Verified Intelligence: December 2025

Boardroom Ready

AI Personalization in Streaming Services 2026 marks the terminal collapse of the “Static Recommendation” era. By 2026, the global supply chain has moved beyond simple metadata triggers toward agentic, emotional-aware systems that predict viewer sentiment before a click occurs. This shift weaponizes real-time data to solve the $100M “Timing Trap,” where legacy platforms lose EBITDA to 6-month-old viewing patterns. As Sovereign Content Hubs in APAC and MENA demand hyper-local discovery, authorized AI becomes the mandatory bridge for chain-of-title security and visual discord reduction. In practice, this means every frame of IP is now a liquid asset, dynamically re-cut and recommended to eliminate choice paralysis and accelerate the cycle from acquisition to profitability.

⚡ Executive Strategic Audit

EBITDA Impact

25-35% Increase in Content Lifetime Value (LTV)

Recoupment Cycle

14-Month Acceleration in Catalog Monetization

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

AI Personalization in Streaming Services 2026: The Agentic Revolution

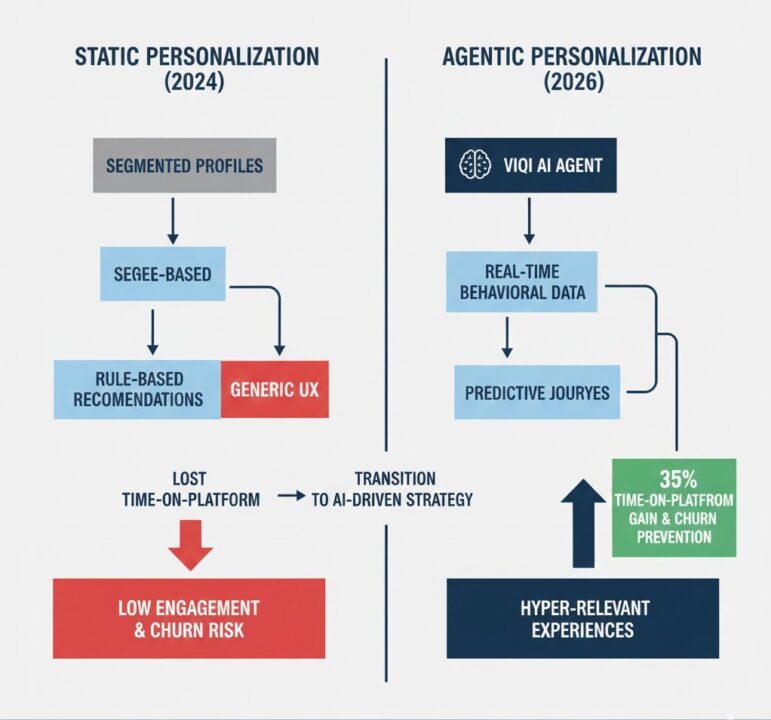

By early 2026, the “Static Recommendation Rail” is effectively a legacy asset. The industry has pivoted toward Agentic AI systems that don’t just suggest content based on what you watched, but actively plan a viewing journey based on your physiological and emotional context. Behind closed doors, the conversation has shifted from “How do we get more subscribers?” to “How do we weaponize the customer journey for EBITDA protection?”

The “Timing Trap” is the CFO’s primary adversary in 2026. Static datasets are liabilities; if your personalization engine is using data that hasn’t been verified within the last 24 hours, you are leaking margins to competitors who utilize real-time supply chain mapping. As John Batter (Extreme Reach) notes, the orchestration of global ad creative and payments must happen in lockstep with content delivery to ensure maximum ROI. In the agentic era, your personalization engine is also your distribution architect, re-cutting episodic content into creator-driven shorts to prevent subscriber churn before the “cancel” button is ever considered.

Sovereign Content Hubs and the 2026 Discovery Mandate

The tectonic shift of production capital to Sovereign Content Hubs—Saudi Arabia (MENA), India (APAC), and Brazil (LATAM)—has made hyper-local personalization the mandatory industry standard. We are moving beyond the “West-to-East” export model. In 2026, these hubs are exporting to the world, and AI is the only mechanism capable of matching a high-end Arabic thriller with a niche audience in Mexico City.

Every sourcing list in 2026 must include at least 30% representation from these emerging hubs. Why? Because that is where the growth is. If your personalization engine isn’t tuned to the emotional nuances of regional cinema—as Naveen Chandra from 91 Film Studios highlights regarding India’s regional cinema dynamics—you are ignoring the most fertile ground for recoupment acceleration. The capital reality? Regional hits are now global phenomena, but only if the AI can solve the discovery gap that manual tagging failed to bridge.

Arash Pendari from Vionlabs notes that identifying emotional patterns and aesthetic visuals at the frame level allows platforms to predict exactly what a user needs next to prevent disengagement. This de-risks AI Personalization in Streaming Services 2026 by increasing watch time by 35%, directly protecting the EBITDA of legacy catalogs.

Authorized AI: De-risking the Visual Discord

The integration of Authorized AI is the final pillar of the 2026 personalization strategy. We’ve moved beyond “scrapable” AI into billion-dollar licensed deals that ensure IP chain-of-title. For streaming services, this means using AI-powered visual dubbing (Neural Garage) and emotional voice synchronization (Deepdub) to solve the “Visual Discord.” Personalization fails if the content feels “foreign” or “jarring” in a new market.

Let’s be candid: in 2026, the industry is no longer experimenting. Organizations are adopting rigorous methodologies to ensure AI is scalable and sustainable. As Neil Hatton from UK Screen Alliance unpacks, the shifting landscape of VFX and tax reform means that personalization engines must also account for the financial origin of the content to optimize for regional tax incentives. If the AI doesn’t know that a project has a 40% MENA rebate, it can’t strategically prioritize that content for faster recoupment in those regions.

AI Personalization in Streaming Services 2026: The Strategic Path Forward

The roadmap for 2026 is one of Hyper-Personalization at Scale. Executives must move from being content collectors to supply-chain orchestrators. This requires embedding agentic AI into the core of the tech stack to handle micro-decisions—from metadata triggers to dynamic ad placement—automatically. The goal is to create a frictionless experience that feels “human” but is driven by census-level data intelligence.

The Bottom Line In 2026, personalization is the only defense against the fragmentation paradox. Platforms that fail to implement authorized, agentic AI will face a 20% margin leakage due to subscriber inertia, while leaders will weaponize these engines to dominate global Sovereign Content Hubs.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Map M&A history of personalization startups in MENA

Filter partners with Authorized AI lip-sync stacks

Monitor competitive slates and licensing for 2026

Find active LATAM AI hubs with 40%+ rebates

Identify MENA partners commissioning scripted local formats

Insider Intelligence: AI Personalization in Streaming Services 2026 FAQ

What is the primary difference between AI recommendations in 2024 and 2026?

The shift is from “Predictive” to “Agentic.” While 2024 systems suggested what to watch next, 2026 systems autonomously manage the entire viewer journey, including dynamic re-cutting of content, emotional synchronization, and localized packaging to prevent churn in real-time.

How do Sovereign Content Hubs impact global personalization strategies?

Sovereign Hubs (APAC, MENA, LATAM) now lead content growth. Personalization must be hyper-local; 30% of global recommendations in 2026 must stem from regional hit mappings to capture the exploding ARPU (Average Revenue Per User) in these growth corridors.

Why is “Authorized AI” critical for streaming service EBITDA?

Unauthorized AI carries legal and chain-of-title risks. Authorized AI, through licensed deals (e.g., Disney/OpenAI), de-risks production and localization, ensuring content is legally compliant and visually seamless across day-and-date global releases, protecting long-term asset value.

Can VIQI assist in finding 2026 personalization technology partners?

VIQI weaponizes real-time census data to find partners. You can query: “Identify vendors in EMEA with verified Agentic AI workflows for streaming” or “Map localization partners with authorized AI voice stacks for 2026 slates” to get boardroom-ready results in seconds.