Impact Deals – November 2025

High-Impact Deals are a spotlight on significant deals and partnerships shaping the global entertainment ecosystem. This section focuses on a range of unique signals Vitrina has picked up in the last month, including innovative financing, new distribution models, and cross-industry collaborations that offer a glimpse into the evolving business of content.

The Netflix-WBD Merger: A Reset in the Media Supply-Chain

Netflix has executed the definitive industry checkmate with an $82.7 billion acquisition of Warner Bros. Discovery’s studio and streaming assets, effectively securing the ultimate content armory. This surgical “spin-merge” strategically decouples growth from decay by spinning off legacy linear networks (CNN, Discovery, TNT) into a standalone entity. By annexing crown jewels like HBO, DC, and Warner Bros. Pictures, Netflix captures Hollywood’s most valuable IP library while leaving the declining cable bundle behind.

Supply Chain Impact:

- IP as Infrastructure: Netflix evolves into an IP-powered hub. Franchises like DC and Harry Potter become long-cycle assets driving sustained supply-chain demand.

- Global Productions (Mixed Ecosystem): Far from insourcing everything, Netflix will double down on a hybrid model—using internal lots for efficiency while relying on regional partners for scale and diversity.

- Volume Evolution: Closing the gap vs. YouTube/Amazon. Expect a dramatic ramp-up in creative throughput across all budget tiers.

- Advertising: Now a core lever. This strategy shifts from “optional” to “essential,” driving new mandates for ad-suitable, episodic formats.

- Theatrical: The “kill switch” on theatrical is a myth. Netflix will use a surgical, variable distribution chain to maximize value.

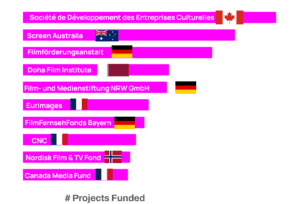

Qatar’s Strategic Entry into the Global Film Supply Chain

In a coordinated strategic expansion, the Qatar Film Committee (QFC) has established an instant end-to-end ecosystem through simultaneous partnerships with Sony Pictures, Miramax, Neon, and Department M for content co-financing and distribution, alongside a critical infrastructure pact with Company 3 to localize post-production. This strategy is underpinned by the new Qatar Screen Production Incentive (QSPI), which offers a market-leading 50% cash rebate; significantly, the rebate for post-production is “untethered” to physical shoots, creating a distinct arbitrage opportunity that encourages regional productions to migrate finishing work to Doha. By prioritizing intellectual property ownership and high-margin technical services over volume-based physical production, Qatar is carving a unique niche that complements rather than directly mirrors the backlot-heavy strategies of neighboring Saudi Arabia and Abu Dhabi, aiming to capture long-term value through global distribution access and a localized digital supply chain.

Disney+ Japan x CJ ENM (Tving) Partnership

Effective November 2025, Disney+ Japan has shifted its strategy from a strict “walled garden” to a “super-aggregator” model by launching a dedicated “TVING Collection” hub that integrates over 60 CJ ENM titles and day-and-date exclusives like Dear X. This “shop-in-shop” arrangement allows Tving to bypass the capital-intensive requirement of building standalone infrastructure (CDN, payments, support) in Japan, while Disney secures high-retention K-content without development risk. Operationally, the deal validates a move toward platform bundling to combat churn and triggers an immediate demand for high-velocity Korean-to-Japanese localization workflows to support simultaneous broadcast windows.

Utopia Studios & Stock Farm Road JV

Utopai Studios and Stock Farm Road have formed “Utopai East,” a 50-50 joint venture that vertically integrates Utopai’s proprietary “human-in-the-loop” AI workflows with SFR’s industrial capital, specifically anchoring the studio to a massive 3-gigawatt AI data center project in Jeollanam-do, South Korea. By coupling creative operations directly to this hyperscale compute infrastructure, the deal creates a sovereign “Script-to-Screen” manufacturing bridge for exporting K-Content to the US, effectively treating GPU capacity as a fixed raw material rather than a variable cloud cost. This “Infrastructure-as-a-Studio” model fundamentally shifts the supply chain, moving competitive advantage from simple IP ownership to the control of the energy and processing power required to scale high-fidelity generative production.

Warner Bros. Animation x Webtoon Entertainment : The Data-Driven Fast Lane

Warner Bros. Animation, and Webtoon Entertainment have forged a strategic 10-series co-production pact that fundamentally accelerates the animation supply chain. By launching with four immediate “straight-to-series” adaptations like The Stellar Swordmaster and Hardcore Leveling Warrior, the deal leverages Webtoon’s 155M+ monthly users to validate IP, effectively outsourcing traditional “greenlight” decisions to audience data rather than studio instinct. This structural shift not only removes development bottlenecks and compresses pre-production timelines by utilizing pre-tested creative assets, but it also creates urgent demand for production vendors capable of translating vertical-scroll aesthetics into cinematic 16:9 formats, diversifying industry sourcing beyond the standard manga or comic book pipelines.

Fifth Season Secures $500M Credit Facility

Fifth Season’s $500M Strategy & Impact In a move that redefines independent studio leverage, Fifth Season (led by Co-CEOs Graham Taylor and Chris Rice) closed a $500 million, five-year credit facility with J.P. Morgan in November 2025 to shift from a “cost-plus” service model to high-margin deficit financing. This liquidity injection fundamentally alters the production supply chain by enabling the studio to act as an “owner-operator,” securing top-tier talent packages and paying vendors on standard terms without waiting for streamer greenlights. By bridging the cash-flow gap between production and licensing, Fifth Season gains the autonomy to retain valuable IP rights and optimize distribution across multiple windows, effectively forcing competitors to upsize their own liquidity to match this speed of capital deployment in the 2026 content market.

TelevisaUnivision & YouTube TV Renewal

The resolved dispute between TelevisaUnivision and YouTube TV transcends a typical linear renewal, establishing a new blueprint for “borderless” aggregation that trades domestic carriage for global platform expansion. By restoring Univision’s linear portfolio while simultaneously integrating the ViX SVOD into YouTube Primetime Channels, the deal evolves YouTube TV from a domestic retransmitter into a global operating system for content, directly triggering its marketplace launch in Mexico. From a supply-chain perspective, this “hard bundling” approach stabilizes critical Hispanic advertising inventory and significantly lowers Customer Acquisition Cost (CAC) by removing transactional friction, demonstrating that future carriage leverage will increasingly rely on hybrid models that combine linear retention with multi-territory app distribution.

ITV x TikTok “Pulse Premiere” Partnership

ITV has partnered with TikTok to join the “Pulse Premiere” program, allowing advertisers to place campaigns directly adjacent to marquee IP like Love Island and Six Nations on the “For You” feed. In a strategic shift, ITV’s BE Studio retains control over sales, enabling the bundling of linear, VOD, and social inventory into a single transaction. This move impacts the content supply chain by necessitating “near-live” editing workflows to capture cultural moments instantly, effectively mandating social-first cutdowns as standard deliverables in future production commissions to drive a unified “Total Video” measurement strategy.

Unified Workflows: BBC Studios & Moonraker’s Pipeline for Immersive Media

BBC Studios Science Unit has formed a strategic alliance with Moonraker VFX to extend its premium science IP into the high-growth Location-Based Entertainment (LBE) sector. By pivoting from a traditional service model to a co-development partnership, the deal creates a unified supply chain where high-resolution digital assets are built once for broadcast and seamlessly adapted for large-format venues like planetariums and immersive galleries. This move not only amortizes high-cost VFX production across new physical windows but also establishes a scalable pipeline for converting educational content into ticketed cinematic experiences globally.