Introduction

Entertainment finance companies play a crucial role in bringing films, TV shows, and digital content to life. These firms specialize in funding creative projects, ensuring production teams have the necessary resources to develop high-quality content.

The entertainment industry operates on complex financial models that combine investments, co-productions, tax incentives, and distribution deals. Unlike traditional business financing, entertainment finance requires deep industry knowledge, risk assessment, and strategic partnerships to maximize returns.

In this guide, we explore the landscape of entertainment financing, key players, funding strategies, and how companies like Vitrina help industry professionals connect with financiers and decision-makers.

Key Players in Entertainment Financing

Several types of organizations participate in entertainment finance, each with its own funding model and area of expertise:

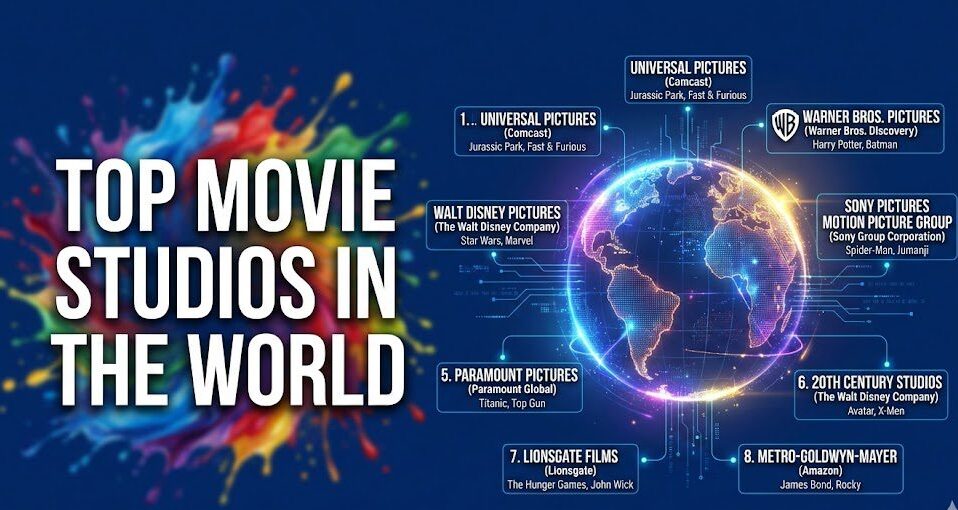

1. Film and Television Production Studios

Major studios such as Warner Bros., Disney, and Netflix often finance their own productions. They have in-house investment teams that evaluate projects and allocate budgets based on revenue potential.

2. Independent Entertainment Finance Companies

Companies like Forest Road, Great Point Media, and Ingenious Media specialize in funding independent productions. These firms provide capital in exchange for future revenue participation, tax credits, or equity stakes.

3. Private Equity and Venture Capital Firms

Private investors, hedge funds, and venture capital firms invest in entertainment projects, particularly high-growth sectors like streaming platforms, gaming, and virtual production.

4. Banks and Institutional Lenders

Traditional banks, including Comerica and City National Bank, offer specialized entertainment financing options such as production loans, gap financing, and bridge loans.

5. Government Grants and Incentives

Many countries provide tax incentives, grants, and rebate programs to attract film and TV productions. Popular locations like Canada, the UK, and New Zealand offer competitive tax credits to offset production costs.

How Entertainment Finance Works

Entertainment financing typically involves multiple funding sources to reduce risk and maximize profitability. Below are common strategies used to finance films and TV projects:

1. Pre-Sales and Distribution Agreements

Production companies secure financing by selling distribution rights in advance. Distributors, broadcasters, and streaming platforms pay for the right to air content before it is produced.

2. Gap Financing

A lender covers the difference between a project’s secured financing and its total budget. This type of loan is repaid through revenue generated from distribution deals.

3. Tax Credits and Incentives

Filmmakers leverage tax incentives offered by governments to offset production costs. These credits can be sold to third-party investors or banks for immediate cash.

4. Equity Investment

Investors provide capital in exchange for an ownership stake in the project. This method is common for independent productions seeking financial partners.

5. Debt Financing

Producers take out loans secured against future revenues, such as box office earnings, streaming deals, or syndication agreements.

6. Co-Production Agreements

Two or more production companies collaborate on a project, sharing financial responsibility, creative input, and revenue distribution.

Challenges in Entertainment Financing

While entertainment financing provides opportunities for content creation, it also comes with significant risks and challenges:

1. High Financial Risk

Not all films and TV shows recoup their investment. The industry is unpredictable, and market trends can shift rapidly.

2. Complex Deal Structures

Entertainment financing often involves multiple stakeholders, including investors, banks, production houses, and distributors, making deal negotiations intricate.

3. Regulatory and Compliance Issues

Different countries have varied tax laws, co-production treaties, and investment regulations, complicating the funding process.

4. Difficulty in Finding the Right Partners

Connecting with the right financiers, distributors, and co-producers can be challenging, especially for independent content creators.

5. Piracy and Revenue Leakage

Unauthorized distribution of content can impact revenue streams, reducing financial returns for investors and production companies.

How Vitrina Supports Entertainment Finance Companies

Vitrina provides essential market intelligence and business networking tools that support entertainment finance companies in identifying, evaluating, and connecting with the right partners.

1. Access to Global Film & TV Projects

Vitrina tracks every film and TV project worldwide, mapping them to key decision-makers, financiers, and service providers.

2. Deep Company & Executive Profiling

Entertainment finance firms can evaluate potential investment opportunities using Vitrina’s extensive database of production companies, executives, and market trends.

3. Streamlined Outreach & Partnerships

With verified contact details and structured company profiles, financiers can connect directly with producers, distributors, and service vendors to explore collaboration opportunities.

4. Competitive Intelligence & Market Trends

By tracking competitors and ongoing productions, Vitrina helps entertainment finance companies make data-driven investment decisions.

Vitrina does not provide direct financing but enables finance companies to make informed decisions, discover new opportunities, and expand their industry connections.

Conclusion

Entertainment finance companies play a vital role in funding the global film and TV industry. From major studios to independent financiers, these organizations provide the necessary capital to bring creative projects to life. However, navigating the complexities of entertainment financing requires market knowledge, strategic partnerships, and access to reliable industry data.

Vitrina empowers entertainment finance companies with deep insights, verified executive profiles, and real-time project tracking to help them make smarter investment decisions. Whether you’re looking to finance a new film, co-produce a TV series, or explore strategic collaborations, Vitrina offers the tools you need to stay ahead in the evolving entertainment landscape.

Frequently Asked Questions

Entertainment finance companies provide funding for film, TV, and digital content projects. They can be banks, private equity firms, independent financiers, or production studios.

They earn revenue through equity stakes, interest on loans, revenue-sharing agreements, and tax credit monetization.

Tax incentives reduce production costs and attract investors. Many producers sell these credits to secure upfront funding.