-episode series commissioned by RTÉ, Family Channel in Canada, and Ketnet in Belgium. The series, which follows cancer-free teen Louise Edgar on a mission to make up for lost time, is tailored for a 9- to 13-year-old audience (🇨🇦 🇧🇪)

- Tim Roth Joins John Maclean’s ‘Tornado’: Survival Thriller Gains Global Traction with Multiple Pre-Sales Tim Roth joins John Maclean’s survival thriller “Tornado,” currently filming in Scotland, with global sales managed by HanWay Films. The film has secured pre-sales in numerous territories, including Lionsgate, The Jokers, ZDF, September Films, M2, MCF, NOS Audiovisuals, The Film Group, Front Row, Shaw, and Cinesky for ships and airlines. ( 🇬🇧 🇮🇪 🇫🇷 🇩🇪 🇦🇹, Benelux, Central Europe, former Yugoslavia 🇵🇹 🇬🇷 Middle East 🇸🇬)

- Finecut Secures Global Rights for Hong Sangsoo’s ‘A Traveler’s Needs’ Starring Isabelle Huppert at Berlinale Finecut acquires global sales rights for “A Traveler’s Needs,” Hong Sangsoo’s film starring Isabelle Huppert, slated for the Berlinale Competition premiere. This marks the third collaboration between Huppert and Hong, promising a “light but piercing take on human relationships (🇭🇰)

- Aaron Kwok’s Action Comedy ‘Rob N Roll’ Set for Extensive International Release Amid Chinese New Year Aaron Kwok-starrer “Rob N Roll,” an action comedy from Hong Kong directed by Albert Mak, is poised for its most extensive international release for a Chinese New Year film since the pandemic. Entertaining Power will manage distribution in twelve territories, encompassing non-traditional markets such as Africa and Cambodia. (🌐)

Acquisition Deals

Streamers & channels acquiring latest content across the world- Monster Loving Maniacs Secures European TV Deals with Broadcasters Across the Continent Monster Loving Maniacs, an animated comedy tailored for 6- to 10-year-olds, has achieved multiple sales across Europe and will debut on TV channels in France, Hungary, Latvia, the Basque Country, and Belgium. Notable deals include partnerships with CANAL+ in France, RTL Klub in Hungary, VRT’s Ketnet in Belgium, and TV3 in Latvia.(🇪🇺)

- Hulu Acquires ‘Thank You, Goodnight: The Bon Jovi Story’ Documentary Series Hulu secures “Thank You, Goodnight: The Bon Jovi Story,” a four-part documentary series providing an first-ever, comprehensive exploration of the band’s history. Directed and executive produced by Gotham Chopra, the series, with full cooperation from past and present members, particularly focuses on the life of the frontman. (🇺🇸)

- Limonero Films’ Factual Titles, Including ‘The Wandering Chef’ and ‘Cyberwar,’ Snapped Up by Netflix, RTVE, and Others Globally Netflix, RTVE, among other platforms have acquired factual titles from UK distributor Limonero Films, including “The Wandering Chef,” “Cyberwar,” “Hidden Flavours Of India: Northeast,” and “13 Days,”. DMC in Egypt additionally has secured a package of documentaries. (🌐)

- BBC Secures Rights for Season 2 of Irish Crime Drama ‘Kin The rights for Season 2 of the Irish crime drama “Kin,” produced by BRON Studios and Headline Pictures, have been acquired by the BBC. The series follows the Kinsella family in Dublin’s crime world, navigating new threats, and is scheduled to premiere on BBC One soon. (🇬🇧)

- Woodcut Media’s ‘Titanic in Colour’ Secures Pre-Sales with Channel 4 and Australia’s SBS Woodcut Media’s upcoming docu series, “Titanic in Colour,” has secured pre-sales with Channel 4 in the UK and Australia’s SBS. The series employs unique colorization techniques to vividly depict the ill-fated vessel, delving into the lives of passengers and the enduring psychological impact on survivors.(🇬🇧 🇦🇺)

Global Entertainment Leaders Speak

Partnership Deals

Cross-Border Collaborations, Joint Ventures, M&A and Partnerships!- Mediawan Acquires Majority Stake in London’s Misfits Entertainment, Set to Premiere ‘Super/Man’ Documentary at Sundance 2024 Mediawan acquires a majority interest in Misfits Entertainment, a London-based prodco known for crafting high-quality content for the global market. Misfits is set to premiere documentary “Super/Man: The Christopher Reeve Story,” at the Sundance 2024 Film Festival. (🇫🇷)

- Sony Pictures Networks India Terminates $10 Billion Merger Deal with Zee Entertainment Enterprises Sony Pictures Networks India has terminated its $10bn merger agreement with Zee Entertainment Enterprises, citing unmet conditions and disagreements. Despite good-faith discussions to extend the end date, the merger did not close within the 24-month timeline, leading to the termination of the definitive agreement. The merger had aimed to create a media giant with over 90 channels. (🇮🇳)

- Ateliere and AWS Forge 5-Year Collaboration to Revolutionize Global Media Production with Cloud Solutions Ateliere Creative Technologies and Amazon Web Services (AWS) have joined forces for a five-year Strategic Collaboration Agreement (SCA) to transform media production and distribution globally using cutting-edge cloud solutions, and impact the entire B2B supply chain. AWS to provide significant support and funding for product development, customer adoption, and marketing initiatives. (🌐)

- Imagine Entertainment Partners with Fifth Season for Multi-Year Co-Financing and Production Collaboration Imagine Entertainment, led by Brian Grazer and Ron Howard, has initiated a multi-year co-financing and production collaboration with Fifth Season. The partnership kicks off with documentaries featuring photographer Richard Avedon and comedian Martin Short, and both entities plan to co-finance additional projects in the future. (🇺🇸)

Companies Making Headlines

Launch and Expansions of facilities, studios, services & technologies- Tribeca Enterprises and Giant Pictures Launch Tribeca Films: Empowering Independent Filmmakers in Canada Tribeca Enterprises and Giant Pictures have introduced Tribeca Films, a distribution label focused on empowering independent filmmakers by providing creative control and facilitating the distribution process across streaming platforms to generate revenue for high-quality films. (🇨🇦)

- Fremantle Acquires Minority Stake in Boldprint Studios, UK’s New Unscripted Content Powerhouse Fremantle is obtaining a minority stake in Boldprint Studios, a recently established prodco helmed by Phil Harris (Former Channel 4’s Head of Entertainment) and Lou Hutchinson (Former Twofour’s Head of Entertainment). The company is focussed on unscripted formats spanning reality, and factual entertainment. (🇬🇧)

- ODMedia Acquires Pixagility to Expand Digital Video Presence in Europe and Africa ODMedia has acquired Pixagility, a French content services company operating in France and Africa, in a strategic move to strengthen its presence in Europe and Africa and become a leading digital video entertainment provider by combining ODMedia’s industry expertise with Pixagility’s local capabilities. (🇪🇺 🇿🇦)

- RedBird IMI Invests in Media Res, Securing Strategic Partnership for The Morning Show Production Jeff Zucker’s RedBird IMI acquires a stake in Media Res, the prodco behind Apple TV+ drama “The Morning Show,” enabling a strategic partnership. Media Res founder Michael Ellenberg will retain majority ownership and control. (🇺🇸)

- LucidLink and Projective Technology Team Up to Transform Global Cloud-Based Post-Production LucidLink and Projective Technology collaborate to revolutionize cloud-based post-production. By integrating Projective’s Strawberry platform with LucidLink’s remote connectivity solution, they aim to establish a seamless, secure, and efficient cloud-first environment for creative teams globally. (🌐)

Featured New Specializations

Global innovations & breakthroughs in the Entertainment supply-chain- Wasabi Technologies Acquires Curio AI to Drive AI-Powered Intelligent Storage in M&E Industry Wasabi Technologies has acquired Curio AI from GrayMeta, including the intellectual property and team, with GrayMeta CEO Aaron Edell joining Wasabi as SVP of AI & ML. Wasabi plans to integrate Curio AI tech into a new AI-powered intelligent storage for the M&E industry. (🇺🇸)

- Arcturus Unveils AVV: Game-Changing Codec for Real-time Volumetric Video in Digital Content Creation Arcturus introduces Accelerated Volumetric Video (AVV), a high-performance codec enabling lightweight, scalable volumetric video for real-time rendering and playback in game engines, revolutionizing digital content creation by allowing virtual production teams and game creators to seamlessly integrate a greater number of volumetric characters into their scenes while preserving superior data quality. (🇺🇸)

- Filmbankmedia Strengthens Content Security with Irdeto TraceMark Forensic Watermark Solution Filmbankmedia has opted for Irdeto TraceMark to bolster content security, employing the forensic watermark solution to uniquely mark each distributed file. This reinforces their commitment to protecting valuable content and facilitates tracking of unauthorized copies back to individual distributors. (🇬🇧)

Animation, VFX & Virtual Production

Latest global updates in Animation, Visual Effects VFX & Virtual Production- Tamil Nadu Unveils Ambitious 500-Crore Film City with Virtual Production and Unreal Engine Innovation Indian state of Tamil Nadu plans a cutting-edge 500-crore film city in Chennai, integrating virtual production with ‘Unreal Engine powered-LED walls’ to revolutionize filmmaking, attract national productions, and position the region as a global hub. (🇮🇳)

- Lola VFX Teams Up with VAST Data to Revolutionize Data Management in Film and TV Production Lola Visual Effects (VFX) collaborates with VAST Data to enhance data management in film and television production, reducing playback delays, improving editing efficiency, and fostering global collaboration for data-intensive feature films and television series.

- Picture Shop Chooses Jigsaw24 for Avid NEXIS Storage and Media Composer Enterprise in Multi-Year Deal Picture Shop has signed a multi-year contract with Jigsaw24 Media for Avid NEXIS Storage and Media Composer Enterprise subscriptions and support, transitioning to Avid’s subscription model for storage and consolidating storage across its UK facilities with a move from NEXIS E-series to F-series storage engines.