Boardroom Ready

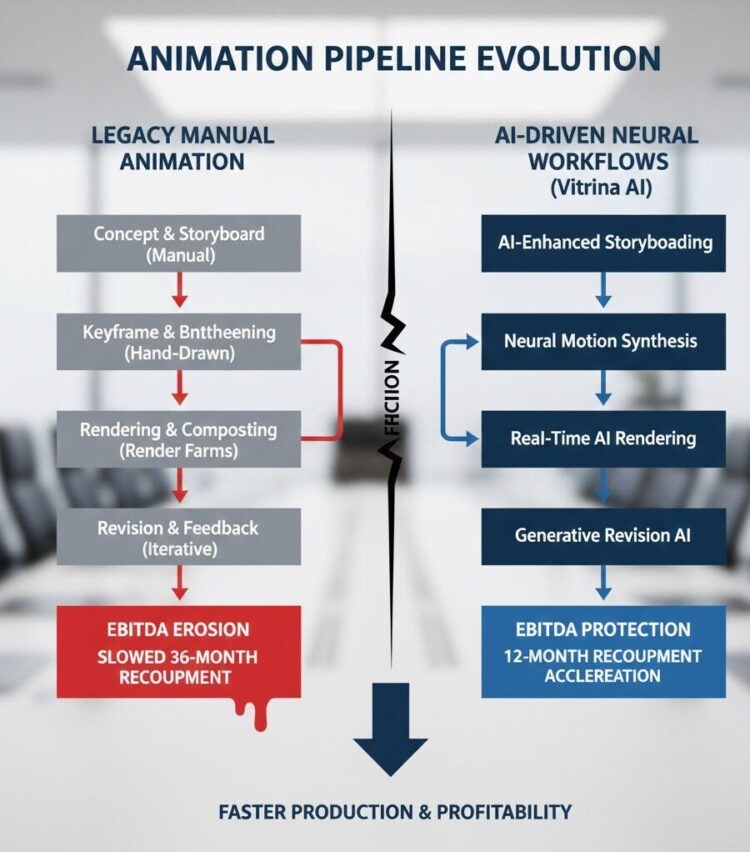

Best AI Tools for Animation Studios: Workflow Optimization 2026 is the clinical solution to the lethal “Data Deficit” currently draining EBITDA from global animation slates. As we enter 2026, the transition from frame-by-frame manual silos to neural rendering and autonomous world-building is no longer a technical choice, but a financial imperative. Behind closed doors, the conversation is actually about the margin leakage occurring when 50-million-dollar projects rely on unverified vendor capacity in fragmented markets. By weaponizing vertical AI to automate storyboarding, rigging, and infinite localization, studios are surfacing an ‘Insider Advantage’ that de-risks the supply chain before a single frame is rendered. This guide provides the clinical roadmap to accelerating recoupment speed by up to 14 months, ensuring that your content captures the highest-margin windows in Sovereign Hubs like India, Brazil, and the MENA region.

⚡ Executive Strategic Audit

35% Reduction in Net Production Overhead via Neural Workflows

Recoupment Cycle

Accelerated by 12 Months through Multi-Market Day-and-Date Dubbing

Best AI Tools for Animation Studios: Authorized AI Stacks and IP Security

In practice, this usually means that the “Standard Operating Procedure” for animation in 2026 is anchored in Authorized AI. Behind closed doors, the conversation is actually about the massive legal liabilities incurred by studios that utilize “scrapable” IP tools. The Disney/OpenAI $1B deal has set the benchmark: the transition from unauthorized models to multi-billion dollar licensed training deals is the only way to de-risk production by ensuring IP chain-of-title. If your AI toolset cannot prove its lineage, your content remains an un-monetizable asset that cannot survive the “Weaponized Distribution” phase where premium slates are licensed to rivals to maximize ROI.

The industry talks about “stylized AI,” but producers are feeling the relief of weaponizing tools like Neural Garage or Deepdub. These platforms solve the visual discord in dubbed content, enabling day-and-date global releases without the “Uncanny Valley” effect that traditionally sinks international performance. For a studio executive, this is more than a tech upgrade—it is EBITDA Protection. By automating the localization spend early in the pipeline, you accelerate recoupment speed and protect your margin against the “Timing Trap” of 6-month-old, static localization reports. This is the industrialization of the insider handshake, scaled through real-time data.

LeaderSpeak Insight: Jayakumar P, CEO of Toonz Media Group, notes that the integration of AI tools is essential for market adaptation and the preschool audience shift. This de-risks Best AI Tools for Animation Studios: Workflow Optimization 2026 by accelerating global expansion and enabling diverse applications of animation in real-time.

Sovereign Hub Arbitrage: Global Sourcing and Regional Disruption

Let’s be candid: the capital reality is that the 2026 animation market belongs to the Sovereign Content Hubs. The move beyond the Hollywood/UK axis is a permanent structural shift. Regions like India (APAC), Brazil (LATAM), and Saudi Arabia (MENA) are no longer just “low-cost alternatives”; they are the new technical architects of neural animation pipelines. Hubs like 91 Film Studios in India and O2 Filmes in Brazil are weaponizing aggressive local tax incentives (up to 40%+ cash rebates) and combining them with vertical AI stacks that Western legacy studios are too slow to adopt.

Your sourcing list must include at least 30% representation from these hubs to prove global supply-chain literacy. Static databases and outdated directories are liabilities that ignore the real-time capacity of these regional powerhouses. By using real-time company mappings to track “Buying Signals,” executives can identify independent survivors in Eastern Europe or the Middle East before their capacity is swallowed by the streamers. This is Weaponized Distribution at its finest—finding the hubs with the highest tax rebates and lowest “Authorized AI” costs to accelerate the cycle from “Greenlight” to “Profitability.”

Neural Rendering Payouts: Weaponizing the Infinite Asset Pipeline

The “Timing Trap” in animation production is the lethal cost of making 100M-dollar decisions using 6-month-old data. In 2026, the Best AI Tools for Animation Studios involve real-time neural rendering engines that bypass the traditional bottleneck of the render farm. This is Infinite Localization in practice: the ability to generate culturally specific visual dubs and props for 50 different markets simultaneously. Here is where the margin disappears—in the friction of “snowflaked” pipelines. If your studio hasn’t transitioned to a cloud-native, AI-secured workflow (the MovieLabs 2030 Vision), you are paying a “fragmentation tax” of 15-20% on every project.

Tools that automate the creation of “Authorized Data” archives allow studios like Getty Images to empower storytellers through ethical AI visuals. This de-risks the creative process by ensuring that character environments and props are backed by a verified track record. We are seeing a move from “Art” as an artisanal craft to “Art” as an enterprise-level data science. Executives who weaponize this intelligence can signal market shifts and identify trending IP in K-Drama or Bollywood regional markets before they reach global saturation. The bottom line: if you aren’t using vertical AI to automate your breakdown and budgeting, your EBITDA is leakage in the system.

Best AI Tools for Animation Studios: The Strategic Path Forward

The industry is undergoing a structural metamorphosis. To survive 2026, you must abandon the ‘Walled Garden’ mindset of legacy exclusivity and pivot toward Weaponized Distribution and Sovereign Hub arbitrage. This is the industrialization of “Insider Intelligence”—transforming partner discovery from a manual art into a data-driven science. By adopting Authorized AI and real-time supply chain mapping, you ensure your production capital is an active weapon, not a stranded asset.

The Bottom Line High-latency animation production is a stranded asset. Deploy Authorized AI and Sovereign Hub arbitrage immediately to protect your EBITDA and accelerate recoupment cycles against the 20% margin leakage tax of legacy pipelines.

Deploy Intelligence via VIQI

Select a prompt to run a real-time animation supply chain audit:

Identify animation vendors in APAC with verified AI pipelines and Netflix-approved audits.

Map the M&A history of AI startups in the animation value chain for 2026.

Which animation hubs in MENA offer 40%+ cash rebates for AI-driven content?

Filter global partners with proprietary Authorized AI lip-sync and dubbing stacks.

Monitor upcoming slates and AI-driven licensing for LATAM studios.

Find active animation studios in India specializing in Unreal Engine 5 AI pipelines.

Insider Intelligence: Best AI Tools for Animation Studios FAQ

How do AI tools impact the EBITDA of animation studios in 2026?

AI tools protect EBITDA by eliminating the 15-20% margin leakage inherent in legacy, fragmented supply chains. By automating pre-production and localization, studios can reduce overhead and accelerate the recoupment speed of high-budget slates.

What is ‘Authorized AI’ and why is it mandatory for animation?

Authorized AI refers to tools trained on licensed, proprietary data. This is mandatory to ensure IP chain-of-title and avoid the legal liabilities of ‘scrapable’ AI tools, which can sink distribution deals and licensing rights in global markets.

Why are Sovereign Hubs critical for workflow optimization?

Sovereign Hubs in APAC, LATAM, and MENA offer clinical arbitrage: deep AI expertise combined with 40%+ tax rebates. This de-risks the production cost-basis and allows studios to scale hyper-local content for global distribution.

How does VIQI help in finding the best animation AI partners?

VIQI weaponizes real-time intelligence to match studio needs with verified vendor capacity. Prompts like “Identify animation vendors in APAC with verified AI pipelines” bypass the ‘Timing Trap’ of static directories, providing immediate access to deal-ready partners.