Overview of Warner Bros. Discovery Performance

Warner Bros. Discovery (WBD) announced impressive third-quarter 2024 financial results, showing substantial growth in its direct-to-consumer (DTC) segment. The company’s DTC profit surged to $289 million, a marked increase from $111 million in the same period last year, with streaming subscribers reaching a global total of 110.5 million. This gain was fueled by extensive international streaming of the Paris Olympics, new market launches, and an influx of fresh content after the resolution of last year’s Hollywood strikes.

Subscriber and Revenue Growth Driven by Paris Olympics and Market Expansion

Warner Bros. Discovery experienced its largest-ever quarterly growth in streaming subscribers, adding 7.2 million new users. This growth spanned multiple regions, contributing to a 9 percent increase in total DTC segment revenue, which reached $2.63 billion. The company attributed this success to the Paris Olympics, expanding streaming operations in international markets, and fresh content releases.

CEO David Zaslav on "Generational Disruption" and Future Vision

CEO David Zaslav addressed shareholders, noting that Warner Bros. Discovery is in a period of “generational disruption” that presents both challenges and opportunities. He emphasized the company’s ongoing efforts to unlock asset value and drive DTC growth.

“We are doing the work necessary to evaluate all steps, operationally and strategically, to improve performance and unlock shareholder value,” Zaslav said.

Strategic Goals and International Expansion of Max Streaming Platform

Zaslav highlighted the company’s commitment to the Max platform, which now operates in 72 markets and is set to expand further in 2025. This international expansion, combined with improvements in legacy TV networks, has laid the groundwork for sustainable growth across Warner Bros. Discovery’s portfolio.

Ongoing Strength of Linear TV Networks and New Charter Communications Partnership

Warner Bros. Discovery also reported a renewed partnership with Charter Communications, underscoring the value of its linear TV assets, including TNT, TBS, and HLN. Zaslav highlighted the importance of the linear network business, noting that the Charter agreement reinforces the strategic role these assets play within WBD’s larger portfolio.

Financial Highlights: DTC and Networks Segments

- DTC Segment: Quarterly distribution revenue increased by 8 percent, and global average revenue per user (ARPU) grew to $7.84, driven by subscriber growth and pricing adjustments.

- Networks Segment: Revenue rose by 3 percent to $5.01 billion, while advertising revenue faced challenges due to cord-cutting and a soft U.S. linear advertising market. Adjusted EBITDA in this segment was $2.12 billion, with European Olympics broadcasts impacting results by $65 million.

Studios and Games Performance

The studios segment reported mixed results, with theatrical revenue down 40 percent due to the performance of recent releases compared to last year’s success with Barbie. TV revenue, however, increased by 30 percent due to strike impacts on the previous year’s performance. Games revenue fell by 31 percent, largely influenced by last year’s high-performing titles.

Analyst Insights and Stock Performance

Bank of America analyst Jessica Reif-Ehrlich reiterated her “buy” rating, citing Warner Bros. Discovery’s strong asset portfolio and future growth catalysts, including the continued rollout of Max and potential ad market recovery. Following the release of its financial results, WBD shares rose 1.4 percent in pre-market trading.

CEO Statement on Strategy and Transformation

“Warner Bros. Discovery’s third-quarter results demonstrate that, while navigating extraordinary disruption, our strategy is yielding important results,” Zaslav remarked. “Our rapid international expansion and commitment to high-quality, diverse content are accelerating momentum in our global direct-to-consumer business.”

The company remains focused on leveraging its strategic assets and partnerships to deliver consistent, sustainable growth amid a rapidly evolving media landscape.

Find

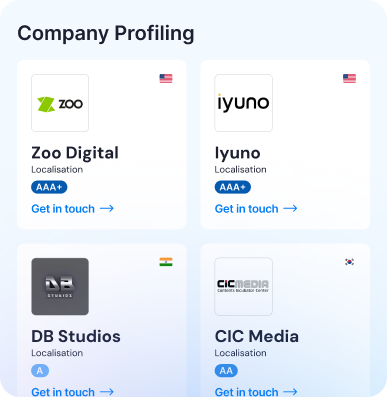

Partners

Content Financiers, Vendors, Commissioners, CoPro Studios, Licensing, Streamers, Networks.

Find Partners

Discover the right companies to collaborate, co-produce, license, or pitch to.

- Search global financiers, vendors, commissioners, and co-pro studios

- Identify streamers, broadcasters, and network buyers by region and genre

- Qualify companies based on deals, specializations, and leadership

Discover Unreleased Content

Films, Series, Animation, Documentaries: In- Development, In- Production, In-Post, In- Slate, Formats, Pre-Buys

Find

People

Execs, Dealmakers, Experts, Decision-makers. Their Profiles, Recent Projects, Recent Deals and Contact Details.

Get Market

Intel

Trending Content, Genres, Languages. Top Countries, Companies. Platform Search & Queries, Reports, Webinars