Content ROI calculation for streaming platforms is the advanced process of evaluating project profitability by cross-referencing production costs against granular engagement metrics, subscriber acquisition value, and secondary licensing revenue.

This involve tracking “what, when, pauses, and rewinds” to determine the completion rate and “Weaponized Distribution” potential of every title.

According to industry intelligence from Vitrina AI, over 70% of major streamers have shifted from “gut-feeling” greenlighting to a data-powered framework tracking 1.6 million titles across the global supply chain.

In this guide, you will learn the five pillars of data-driven acquisition, the mechanics of the “Frenemy Pact” for maximizing ARPU, and how supply chain intelligence eliminates the costly market intelligence deficit.

While legacy methods relied on siloed personal networks and trade reports, the modern era defines success through the ability to turn regional hits—like “Squid Game” or “Money Heist”—into global phenomena using predictive ROI engines.

This analysis addresses the critical gap in accessible strategic resources by breaking down the complex formulas used by top-tier streamers to ensure every dollar spent on content contributes to a competitive moat.

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Table of Contents

Key Takeaways for Strategy Leads

-

Data Over Instinct: Modern ROI calculation uses viewing data (pauses/rewinds) to greenlight content, exemplified by the David Fincher/Kevin Spacey “House of Cards” data-driven gamble.

-

Weaponized ROI: ROI is no longer limited to platform exclusivity; strategy teams now license high-value content to rivals 18-24 months post-release to maximize market efficiency.

-

Supply Chain Efficiency: Platforms tracking 140,000+ global distributors identify trending international titles 5x faster than manual sourcing methods.

What is Content ROI Calculation in the Streaming Era?

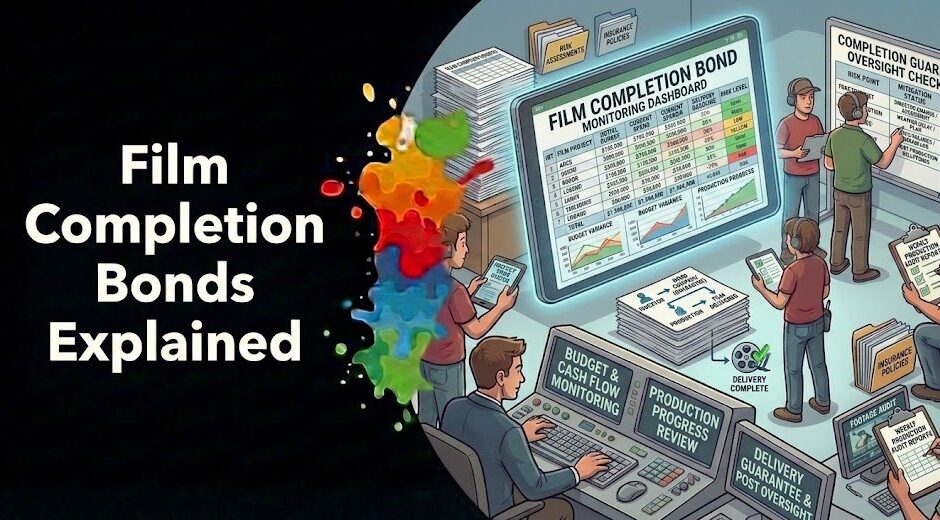

Content ROI calculation in the modern streaming landscape has evolved from a simple box-office metric into a multi-dimensional analytics engine. Unlike traditional theatrical releases where success is measured by ticket sales, streaming ROI tracks the “Customer Lifetime Value” (CLV) attributed to a specific title. This involves monitoring how many “Net New” subscribers a show attracts and, crucially, how effectively it prevents “churn” (cancellation) among existing users.

The complexity of this calculation is driven by the industry’s scale—comprising over 600,000 companies and 5 million professionals. In an ecosystem where a single production can involve multiple global hubs, executives must use supply chain intelligence to verify the track record of co-production partners and vendors. Without a “single source of truth,” platforms face a “data trust deficit” that exposes projects to significant financial and operational risks.

Analyze market trends and content financing data:

How Does the Netflix Strategy Influence ROI Decisions?

Netflix has transformed content acquisition into a science built on five core pillars: a data-driven engine, original content focus, global expansion, content diversification, and aggressive spending. By analyzing vast amounts of viewing data, the platform can predict the ROI of a project before it even enters development. For instance, the greenlighting of “House of Cards” was based on data suggesting that audiences who enjoyed David Fincher films also had a high affinity for Kevin Spacey.

Furthermore, Netflix leverages its global platform to turn regional hits into international phenomena. Titles like “Dark” (Germany) and “Money Heist” (Spain) achieved high ROI by tapping into international subscriber growth while controlling IP ownership to avoid expiring licensing deals. For strategy officers, the Netflix model demonstrates that “Content ROI” is as much about global distribution logistics as it is about creative storytelling.

Analyze competitor content acquisition trends:

Industry Expert Perspective: AVOD, FAST, and Beyond: How Whip Media is Shaping the Future of Streaming Solutions

Carol Hanley, CEO of Whip Media, discusses how streaming analytics, revenue tracking, and audience insights are foundational to ROI. This video addresses the market gap in understanding how “Performance Personalization” impacts the bottom line for FAST and AVOD platforms.

Carol Hanley explores Whip Media’s focus on streaming analytics, royalties, and revenue tracking. She reveals how these tools help streamline content performance reporting across FAST, SVoD, and AVoD platforms to maximize market efficiency.

What is Weaponized Distribution and How Does it Affect ARPU?

As the “Streaming Wars” settle into a period of strategic cooperation, platforms have adopted “Weaponized Distribution.” This strategy involves licensing high-value content to rival platforms 18-24 months post-release to generate fresh revenue and recoup production costs on “sunk” assets. For instance, Amazon MGM Studios now licenses films like “James Bond” to Netflix, while Warner Bros. Discovery utilizes a “rotational window” strategy to maximize Average Revenue Per User (ARPU).

This “Frenemy Pact” shifts the ROI calculation from rigid exclusivity to market efficiency. By treating content as a weaponized asset that can be deployed across multiple platforms, strategy teams can significantly lower the financial risk of high-budget originals. Understanding these shifts requires deep “Deals Intelligence” to monitor competitive moves and emerging financial models in real-time—a capability provided by specialized supply chain platforms.

How Does Supply Chain Intelligence Reduce Sourcing Risk?

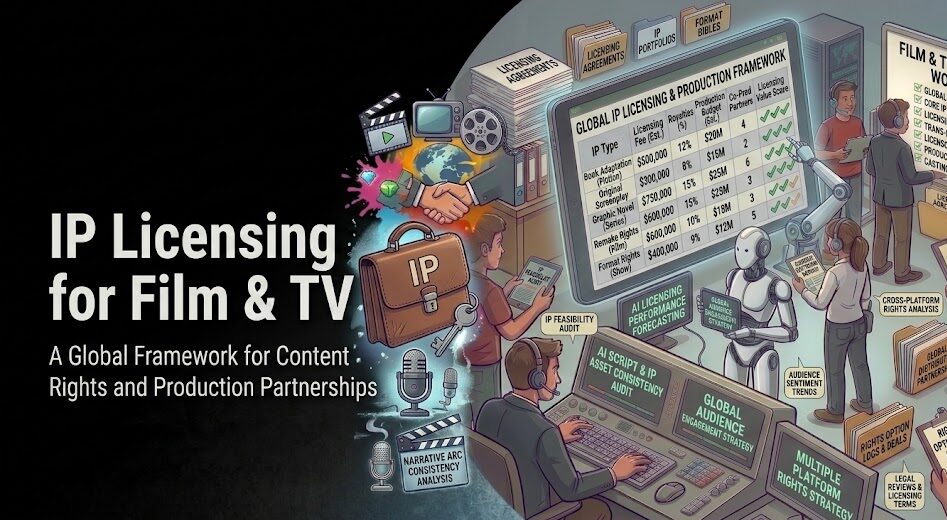

The entertainment industry is undergoing a structural metamorphosis from an opaque, relationship-driven ecosystem to a data-powered framework. Vitrina AI addresses the “data deficit” by providing structured, verifiable intelligence on the global supply chain. This allows executives to perform due diligence on 140,000+ companies and 5 million professionals, ensuring that partners have a verifiable track record before capital is committed.

By tracking over 1.6 million titles and 30 million relationships, Vitrina acts as a “digital lighthouse,” helping acquisition leads find regional content and distributors 5x faster. This transparency eliminates the risk of “word-of-mouth” sourcing and provides strategy teams with the “insider advantage” of a Hollywood agent, scaled globally. In a hyper-competitive market, this data-driven approach is the only way to achieve sustainable content ROI.

“The transition from relationship-based greenlighting to data-driven science is not just an efficiency gain; it’s a survival mechanism. Platforms that master Content ROI calculation using supply chain intelligence are building competitive moats that will define the next decade of media.”

Moving Forward

Content ROI calculation has shifted from a post-release analysis to a pre-greenlight science. This evolution addresses the identified market gaps in data-driven discovery and weaponized distribution models.

Whether you are a CXO looking to monitor global production slates, or an Acquisition Lead trying to discover trending regional IP, the unified solution lies in actionable, real-time intelligence.

Outlook: Over the next 12-18 months, the integration of “Authorized AI” data markets will further transform ROI, as archival content libraries become high-margin assets for training localized AI models.

Frequently Asked Questions

Quick answers to the most common queries about content ROI and streaming strategy.

What metrics are most important for Content ROI in streaming?

How does Netflix use data to predict ROI?

What is “Weaponized Distribution”?

How does supply chain intelligence improve ROI?

What is a “Data Trust Deficit”?

Can regional content drive high global ROI?

What is the “Weaponized Distribution” window?

Does Vitrina AI track unreleased projects?

About the Author

Strategy Analyst at Vitrina AI, specializing in media finance and entertainment supply chain transformation. Connect with the team on Vitrina.