In the ever-evolving world of cinema, securing the right financial backing can transform a visionary script into a box office sensation. Film financing companies in Pakistan have emerged as powerhouses in the industry, offering diverse funding opportunities for both independent filmmakers and major productions.

Through Vitrina’s extensive global network, filmmakers can access top-tier film financing companies in Pakistan, connecting them with the resources needed to bring their cinematic dreams to fruition. This comprehensive guide will help you navigate these opportunities, ensuring your project finds the financial support it needs.

Table of content

- Introduction: The Film Financing Landscape in Pakistan

- Understanding Film Financing: A Brief Overview

- Top Film Financing Companies in Pakistan

- Independent Film Financing: Opportunities and Challenges

- Private Equity in Film Financing: What You Need to Know

- How to Approach Film Financing Companies

- The Future of Film Financing in Pakistan

- How Vitrina Connects Filmmakers with Financing Companies

- KeyTakeaways

- FAQs About Film Financing in Pakistan

Introduction: The Film Financing Landscape in Pakistan

Pakistan has become a beacon for filmmakers seeking funding, thanks to its robust financial sector, favorable tax incentives, and a growing appreciation for both local and international cinema. The film financing landscape here is diverse, encompassing everything from major studio backing to innovative crowdfunding platforms. As we delve deeper, we’ll explore how this unique ecosystem supports filmmakers in bringing their visions to life.

Understanding Film Financing: A Brief Overview

Before we explore specific film financing companies in Pakistan, it’s crucial to understand the basics of film financing. At its core, film financing involves raising capital to fund the production, post-production, and distribution of a film. This can come from various sources, including:

- Private investors

- Production companies

- Government grants

- Pre-sales agreements

- Crowdfunding

Each method has its pros and cons, and the right approach often depends on the scale and nature of your project. For instance, independent films might lean more towards grants and crowdfunding, while larger productions might seek studio backing or private equity investment.

Curious how Vitrina can help you? Try it out today!

Trusted by global entertainment leaders to grow business, acquire high-demand content, promote projects and services, and track every Film + TV production worldwide

Top Film Financing Companies in Pakistan

While we’re currently expanding our list for film financing companies in this location, you can still discover and connect with leading film financing companies worldwide on Vitrina. Sign up now to start your search!

What Are Film Financiers Looking For?

Independent Film Financing: Opportunities and Challenges

Independent filmmakers face unique challenges and opportunities when seeking financing in Pakistan. While there’s a growing appetite for fresh, innovative content, securing funding can still be an uphill battle.

Opportunities:

- Niche funding options for specific genres or themes

- Potential for creative control

- Access to alternative financing methods like crowdfunding

- Increasing demand for diverse storytelling

Challenges:

- Competing with bigger productions for funds

- Proving commercial viability without big-name attachments

- Navigating complex financing structures

- Limited resources for marketing and distribution

Private Equity in Film Financing: What You Need to Know

Private equity film financing companies in Pakistan have become increasingly important players in the industry. These firms invest capital in exchange for a share of the film’s profits. Key points to understand:

- Higher potential returns, but also higher risk

- Often focused on commercial viability and potential for high returns

- May have specific genre or budget preferences

- Can provide valuable industry connections and expertise

- Typically look for projects with budgets over $10 million

- May require more control over the production process

When approaching private equity firms, be prepared with a solid business plan, market analysis, and a clear path to profitability.

How to Approach Film Financing Companies

Securing funding from film financing companies in Pakistan requires preparation and strategy:

Develop a comprehensive business plan

- Include detailed budget breakdowns and revenue projections.

- Highlight potential ancillary revenue streams (merchandising, streaming rights, etc.).

Create a compelling pitch deck

- Use visual aids to showcase your project’s unique selling points.

- Include mood boards or concept art to convey your visual style.

Understand the company’s investment criteria

- Research their past projects and preferred genres.

- Tailor your pitch to align with their investment philosophy.

Be prepared to discuss potential returns

- Have realistic projections based on comparable films.

- Be transparent about risks and mitigation strategies.

Have a clear distribution strategy

- Outline potential distribution partners or strategies.

- Highlight any pre-sales or letters of interest from distributors.

Be open to feedback and negotiations

- Show flexibility and willingness to adapt your project.

- Demonstrate how their input can enhance the film’s potential.

Remember, these companies receive numerous pitches. Make yours stand out with a clear vision and solid financial projections.

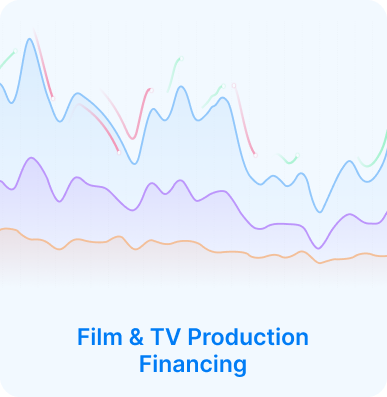

The Future of Film Financing in Pakistan

The landscape of film financing in Pakistan is continually evolving. Emerging trends include:

Increased use of blockchain and cryptocurrency in film financing:

- Tokenization of film investments for fractional ownership.

- Smart contracts for more transparent profit sharing.

Growth in impact investing for socially conscious films:

- Funds dedicated to projects addressing social and environmental issues.

- Partnerships with NGOs and foundations for cause-related filmmaking.

Rise of hybrid financing models combining traditional and alternative methods:

- Mixing equity investments with crowdfunding campaigns.

- Blending pre-sales with revenue-based financing.

Greater emphasis on global co-productions:

- Leveraging international tax incentives and grants.

- Tapping into multiple markets for increased revenue potential.

As the industry continues to change, film financing companies in Pakistan are adapting to meet the needs of modern filmmakers.

How Vitrina Connects Filmmakers with Financing Companies

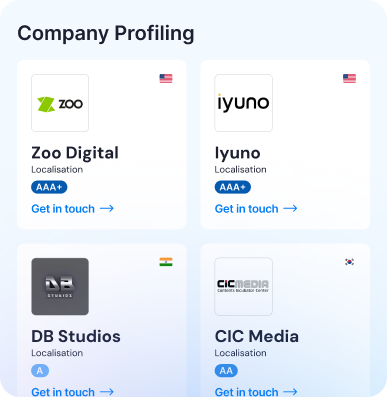

Vitrina Business Network (VBN) offers filmmakers a powerful platform to connect with global content financing companies, streamlining access to critical funding opportunities for film and TV projects. Here’s how VBN bridges the gap between filmmakers and financiers:

1. Comprehensive Global Network of Financiers

VBN has mapped over 2,200 pre-production and financing companies across 100 countries. Filmmakers can explore this vast network to find specialized financiers that match their project’s size, genre, region, or stage of development. This is especially valuable for filmmakers working on niche or regional content that require tailored financing options.

2. Project Matching Based on Financing Criteria

Filmmakers can leverage Vitrina’s powerful data API, the Vitrina Global Film+TV Projects Tracker API, which tracks film and TV projects at various stages of development. The API not only provides details about ongoing projects but also links them with financiers, co-producers, and distribution partners who are aligned with similar genres or financial models.

3. Dynamic, Curated Opportunities

Filmmakers can receive curated lists of financing companies and co-production partners that are actively seeking projects to finance. VBN continuously updates this list based on industry trends and the evolving landscape, ensuring filmmakers are always connected with the most relevant and current opportunities.

4. Direct Connection with Decision Makers

VBN identifies key executives and decision-makers within financing companies, providing direct channels for filmmakers to pitch their projects to the right individuals. This eliminates the guesswork and allows for more targeted outreach and higher chances of securing funding.

5. Support for International Co-Productions

For filmmakers seeking co-production opportunities, VBN helps match them with financing companies that specialize in international collaborations. This is particularly beneficial for projects looking to access tax incentives or regional funding schemes by involving multiple countries.

6. Strategic Market Briefings

Vitrina regularly provides strategic briefings to CXOs and executives at top financing companies. These briefings include insights on upcoming trends, project opportunities, and emerging markets, giving filmmakers enhanced visibility to key financiers actively seeking new investments.

By leveraging Vitrina’s vast network, advanced project tracking tools, and direct access to decision-makers, filmmakers can efficiently find financing partners that align with their creative vision and production needs, ensuring smoother paths to successful funding and project realization.

Key Takeaways:

- Pakistan offers a diverse range of film financing options, from major studio backing to innovative crowdfunding platforms.

- Independent filmmakers face both opportunities (niche funding, creative control) and challenges (competition, proving viability) in securing financing.

- Private equity film financing in Pakistan offers high potential returns but comes with higher risk and often focuses on commercial viability.

- Approaching film financing companies requires thorough preparation, including a comprehensive business plan, compelling pitch deck, and clear distribution strategy.

- Emerging trends in Pakistan’s film financing landscape include blockchain technology, impact investing, hybrid financing models, and increased focus on global co-productions.

- Vitrina serves as a valuable platform connecting filmmakers with film financing companies, offering tools and insights to navigate the funding process.

- Success in securing film financing often depends on understanding each company’s investment criteria, being open to feedback, and demonstrating a clear path to profitability.

- Government incentives, including tax credits and grants, play a significant role in Pakistan’s film financing ecosystem.

- The future of film financing in Pakistan is evolving towards more innovative, flexible, and globally-oriented funding models.

These key takeaways summarize the main points of the article, providing readers with a quick overview of the film financing landscape in Pakistan.

Frequently Asked Questions

This varies by company, but many start considering projects with budgets of $500,000 and up. Some private equity firms may have higher minimums of $5-10 million.

Most companies prefer a completed script, but some may consider well-developed treatments for established filmmakers. Having a polished script significantly increases your chances of securing funding.

It can range from a few months to over a year, depending on the project and financing method. Be prepared for a lengthy process and plan your production timeline accordingly.

Yes, Pakistan offers various tax incentives and grants for qualifying productions. These can include tax credits, rebates, and direct subsidies. Research the local film commission for specific programs.

Many financing companies in Pakistan are open to international projects, especially co-productions. However, some funding may be reserved for local productions or require a local partner.

Securing funding for your film project can be a complex journey, but with the right approach and partners, it’s an achievable goal. The diverse landscape of film financing companies in Pakistan offers opportunities for projects of all scales and genres. By understanding the market, preparing thoroughly, and leveraging platforms like Vitrina, you can navigate this landscape successfully and bring your cinematic vision to life.

Ready to take the next step in financing your film? Explore top film financing companies in Pakistan through Vitrina and turn your script into screen reality!

Learn more about independent film finance strategies

Remember, in the world of film financing, persistence and preparation are key. With the right financing partner and a compelling project, your film could be the next big success story coming out of Pakistan. Lights, camera, finance!