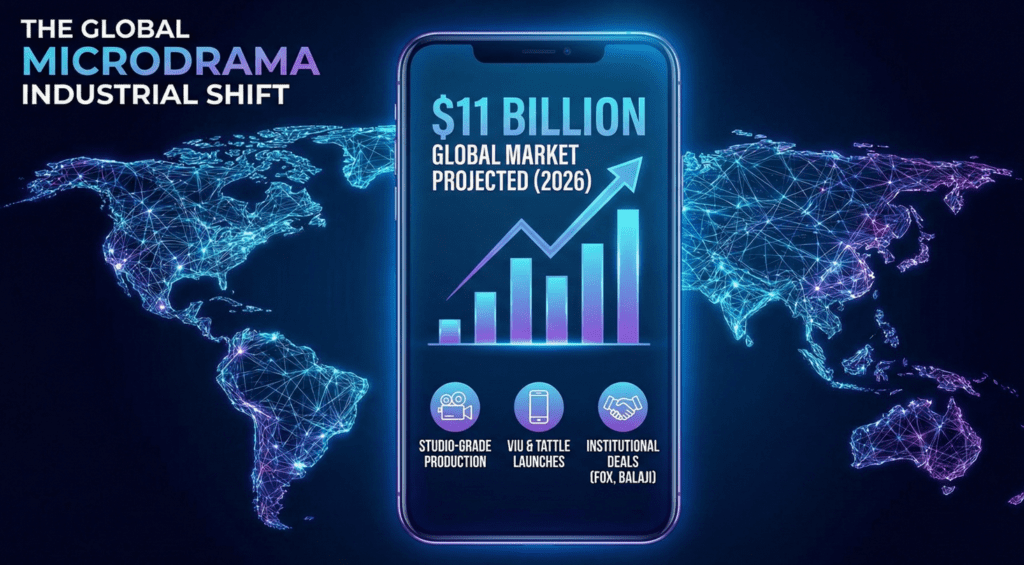

The global film and television financing landscape has undergone a structural reset.

Indie is good.

Small budgets are not just viable—they are preferred.

These are the projects that continue to get financed in today’s market.

Large budgets, which once commanded attention and prestige, now face far greater scrutiny. Investor appetite for outsized risk has declined sharply. Scale alone no longer impresses. In many cases, it alarms.

What matters—more than ever—is fiscal discipline.

The ledger is king.

The spreadsheet has teeth.

Project budgeting, profit potential, and real-world viability are the primary filters investors apply today. This is not a creative judgment—it is a commercial one. And it is being applied consistently across markets.

The End of Easy Money

For much of the past decade, vanity projects and hobby-driven productions floated on an abundance of capital and inflated expectations. Those conditions no longer exist.

We are not in a bubble anymore.

Capital today is cautious, deliberate, and selective. Financing structures have shifted accordingly.

Gap financing has emerged as the new equity—bold, risk-tolerant, but thin. These investors are stepping in where others hesitate, often bridging uncertainty rather than underwriting scale.

Debt, meanwhile, has become increasingly complex. In high-interest-rate environments, it is expensive and unforgiving. In other markets, it is constrained by collateral requirements, guarantees, and legal friction that can slow or derail deals altogether.

True equity remains the most coveted form of capital—and also the rarest. It is available primarily to producers with exceptional track records, privileged access, or long-standing relationships. For most projects, it is no longer a given.

A Critical Shift: Incentives and Pre-Buys

One of the most under-discussed changes of the last 18 months has been the global recalibration of tax incentives and government support.

These incentives are no longer optional upside—they are foundational to financing strategies.

Whether domestic or cross-border, securing tax credits, rebates, and government sops has become critical to making projects viable. Increasingly, this requires international partnerships, co-production structures, and early strategic alignment across territories.

Equally critical are pre-buys.

Pre-buys across territories—by broadcasters, streamers, and distributors—are once again a cornerstone of risk mitigation. They provide early validation, cash flow certainty, and leverage in assembling the rest of the financing stack.

Projects that secure incentives and pre-buys early are the ones that move forward. Others stall.

What Investors and Commissioners Really Want

At the end of the day, the divide is simple:

- Investors want returns.

- Commissioners want exclusive IP.

But both are drawn to the same kind of producer.

Not the loudest.

Not the most ambitious on paper.

But the one who finishes.

The producer who executes.

Who controls budgets tightly.

Who understands trade-offs.

Who delivers on time and on plan.

In 2026, finishers get funded.

The Role of Matchmaking in a Fragmented Market

As financing structures grow more complex and capital more selective, the challenge is no longer just raising money—it is finding the right partners.

This is where Vitrina Concierge plays a critical role.

By tracking projects, financiers, commissioners, incentives, and pre-buy activity across markets, we help producers find, matchmake, and connect with the partners most aligned to their specific project needs—whether that’s capital, co-production support, incentives, or early buyers.

In a world defined by discipline, precision matters.

The future of film and television financing will not be driven by scale or spectacle—but by structure, strategy, and execution.

That is the story of Film and TV financing in 2026.