TV formats in Spanish are intellectual property (IP) frameworks for television shows originally developed in Spanish-speaking territories, licensed for local adaptation or global distribution.

With over 500 million native speakers globally, Spanish language content has transitioned from a regional specialty to a primary driver of subscriber growth for international streamers.

As the television services market expands toward a projected $390.47 billion by 2025, acquisition leads are increasingly prioritizing “Super-Regional” hits from Spain, Mexico, and Colombia that can be adapted for diverse Hispanic audiences.

In this guide, you will explore the mechanics of sourcing these formats, managing co-production treaties, and using vertical AI to identify high-velocity IP.

The 2026 landscape is no longer defined by the traditional telenovela model alone. It is now a highly fragmented ecosystem requiring supply chain visibility to track projects across 140,000 active companies.

This analysis provides the first comprehensive roadmap for navigating the Spanish language format market using structured, verifiable intelligence.

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

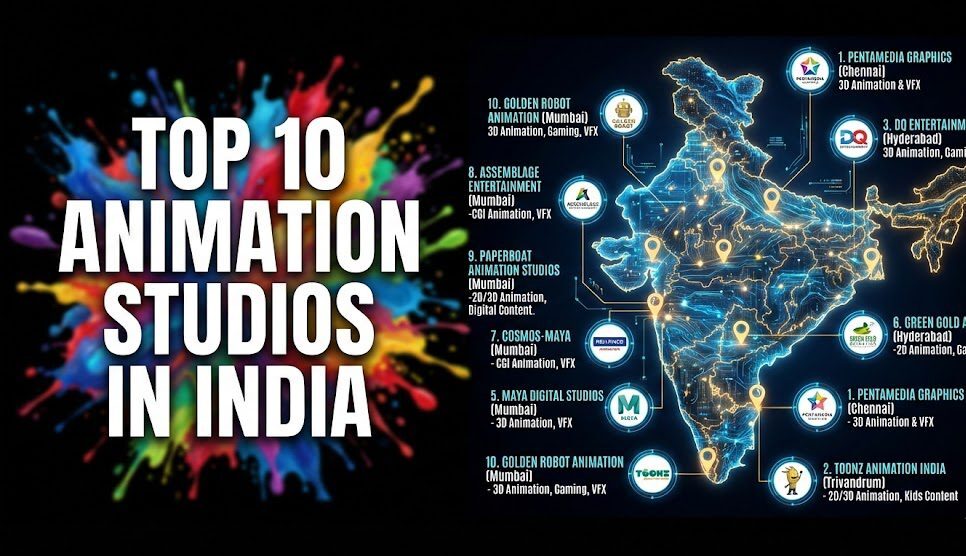

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Table of Contents

Strategic Insights for Content Buyers

- Diversified Unscripted Growth: While scripted drama remains prestigious, unscripted formats like reality competitions and game shows from Spain and Argentina are seeing 40% faster licensing turnarounds in 2026.

- The Pan-Regional Advantage: Successful formats are those designed for “Super-Regional” appeal, allowing a single license to serve multiple LatAm markets with minimal cultural friction.

- Data Trust Deficit: The primary barrier to licensing is the lack of verified production data. Using a centralized supply chain platform reduces vetting time by over 70%.

Defining TV Formats in Spanish

A TV format in Spanish is a proprietary concept or “Bible” for a television program that originated in Spain or Latin America. These formats range from long-form scripted dramas, traditionally known as telenovelas, to modern unscripted reality competitions. The defining characteristic of these formats is their cultural adaptability within the Ibero-American space, which allows for seamless cross-border licensing.

In 2026, the definition has expanded to include “Streaming-First” formats. These are shorter, high-concept series designed for global algorithmic resonance. For acquisition leads, these formats are highly valuable because they come with a built-in “cultural proximity” for the US Hispanic market, which remains the most lucrative segment of the global Spanish-speaking audience.

Find top Spanish-language format creators:

The Licensing Landscape: LatAm and Spain

The market for Spanish language formats is traditionally split between the “Madrid Hub” and the “LatAm corridor” (primarily Mexico, Colombia, and Argentina). Spain has emerged as a powerhouse for unscripted exports, with formats like Tu Cara Me Suena (Your Face Sounds Familiar) being licensed in over 40 countries. In contrast, the Latin American market remains the global leader in scripted format IP, with telenovela structures being adapted as far as Turkey and the Middle East.

Licensing these formats in 2026 requires a sophisticated understanding of regional rights. Unlike the English market, the Spanish market often involves complex multi-territory deals that include broadcast rights for local LatAm networks alongside global streaming rights. This “Weaponized Distribution” strategy allows major players to control a format’s lifecycle across both linear and digital platforms simultaneously.

Track Spanish scripted remakes in production:

Discovery 2.0: AI-Driven Partner Matching

The transition from an opaque, relationship-driven market to a data-powered framework is most evident in format discovery. Senior executives previously relied on personal networks to source IP from LatAm. However, with over 600,000 companies in the global ecosystem, manual networking is no longer viable for maintaining deal velocity. Vertical AI is now used to map 30 million industry relationships, identifying which Spanish producers have the highest “Reputation Scores” for cross-border adaptations.

Expert Perspective: Cultural Context and AI in International Content

In this session, Arash Pendari of Vionlabs discusses how AI identifies cultural context and emotional patterns, a critical factor for acquisition leads when adapting Spanish formats for non-Spanish speaking audiences.

Key Insights

Understanding emotional resonances across borders is essential for format adaptation. AI-driven metadata analysis helps buyers predict which Spanish unscripted mechanics will translate to global viewers by analyzing cultural context processing.

Co-Production Models and Fiscal Incentives

One of the most significant gaps in current format licensing guides is the failure to address co-production treaties. Spain, for instance, has bilateral agreements with almost every Latin American country, allowing producers to pool resources and access local tax rebates. For an acquisition lead, licensing a format from a company that has “Co-Production Ready” status means the project can be financed with a 20% to 50% lower capital requirement.

Vertical AI platforms like Vitrina help buyers qualify partners based on these fiscal specializations. By automating the due diligence process for co-production history, companies can perform precision outreach to the top 100 high-value targets monthly, significantly accelerating the path to greenlighting a Spanish-language adaptation.

Analyze LatAm co-production trends:

The Impact of FAST and Streaming on Spanish IP

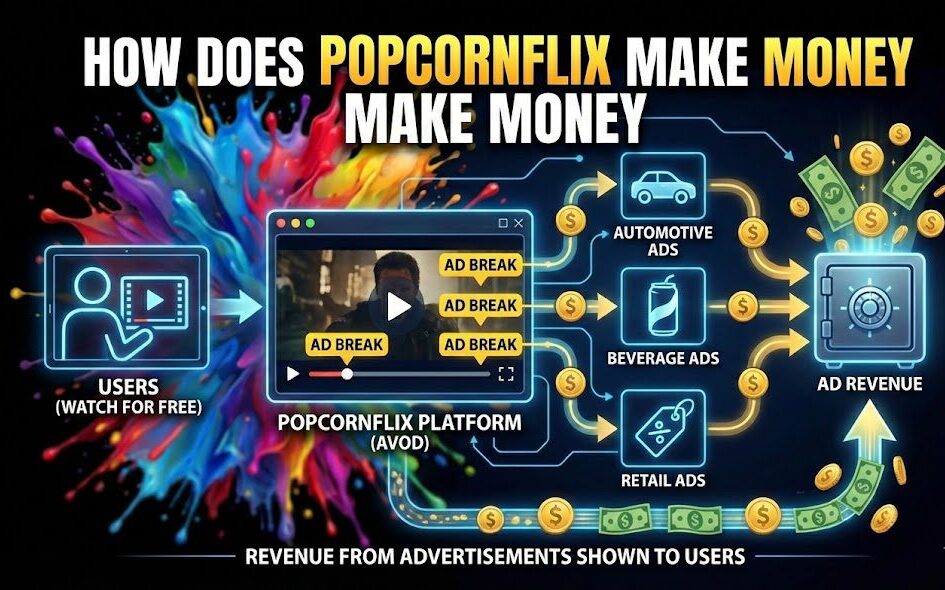

The rise of Free Ad-Supported Streaming TV (FAST) in the US and Latin America has created a massive secondary market for library-depth Spanish formats. Platforms like VIX and Pluto TV are aggressively acquiring “volume IP”—classic game shows and unscripted formats that can sustain 24-hour dedicated channels. For format owners, this means the tail-end of a format’s lifecycle is now significantly more profitable than in the linear-only era.

Conclusion: The Future of Hispanic Content

The market for TV formats in Spanish has transitioned into a “Borderless” era where data intelligence is the only way to manage global scale. This guide has highlighted the shift from relationship-based sourcing to automated supply chain tracking, ensuring that acquisition leads can move with precision.

By integrating vertical AI into the vetting process, buyers can mitigate the inherent risks of regional fragmentation and unlock the full potential of Hispanic IP.

Outlook: The next 24 months will see a surge in “Super-Regional” unscripted formats as FAST platforms and streamers consolidate their Hispanic content offerings.

Frequently Asked Questions

Which country is the leading exporter of Spanish TV formats?

Spain currently leads in unscripted format exports, while Mexico and Colombia remain the dominant exporters of scripted (telenovela) IP.

Can a Spanish format be adapted for the US market?

Yes, many successful US shows are adaptations of Spanish formats, such as Jane the Virgin (adapted from Venezuela’s Juana la Virgen).

What is a “Super-Regional” format?

A Super-Regional format is designed to appeal to multiple Spanish-speaking territories simultaneously, reducing production costs by using a single hub for multiple local versions.

How does vertical AI help in sourcing Spanish IP?

Vertical AI maps verified production histories and executive movements, allowing buyers to qualify partners based on their success rate in cross-border adaptations.

What are the typical licensing fees for Spanish unscripted formats?

Fees generally range between 7% and 12% of the local production budget, often including consultancy from the original production team.

Are there tax incentives for co-producing Spanish formats?

Yes, many countries like Spain and Colombia offer significant tax rebates (often 20% to 40%) for projects that qualify under official co-production treaties.

What role do FAST channels play in Spanish IP?

FAST channels act as high-volume library buyers for legacy formats, creating a lucrative secondary revenue stream for format owners.

How has Netflix impacted the Spanish format market?

Netflix has increased the demand for “prestige” Spanish scripted formats, shifting the market toward higher-budget, shorter-run series over traditional 100-episode telenovelas.

About the Author

Written by the Vitrina Editorial Team. Our analysts bridge the gap between regional IP and global distribution using proprietary data from over 140,000 verified entertainment companies. Connect on Vitrina.