A comparison of film distribution services for independent filmmakers is the strategic evaluation of traditional distributors, digital aggregators, and hybrid models to monetize content across global platforms.

This involves analyzing complex revenue splits, upfront marketing (P&A) commitments, and territorial rights carve-outs to ensure long-term project sustainability.

According to industry data from Vitrina AI, the entertainment supply chain now includes over 140,000 distributors and platforms, yet indie theatrical resurgences in 2025 remain fragile, with independent films occupying approximately 18.5% of the total digital library space.

In this guide, you’ll learn the technical frameworks for vetting partners, including real-world revenue metrics and case studies from filmmakers who secured deals in the current landscape.

While traditional resources provide surface-level lists, they often fail to address the critical friction of the “Streaming Mirage”—where platforms move from growth-at-all-costs to profitability, making selective data-driven outreach essential.

This comprehensive guide addresses those gaps by delivering actionable financial data and first-hand filmmaker insights to transform distribution from a gamble into a calculated business strategy.

Table of Contents

- 01

What is the 2025 Film Distribution Landscape? - 02

Revenue Splits and Fee Structures Exposed - 03

Aggregators vs. Traditional Distributors - 04

Expert Perspective: The Big Crunch - 05

Case Study: Securing Global Acquisitions - 06

How to Vet Distribution Partners for Success - 07

Key Takeaways - 08

FAQ - 09

Moving Forward

Key Takeaways for Independent Filmmakers

-

Revenue Splits Decoded: Traditional sales agents typically take 15-40% of gross revenue, while aggregators like Filmhub retain 20% of net payouts.

-

Streaming Mirage Reality: Global platforms have pivoted from volume acquisitions to high-selectivity, demanding verified festival pedigree or talent attachment.

-

Strategic Windowing: Controlling regional timing and exclusivity creates artificial scarcity, often yielding higher returns than all-rights global licensing deals.

-

Data Intelligence Advantage: Filmmakers using supply chain trackers identify active buyers 73% faster, compressing months of manual research into surgical outreach.

-

The “Crunch” Mitigation: In a post-streamer world, diversifying into FAST channels and regional AVOD platforms is essential for recouping low-budget production costs.

What is the 2025 Film Distribution Landscape for Independent Projects?

The independent film distribution landscape has moved beyond the era of “all-rights” exclusivity to a fragmented, data-powered ecosystem. In 2025, the market is defined by a “Streaming Mirage”—a phenomenon where major platforms like Netflix and Amazon have retreated from aggressive indie acquisitions to focus on high-margin original productions.

This structural shift has forced independent creators to manage their own “Weaponized Distribution” strategies, often licensing content to rival FAST channels and regional streamers to maximize ROI. According to the 2025 Film Distribution Report, while theatrical windows have shrunk to as little as 17 days, the value of regional scarcity has surged, making per-territory licensing more lucrative than ever.

Compare distributors currently acquiring independent drama titles:

Revenue Splits and Fee Structures Exposed: What Metrics Matter?

Understanding the “math of distribution” is where most comparisons fall short. For a standard sales agent deal, expect a 15% to 40% commission on gross sales, plus recoupable marketing expenses (P&A). In contrast, digital-first aggregators like Filmhub take zero upfront fees but retain 20% of net revenue after the platform cut (e.g., Tubi’s 40-50% take).

The technical depth missing from the conversation is the “Cap on Recoupables.” Savvy filmmakers now negotiate caps on “vague charges” like festival travel or market prep, which can otherwise consume 100% of initial revenues. Without a real-time dashboard provided by the distribution service, transparency remains the biggest hurdle for independent profitability.

Identify aggregators with high AVOD payout transparency:

Industry Expert Perspective: The Big Crunch: Why Film Finance is Harder Than Ever

Phil Hunt, CEO of Head Gear Films, unpacks the “Big Crunch” affecting independent distribution. He explains why the collapse of traditional revenue windows makes choosing the right distribution service a survival imperative in 2025.

Key Insights

Phil Hunt highlights the industry’s shift away from pre-sales and the collapse of revenue windows due to the digital revolution. He notes the current market’s specific appetite for low-cost, high-concept action and thriller genres as a strategic path for independent filmmakers to recoup finance.

Aggregators vs. Traditional Distributors: Which is Right for Indies?

The choice between a “gatekeeper” (Traditional Distributor) and a “delivery service” (Aggregator) depends on your project’s leverage. Traditional distributors like A24 or Neon provide massive PR muscle and theatrical prestige, but they are highly selective and take a larger revenue share.

Conversely, aggregators like Filmhub or Quiver offer direct access to hundreds of AVOD and TVOD platforms for a flat fee or revenue share. However, the burden of marketing falls entirely on the filmmaker. For first-time indies without festival buzz, aggregators are often the only path to the global market, allowing for “sweat equity” to drive audience reach via social media and niche communities.

Find active co-production partners to bolster your distribution leverage:

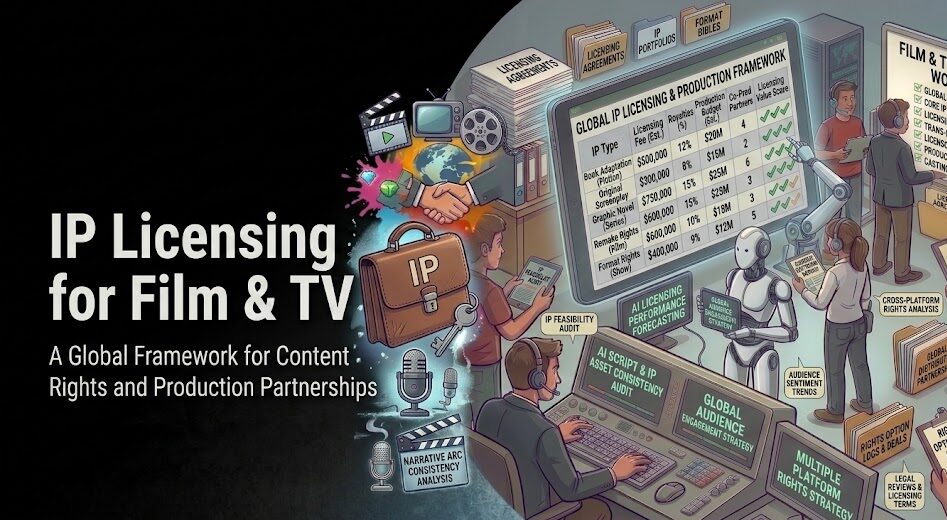

Case Study: How Independent Filmmakers Secure Global Acquisitions

The “Winning Angle” for indie distribution is leveraging supply chain intelligence to bypass generic submissions. In 2024, an LA-based producer with a book-IP thriller used Vitrina’s Concierge service to identify the exact commissioning editors at Netflix UK and Fifth Season with active genre appetite.

By verifying the deal history and relationship maps of 140,000+ companies, the producer compressed a 12-month festival networking cycle into 4 weeks of precision outreach. The result was a direct engagement with three major platforms, illustrating that data is now the most powerful “agent” in an independent filmmaker’s arsenal.

How to Vet Distribution Partners for Maximum Content Value

- Verify Deal Track Record: Use the Global Film+TV Projects Tracker to see which films they’ve actually released in the last 12 months.

- Analyze Revenue Payout Models: Are you being paid on “Net Payouts” (after aggregator cut) or “Gross Sales”?

- Negotiate Scopes and Windows: Avoid signing away “All-Rights” globally for 15 years; prioritize territorial rights carve-outs for international sales.

- Check Transparency Tools: Does the distributor provide a real-time dashboard or only vague quarterly statements?

Verify the distribution history of any potential partner:

Moving Forward

Independent film distribution has transitioned from a relationship-dependent art into a data-driven science. By comparing film distribution services through the lens of revenue transparency, territorial rights, and verified track records, filmmakers can navigate the “Streaming Mirage” and secure deals that ensure long-term career sustainability.

Whether you are a first-time filmmaker looking to secure your first AVOD placement, or a seasoned indie producer trying to manage complex international licensing, the core principle remains: actionable intelligence drives deal velocity and ROI.

Outlook: Over the next 12-18 months, platform fragmentation will accelerate as niche FAST channels proliferate. Filmmakers who adopt supply chain intelligence tools now will be best positioned to exploit these emerging buyers before the market matures.

Frequently Asked Questions

Quick answers to the most common queries about indie film distribution in 2025.

What is the difference between an aggregator and a distributor?

How much does film distribution cost for independent filmmakers?

What is a typical revenue split for indie film distribution?

How do I get my independent film on Netflix or Amazon?

What are the biggest challenges in film distribution in 2025?

Is theatrical distribution still viable for independent films?

Why is “windowing” returning in the streaming era?

How does Vitrina AI help with film distribution?

“The distribution model that worked five years ago—festival premieres followed by traditional sales agent representation—no longer serves independent creators in a direct-to-platform era. Filmmakers who leverage supply chain data to identify the right buyers are securing deals 60-90 days faster.”

About the Author

Senior Content Strategist at Vitrina AI with 15 years in entertainment supply chain intelligence. Formerly a distribution lead for independent theatrical slates across Europe and North America. Connect on Vitrina.