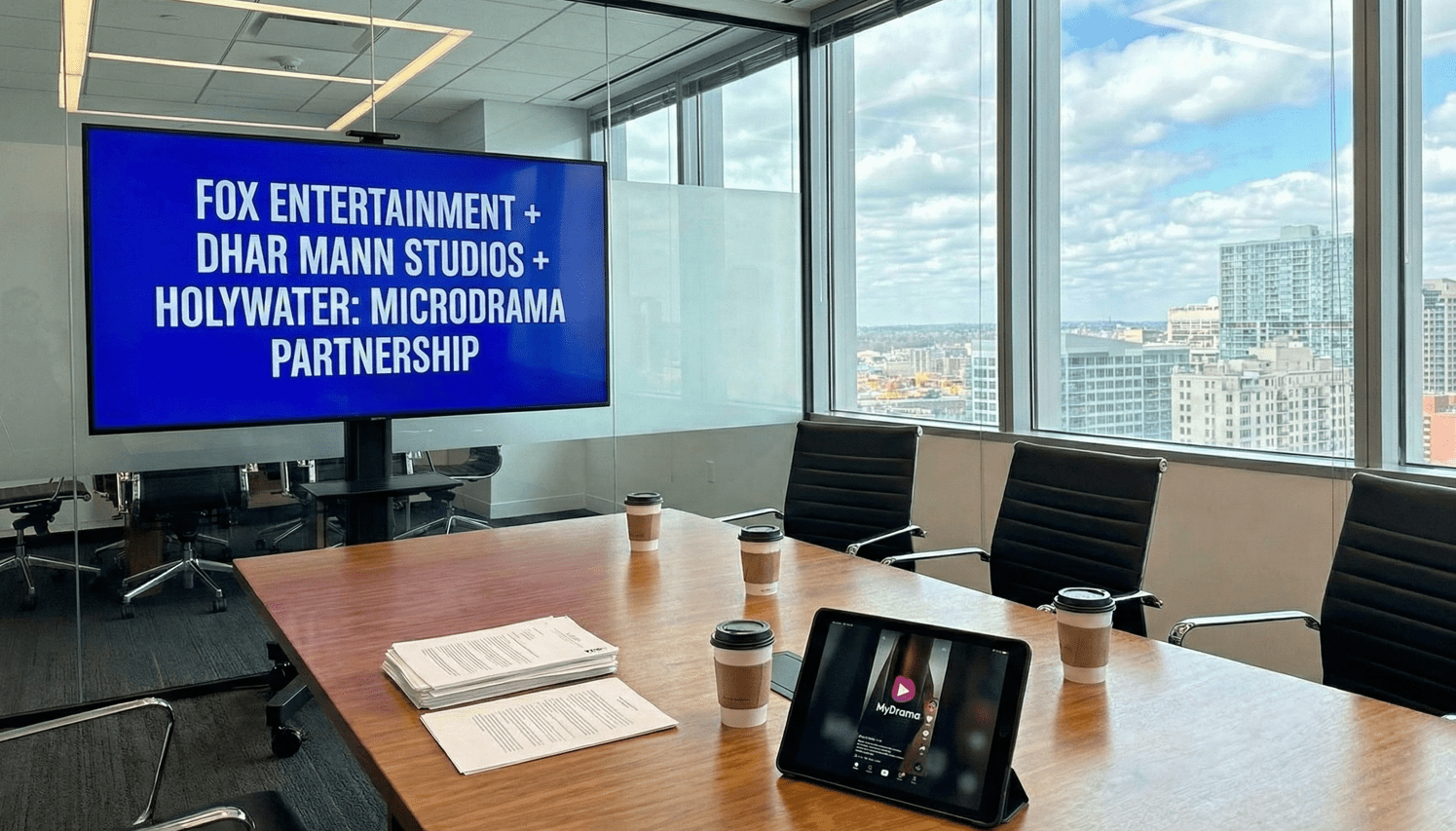

Deal Overview

Fox Entertainment has formalized a two-tier industrial pivot into the microdrama sector, headlined by a partnership with Dhar Mann Studios and backed by a massive internal production slate. The primary mechanism is a 40-title deal where Dhar Mann Studios produces scripted vertical series for the Fox-invested Holywater platform (MyDrama). Uniquely, Dhar Mann retains full IP ownership and creative independence—a rarity in studio-creator deals—granting Fox only an exclusive premiere window before rights revert for global sales. Simultaneously, Fox Entertainment Studios is producing a separate slate of 200 original vertical series for Holywater. This internal slate leverages Fox’s owned production engines, ensuring the platform has a “base load” of studio-owned IP while the Dhar Mann partnership provides the high-visibility “tentpole” content to drive user acquisition.

Parties & Dealmakers

Fox Entertainment (Acquirer/Distributor) is led by CEO Rob Wade, the architect of this vertical studio strategy. Fox Entertainment Global, led by President Prentiss Fraser, manages the worldwide distribution of these assets post-windowing. Dhar Mann Studios is represented by Founder Dhar Mann and CEO Sean Atkins, with Erin McFarlane (Head of Vertical Content) overseeing production. Holywater (Platform/Tech Partner) is led by Co-Founders Bogdan Nesvit and Anatolii Kasianov. Internally, Fox is mobilizing Bento Box Entertainment (Animation) and Studio Ramsay Global (Unscripted) to adapt their formats for the vertical screen.

Strategic Validation of the Microdrama Format

This deal represents the “Mainstreaming” of the vertical microdrama. By committing to 200 internal titles and partnering with the sector’s biggest creator, Fox is validating the 9:16 format as a legitimate, tradeable asset class rather than just a social media trend. The “Creative Independence” clause for Dhar Mann is the critical lever here: it acknowledges that regarding engagement retention on mobile, the creator knows more than the studio. Fox is effectively trading IP ownership for format validation—using Mann’s massive audience to prove that MyDrama is a viable competitor to ReelShort. For the internal slate, involving heavyweights like Studio Ramsay Global and Bento Box signals that Fox intends to elevate production values beyond the “lo-fi” soap opera tropes currently dominating the market, potentially creating the first “Premium Vertical” category.

Supply-Chain Impact

Fox’s commitment to 240+ total series forces a maturation of the vertical supply chain. Post-production houses must now scale to handle “studio-grade” deliverables for thousands of 2-minute episodes. It creates a new revenue stream for legacy IP holders: if Bento Box can successfully translate animation to vertical, it opens the floodgates for other studios (e.g., Warner Bros. Animation, Nickelodeon) to license their libraries for “vertical remixing.” Furthermore, Prentiss Fraser’s involvement suggests a push to standardize Vertical Rights International Sales, moving the monetization model from “in-app coin purchases” to traditional B2B territory sales to broadcasters seeking to capture Gen Z.

Vitrina Perspective

The Dhar Mann partnership is the definitive signal that “Microdramas” have graduated from the gig economy to the studio lot. By engaging a creator with 160M followers not as talent, but as an independent supplier retaining IP, Fox is conceding that in the vertical economy, the creator is the studio. This deal de-risks the format for the entire industry; if Fox can successfully window Dhar Mann’s “moral lesson” stories into global territories via Prentiss Fraser’s team, it validates the vertical series as a globally travelable TV format. We expect this to trigger a wave of “Creator-First” output deals where studios trade ownership for immediate access to pre-built mobile audiences.