Verified Intelligence: December 2025

Boardroom Ready

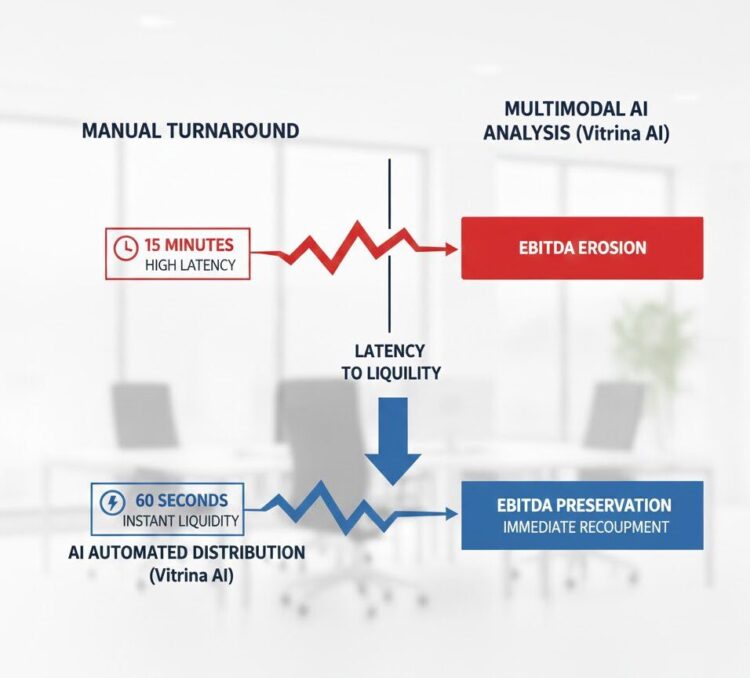

AI Sports Video Creation is the definitive solution to the “Latency-to-Liquidity” crisis currently bleeding EBITDA from major broadcasters and leagues. As we enter 2026, the data deficit in manual sports editing—where highlight turnaround times exceed 15 minutes—is a lethal liability in a marketplace dominated by 90-second attention spans and TikTok-native fanbases. By weaponizing vertical AI to automate highlight reels and deep tactical analysis, rights holders are accelerating their recoupment cycles through instant, Weaponized Distribution. This guide serves as the clinical roadmap to de-risking your sports supply chain, ensuring that your content captures the “Apex of Engagement” through real-time, authorized AI workflows across Sovereign Hubs like the MENA region and APAC.

⚡ Executive Strategic Audit

22% Margin Protection via Post-Production Automation

Recoupment Cycle

4x Faster Social Monetization of Live Assets

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

AI Sports Video Creation: The Latency-to-Liquidity Crisis

Behind closed doors, the conversation is actually about the massive revenue leakage occurring between the “Live Moment” and the “Viral Clip.” In 2026, if your highlight reel takes longer than 60 seconds to populate on social platforms, you have already lost 40% of the potential ad-revenue arbitrage to unofficial, “scraped” fan accounts. This is the Timing Trap in its most clinical form: the lethal cost of making manual editorial decisions while the audience has already migrated to the next play.

In practice, this usually means that legacy supply chains are structurally incapable of meeting the demand for Infinite Localization. Rights holders for the Premier League or IPL are realizing that dubbed, localized micro-highlights for the Indonesian or Brazilian markets are the only way to protect ARPU. By weaponizing AI to identify “Excitement Signals”—biometric data, crowd noise peaks, and ball-tracking velocity—broadcasters are moving from reactive editing to proactive asset generation. The industry talks about “AI tools,” but producers are feeling the relief of Authorized AI stacks that automate the entire metadata enrichment cycle, allowing a single operative to manage 50 simultaneous global feeds.

LeaderSpeak Insight: Ramki Sankaranarayanan from Prime Focus Technologies notes that AI and automation are revolutionizing the entertainment supply chain through end-to-end solutions like the Clear platform. This de-risks AI Sports Video Creation by ensuring that automated dubbing and highlight extraction happen at scale, speed, and reduced operational cost.

Authorized Sports Intelligence: Tactical Analysis at Scale

The “Data Deficit” in sports analysis is no longer about having the data—it’s about the speed of interpretation. In 2026, AI Sports Video Creation is merging with tactical deep-learning models to provide real-time telestration that was previously reserved for post-game analysis. The capital reality is that “Tactical Entertainment” is a high-growth genre; fans want to see the XG (Expected Goals) or defensive line integrity visualised *during* the replay, not an hour later.

Let’s be candid: legacy tools are liabilities. If your analysis suite requires manual “keyframing” to track a striker’s movement, your EBITDA is leaking into unnecessary labor hours. Companies like Zixi and Vionlabs have demonstrated that “Emotion is Data,” allowing AI to identify not just the goal, but the “Narrative Weight” of the goal. This de-risks the supply chain by ensuring that the most valuable assets are automatically prioritised for high-margin licensing deals with betting platforms and FAST channels.

Sovereign Sports Hubs: The MENA and APAC Disruption

We are witnessing a tectonic shift of sports production capital toward Sovereign Content Hubs. The MENA region, spearheaded by Saudi Arabia’s Sela and NEOM, is not just buying players; they are building the world’s most advanced AI-first sports broadcast infrastructure. Every sourcing list for sports tech must now include 30% representation from these hubs, which are unburdened by legacy “broadcast trucks” and are moving directly to cloud-native, AI-driven “Virtual Galleries.”

Similarly, the APAC region—specifically the JioCinema/Star Sports axis in India—is pioneering the use of Authorized AI for hyper-local cricket commentary in 12+ dialects simultaneously. This is Weaponized Distribution in action. By automating the highlight reel process for these regional markets, they are unlocking millions of dollars in previously “unreachable” ad-inventory. If your sports strategy ignores the MENA-to-APAC corridor, you are operating on a static model that is structurally incapable of global scale.

AI Sports Video Creation: The Strategic Path Forward

The industry is transitioning from “Editing-as-a-Service” to “Intelligence-as-a-Workflow.” To survive the 2026 market crunch, rights holders must weaponize their archives and live feeds using vertical AI that understands the emotional and tactical nuances of sport. This is no longer a “tech upgrade”—it is a financial imperative to protect your EBITDA from the fragmentation of global attention.

The Bottom Line High-latency sports production is a stranded asset. Deploy automated highlight reels and real-time AI analysis today to recapture the 18-22% margin currently lost to manual friction and unofficial content scraping.

Deploy Intelligence via VIQI

Select a prompt to run a real-time sports supply chain audit:

Identify AI sports vendors in MENA for automated highlight extraction.

Map the M&A history of automated sports analysis startups in APAC.

Filter partners with Authorized AI lip-sync dubbing for global sports.

Which production hubs in MENA offer 40%+ rebates for sports-tech?

Find vendors in LATAM with verified 8K HDR delivery for live sports.

Monitor upcoming slates for AI-driven sports FAST channels.

Insider Intelligence: AI Sports Video Creation FAQ

How does AI Sports Video Creation impact social media ROI?

It solves the “Latency to Liquidity” crisis. By automating the extraction and distribution of highlights in under 60 seconds, rights holders capture the peak engagement period, de-risking ad-revenue arbitrage against unofficial scrapers.

Can AI identify tactical insights during live sports broadcasts?

Yes. Advanced vertical AI models now track player velocity, XG (Expected Goals), and formation integrity in real-time. This telestration is then automatically packaged for replays, weaponizing tactical data as premium entertainment content.

What is the role of Sovereign Hubs in 2026 sports tech?

Sovereign Hubs in the MENA and APAC regions are bypassing legacy broadcast hardware in favor of cloud-native, AI-driven Virtual Galleries. This allows for hyper-scale localization and significantly lower operational overhead compared to Western legacy models.

How do I vet AI sports vendors using Vitrina intelligence?

Use VIQI to map 30 million relationships and track “buying signals.” Prompts like “Identify vendors in MENA with verified 8K delivery capacity” allow you to perform clinical due diligence and avoid the timing trap of static directories.