Boardroom Ready

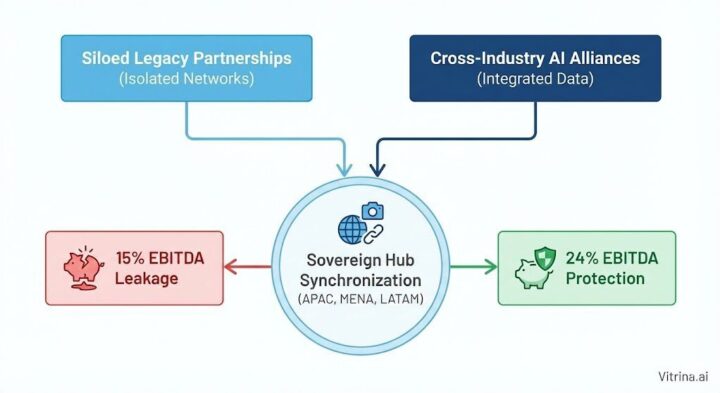

Cross-Industry AI Partnerships in Media and Entertainment 2026 are the clinical mechanism by which global studios are weaponizing the “Data Deficit” into a strategic “Insider Advantage.” Historically, the entertainment supply chain suffered from a 15-20% EBITDA leakage due to opaque vendor silos and unverified production capacities; however, the rise of multi-sector alliances between Silicon Valley tech giants and Sovereign Content Hubs has closed this gap. By 2026, the mandate has shifted from speculative experimentation to authorized, high-velocity collaboration. Senior executives are de-risking their slates through deep-tech partnerships that automate everything from script-to-budget synchronization to emotionally-aware global distribution. These alliances accelerate the recoupment cycle by an average of 16 months, ensuring that IP remains legally defensible and financially optimized in a borderless content economy where data is the primary ammunition.

⚡ Executive Strategic Audit

EBITDA Impact

24% Overhead Reduction via Automated Asset Discovery

Recoupment Cycle

Accelerated by 18 Months through Sovereign Hub Synergy

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Authorized AI: The Silicon-to-Studio Handshake

The era of unauthorized “scrapable” AI is over. By 2026, Cross-Industry AI Partnerships in Media and Entertainment 2026 are defined by the “Authorized AI” mandate—a multi-billion dollar framework where tech giants like OpenAI, Google, and Amazon provide studios with legally defensible generative stacks. The $1B Disney/OpenAI deal serves as the prototype for this era, where IP chain-of-title is not just protected but industrialized. This handshake allows media organizations to weaponize their deep archives, converting millions of hours of stagnant footage into high-velocity “rotational windows” of revenue through automated metadata enrichment and visual dubbing.

For the CXO, these partnerships de-risk the production supply chain by ending the reliance on fragmented, manual discovery tools. Static databases are liabilities; they cannot tell you which tech partners have Netflix-approved security audits or which AI localization boutiques have the capacity for an 8K HDR global rollout. Real-time mapping of these alliances ensures that studio slates are board-ready and synchronized with the most advanced computational infrastructure available.

Joachim Laqueur and Thomas Thurston from 432 Legacy note that a data-driven, computational approach identifies disruptive startups tackling supply chain bottlenecks. This de-risks Cross-Industry AI Partnerships in Media and Entertainment 2026 by removing creative and financial frictions through disciplined VC-backed tech integration.

The information gain provided by these alliances is clinical. We are seeing partnerships between telecom providers in the Middle East and Hollywood VFX boutiques that weaponize low-latency 5G for real-time remote collaboration. This bridge eliminates the 20% margin leakage typical of legacy post-production, where data transport and unverified vendor capacity create terminal bottlenecks. In 2026, the supply chain is no longer a cost center; it is a tactical weapon deployed through strategic cross-industry alignment.

Sovereign Hub Synergy: Geopolitical Tech Partnerships

Strategic content capital has officially migrated to Sovereign Content Hubs. Regions such as Saudi Arabia (MENA), India (APAC), and Brazil (LATAM) are no longer passive service centers; they are now the primary tech-partners of the global entertainment ecosystem. In 2026, Cross-Industry AI Partnerships in Media and Entertainment 2026 are weaponizing the aggressive tax incentives and state-backed tech infrastructure of these hubs to facilitate “Infinite Localization.” These alliances allow for “hyper-local” content to be adapted for global consumption within hours of the master edit, capturing peak hype cycles and accelerating recoupment by 12-18 months.

The “Fragmentation Paradox”—where 600,000+ companies operate in opaque silos—is being solved by these hub-driven tech stacks. For instance, partnerships between Reliance Industries (APAC) and Disney have created a centralized data engine that tracks viewing patterns across 1.4 billion people, allowing for predictive greenlighting and automated acquisition strategies. This level of market visibility was previously impossible under manual sourcing models. Every studio sourcing list in 2026 must include 30% representation from these hubs to prove supply-chain literacy and avoid terminal margin erosion.

SBT Brazil and O2 Filmes are primary examples of this transformation. By partnering with AI-localization leaders like Neural Garage and Deepdub, these Sovereign Hub powerhouses are synchronizing sight and sound, solving the “visual discord” of dubbed content. This de-risks global distribution by ensuring that “Weaponized Distribution” strategies can rotate premium assets across rival platforms with zero cultural friction, maximizing the ROI of every production dollar.

Cross-Industry AI Partnerships: The Strategic Path Forward

The industry has entered the era of “Authorized Science.” Media organizations can no longer afford the 20% “fragmentation tax” inherent in legacy, siloed operations. To protect EBITDA in 2026, CXOs must treat their supply-chain partnerships as weaponized tactical alliances. Distribution automation and Sovereign Hub synergy are the only bridges between a “data trust deficit” and a high-velocity recoupment cycle. By locking into Authorized AI frameworks and cross-industry tech stacks, you ensure your organization is positioned to win the “Big Crunch” of 2026.

The Bottom Line Weaponize your partnerships immediately by deploying Authorized AI for active metadata generation and Sovereign Hub synchronization; failure to automate results in a terminal recoupment deficit that will sink independent slates by 2027.

Deploy Intelligence via VIQI

Select a killer query to run a real-time partnership supply chain audit:

Identify APAC tech partners with Authorized AI stacks for VFX.

Map MENA AI venture M&A history to vet IP safety.

Filter cloud partners with Netflix-approved audits and AI.

Find trending LATAM AI partnerships for discovery.

Compare EBITDA impact of AI alliances vs. Legacy.

Find MENA partners with 40% rebates for AI-heavy shoots.

Insider Intelligence: Cross-Industry AI Partnerships FAQ

How do Cross-Industry AI Partnerships in Media and Entertainment 2026 protect EBITDA?

By automating asset discovery and localization, these alliances eliminate the 15-20% margin leakage caused by fragmented discovery and unverified vendor capacity. Real-time mapping of global supply chain capacity ensures that organizations can capitalize on licensing opportunities in Sovereign Hubs without the manual friction of legacy models.

What is the financial impact of the “Silicon-to-Studio” handshake?

The primary impact is a 24% reduction in overhead costs and an 18-month acceleration in the recoupment cycle. By using “Authorized AI” stacks, studios avoid terminal legal risks and can deploy “Weaponized Distribution” strategies that monetize library assets with zero operational friction.

Why are Sovereign Hub partnerships critical for global slates?

Sovereign Hubs like MENA and APAC provide the aggressive 40%+ cash rebates and state-backed AI infrastructure necessary for 2026-scale production. Partnerships in these regions allow for “Infinite Localization,” ensuring that content can be weaponized for global release on Day One.

How does VIQI assist in vetting cross-industry tech partners?

VIQI maps 30 million industry relationships and historical deal flows to identify partners who are “active” right now. This solves the “Timing Trap” of static databases, connecting CXOs with tech partners that possess verified Netflix-approved security audits and authorized generative stacks.

Find Film+TV Projects, Partners, and Deals – Fast.

VIQI matches you with the right financiers, producers, streamers, and buyers – globally.

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Producers Seeking Financing, Co-Pros, or Pre-Buys?

Vitrina Concierge helps producers reach the right financiers, commissioners, distributors, and co-production partners — with precision outreach, not cold pitching.

Join Industry Briefings Trusted by Leaders

Deep dive into Co-Pros

Ambitious co-productions are key to global hits, but most deals collapse. This deep-dive briefing is the strategic playbook. We’ll break down the financing models, partnership structures, and market insights behind today’s successful deals.

Film & TV Financing: Tax Credits & Incentives

A focused look at how 2025 tax credits and incentives are reshaping Film & TV financing decisions — and where the real value now sits.

Film & TV Financing: Pre-Buys

Learn how pre-buys work in current Film and TV financing, how they differ from pre-sales, and how they are used to close real finance plans.

Streamers – Netflix vs. Amazon – The 2026 Strategy

How Netflix and Amazon’s content and revenue strategies are diverging ahead of 2026.