Introduction (Q4 2025 Netflix Quarterly Results — Media & Entertainment)

This analysis examines Netflix Q4 2025 performance, drivers and risks for Q4 2025, based on the latest shareholder letter and investor earnings call. The lens is global, with emphasis on Strategic Consolidation and M&A Acceleration, Advertising Business Scaling, and Content Evolution, balanced against Content Licensing Volume Declines and the M&A-Related Financial Drag.

Netflix Highlights Growth in Advertising Scaling & Branded Originals

A read of Netflix’s Q4 2025 results shows strength in key content-driven areas.

-

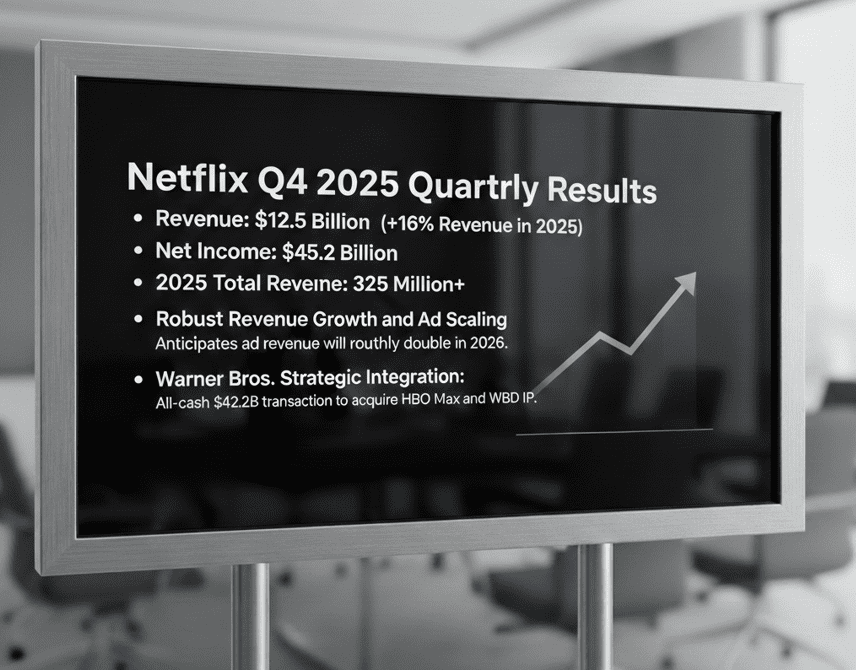

Robust Revenue Growth and Ad Scaling (+16% Revenue in 2025): The company delivered $45.2B in revenue for 2025 and anticipates ad revenue will roughly double in 2026.

-

Paid Membership Milestone (325M+ Members): Netflix reached a massive global footprint serving an audience approaching one billion people, providing the scale necessary for the ad business and newer content initiatives.

Fandom and Branded Originals Outperformance (+9% Viewing Growth): While overall engagement grew modestly, viewing of branded originals increased significantly, driving higher retention and acquisition

Netflix Faces Challenges in Content Licensing & M&A Expenses

Despite segment successes, Netflix’s Q4 2025 results also expose significant enterprise-wide challenges.

-

Content Licensing Volume Declines: A year-over-year decrease in non-branded “second-run” viewing hours occurred as the elevated licensing period from the 2023-2024 production strikes normalizes.

-

Currency Fluctuations and F/X Neutral Growth Gaps: Unfavorable foreign exchange movements impacted reported revenue, creating a disparity between reported growth and F/X neutral growth in regions like Latin America.

-

M&A-Related Financial Drag (~0.5 Point Margin Impact): The acquisition of Warner Bros. introduced bridge loan interest expenses and acquisition-related costs that weigh slightly on operating margins.

Netflix’s Strategic Plan; Focus on Warner Bros. & Cloud Gaming

Netflix’s Q4 2025 results also detail the company’s strategic initiatives.

-

Warner Bros. Strategic Integration: Netflix is moving to an all-cash $42.2B transaction to expedite the deal, focusing on acquiring HBO Max and WBD’s vast IP library to offer flexible subscription options.

-

Cloud-First Gaming and Interactive Features: Expanding game availability to TV screens using mobile phones as controllers and reimagining major franchises like FIFA for the platform.

-

Global Live Events Expansion: Netflix is scaling beyond the US with major events like the World Baseball Classic in Japan and live fan voting for unscripted series.

Netflix Senior Leadership Will Focus On Advertising Monetization & Margins

Netflix’s leadership focus areas are very clear from the latest Q4 2025 results.

-

Advertising Monetization and Closing the ARM Gap: Management’s primary focus is increasing the monetization of growing inventory to close the revenue gap between ad-tier and ad-free plans.

-

Operating Margin Expansion Target (31.5%): Management aims to sustain a pattern of margin growth while balancing aggressive reinvestment in new initiatives.

-

Next-Generation Ad Formats (Q2 2026 Rollout): Leadership intends to launch globally enhanced interactive video ads to drive better business outcomes for advertisers.

Conclusion

Netflix’s performance in 2025 has set a high bar, successfully scaling its ad business and crossing significant membership milestones. While headwinds like currency fluctuations and a decline in licensed content viewing persist, the company’s aggressive pivot toward strategic M&A with Warner Bros. and expansion into live events and cloud gaming signals a move beyond traditional streaming. By focusing on closing the ARM gap and expanding operating margins to 31.5%, leadership is aligning high-value fandom with disciplined financial growth.