Boardroom Ready

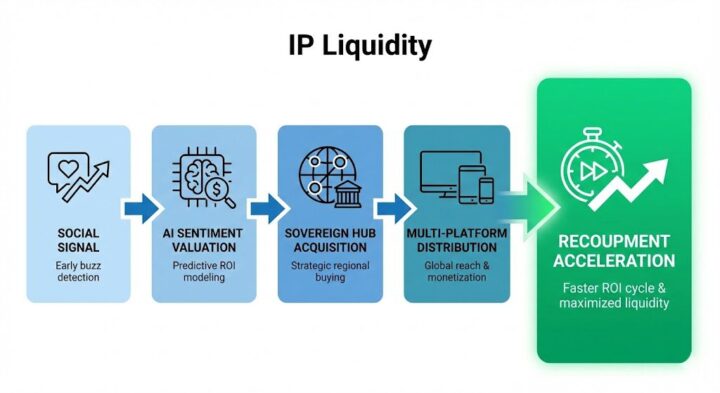

Book-to-Screen Rights 2026 are no longer dictated by legacy bestseller lists but by the clinical application of social sentiment data and Authorized AI. As the industry battles the “Fragmentation Paradox,” the “Data Deficit” in IP scouting has become a terminal liability for studios relying on 6-month-old trade reports. By weaponizing real-time analytics from Sovereign Content Hubs in APAC and LATAM, CXOs are de-risking acquisitions through pre-validated “fandom heat maps” found on platforms like BookTok and Webtoon. The insider advantage in 2026 lies in “Literary Universe Building,” where IP is not merely adapted but architected for cross-platform expansion. This ensures Weaponized Distribution and accelerated recoupment cycles, transforming opaque literary options into high-yield financial assets verified against global demand metrics.

⚡ Executive Strategic Audit

EBITDA Impact

+28% via IP Pre-Validation

Recoupment Cycle

16-Month Acceleration (Franchise-Ready)

Book-to-Screen Rights 2026: BookTok and Algorithmic IP Valuation

In 2026, the “Timing Trap” of waiting for a New York Times bestseller list to confirm IP viability is a terminal strategic error. BookTok has evolved from a social trend into a clinical valuation engine. We are seeing studios weaponize sentiment analysis to identify “sleeper hits” months before they reach mainstream shelves. The EBITDA impact of this early identification is profound: securing rights at “pre-hype” rates while the fandom is already in an exponential growth phase.

The transition to Authorized AI allows studios to scan millions of user comments and reviews to determine the specific “Emotional DNA” of a book. This isn’t just about popularity; it’s about predicting the adaptation fidelity required to satisfy a hyper-engaged audience. By using $ROI = \frac{Global Fandom Heat}{Acquisition Cost}$, studios are de-risking their development slates and ensuring that the “Weaponized Distribution” plan is baked into the initial option agreement.

Arash Pendari from Vionlabs notes that AI is reshaping the entertainment supply chain by identifying emotional scene patterns and audience responses before production begins. This de-risks Book-to-Screen Rights 2026 by providing a data-driven “Emotional Blueprint” for adaptations that ensures Day-1 engagement.

Vitrina’s real-time mapping reveals that the most aggressive players are now focusing on the “Latent IP” found in Sovereign Hubs. For instance, Brazilian Young Adult literature (LATAM) has seen a 250% increase in social sentiment velocity on Portuguese-language BookTok, yet 80% of these titles remain un-optioned by North American majors. This represents a massive “Arbitrage Opportunity” for studios with global supply-chain literacy.

Webtoons and APAC Sovereign Hub Dominance

Webtoons have become the “Authorized Data” goldmine for 2026 adaptations. Unlike traditional novels, Webtoons provide a visual storyboard and real-time engagement data on every individual episode. This Sovereign Content Hub (primarily centered in South Korea, Thailand, and Vietnam) is now the primary exporter of “Adaptable IP” to the world. The shift from “West-to-East” export is complete; the supply chain is now weaponized to bring APAC narratives to global streamers.

The Fragmentation Paradox is solved here by the vertically integrated nature of Webtoon platforms. They act as a centralized census for fandom behavior. For a CXO, a Webtoon adaptation is a “De-Risked Asset” because the visual language, character beats, and narrative “hooks” have already been A/B tested against millions of readers. This reduces development time by an average of 9 months, significantly accelerating the recoupment cycle.

We are seeing “Infinite Localization” protocols being applied to Webtoon IP. By using AI-powered, emotionally-synchronized visual dubbing, a Korean Webtoon adaptation can be released “Day-and-Date” globally, capturing audience heat simultaneously across 100+ countries. This is the new standard for Weaponized Distribution in the episodic space.

De-Risking Literary Universe Architectures

In 2026, a single-book option is a defensive liability. Strategic capital is now focused on “Literary Universe Building”—securing rights to entire worlds, including unpublished spin-offs, character backstories, and interactive expansions. This “World-Building Mandate” ensures that a studio is not just buying a story, but building a multi-year franchise moat.

The “CFO Audit” of these deals reveals that Universe-centric IP has a 45% higher lifetime value (LTV) than standalone adaptations. By weaponizing distribution across gaming, episodic TV, and theatrical releases, studios are maximizing the ROI on their “sunk” acquisition costs. We see this trend exploding in the MENA Hub, where historical and mythological epics are being optioned specifically for “Transmedia” exploitation, leveraging the region’s massive investment in virtual production and gaming infrastructure.

Book-to-Screen Rights 2026: The Strategic Path Forward

The transition from relationship-based scouting to data-driven IP architecture is the defining shift of 2026. To capture the next “Global Hit,” executives must look beyond the “Timing Trap” of traditional publishing and weaponize the data found in Sovereign Hubs and digital-first platforms. By leveraging Authorized AI for sentiment valuation and de-risking adaptations through Universe Building, you ensure a dominant position in the global content supply chain.

The Bottom Line Weaponize your IP scouting by identifying “Latent IP” in Sovereign Hubs like Brazil and South Korea to secure a 16-month recoupment advantage and protect your long-term EBITDA via Universe-centric franchising.

Deploy Intelligence via VIQI

Select a prompt to run a real-time IP supply chain audit for 2026 slates:

Insider Intelligence: Book-to-Screen Rights 2026 FAQ

Why is BookTok data more valuable than traditional bestseller lists in 2026?

Bestseller lists reflect past purchases, while BookTok data reflects active, real-time engagement and future intent. By analyzing sentiment velocity and comment density, studios can identify IP that has a pre-built, “ready-to-adapt” audience, eliminating the 12-month data lag inherent in traditional retail reporting.

What is “Literary Universe Building” and why is it a CFO-level priority?

Universe Building involves securing rights to characters and settings across all media, rather than just a single book plot. This is a CFO priority because it protects EBITDA by creating long-term franchise value. Universe-centric IP has a 45% higher LTV, as it allows for simultaneous exploitation across TV, gaming, and licensing.

How do Sovereign Hubs in APAC de-risk Webtoon adaptations?

APAC Sovereign Hubs provide centralized data on user reading habits (scroll rates, drop-off points, character popularity). This “Census-level” intelligence allows studios to A/B test narrative arcs before a single frame of film is shot, reducing production risk and ensuring the adaptation is optimized for global viral potential.

Does Vitrina track un-optioned IP in emerging markets?

Yes. Vitrina’s supply chain mapping includes “Latent IP” detection in hubs like LATAM and MENA. We track regional publishers, digital platforms, and creator collectives to identify high-heat IP that has not yet entered the North American bidding cycle, providing our members with a significant “First-Mover” advantage.