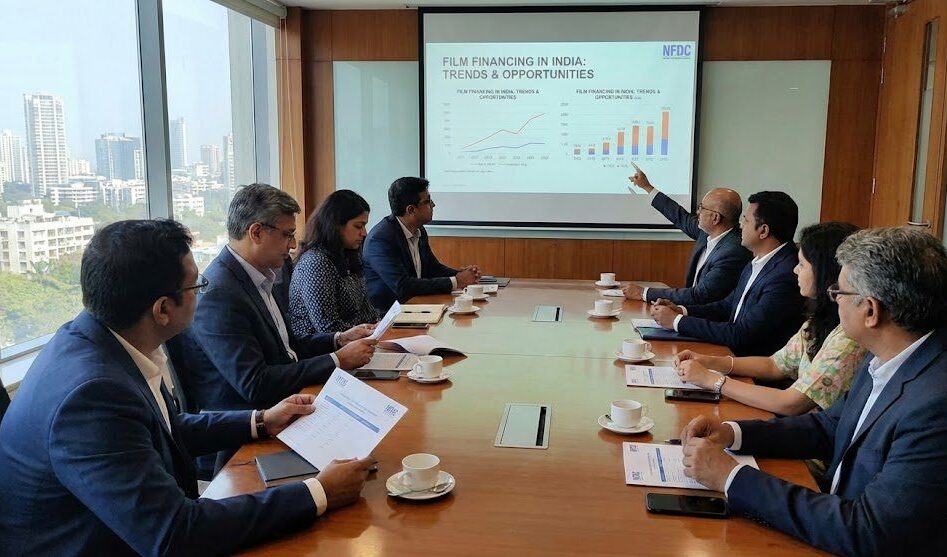

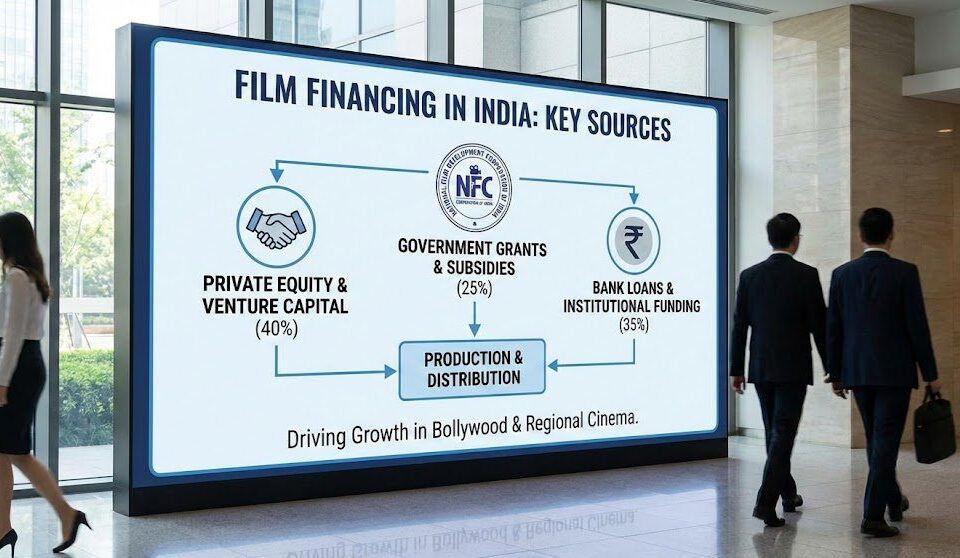

The common ways to finance an independent film in India include a strategic mix of equity investments, government incentives (NFDC), OTT pre-sales, and emerging crowdfunding models.

Modern financing involves moving beyond traditional personal networks to leverage data-driven intelligence for identifying active co-production partners and digital platform commissioning windows.

According to industry reports, the Indian film industry is projected to grow at a CAGR of 10%+, with over 70% of independent success stories now utilizing “hybrid financing” models that combine private capital with platform licensing.

In this guide, you’ll learn actionable steps for securing capital, navigating the regional funding landscape, and using supply chain intelligence to compress months of research into strategic outreach.

While legacy resources focus on broad Bollywood studio models, they fail to address the practical “how-to” for independent creators seeking regional incentives or digital-first financing.

This guide fills those gaps by detailing the shift from relationship-based funding to intelligence-led project tracking.

Table of Contents

- 01

What is Independent Film Financing in India? - 02

How Do Equity Investments and Angel Investors Work in India? - 03

When Should You Apply for NFDC and Government Incentives? - 04

Why Do Producers Prioritize OTT Pre-Sales for Content? - 05

How Are Emerging Crowdfunding Trends Reshaping Indie Finance? - 06

What Role Does Organized Capital Play in Regional Cinema? - 07

The 5 Biggest Challenges in Indie Finance (And How to Overcome Them) - 08

Key Takeaways

Key Takeaways for Independent Producers

-

Hybrid Funding is Mandatory: Modern indie success in India requires blending equity capital with OTT pre-sales and government subsidies to secure a viable production budget.

-

Regional Market Potential: Organized capital is shifting toward South Indian and regional cinema markets where ROI potential often outpaces traditional mainstream projects.

-

Data Intelligence Wins: Producers using supply chain tracking identify active funding partners 70% faster than those relying solely on manual trade show networking.

What is Independent Film Financing in India?

Independent film financing in India is the multi-layered process of securing capital for non-studio projects through private, public, and digital channels. This involves a structural shift from relying on unorganized “personal debt” to professional “organized capital” models.

Traditional methods such as personal savings and high-interest private loans are being replaced by structured equity deals and “Minimum Guarantee” (MG) contracts from streaming platforms. For indie creators, the goal is to build a “financing stack” that minimizes personal risk while maintaining creative control.

Find active co-production partners in India:

How Do Equity Investments and Angel Investors Work in India?

Equity financing is the most prevalent model for Indian indies, where investors provide upfront capital in exchange for a percentage of ownership and future profits. Unlike bank loans, equity investors bear the financial risk alongside the producer, making this “soft capital” highly sought after.

Angel investors in the Indian context are often high-net-worth individuals (HNIs) from non-film backgrounds looking to diversify their portfolios. To attract these investors, producers must present a “packaged” project including a verified script, attached talent, and a clear distribution intelligence strategy.

When Should You Apply for NFDC and Government Incentives?

The National Film Development Corporation (NFDC) provides critical support through film funds and co-production schemes. Applying for these incentives should be a first-order priority during the late-development or pre-production stages, especially if your project has international co-production potential.

State-level incentives—such as those offered in Uttar Pradesh, Maharashtra, and Karnataka—can provide cash rebates or tax exemptions for filming locally. For independent producers, these incentives often act as “gap financing,” covering the final 20-30% of the production budget.

Industry Expert Perspective: Beyond Bollywood: Unpacking India’s Regional Film Markets

Explore how organized capital is transforming the financing landscape for regional cinema in India, moving beyond traditional studio models to data-driven investment frameworks.

Naveen Chandra discusses the transition from media executive to filmmaker, highlighting the founding philosophy of organized capital funds for films and the misunderstood potential of India’s regional cinema markets.

Why Do Producers Prioritize OTT Pre-Sales for Content?

OTT (Over-The-Top) pre-sales have become the “financial backbone” of independent film in India. By selling digital rights to platforms like Netflix, Amazon Prime, or regional streamers (Aha, Hoichoi) before completion, producers can use the contract as collateral for bank loans or to reassure equity investors.

Pre-sales provide a “Minimum Guarantee” that significantly lowers the risk for all stakeholders. However, securing these deals requires deep intelligence into platform-specific commissioning trends—knowing which platforms are currently seeking specific genres or regional narratives.

Identify regional OTT distributors in India:

How Are Emerging Crowdfunding Trends Reshaping Indie Finance?

1. Leverage Reward-Based Crowdfunding (Wishberry/Kickstarter)

Traditional reward-based crowdfunding allows producers to raise small amounts from a large crowd in exchange for perks. While it rarely funds an entire feature, it is an excellent tool for “test marketing” and building an early community.

Real-World Signal: Successful Indian indies like Lucia raised significant portions of their budget through community-driven campaigns, proving audience demand to larger distributors.

2. Utilize Micro-Equity and Participatory Models

Newer models involve micro-equity where specialized platforms allow professional investors to fund “slates” of independent projects. This diversifies their risk while providing a steady stream of capital to indie studios.

What Role Does Organized Capital Play in Regional Cinema?

Organized capital funds, such as 91 Film Studios and Drishyam’s $20M content fund, are filling the “experience gap” left by traditional banks. These funds offer not just money, but production expertise and distribution networks, specifically targeting regional markets (Tamil, Telugu, Malayalam) where ROI is proven.

By treating film as an asset class, these funds enable independent producers to scale their operations. Utilizing Vitrina’s verified partner database, producers can now vet these funds based on their past project performance and genre specialization.

The 5 Biggest Challenges in Indie Finance (And How to Overcome Them)

1. Lack of Detailed Business Plans: Most indie pitches fail because they focus 100% on creative and 0% on recoupment. Solution: Include a detailed market analysis and distribution intelligence report.

2. Over-reliance on Festival Routes: Festivals are prestige, not profit. Solution: Parallelize your festival strategy with direct platform outreach using real-time project tracking.

3. Misaligned Budgeting: Budgeting for “art” without considering regional ROI thresholds. Solution: Use benchmark data to align your budget with typical acquisition prices for your genre.

“The financing model for Indian indies has shifted from ‘who you know’ to ‘what you know about the buyer.’ Producers who leverage data intelligence to identify active commissioning windows are securing financing 60 days faster than those relying on legacy networking.”

Moving Forward

The independent film financing landscape in India is evolving into a professionalized, data-driven ecosystem. By integrating government incentives, OTT pre-sales, and organized capital funds, producers can bridge the gaps that previously hindered creative freedom.

Whether you are an independent producer looking to secure development capital, or a strategy lead trying to monitor competitive slates, the principle remains: actionable intelligence drives deal velocity.

Outlook: Over the next 18 months, regional content and FAST channel expansion will create more localized funding opportunities for niche storytelling.

Frequently Asked Questions

What are the common ways to finance an independent film in India?

How do I find financiers for regional films in India?

Does NFDC provide funding for all independent films?

Can I use OTT pre-sales to fund my production?

About the Author

Strategy specialist with 15+ years in the Indian entertainment supply chain, specializing in film finance and regional market intelligence. Connect on Vitrina.