A film capital stack is the hierarchical structure of various funding sources—equity, debt, mezzanine financing, and tax credits—that comprise a project’s total budget.

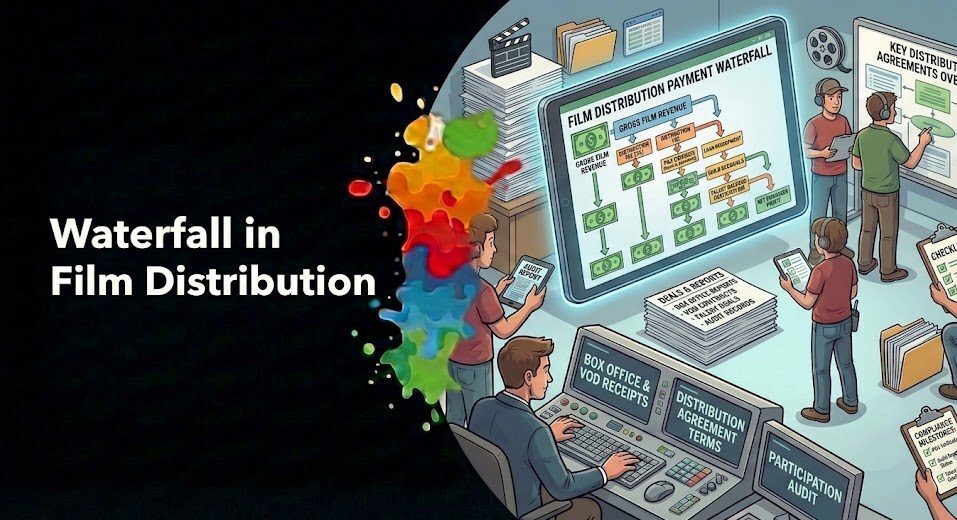

Each layer of the stack represents a different level of risk and priority in the “waterfall,” determining who gets paid first when the project generates revenue.

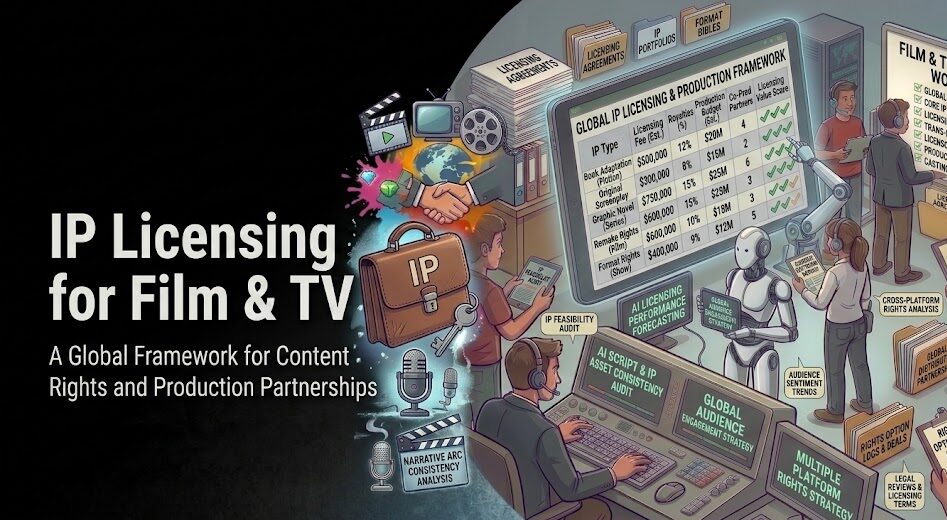

In today’s “weaponized distribution” landscape, producers are leveraging supply chain intelligence from platforms like Vitrina AI to identify low-cost layers such as regional co-production grants and tax incentives before committing to high-cost equity.

Understanding this financial DNA is critical for independent producers to retain backend ownership and ensure long-term sustainability in a hyper-competitive global market.

Financial Roadmap

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Key Financial Insights

-

Hierarchy Matters: Senior debt and bridge loans sit at the top of the stack and are paid first, while equity sits at the bottom, bearing the most risk.

-

The 140k Advantage: Accessing a database of 140,000+ verified companies allows producers to find regional soft money and tax credit financiers globally.

-

Precision Discovery: VIQI AI processes 30 million relationships to identify financiers who specifically fund your project’s genre and budget level.

The Layers of the Capital Stack: From Senior Debt to Equity

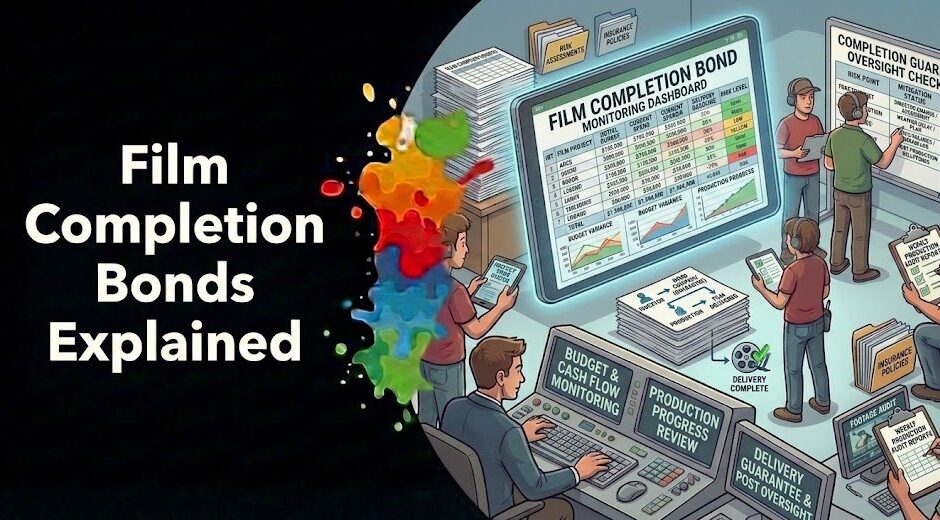

The capital stack is the blueprint of a film’s financial viability. At the top sits Senior Debt, often secured against tax credits or reliable pre-sales. This is followed by Mezzanine Financing and “Gap” loans, which cover the remaining budget that hasn’t been secured by senior lenders.

The base of the stack is Equity—the most expensive form of capital because investors demand a premium return for taking on the highest risk. For independent producers, the goal is to minimize high-cost equity by maximizing “soft money” layers. This requires a deep understanding of global subsidies and co-production treaties that act as the project’s financial DNA.

Identify low-cost financing layers for your project:

The Data Deficit in Film Finance: Why Producers Lose Control

One of the greatest threats to an independent producer is the Data Deficit. Relying on opaque personal networks means you only see the financing options immediately visible to you. This fragmentation often leads to producers accepting predatory equity terms simply because they aren’t aware of alternative global financiers.

Market intelligence from Vitrina AI bridges this gap by providing a structured, verifiable view of the entire 600,000-company ecosystem. By tracking 1.6 million unreleased titles and their funding sources, producers can identify exactly who is currently active in the market. This transparency transforms a project from a financial gamble into a data-driven enterprise.

Expert View: Financial Sustainability in Independent Film

Kirsty Bell, founder of Goldfinch, explains how bridging the gap between art and enterprise requires a disciplined approach to creative financing and revenue stream diversification.

Optimizing the Stack with Global Intelligence

The modern producer uses Global Project Trackers to see where the money is moving. By analyzing three-year rolling views of production volumes and financing trends, you can identify “over-financed” genres to avoid and “under-served” niches where capital is looking for projects. This is the industrialization of film finance.

Utilizing specialized Vertical AI tools allows you to perform due diligence on potential partners instantly. Instead of wondering if a new fund in the Middle East is reputable, you can check their specialization, deal history, and reputation scores on Vitrina. This ensures that every layer of your capital stack is built on a foundation of verified, institutional-grade data.

Perform due diligence on global financing partners:

Closing the Stack

Building a sustainable capital stack requires a transition from “personal networks” to “data intelligence.” By understanding the hierarchy of risk and utilizing global supply chain data, independent producers can regain control over their project’s destiny.

The era of opaque film financing is over. In 2026, the producers who retain their backend are the ones who decode their project’s financial DNA using the industry’s most advanced intelligence platforms.

Finance FAQ

What is “Senior Debt” in film?

How does “Gap Financing” work?

Why should I use Vitrina for financing?

What is the “Waterfal” in film finance?

How can AI help me structure my stack?

What is “Soft Money”?

Can I perform due diligence on financiers?

What is “Weaponized Distribution”?

“The producer who treats their capital stack like a puzzle—leveraging data to find the cheapest pieces first—is the one who survives the ‘Streaming Wars’ with their IP intact.”

About the Author

Specializing in entertainment finance and supply chain optimization, I help independent producers navigate the transition from relationship-based deals to data-powered enterprise models. My goal is to empower creators with the tools they need to secure better financing and protect their backend.