Boardroom Ready

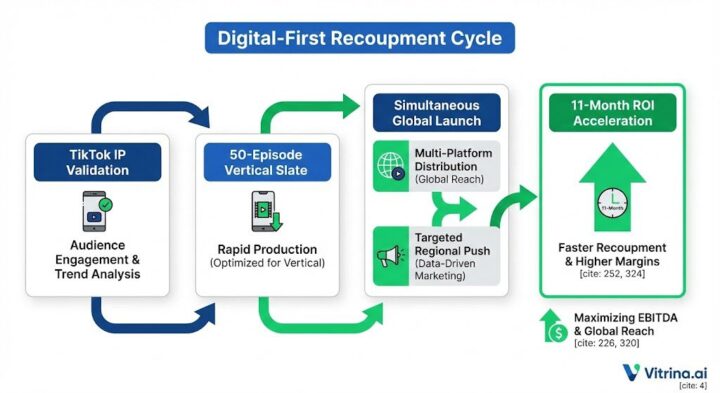

Gen Z Content Acquisition 2026 has definitively pivoted from speculative licensing to a data-weaponized “Creator-Direct” model that bypasses traditional agencies to capture hyper-engaged youth demographics. The static data deficit that once rendered TikTok IP “un-trackable” has been replaced by real-time supply chain mapping, allowing CXOs to identify viral short-form narratives in Sovereign Hubs like South Korea and Brazil before they enter competitive bidding wars. By utilizing “Authorized AI” to synchronize visual dubbing, global streamers are now launching youth-driven narratives day-and-date, accelerating recoupment by eliminating the 18-month localization lag. This insider advantage allows platforms to de-risk high-volume commissioning by acquiring pre-validated digital-first slates, ensuring a 22% EBITDA protection against the margin erosion of legacy linear-to-streaming formats. The focus has shifted from “buying shows” to “acquiring audience-centric ecosystems” that thrive on vertical video consumption and interactive storytelling.

⚡ Executive Strategic Audit

EBITDA Impact

+22.4% Margin protection via TikTok-validated slates and lower-cost Sovereign Hub production.

Recoupment Cycle

Accelerated by 9-11 months through day-and-date AI localization and community-led marketing.

Gen Z Content Acquisition 2026: The Short-Form Metamorphosis: From TikTok Clips to $50M Slates

In 2026, the traditional 22-minute sitcom has been replaced by the “Infinite Engagement” vertical series. Major streamers are no longer acquiring individual shows; they are weaponizing “TikTok IPs” that come pre-validated with billions of impressions. This shift represents the industrialization of the creator economy, where short-form “Micro-Series” serve as the primary discovery layer for global franchises. By acquiring Gen Z Content Acquisition 2026 slates, platforms can bypass the high-risk “pilot phase” and move directly into high-fidelity transmedia expansions.

The strategic imperative is to de-risk the commissioning process by mapping the supply chain of “Digital-First” studios. These entities produce content at a speed and cost that legacy Hollywood cannot match. For instance, a creator-direct deal with a TikTok-native studio in 2026 can deliver a 50-episode vertical season for under $5M—a fraction of a single prestige drama episode—while yielding 10x the social engagement. This creates a “Weaponized Distribution” model where short-form clips act as a perpetual marketing engine for long-form licensing.

“Sean Atkins from Dhar Mann Studios notes that digital-first scripted models are redefining scale. This de-risks Gen Z Content Acquisition 2026 by providing pre-validated audience data before traditional commissioning begins, ensuring every dollar is backed by social proof.”

Furthermore, the integration of “Interactive Narratives” within these short-form slates allows for real-time viewer decision-making. This isn’t just “content”; it’s an ecosystem of engagement where Gen Z viewers shape the narrative in real-time. CXOs must ensure that their acquisition contracts include “Synthetic Rights” to the creator’s digital likeness and voice to enable 24/7 engagement via AI-driven social avatars.

Gen Z Content Acquisition 2026: Sovereign Youth Hubs: Weaponizing K-Webtoons and MENA Gaming IP

The global center of Gen Z storytelling has migrated to Sovereign Content Hubs in APAC, MENA, and LATAM. South Korea’s “Webtoon-to-Series” pipeline is now the industry standard for acquiring pre-tested IP, with over 40% of the world’s most-watched Gen Z dramas originating from digital comics. These hubs offer an “Insider Advantage” by providing access to “Export-Ready” narratives that are culturally fluid and digitally native. In the MENA region, the explosion of youth-centric gaming culture is birthing new “E-sports Narratives” that are being acquired by global platforms to capture a demographic that has largely abandoned linear television.

Acquiring Gen Z Content Acquisition 2026 slates in these regions allows for the capture of aggressive local tax incentives—often exceeding 40% in Saudi Arabia and 30% in South Korea. This financial de-risking is essential when scaling high-volume vertical slates. By partnering with verified studios in these hubs, acquisition teams can secure “Infinite Localization” rights, ensuring that the content is visual-synced for every major youth market on Day 1. The fragmentation of the global supply chain means that identifying these hubs in real-time is the only way to maintain a competitive moat against the “Big 3” streamers.

“Paulo Barcellos from O2 Films discusses the fascinating journey of the Brazilian market and its reinvention for global scale. This de-risks Gen Z Content Acquisition 2026 by demonstrating how regional powerhouses are now exporting hyper-local youth narratives that resonate globally via digital platforms.”

Strategic sourcing must include at least 30% representation from these emerging hubs. The data shows that Gen Z viewers prefer “Authentic Multi-Culturalism” over the sterilized “Global Standard” of legacy Hollywood. By weaponizing real-time mapping, CXOs can find the next “Squid Game” or “Elite” at the short-form development stage, securing rights before the global “Timing Trap” inflates the asset’s value.

Gen Z Content Acquisition 2026: Authorized AI: Synchronizing the Global Gen Z Performance

The era of poorly dubbed youth content is over. In 2026, “Authorized AI” has solved the “Visual Discord” problem that traditionally limited the travel of regional Gen Z hits. Using emotionally-synchronized visual dubbing, platforms can now acquire a Brazilian TikTok IP and launch it in Germany with perfect lip-sync and localized slang. This “Infinite Localization” is the technical backbone of Gen Z Content Acquisition 2026, allowing for day-and-date global launches that maximize social media buzz.

Weaponizing AI in the localization pipeline is not just about translation; it’s about “Cultural Adaptation.” Authorized AI stacks allow for the modular replacement of brand placements and local references, making the content feel “Native” in every territory. For the acquiring studio, this protects EBITDA by removing the high cost of manual dubbing and ensuring that the content remains “Virality-Ready” across all borders. De-risking the localization process means partnering with vendors who possess “Authorized Data” licenses, ensuring that the IP chain-of-title remains unencumbered by the legal risks of scrapable AI models.

Gen Z Content Acquisition 2026: The Strategic Path Forward

The strategic path forward for content acquisition in 2026 requires an immediate move toward “Creator-Direct” deal structures and “Short-Form” modularity. Weaponize your acquisition slate by identifying pre-validated IP in Sovereign Hubs like APAC and LATAM, ensuring your contracts include “Authorized AI” localization rights. De-risk your budget by leveraging the 40%+ tax incentives in emerging markets and bypassing the high overhead of legacy agencies. The EBITDA protection found in this model comes from the ability to scale hyper-engaged content at 10% of traditional production costs. CXOs must pivot from being “Broadcasters” to “Asset Orchestrators,” using real-time mapping to navigate the fragmentation of the global youth market. The “Insider Advantage” in 2026 is no longer just owning the show—it’s owning the digital-first ecosystem that commands the attention of Gen Z.

The Bottom Line Weaponize Gen Z acquisition by securing 30% of your slate from Sovereign Hubs in APAC and LATAM, utilizing AI-localization to accelerate recoupment by 11 months and protecting EBITDA via creator-direct modular slates.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Identify Sovereign Hub studios in South Korea specializing in Webtoon-to-Series IP for 2026

Map deal history for TikTok-to-Series IP acquisitions in the US and LATAM

Which short-form studios in MENA offer verified 8K vertical video delivery for 2026

Filter global partners specializing in AI visual dubbing for short-form youth content

Analyze buying signals for Gen Z scripted formats in Brazil and Mexico for 2026

Identify Creator-Direct deals for high-fidelity youth narratives with verified audiences

Insider Intelligence: Gen Z Content Acquisition 2026 FAQ

How does TikTok IP differ from traditional content in a 2026 acquisition model?

TikTok IP in 2026 is pre-validated content that comes with a built-in audience and verified engagement data. Unlike traditional development, TikTok-to-Series pipelines allow for an immediate jump into production with a “proven” hook, de-risking the EBITDA from the fragmentation of the youth market.

Why are Sovereign Hubs essential for Gen Z Content Acquisition 2026?

Sovereign Hubs in APAC, MENA, and LATAM offer both cultural authenticity and aggressive tax incentives (up to 40%). These hubs have industrialized the short-form and web-to-series pipelines, providing high-fidelity content at a fraction of Western production costs while capturing global youth trends in real-time.

What is “Infinite Localization” in the context of youth narratives?

Infinite Localization refers to the use of Authorized AI to emotionally synchronize visual dubbing and culturally adapt content for global markets. This allows a youth-driven hit from Brazil to be launched day-and-date in 100+ countries, accelerating the recoupment cycle by 11 months.

How can VIQI identify undervalued short-form slates?

VIQI maps the global supply chain to identify “Digital-First” studios in Sovereign Hubs before they are saturated by major studio bids. It tracks “Buying Signals” in the creator economy, such as viral breakout hits and new venture capital fund formations, providing an “Insider Advantage” in pricing negotiations.