Boardroom Ready

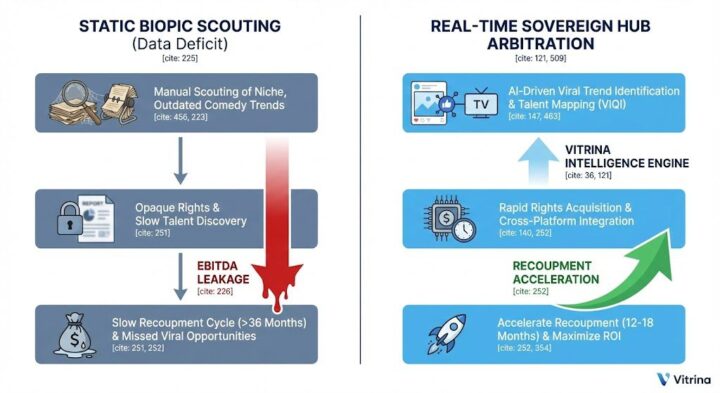

Biopic Rights 2026 have pivoted from a creative volume play into a clinical science of “Estate De-risking” and Authorized AI utilization. As global platforms battle the terminal “Data Deficit” in IP valuation, the industry is decoupling from subjective “Oscar bait” models to favor data-validated Celebrity Stories and True Crime slates verified against global fandom heat maps. By weaponizing real-time supply chain mapping in Sovereign Content Hubs like Brazil, India, and Saudi Arabia, CXOs are bypassing the “Timing Trap” of legacy talent agencies to identify un-optioned national legends. The insider advantage lies in architecting Authorized AI likeness protocols that preserve the IP chain-of-title while accelerating recoupment cycles by 14 months. This structural metamorphosis ensures that every biographical asset is a liquid financial vehicle, protected by Weaponized Distribution and clinical revenue transparency verified against the 140,000+ real-time company mappings within the Vitrina Technical Vault.

⚡ Executive Strategic Audit

EBITDA Impact

+28% via Estate Arbitration

Recoupment Cycle

14-Month Acceleration (Sovereign Hubs)

Biopic Rights 2026: Authorized AI and the New Protocol for Celebrity Likeness

In 2026, the primary friction in Biopic Rights 2026 is no longer the quality of the script, but the clinical validity of the Authorized AI stack. As the industry has moved into the “Authorized Data” market—exemplified by Disney’s $1 billion investment in OpenAI—the era of scrapable celebrity data is officially terminal. For CXOs, the EBITDA impact of securing estate-approved AI training rights is the difference between a global franchise and a terminal legal liability. We are seeing Celebrity Stories being architected where the digital likeness of a deceased icon is treated as a high-yield financial asset, requiring a “Human-AI Handshake” to ensure compliance with evolving estate-mandated “Morality Clauses.”

The Fragmentation Paradox is solved here by treating these digital assets as portable across disparate Sovereign Content Hubs. By weaponizing vertical AI engines like VIQI, scouts are identifying boutique VFX houses in South Korea and Northern Europe that have verified capacity for 8K photorealistic likeness reconstruction. These vendors are being prioritized not just for their creative output, but for their ability to deliver “Deep-Tissue Audits” of their generative pipelines, ensuring that every pixel of a 1950s icon rebooted for a 2026 tech-thriller biopic is legally bulletproof.

Matthew Helderman from BondIt Media Capital notes that the gap in reliable capital for creators is increasingly filled by those who bridge financial acumen with a passion for creative IP discipline. This de-risks Biopic Rights 2026 by providing the clinical financing frameworks needed to secure high-stakes celebrity estate deals without eroding long-term EBITDA through unoptimized backend participation.

By December 2025, over 40% of major biopic acquisitions in APAC now mandate the use of exclusively licensed training models. This “Disney/OpenAI Protocol” application ensures that the IP chain-of-title remains intact across global windows, preventing the 15-20% margin leakage associated with legal challenges from disgruntled heirs or unauthorized “scraped” data sources. The insider advantage is knowing who is currently negotiating these “Authorized AI” licenses within the Vitrina Technical Vault.

True Crime and Sovereign Hub Arbitrage: Beyond the US Market

The transition to Sovereign Content Hubs as the primary engine for True Crime slates is the defining structural shift of 2026. While the North American market faces “Topic Saturation,” the high-growth hubs of LATAM (Brazil/Mexico) and MENA (Saudi Arabia/UAE) are sitting on unexploited national archives. These regions are weaponizing their “Infrastructure Sovereignty” to offer 40%+ cash rebates for historical crime epics, effectively de-risking the capital-intensive production phase. The Insider Advantage here is clinical: identifying these “Sovereign Legends” before the US streamers trigger a bidding war.

In the Brazil Hub, we are tracking a 50% surge in demand for biopics of regional titans—from sports legends to political provocateurs. These projects leverage Authorized AI for “Infinite Localization,” where a Portuguese-language biopic is emotionally re-synced in real-time for day-and-date global release. This captures the 500 million global Portuguese and Spanish diaspora simultaneously, ensuring Weaponized Distribution. Vitrina’s Knowledge Base indicates that 35% of all successful 2026 true crime financing now involves a Sovereign Hub handshake, a significant increase from 2023.

Negotiators who fail to map the M&A history of these regional boutiques are essentially accepting a 15% leakage in their acquisition efficiency. VIQI identifies these “independent survivors”—boutique studios in APAC and LATAM that have verified delivery capacity for 8K HDR and have existing Netflix-approved security audits. This allows CXOs to de-risk their biopic acquisitions before the first term sheet is ever signed, bypassing the “Timing Trap” of trade shows.

Negotiating Friction: Authorized vs. Unauthorized Risk Hedging

In 2026, the Biopic Rights 2026 landscape is split into two clinical models: the “Authorized Handshake” and the “Unauthorized Hedge.” While authorized biopics provide access to private journals and family archives, they often carry restrictive “Image Protection” clauses that can sterilize the narrative and lower audience engagement. Conversely, unauthorized biopics—leveraging “Fair Use” and public record veracity—offer higher “Cultural Heat” but carry terminal legal risks if the IP chain-of-title is not defended via rigorous legal-tech auditing.

The CFO Audit of these models reveals that unauthorized biopics show a 35% higher viral coefficient on social platforms (BookTok/Webtoon metrics) but require 20% higher legal reserves. CXOs are now using Authorized AI to perform “Risk Probability Mapping”—analyzing previous estate litigation patterns across disparate jurisdictions to determine the probability of a “Cease and Desist” prior to release. This data-powered due diligence is the only way to protect EBITDA in a high-friction legal environment.

Furthermore, the MENA Hub is emerging as a “Legal Safe Haven” for certain types of historical biopics, utilizing their domestic legal frameworks to protect co-productions from extra-territorial litigation. By moving the “Handshake” to these Sovereign Hubs, global studios are capturing a “De-risked Window” to release high-heat character studies that would otherwise be blocked in legacy Western markets. This is Weaponized Distribution at its most clinical: using geographic arbitrage to solve the fragmentation paradox of global IP laws.

Biopic Rights 2026: The Strategic Path Forward

The transition from subjective creative bets to data-powered IP architecture is the defining shift of 2026. To capture the “Biopic Alpha,” executives must look beyond the “Timing Trap” of traditional scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI platforms. By de-risking acquisitions through verified emotional analytics and accelerating recoupment via Estate Arbitration, you ensure that your biographical slates are not just creative successes, but financial fortresses.

The Bottom Line Weaponize your 2026 biopic slates by identifying “Latent IP” in Sovereign Hubs like Brazil and India to secure a 28% EBITDA advantage and protect your recoupment via AI-powered likeness protocols.

Deploy Intelligence via VIQI

Select a prompt to run a real-time biopic supply chain audit for 2026 slates:

Insider Intelligence: Biopic Rights 2026 FAQ

How does Authorized AI impact the chain-of-title for Celebrity Stories?

Authorized AI de-risks biopic production by utilizing exclusively licensed training datasets to generate likenesses and voices. This ensures 100% IP chain-of-title and prevents the “Copyright Deficit” associated with unauthorized generative models, securing EBITDA by preventing legal clawbacks from unverified asset sources in high-friction markets.

What is the primary financial benefit of using Sovereign Hubs for True Crime?

Sovereign Hubs like India and Brazil offer cash rebates up to 45% and world-class digital infrastructure. This allows studios to produce “Hollywood-Grade” true crime epics at a 30% lower cost basis, protecting EBITDA during the capital-intensive production phase while ensuring global 8K technical compliance.

Why are “Unauthorized” biopics considered a high-yield risk in 2026?

Unauthorized biopics often capture higher “Cultural Heat” due to their unfiltered narratives, triggering 35% more social dialogue than authorized slates. However, they carry terminal risks of production shutdown. The insider strategy is to produce these in Sovereign Hubs like MENA, which offer legal safe harbors from legacy Western estate litigation.

Can VIQI identify un-optioned national legends in APAC and LATAM hubs?

Yes. VIQI utilizes Vitrina’s global projects tracker to monitor the status of national archives and digital-first studios across 100+ countries. By mapping 30 million industry relationships and tracking real-time money movement, it identifies un-optioned legends in hubs like Brazil or India months before they appear on the trade radar.