Introduction

This analysis examines Prime Video Q4 2025 performance drivers and strategic roadmap for Q4 2025, based on the latest financial results and conference call materials. The analysis highlights the segment’s successful transition to a live sports powerhouse and its evolution into a high-margin advertising engine, driven by record-breaking viewership and aggressive global rights acquisitions.

Prime Video Highlights Growth in Live Sports & Advertising

A read of Amazon’s Q4 2025 results shows significant strength in key media and entertainment areas.

-

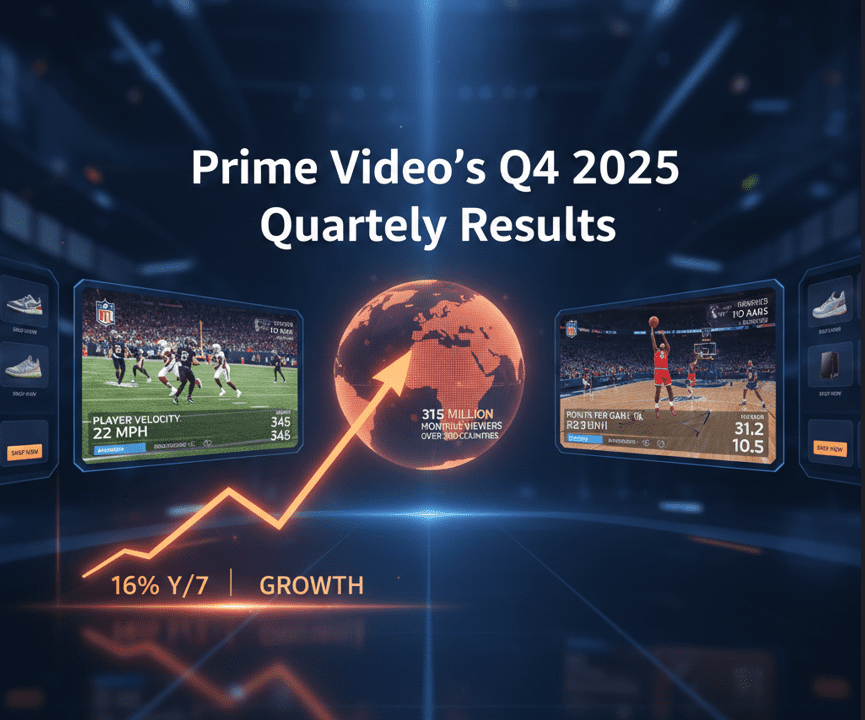

Record-Breaking Live Sports Viewership (Up 16% Y/Y): The fourth season of Thursday Night Football (TNF) on Prime Video was the most-watched ever, marking three consecutive years of double-digit growth.

-

History-Making Streaming Milestones (31M+ Viewers): Prime Video successfully hosted the most-streamed NFL game in history, demonstrating the platform’s capacity for massive concurrent global events during the Packers vs. Bears Wild Card Playoff.

-

Overall Group Advertising Services Momentum (Up 22% Y/Y): Total advertising revenue for the Amazon Group reached $21.3 billion in Q4. Prime Video is a key contributor to this growth as the company continues to innovate and identify new customer solutions in the ad-supported tier.

Prime Video’s Strategic Plan: Focus on Global Rights & Demographics

Amazon’s Q4 2025 results detail the company’s aggressive strategy to secure long-term viewer loyalty and high-value demographics.

-

Long-Term Global Sports Rights Moat: Amazon has secured multi-year stability by extending marquee European football rights through the end of the decade, specifically the UEFA Champions League across major markets like Germany, Ireland, Italy, and the UK.

-

Strategic Demographic Expansion (NBA on Prime): The debut of the NBA on Prime Video in over 200 countries is a deliberate move to attract a younger audience, a demographic that is increasingly moving away from traditional linear television.

Investment in Content & Financial Commitment

The company maintains a massive commitment to its media library to drive Prime member “stickiness.”

-

Accelerated Annual Content Spend ($22.4B in 2025): Total investment in video and music content rose 10% year-over-year. This reflects the significant capital required to compete for premium live sports and high-quality original programming.

-

Capitalized Content Assets ($36.5B Total): The company’s total capitalized video and music costs reflect the long-term value Amazon places on its entertainment library as a driver for the broader Prime ecosystem.

Conclusion

Prime Video has successfully transitioned from a supplemental benefit to a central, high-margin revenue engine within the broader Amazon Group. By connecting record-breaking sports viewership with a rapidly growing advertising business that reached $21.3 billion this quarter, Amazon is creating a self-sustaining media ecosystem. Looking forward, the focus remains on leveraging exclusive global rights and demographic-targeted content to drive long-term engagement and return on invested capital.