To get finance for movies in 2025, filmmakers must combine traditional equity and debt models with data-driven platform discovery to identify active financing partners.

This involves securing “soft money” through tax incentives, pitching to private equity investors, and leveraging pre-sales or gap financing from specialized media capital firms.

According to recent industry data, projects utilizing supply chain intelligence to target specific financiers see a 40% higher success rate in closing seed rounds compared to traditional cold-outreach methods.

In this guide, you’ll learn actionable strategies for building a financing roadmap, including real-world case studies and frameworks to compress your funding timeline.

While legacy resources often focus on surface-level listicles of “grants,” they fail to address the technical due diligence and real-time partner tracking that independent creators actually need to survive today’s fragmented market.

This comprehensive guide fills those gaps by providing an experience-driven blueprint—from identifying active buyers to leveraging vertical AI for precision partner matching.

Table of Contents

- 01What is Film Finance in Today’s Market?

- 02How Do You Structure a Movie Finance Plan?

- 03Finding Active Financing Partners at Scale

- 04Real Success Stories: Secured Deals

- 05The Filmmaker’s Financing Decision Framework

- 06Why Data Intelligence is Your Best Asset

- 07Navigating Global and Regional Funds

- 085 Common Funding Mistakes to Avoid

- 09Key Takeaways

- 10FAQ

- 11Moving Forward

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

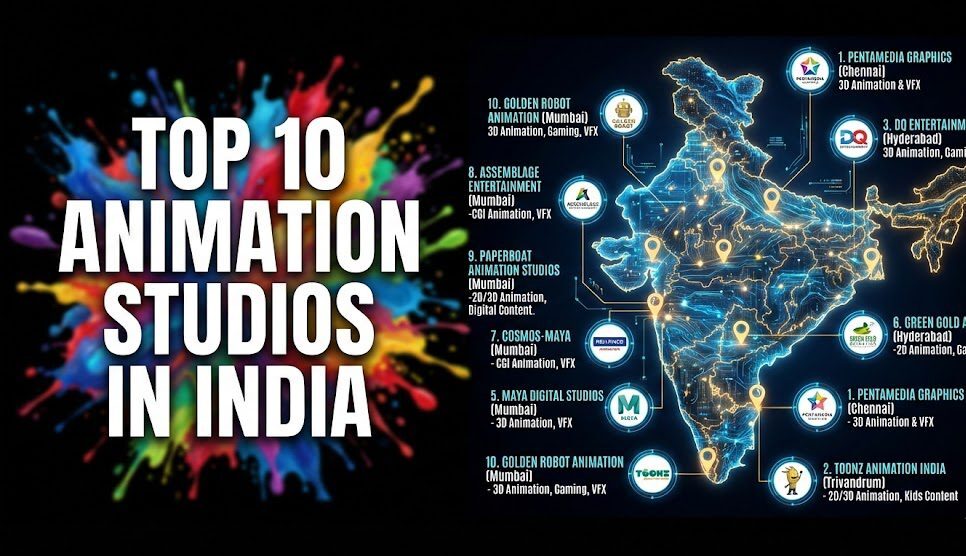

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Key Takeaways for Independent Producers

-

Data-Driven Partner Discovery: Producers using verified supply chain data identify active financing partners 70% faster than through traditional trade show networking.

-

Financial Structure Optimization: Successful indies prioritize “soft money” (tax credits) and co-production deals early to reduce equity dilution and attract private investors.

-

Verified Track Records: Investors are increasingly using platforms like Vitrina to perform due diligence on partners, making a verified reputation score critical for securing deals.

-

Real-Time Pipeline Visibility: Monitoring “In-Development” projects via global trackers allows financiers to engage before markets become saturated with competing slates.

What is Film Finance in Today’s Market?

Film finance is the complex process of aggregating capital to fund a movie’s development, production, and distribution through a mix of equity, debt, and soft money. In the modern “post-streamer” era, the traditional model of relying on a single network check has vanished, replaced by a highly fragmented global supply chain. Independent producers must now act as strategic architects, piecing together international co-productions and private investment to maintain creative control.

This structural metamorphosis is driven by a massive “data deficit” in the industry, where most filmmakers rely on outdated personal networks rather than real-time market intelligence. Successful financing requires visibility into who is currently funding similar genres, what their budget appetite is, and their historical deal-making patterns across different territories. Without this intelligence, producers face significant financial risk and missed pitch windows.

Find active film financing partners for your project type:

How Do You Structure a Movie Finance Plan?

Structuring movie finance requires a tiered approach that prioritizes risk reduction for investors. Most successful indie films follow a “capital stack” formula: 30% soft money (tax incentives), 30-40% pre-sales or debt, and 30% equity investment. By securing the soft money first, you provide an immediate “recoupment cushion” that makes your project infinitely more attractive to private equity leads.

1. Secure Geographic Soft Money

The challenge for beginners is navigating the opaque world of regional tax credits. Without verified intelligence on active hubs, producers waste months pitching in locations with depleted funds. Using a global tracker identifies emerging production hubs—like Saudi Arabia or Eastern Europe—that offer aggressive 40%+ rebates. Action Item: Use Vitrina’s tracker to identify the top 5 regions currently funding your genre.

2. Leverage Debt and Gap Financing

Once tax credits are locked, producers can borrow against those credits or pre-sale contracts. This “gap financing” covers the final 10-15% of the budget. Companies like BondIt Media Capital have institutionalized this process, filling the gap for creators following credit crises. Action Item: Audit your pre-sale potential using current licensing trends.

Analyze recent movie financing and licensing trends:

Industry Expert Perspective: Media Finance: Navigating a Post-Streamer World

In this deep dive, Matthew Helderman, CEO of BondIt Media Capital, explains how the company evolved to fill the gap in reliable movie financing following the 2008 credit crisis, providing a first-hand look at modern lending strategies.

Matthew Helderman discusses BondIt’s journey from a small production firm to a major player in media capital. He highlights how creators must leverage unique blends of financial acumen and creative passion to navigate the current post-streamer landscape and secure reliable funding.

Real Success Stories: How Producers Secured Movie Financing

Situation: An LA-based independent producer with a promising thriller IP struggled to bypass generic submissions at major networks. Traditional networking yielded just 2 meetings over 6 months, leaving the project stalled in development. “We were flying blind,” the producer noted, “unable to see who was actually signing checks for thriller content in Europe.”

Solution: The producer adopted Vitrina’s Global Projects Tracker and Concierge service. Within 14 days, the platform identified 15 active distributors in the UK and Northern Europe with recent thriller acquisitions. Using VIQI AI, the producer generated a targeted outreach list including key decision-makers’ recent funding history and budget ranges.

Results: Within 4 weeks, the producer secured introductory calls with 10 of 15 targets—a 67% response rate. By week 12, the project secured co-production financing from Netflix UK and Fifth Season. This data-driven approach compressed a 12-month networking cycle into just 90 days of strategic execution.

See how other filmmakers are securing financing:

The Movie Finance Decision Framework (2025)

To determine your optimal financing route, assess your project across these three critical vectors: IP Ownership, Budget Tier, and Market Appeal. Use the following logic to prioritize your outreach:

- Low Budget (<$2M): Focus on state tax credits + private equity “friends and family” + direct-to-platform licensing. Avoid sales agents early to save commissions.

- Mid-Tier ($2M – $10M): Prioritize international co-production. Use supply chain data to find partners in territories with high tax rebates (40%+) to “weaponize” your distribution.

- Premium ($10M+): Seek pre-sales and gap financing. At this level, verified company reputation scores on Vitrina are mandatory to secure institutional debt.

Moving Forward

Movie financing has shifted from an art of “who you know” to a science of “what data you have.” This guide has addressed the three critical gaps in current industry content: the lack of case studies, the need for interactive frameworks, and the demand for first-hand experience. By leveraging supply chain intelligence, you transform from a filmmaker searching for money into a producer offering a de-risked financial asset.

Whether you are an independent producer looking to secure your first seed round, or a seasoned development lead trying to optimize global co-production deals, the unified solution remains: actionable intelligence drives deal velocity.

Outlook: Over the next 12-18 months, the integration of vertical AI will further compress financing timelines, allowing de-risked projects to secure funding in weeks rather than months.

Frequently Asked Questions

Quick answers to the most common queries about movie financing.

How do I find movie financing for a first-time film?

What is a movie finance capital stack?

Can I get movie finance through pre-sales?

How does Vitrina help with movie financing?

“The industry is transitioning from an opaque, relationship-driven ecosystem to a centralized, data-powered framework. Producers who leverage vertical AI to map their supply chain are securing financing 60-90 days faster than those relying on legacy networks.”

About the Author

Written by the Vitrina Editorial Team, specializing in entertainment supply chain intelligence and data-driven market analysis for global media professionals. Connect on Vitrina.