Pricing film pre-sales is the strategic process of setting Minimum Guarantees (MGs) against international territory rights based on package bankability, genre demand, and current market data.

It isn’t just about picking a number; it’s about balancing the upfront “Ask”—the cash required to close your funding gap—with the “Take”—the backend participation and P&A commitments that drive long-term ROI. In the 2025 landscape, where streamers have pulled back on output deals, your pricing strategy is the difference between a greenlight and a dead project.

The gap between a sales agent’s “high” estimate and the actual check cut by a distributor is where independent films either thrive or die. If you overprice, you’ll find yourself with a pile of unsold territories and a gap lender who won’t budge. Underprice, and you’ve left the very capital on the table that could have elevated your production value. It’s a high-stakes game of insider candor and financial framing.

Table of Contents

Stop Guessing Who’s Financing. Get Targeted Outreach.

Stop searching and start getting funded. We identify the exact decision-makers currently backing projects like yours, turning raw data into risk-aligned capital partnerships.

Major Studios

Scouting early stage projects, IP, and Regional partners for global studio pipelines.

IP Owners & Leads

Connecting creative leads with qualified financiers and major streaming platforms.

Streamers

Securing high-value pre-buy content and discovering early-stage global IP for platforms.

Indie Producers

Bridging the gap for indie filmmakers to reach executive production partners and capital.

Global Financing Ecosystems

Mapping complex markets and pairing projects with disciplined, risk-aligned capital across global territories worldwide.

The 2025 Market Reality: Why Static Estimates Are Dangerous

Behind closed doors, sales agents are admitting what the trades often gloss over: the traditional pre-sale corridors are narrowing. We’re seeing a fundamental shift where “good enough” packages no longer trigger automatic pre-buys in anchor territories like Germany or France. Today, pricing film pre-sales requires a granular understanding of how territory values fluctuate weekly based on theatrical performance and local streamer quotas.

If you’re relying on 2023 pricing data to structure your 2025 production financing, you’re setting yourself up for a “Big Crunch.” The capital reality is that mid-budget indies ($5M-$15M) are seeing MG compression of 20-30% in Western Europe, while growth markets in MENA are showing surprising resilience. You’ve got to be precise. Peer-level insiders recognize that a generic 10% allocation for “Rest of World” is no longer an acceptable input for a sophisticated capital stack.

Phil Hunt, CEO of Head Gear Films, explains the shift in market dynamics:

As Hunt notes, the “Crunch” is real. Producers who don’t de-risk through accurate pricing are finding their production financing stalled. The solution isn’t just lowering your “Ask”—it’s optimizing the structure of the deal itself.

The “Ask and Take” Negotiation Model: Pricing Beyond the MG

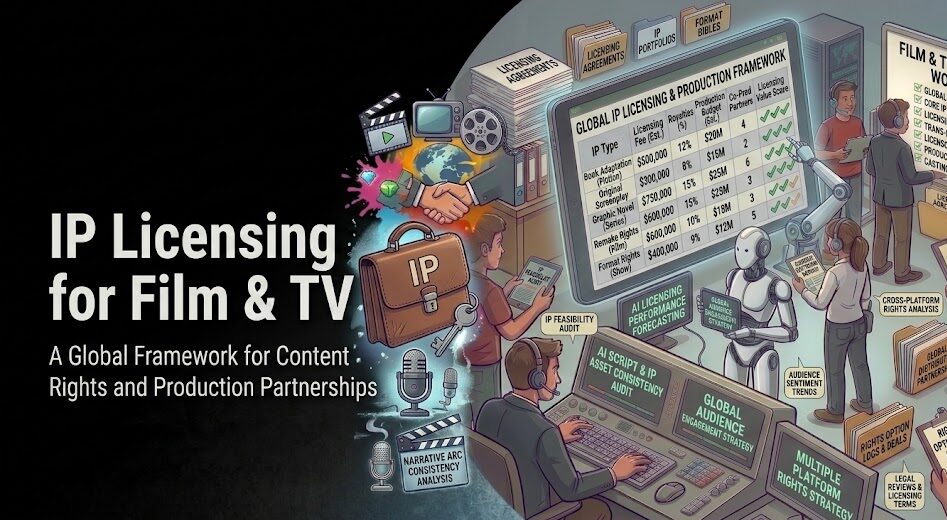

The “Ask and Take” model is a Vitrina proprietary framework designed to move the conversation from “How much cash can I get now?” to “How do I maximize the total value of this territory?” When you’re negotiating film pre-sales, you aren’t just selling rights; you’re forming a strategic partnership with a distributor.

The Vitrina Pre-Sale Pricing Matrix™

Use this matrix to calibrate your “Ask” based on territory importance and package strength.

| Territory Type | The “Ask” (MG Target) | The “Take” (Backend/P&A) |

|---|---|---|

| Anchor (DE, FR, UK) | High (10-15% of budget) | Theatrical commitment focus |

| Growth (MENA, SEA) | Moderate (3-7% of budget) | Aggressive rev-share tiers |

| Mature (IT, ES, JP) | Fixed Fee / Mid-MG | Output deal integration |

The real dynamic here? You might take a lower MG (the “Ask”) in exchange for a higher P&A commitment or a better position in the recoupment waterfall (the “Take”). For an independent producer, this isn’t a compromise—it’s a calculated move to de-risk the project’s longevity. Strategic players understand that cash-in-hand is vital for the greenlight, but the backend is where the margin is protected.

Producers looking to benchmark their “Ask” can explore current market valuations on Vitrina to see what similar packages are commanding in real-time.

Territory Price Points: What Markets Are Actually Paying in 2025

Let’s look at the numbers. While every film is unique, current market signals suggest the following benchmarks for a “bankable” indie thriller budgeted at $10M:

- Germany (GSA): $800K – $1.2M. Still the powerhouse of European pre-sales, but theatrical commitments are mandatory for the high end of that range.

- France: $600K – $900K. Heavily influenced by TV output deals and local subsidies; pricing is compressed if the cast doesn’t resonate with Gallic audiences.

- United Kingdom: $500K – $750K. Often bundled with US rights or treated as a separate “anchor” depending on the sales agent’s strength.

- MENA (Saudi Focus): $300K – $500K. A rapidly growing sector where Sovereign Content Hubs™ are aggressively bidding to attract high-concept genre content.

Now, don’t get distracted by these “headline” numbers. The all-in cost of securing these deals—including the sales agent’s 10-25% commission and legal delivery costs—can erode your net capital significantly. You’ve got to calculate your IRR differential based on the net check, not the gross MG.

Find the Financiers Backing Your Genre

Stop searching and start getting funded. We identify the exact decision-makers currently backing projects like yours, turning raw data into risk-aligned capital partnerships.

Negotiating with Sales Agents: Analyzing the “High-Low” Spread

Your sales agent is your frontline, but their “estimates” are often designed to win your business, not necessarily reflect the market’s floor. When you receive a territory value list, look for the “Spread”—the difference between the High and Low estimates. A spread greater than 50% signals a lack of market certainty.

Here’s the thing: Gap lenders only care about the “Low” estimate. In fact, most will take 60-70% of the Low as their collateral base. If your sales agent is pricing your pre-sales with too much fluff, your gap lender will simply walk away. You need to weaponize your negotiation by demanding data-backed justifications for every territory value on that list.

Matthew Helderman of BondIt Media Capital discusses how lenders view these estimates:

The capital stack doesn’t just protect margin—it fundamentally de-risks the entire investment thesis. If you’re struggling to validate your sales agent’s numbers, ask VIQI for a market reality check on your specific genre and cast package.

Weaponizing Data: How to Defend Your Pre-Sale Prices to Gap Lenders

Gap financing—the bridge between secured capital and budget—typically closes 4-8 weeks from application, but only if your documentation is clean. To defend your pre-sale pricing to a lender, you need more than just a sales agent’s signature. You need “Comparative Intelligence.”

Show the lender three things:

- Track Record: How similar films from this sales agent performed in these specific territories over the last 18 months.

- Theatrical Floor: Evidence of theatrical appetite for your genre in the anchor markets.

- Pre-Buy Velocity: Have any other films in this “class” sold recently? This signals market momentum.

When you present this level of financial framing, you aren’t just a producer looking for cash; you’re a strategic partner presenting a de-risked asset. That’s how you compress your financing timeline and protect your IRR.

How Vitrina Helps with Pricing Film Pre-Sales

Finding the right pre-sale strategy isn’t just about rates—it’s about access to the right data at the right room. Vitrina’s platform connects producers with the intelligence needed to price, negotiate, and close deals with confidence.

- Explore the database to compare sales agents and territory activity.

- Ask VIQI for specific territory value benchmarks based on your current package.

- Contact Concierge for hands-on assistance in structuring your international sales strategy.

Frequently Asked Questions

How do you calculate film pre-sale prices?

You calculate pre-sale prices by analyzing three variables: Genre Demand, Cast Bankability, and Territory Historicals. Sales agents use these to create a “High-Low” estimate grid. Producers should focus on the “Low” estimate as the realistic baseline for financing purposes, typically expecting anchor territories to cover 10-15% of the budget.

What is a good minimum guarantee for an indie film?

A “good” MG is one that actually triggers a check. In 2025, for a $5M film, an MG of $500K for Germany is considered strong. However, don’t just look at the cash; look at the P&A commitment. A $400K MG with a $200K theatrical spend commitment is often more valuable than a $500K MG with a straight-to-streaming plan.

Why are pre-sale prices declining in 2025?

The primary driver is the pullback of global streamers from high-volume licensing deals. Local distributors can no longer “flip” a title to a streamer for an immediate profit, forcing them to rely on theatrical and VOD performance. This increases their risk, which they pass on to producers through lower MGs and more conservative pricing.

Can you secure gap financing without pre-sales?

It’s incredibly difficult. Most gap lenders require at least one or two “anchor” pre-sales to validate the sales agent’s estimates. Without real checks cut by distributors, your estimates are just “speculative paper,” which gap lenders view as too risky to advance against.

The Bottom Line

Pricing film pre-sales strategically is the key to unlocking your capital stack. By moving beyond static estimates and embracing the “Ask and Take” model, you protect your margins and build partnerships that last beyond a single project. If you’re ready to de-risk your next project, Vitrina’s Concierge team is here to help you navigate the 2025 market reality.