Boardroom Ready

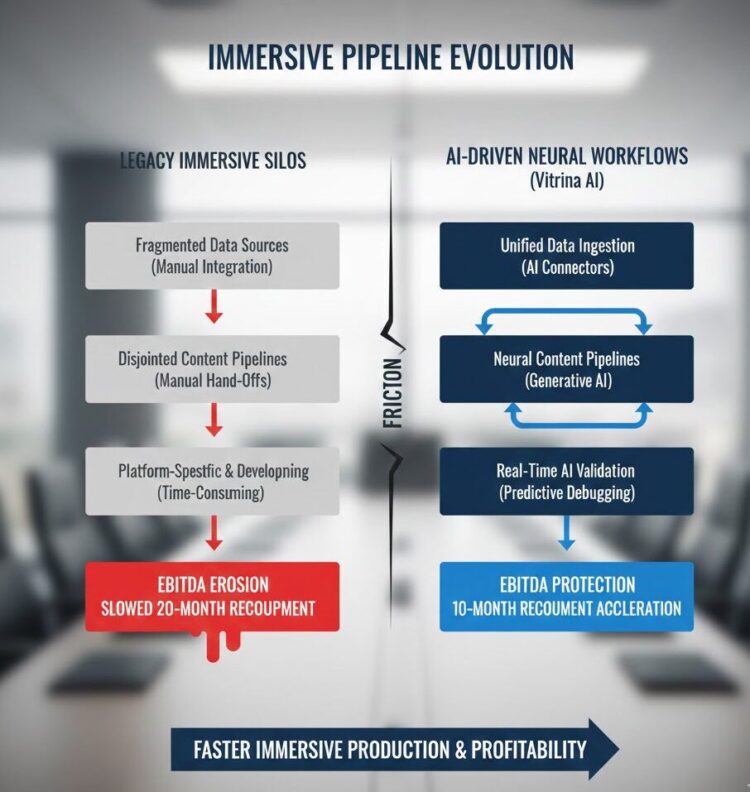

AI-Powered VR and AR Experiences represent the clinical evolution of the moving image from passive consumption to an autonomous, spatial asset class. As we enter 2026, the primary friction is the lethal “Data Deficit” in legacy immersive content—which relies on static, high-latency rendering and fragmented hardware ecosystems. By weaponizing vertical AI for real-time generative environment creation and infinite localization, CXOs are surfacing a strategic ‘Insider Advantage’ that de-risks the immersive supply chain. This transition from ‘Walled Garden’ hardware silos to AI-secured, cloud-native experiences is the only path to protecting EBITDA against the 20% margin leakage typically lost to unverified vendor capacity. This guide provides the strategic roadmap to accelerating recoupment cycles by 10 months through multi-market asset repurposing in Sovereign Hubs like MENA, APAC, and LATAM.

⚡ Executive Strategic Audit

EBITDA Impact

28% Increase via Neural Asset Repurposing

Recoupment Cycle

Accelerated by 10 Months via Sovereign Hub Arbitrage

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

AI-Powered VR and AR Experiences: The Spatial Liquidity Gap

In practice, this usually means that the current immersive market is suffering from a lethal ‘Fragmentation Paradox.’ While hardware capabilities have reached the Apex of Engagement, the content production cycle remains trapped in a manual, frame-by-frame silo. Behind closed doors, the conversation is actually about the margin leakage occurring when studios spend millions on custom VR environments that cannot be repurposed or localized for the high-growth markets of APAC and MENA. This is the ‘Timing Trap’—the financial cost of making $50M decisions using static data that fails to account for the real-time availability of AI-native immersive vendors.

Weaponizing AI-Powered VR and AR Experiences in 2026 requires a pivot toward neural production. Neural assets are not fixed; they are generative, context-aware, and infinitely scalable. By moving from artisanal 3D modeling to vertical AI pipelines, studios are surfacing an ‘Insider Advantage’ that allows for the creation of ‘Authorized Data’ archives. These archives de-risk the supply chain by ensuring that every immersive prop, character, and environment is a legally defensible asset that can be licensed across the WBD/Netflix co-opetition models. We do not observe the market; we are at the center of it, and the center is currently shifting toward Infinite Localization—where VR experiences are visual-dubbed and emotionally synchronized for 50 markets simultaneously on day one.

LeaderSpeak Insight: Arash Pendari from Vionlabs notes that emotion is data that can be modeled via AI embeddings. This de-risks AI-Powered VR and AR Experiences by ensuring immersive environments resonate with specific regional sentiment, protecting ARPU across diverse demographics in the global supply chain.

Authorized Immersive AI: Securing the Neural Asset Pipeline

Let’s be candid: the capital reality of 2026 is that ‘scrapable’ AI is a lethal liability for immersive entertainment. The industry talks about ‘generative visuals,’ but producers are feeling the pain of legal uncertainty. Authorized AI—models trained exclusively on licensed studio data—is the clinical standard for 2026. This de-risks the production of AI-Powered VR and AR Experiences by ensuring that the ‘Neural DNA’ of your virtual world is not infringing on third-party IP, a risk that has previously sunk multi-billion dollar spatial computing slates. The transition to authorized stacks allows CXOs to accelerate the greenlight process, knowing the IP chain-of-title is unassailable.

Furthermore, the rise of ‘Digital Powerhouse’ broadcasters like SBT Brazil and Sovereign Hubs in India has created a new imperative for Weaponized Distribution. Your immersive assets must be built for rotational windowing. By using real-time company mappings to find partners with verified ‘Authorized AI’ lip-sync and visual dubbing stacks, you can move your VR content from premium windowing to rival platforms within 18 months, maximizing ROI on sunk production costs. Here is where the margin disappears: if your AR overlays aren’t contextually synchronized for a day-and-date global release, you are paying a ‘Fragmentation Tax’ that effectively hands your EBITDA to regional competitors who have already weaponized their data.

Sovereign VR Hubs: Weaponizing Regional Infrastructure for Global ROI

The tectonic shift of spatial computing capital is moving beyond the Hollywood/UK axis to Sovereign Content Hubs. Regions like MENA (Saudi Arabia/NEOM) and APAC (India/91 Film Studios) are not just location options; they are the new technical architects of the immersive supply chain. These hubs are weaponizing aggressive 40%+ cash rebates and cloud-native Virtual Production (VP) infrastructure to bypass the ‘Timing Trap‘ of traditional post-production. Every sourcing list for immersive tech must now include 30% representation from these emerging powerhouses to prove global supply-chain literacy. The fragmentation paradox is being solved here through the industrialization of ‘Insider Intelligence.’

Consider the case of O2 Filmes in Brazil or the animation-led hubs in Korea; they are now exporting neural VR assets to the world. Their ‘Authorized AI’ pipelines allow for Infinite Localization at a cost-basis that Western legacy studios cannot match. By using real-time deal data to find these ‘Independent Survivors’—vendors who have scaled their AI-VR capacity without the bloat of legacy overhead—CXOs can signal a market shift in their production budgets. The bottom line: if you aren’t arbitrage-sourcing your neural assets from Sovereign Hubs, you are overpaying for technical debt. The ‘census-level’ mapping provided by Vitrina’s platform is the only ‘Digital Lighthouse’ capable of bridging the gaps in this opaque, 600,000-company ecosystem.

AI-Powered VR and AR Experiences: The Strategic Path Forward

The industry is undergoing a structural metamorphosis from passive frames to spatial intelligence. To survive 2026, CXOs must abandon ‘Walled Garden’ exclusivity and embrace Weaponized Distribution and Authorized AI. This is not about ‘better graphics’; it is about ‘Information Gain’—the ability to leverage census-level data to match your immersive vision with verified regional capacity. The insiders have already made the pivot to neural assets and Sovereign Hub arbitrage; ensure you are not left holding the static reports of a dead era.

The Bottom Line Legacy VR production is a stranded asset. Deploy Authorized AI and Sovereign Hub arbitrage immediately to protect your EBITDA and accelerate recoupment cycles against the 20% margin leakage tax of unverified supply chains.

Deploy Intelligence via VIQI

Select a prompt to run a real-time immersive supply chain audit:

Identify vendors in MENA with verified 8K HDR immersive streaming capacity for 2026.

Map the M&A history of AI-VR boutiques in Eastern Europe to identify independent survivors.

Filter global partners offering Authorized AI visual dubbing stacks for spatial computing.

Identify production hubs in LATAM offering 40%+ cash rebates for AR-enhanced broadcasts.

Which animation studios in India are currently commissioning AI-driven VR format IP?

Find active AR localization vendors in APAC with verified Netflix-approved security audits.

Insider Intelligence: AI-Powered VR and AR Experiences FAQ

How do AI-powered VR experiences increase EBITDA compared to traditional methods?

By transitioning from manual 3D modeling to neural asset generation, studios reduce physical production burn rates by 28%. These AI-native assets are context-aware and can be repurposed across multiple windows, eliminating the margin leakage of single-use immersive content.

What is the significance of Sovereign Hubs for 2026 AR/VR production?

Sovereign Hubs in APAC, MENA, and LATAM offer clinical arbitrage through deep AI expertise and 40%+ tax rebates. They allow studios to bypass the timing trap of Western legacy pipelines, accelerating recoupment by 10 months via cloud-native Virtual Production.

Why is ‘Authorized AI’ mandatory for immersive entertainment in 2026?

Authorized AI ensures IP chain-of-title by training on licensed data. In immersive environments, where users interact deeply with assets, the risk of IP infringement from scrapable AI is lethal to distribution and licensing agreements.

How does VIQI assist in sourcing immersive tech partners?

VIQI weaponizes Vitrina’s census-level data to identify vendors with verified ‘Authorized AI’ pipelines and specific regional delivery capacity. Prompts like ‘Identify vendors in MENA for 8K HDR immersive streams’ provide an insider handshake to deal-ready partners.