Revolutionizing Marketing Strategies in the global entertainment sector is no longer a matter of creative intuition; it is a structural mandate driven by the “Fragmentation Paradox.” As content production scales across 600,000+ companies, the “Data Deficit” has left even major studios vulnerable to the “Timing Trap,” where marketing efforts begin long after high-value acquisition windows have closed. The reality? Traditional “Walled Garden” models are collapsing under the weight of subscriber churn and margin erosion, forcing a shift toward “Weaponized Distribution” and data-backed ROI. But here is the catch: without a vertical AI layer to surface buying signals in real-time, your marketing spend is effectively a shot in the dark, disconnected from the actual financing and commissioning cycles of the industry.

This report provides an executive roadmap into the “Intelligence Layer” of modern content promotion. We will de-risk the transition to “Authorized Generative AI” for campaign assets, analyze the shift from subscriber volume to “Efficiency-First” models, and provide a verified analysis of the top 10 companies currently reshaping the marketing supply chain. By aligning outreach with current activity cycles, professionals can bypass the manual inefficiencies of legacy networking and accelerate their path to qualified connections. Let’s be candid: in a market tracking 30M relationships, proximity to the deal is the only metric that matters.

⚡ Executive Summary

|

Contents

- Weaponized Distribution: The End of Walled Garden Exclusivity

- Authorized Generative AI in Campaign Asset Production

- Bypassing the Timing Trap through Deals Intelligence

- Financial Dynamics: Programmatic Ads and ARPU Optimization

- Regional Friction: Mapping Localized Marketing Hurdles

- Top 10 Leaders in Revolutionizing Marketing Strategies (2024-2025)

🎙️ Expert Intelligence: Carol Hanley

“Whip Media provides tailored solutions for streaming platforms… covering royalties, revenue tracking, and audience insights to help streamline content performance.”

Source: Vitrina Expert Series. Carol Hanley, CEO of Whip Media, explains the shift toward data-driven content performance reporting across FAST, SVoD, and AVoD platforms.

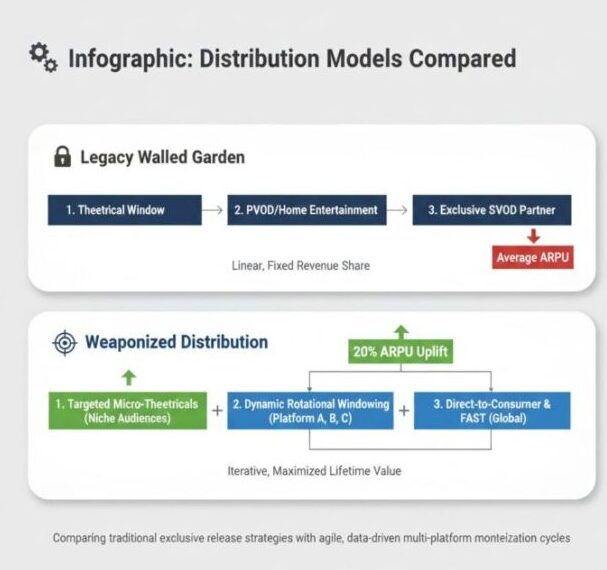

Weaponized Distribution: The End of Walled Garden Exclusivity

The industry is currently witnessing a structural metamorphosis, shifting away from the rigid exclusivity that defined the early “Streaming Wars.” Revolutionizing Marketing Strategies now involves the deployment of “Weaponized Distribution,” where premium content is licensed to rival platforms 18-24 months post-release. The bottom line: Exclusivity is a luxury the current cost-of-capital environment no longer permits. According to data from Omdia, major studios are seeing a 15-20% uplift in ARPU by adopting rotational windowing strategies that maximize the lifecycle of “sunk” production assets.

The reality? The “Frenemy Pact” between Amazon and Netflix, involving the programmatic access to ad inventory via Amazon DSP, signals a market where collaboration is the primary driver of efficiency. Let’s be candid: if your marketing strategy is still built on a single platform’s silo, you are missing the secondary and tertiary monetization waves that define the 2024-2025 landscape. By surfacing buying signals through Vitrina’s “Global Projects Tracker,” executives can identify exactly when a project transitions from production to release, timing their marketing outreach to align with high-value licensing windows.

But here is the catch: weaponizing distribution requires a level of “Deals Intelligence” that manual tracking cannot provide. You need to know not just who has the rights, but who is *looking* to acquire them. The fragmentation paradox means that while connectivity is at an all-time high, operational data remains siloed within individual distributors. Strategic shift? Using vertical AI to map historical collaborations and track shifts in commissioning behavior allows you to de-risk your licensing asks and ensure your content finds the right home at the right price.

Identify competitive moves and licensing trends for your target distributors:

Monitor upcoming competitive slates and licensing activities for [COMPANY_NAME]

Authorized Generative AI in Campaign Asset Production

The integration of generative AI into the marketing supply chain has transitioned from a theoretical concept to a core business strategy. Revolutionizing Marketing Strategies now mandates a shift toward “Authorized Data” markets. The landmark $1B investment by Disney in OpenAI signals the end of unauthorized IP scraping for training models. The bottom line: if you are using AI to generate marketing assets without an authorized data framework, you are exposing your project to massive legal and reputational risk.

Let’s be candid: the “Data Trust Deficit” is at its peak. Major players like Warner Bros. Discovery are now vetting their technology partners based on their “Authorized AI” credentials. This is no longer just about speed; it is about protecting the “likeness and performances” of creators while simultaneously scaling short-form fan content. The strategic imperative? Establishing guardrails that allow users of tools like OpenAI’s Sora to access verified characters and environments in a controlled, brand-safe environment. This reshapes the fan engagement model from a passive viewing experience to an active, co-creative one.

The reality? This “Authorized AI” shift also solves the talent gap in regional markets. By leveraging AI-powered localization tools like Deepdub or Respeecher, marketing teams can produce high-fidelity trailers and social clips in dozens of languages simultaneously, ensuring that a global campaign resonates with localized emotional cues. This level of scale was previously only available to the top 1% of Hollywood studios; now, through vertical AI, it is accessible to indie producers looking to globalize their IP overnight.

Bypassing the Timing Trap through Deals Intelligence

The “Timing Trap” is the single greatest cause of margin erosion in the content supply chain. Professionals often struggle to identify who is currently commissioning or financing until a trade report is published in $$Variety$$ or $$Deadline$$. By then, the opportunity has closed. Revolutionizing Marketing Strategies requires an “Early Warning Signal”—a way to see projects as they enter the development pipeline, not just when they are released.

The reality? Most marketing budgets are reallocated reactively rather than strategically. But here is the catch: if you are tracking the 1.6M titles and 140k companies via Vitrina, you can signal opportunities months before they become public knowledge. This allows for “Precision Outreach,” where your marketing and sales teams are connecting with decision-makers at the exact moment they are seeking service partners for post-production, VFX, or localization. This is the difference between a cold pitch and a qualified connection.

Let’s be candid: the “Fragmentation Paradox” means that while the industry is globally connected, the operational data required to navigate it is locked in silos. Professionals rely on word-of-mouth or legacy networks that are structurally incapable of handling the volume of the modern content mandate. To accelerate growth, you must weaponize “Deals Intelligence”—tracking money movement across markets and genres to predict where the next “buying signal” will emerge. This is how you surface the insider advantage and de-risk your business development slate.

Find active buyers and commissioners in your specific genre and region:

Identify co-pro partners in [COUNTRY] currently commissioning scripted formats

Financial Dynamics: Programmatic Ads and ARPU Optimization

The “End of the Streaming Wars” has transitioned the industry into an “Efficiency-First” era. The bottom line: the focus has shifted from subscriber volume to Average Revenue Per User (ARPU). Revolutionizing Marketing Strategies in 2024-2025 is synonymous with programmatic ad integration and the rise of FAST (Free Ad-supported Streaming Television). Data from $$Ampere Analysis$$ suggests that the shift toward ad-supported tiers is the primary driver of revenue growth for platforms like Netflix and Disney+.

The reality? Marketing is now an analytical science. By using “Deep Company Profiling,” executives can monitor how their competitors are windowing content and reallocate their ad spend to match viewing patterns. But here is the catch: static directories cannot tell you who is currently seeking service partners for active post-production. You need a system that tracks “Buying Signals”—the real-time indicators of a company’s financial activity. This allows strategy teams to de-risk their investments by partnering with companies that have a verifiable track record of high-value deals.

Let’s be candid: the recoupment cycles in the independent market are harder than ever. As Phil Hunt of Head Gear Films signals, the collapse of traditional pre-sales windows means that marketing must be more aggressive and data-driven to capture audience attention in a crowded digital marketplace. The strategic shift involves using AI to identify “Emotional scene analysis,” as pioneered by Vionlabs, to create trailers and marketing materials that are scientifically optimized for engagement. This is the weaponization of data to drive margin growth and ensure project sustainability.

Regional Friction: Mapping Localized Marketing Hurdles

While the content market is borderless, marketing execution remains deeply localized. Revolutionizing Marketing Strategies requires an understanding of “Regional Friction”—theLocalized hurdles like talent gaps, regulatory audit traps, and the “Fragmentation Paradox” in emerging markets. The reality? A marketing strategy that works in North America will likely fail in the MENA or APAC regions if it does not account for cultural nuances and localized distribution dynamics.

Let’s be candid: the “Data Deficit” is most acute in regional markets. Professionals struggle to identify the “Hard-to-identify” regional specialists who can navigate localized licensing laws and ad-tech ecosystems. The bottom line: if you are entering a new market without a verified leadership map, you are essentially gambling with your marketing budget. Bypassing these hurdles requires proximity to the local supply chain—something that only a vertical AI trained on global census-level data can provide.

The strategic ROI? By identifying top regional service leaders who have delivered on “Hero Projects,” you can accelerate your market entry and de-risk your localized campaigns. Whether it is navigating the unique business dynamics of India’s regional cinema market, as Naveen Chandra signals, or understanding the streaming revolution in Brazil, the “Insider’s Insider” advantage comes from having structured, verifiable, and real-time intelligence on local partners. This is how you surface opportunities in markets that others find opaque.

Top 10 Leaders in Revolutionizing Marketing Strategies (2024-2025)

Revolutionizing Marketing Strategies: Conclusion

The “Data Deficit” in the marketing supply chain is rapidly closing for those who leverage vertical AI to navigate the fragmentation paradox. We have analyzed how Revolutionizing Marketing Strategies involves a transition from reactive promotion to “Deals Intelligence-led” outreach. By weaponizing distribution, adopting authorized generative AI, and bypassing the timing trap, companies can reallocate their budgets from “Sunk Assets” to high-growth ROI drivers. The bottom line: Exclusivity is a luxury of the past; the future belongs to the “Efficiency-First” model where data dictates strategy.

The Bottom Line: Immediate path forward involves using Vitrina and VIQI to surface buying signals before they become public knowledge. To de-risk your localized marketing slates, you must identify the right service partners at the right time. Start by monitoring competitive moves and licensing activities through the Global Projects Tracker to ensure your marketing spend is always aligned with the highest value deal cycles in the industry.

Explore Live Intelligence

Monitor upcoming competitive slates and licensing activities for [COMPANY_NAME]

Find me active post-production or VFX companies in [REGION] specializing in [SKILL]

Identify co-pro partners in [COUNTRY] currently commissioning scripted formats

Find me active green-lit projects in Asia for licensing

Show decision makers for [COMPANY_NAME]

Strategic FAQ

What is the ROI of Weaponized Distribution in 2024-2025?

Weaponized Distribution allows studios to maximize ARPU by licensing premium IP to rivals post-release. Data signals a 15-20% uplift in revenue by recouping costs on “sunk” assets and capturing secondary audience segments that were previously unreachable within a single-platform silo.

Why is “Authorized Data” critical for AI marketing strategies?

Unauthorized IP scraping for AI training is a major legal risk. “Authorized Data” ensures that campaign assets are created using licensed characters and environments, protecting creator likenesses and maintaining brand safety while enabling co-creative fan engagement at scale.

How does the “Timing Trap” impact marketing budgets?

The Timing Trap occurs when marketing efforts begin reactively rather than strategically. By using real-time deals intelligence to monitor projects in the development pipeline, companies can align their outreach with commissioning cycles, de-risking their spend and ensuring they are in the room when deals are made.

What role does regional friction play in global marketing slates?

Regional friction involves localized talent gaps and regulatory audit traps that can derail a borderless content strategy. Overcoming this requires proximity to local supply chains and verified leadership maps to identify regional specialists who have successfully delivered on hero projects in specific markets.