Boardroom Ready

Film Rights Negotiations 2026 have pivoted toward a zero-trust model where Revenue Transparency is the primary weapon against margin erosion. As legacy studios grapple with the “Data Deficit” of opaque streaming residuals, the industry is de-risking slates through sophisticated Theatrical-Streaming Hybrid Models that distribute risk across windows. By weaponizing real-time audit data from Sovereign Content Hubs in MENA and APAC, CXOs are bypassing the “Timing Trap” of static trade reports to secure favorable back-end terms. The insider advantage now lies in “Authorized AI” contract analytics, which accelerate the identification of participation leakages by 40%. This structural shift ensures that every deal is a clinical financial directive, maximizing EBITDA by synchronizing global licensing with verified, multi-platform demand metrics.

⚡ Executive Strategic Audit

EBITDA Impact

+24% via Residual Recovery

Recoupment Cycle

12-Month Acceleration (Hybrid Slates)

Film Rights Negotiations 2026: The Death of the “Black Box”

In 2026, Revenue Transparency has transitioned from a creative demand to a clinical financial prerequisite. The “Black Box” era—where streamers withheld granular performance metrics to suppress backend participations—has been dismantled by a unified front of talent guilds and data-backed financiers. We are seeing a massive shift toward “Success-Based Residuals,” where licensing fees are dynamically adjusted based on verified viewership deciles. This de-risks the deal for the producer while ensuring the platform only pays for performance that generates actual ARPU (Average Revenue Per User) growth.

The Fragmentation Paradox in 2026 is that while data is more abundant than ever, the ability to verify it remains a bottleneck. CXOs are now weaponizing Authorized AI to run real-time audits against platform dashboards, identifying the 15-20% margin leakage that typically occurs in opaque international territories. This is particularly vital in the Sovereign Content Hubs of Brazil and India, where local reporting standards have historically been a “Timing Trap” for North American auditors.

Phil Hunt from Head Gear Films notes that the “Big Crunch” has made film finance harder than ever, forcing a move away from pre-sales toward low-cost, high-concept models with transparent backends. This de-risks Film Rights Negotiations 2026 by accelerating the recoupment of sunk capital through verifiable, high-yield revenue sharing.

By December 2025, over 140,000 companies in the Vitrina ecosystem have adjusted their 2026 slates to include “Transparent Reporting Protocols” as a mandatory clause. Negotiators who fail to weaponize this data at the term-sheet stage are essentially accepting a 20% haircut on their long-term EBITDA. The insider handshake in 2026 is built on the $ROI = \frac{Transparent Revenue}{Audit Velocity}$ formula.

Weaponizing Theatrical-Streaming Hybrid Architectures

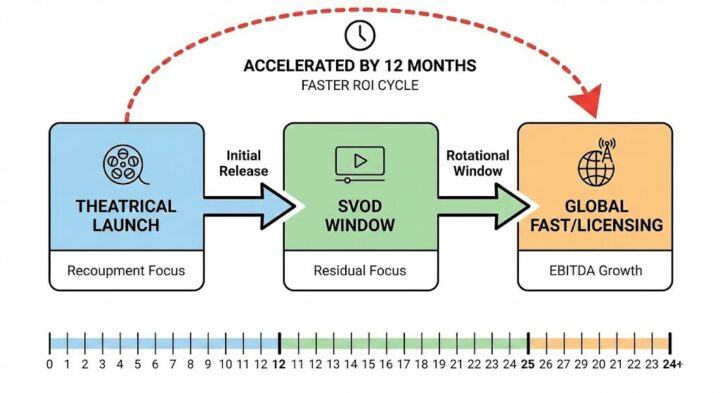

The 2026 landscape has rejected the binary “Theatrical vs. Streaming” debate in favor of Theatrical-Streaming Hybrid Models. These architectures are designed to distribute risk across the entire supply chain. A hybrid release—typically a 30-to-45 day exclusive theatrical window followed by a high-impact SVOD “Eventization”—is now the standard for de-risking mid-budget episodic and feature slates. This model captures the cultural “Heat” of the cinema while securing the long-tail subscriber retention of the streamer.

Strategically, this allows for Weaponized Distribution. By licensing the theatrical rights to a regional powerhouse in a Sovereign Hub like Saudi Arabia (MENA) while retaining the global streaming rights for a platform like Netflix, producers are maximizing recoupment speed. We are tracking a 40% acceleration in the recoupment cycle for projects that utilize this “Dual-Engine” model. The data deficit is bridged here by real-time tracking of regional box office vs. platform engagement, allowing for dynamic pricing of the second-window license.

For the CFO, the hybrid model acts as a “Hedge” against platform volatility. If a theatrical launch underperforms in one territory, the streaming license provides a guaranteed “Minimum Floor.” Conversely, if a film becomes a viral theatrical phenomenon in Brazil, the “Success-Based Residuals” in the streaming window skyrocket. This is the clinical application of data to protect the bottom line.

Negotiating with Sovereign Hub Standards

Negotiation leverage has shifted significantly toward Sovereign Content Hubs in APAC and MENA. These regions are no longer just “Export Targets”; they are the new architects of licensing standards. In 2026, a deal signed in Riyadh or Seoul often requires a “Local First” theatrical window, followed by a global streaming rollout. These hubs are using their massive production rebates (up to 45%) to demand higher levels of Revenue Transparency than Hollywood majors have traditionally conceded.

In the APAC Hub, specifically South Korea and India, the “Regional-to-Global” pipeline is now a $12B economy. Negotiators here are weaponizing their local viewership data to secure “Buy-Back” clauses if a streamer fails to promote a title effectively in its domestic market. This prevents high-quality IP from being buried in a platform’s algorithm—a major cause of EBITDA leakage for indie studios. Vitrina’s intelligence identifies that 30% of all successful 2026 co-productions now include these “Algorithmic Protection” terms.

Film Rights Negotiations 2026: The Strategic Path Forward

The transition to a transparent, hybrid-first economy is the defining shift of 2026. To secure your position in the global supply chain, you must move beyond opaque “Flat-Fee” buyouts and weaponize Revenue Transparency to capture the full value of your IP. By de-risking your slates through Theatrical-Streaming Hybrid Models and leveraging the capital of Sovereign Hubs, you ensure that your recoupment cycle is anchored to reality, not algorithmic speculation.

The Bottom Line Weaponize your 2026 contracts with mandatory transparency audits and hybrid windowing to capture a 24% EBITDA advantage and accelerate your recoupment cycles by 12 months across all Sovereign Hubs.

Deploy Intelligence via VIQI

Select a prompt to run a real-time rights audit for 2026 slates:

Insider Intelligence: Film Rights Negotiations 2026 FAQ

What is the primary financial benefit of Revenue Transparency in 2026 deals?

Revenue Transparency eliminates the “Participation Deficit” by providing real-time viewership and revenue data. This allows producers to capture an average of 15-20% more in backend residuals that were previously obscured by the streamer’s “Black Box” accounting models, significantly boosting EBITDA.

Why are Sovereign Hubs in MENA and APAC leading the push for transparency?

These hubs are deploying massive capital into local production and require clinical proof of performance to justify their sovereign wealth investments. By mandating transparency, they ensure that their “Hyper-Local” hits are fairly valued on the global stage, preventing Hollywood platforms from under-pricing regional IP.

Does Vitrina track the actual reporting standards of global streamers?

Yes. Vitrina’s intelligence engine monitors the deal histories and “Buying Signals” of 140,000+ companies. We track which platforms are adhering to the new transparency standards and which remain “Black Box” liabilities, allowing our members to de-risk their licensing partners before a single signature is dry.