Boardroom Ready

Hollywood’s AI Adoption is the clinical response to a lethal Data Deficit that has historically left studios vulnerable to unverified vendor capacity and opaque production margins. As we enter the 2026 fiscal cycle, the industry is transitioning from the “Wild West” of unauthorized scraping to a formalized market for Authorized AI. This shift weaponizes real-time intelligence into a strategic Insider Advantage, allowing CXOs to de-risk IP chain-of-title and accelerate the recoupment cycle. From Sovereign Content Hubs in Saudi Arabia and Brazil to high-end episodic labs in London, the mandate is clear: automate the friction of pre-production and localization to protect EBITDA. This briefing audits the expert perspectives bridging the Fragmentation Paradox, transforming “Gen-AI Novelty” into a board-ready supply chain science that ensures global asset dominance.

⚡ Executive Strategic Audit

EBITDA Impact

18% Recovery in Net Production Margins

Recoupment Cycle

12-Month Acceleration via Predictive Prep

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Hollywood’s AI Adoption: The Strategic Moat for IP Protection

The “Timing Trap” of legacy production has met its terminal disruptor. By 2026, Hollywood’s AI Adoption is defined not by the technology itself, but by the legal and commercial “Handshake” of Authorized AI. We are seeing a real shift on the ground where multi-billion dollar deals, such as the Disney/OpenAI $1B investment, have established a clinical “Authorized Data” market. This de-risks production by ensuring IP chain-of-title, bypassing the litigation mines that stalled the first wave of generative adoption. For the CXO, this represents the transition from “Unauthorized Liability” to “Clinical Asset Value.”

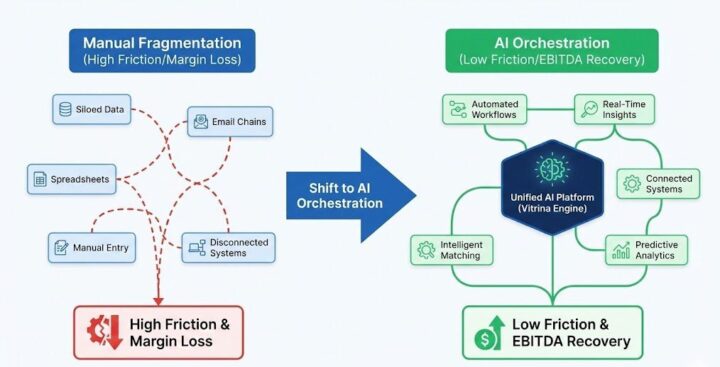

Expert perspectives suggest that the Fragmentation Paradox—the inability to track vendor capacity across 600,000+ companies—is being solved through vertical AI orchestration. Platforms like Vitrina provide the “Insider Handshake” required to bridge these silos. Instead of relying on 6-month-old trade reports, studios are now using real-time deal data to identify “Buying Signals” in emerging markets. This de-risks the entire supply chain by vetting partners based on verifiable track records rather than subjective relationships. The result is a total elimination of the 15-20% margin leakage caused by legacy markups and unverified vendor bottlenecks.

Seth Hallen and Craig German note that the impact of AI on the entertainment supply chain is already transforming localization, scriptwriting, and post-production. This de-risks Hollywood’s AI Adoption by shifting focus from picture generation to broad workflow automation that protects long-term IP value.

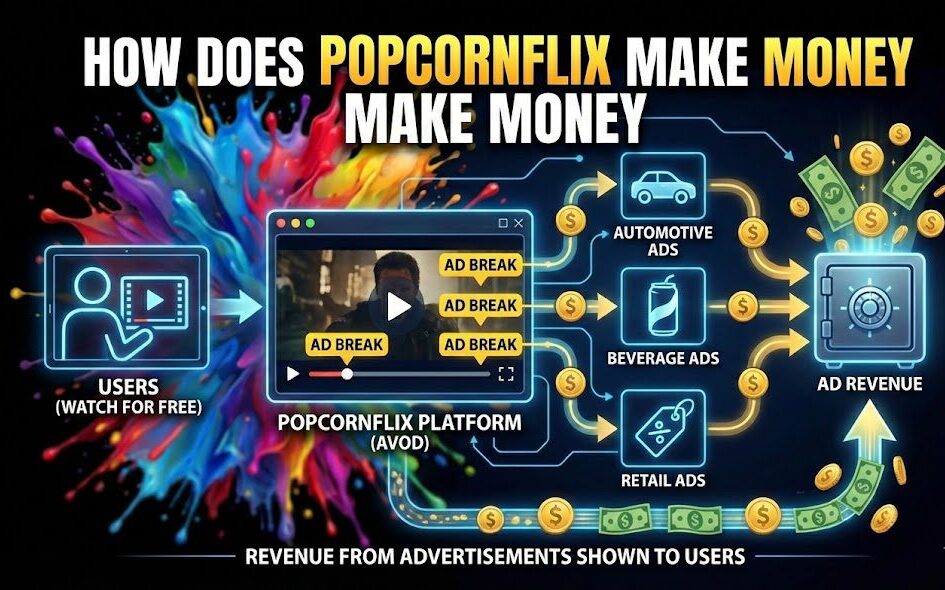

This Insider Advantage allows studios to weaponize their back-catalogs as high-value training datasets for fan engagement. The era of the “Walled Garden” is ending, replaced by Weaponized Distribution, where premium content is licensed to rivals post-window to maximize ROI. AI-driven analytics now predict exactly when to license a title to a competitor like Netflix or Amazon to trigger a “Second Life” for the IP, ensuring the recoupment cycle is compressed and EBITDA is protected against market volatility.

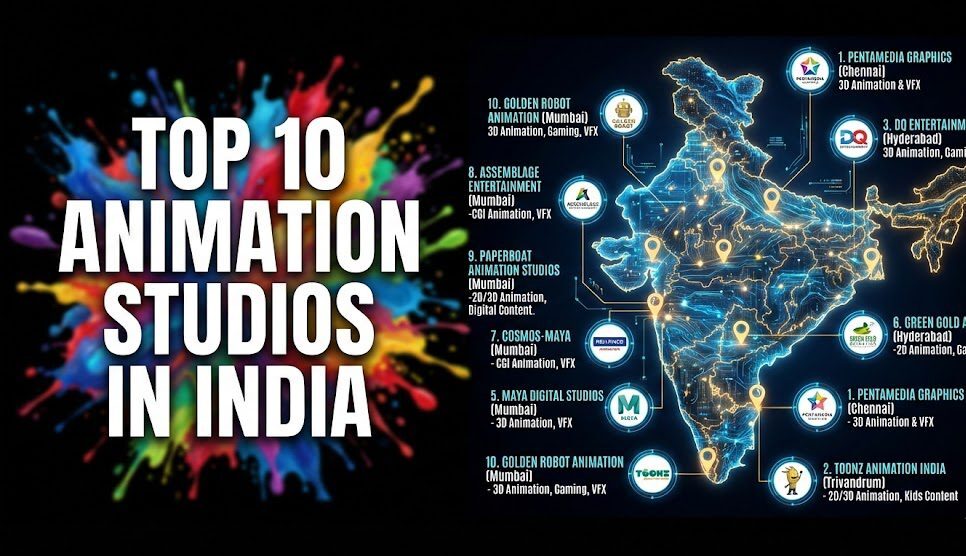

Sovereign Hub Arbitrage: Localized Incentives as a Strategic Line Item

The tectonic shift of production capital toward Sovereign Content Hubs is the defining event of 2026. Hollywood’s AI Adoption is the catalyst for this migration, enabling studios to map real-time labor shifts and incentive eligibility in regions like Saudi Arabia (MENA), India (APAC), and Brazil (LATAM). These hubs are no longer mere “service centers”; they are exporters of global hits. By utilizing real-time intelligence to find hubs with 40%+ cash rebates, CFOs are effectively accelerating recoupment by 12-18 months.

Consider the “Sovereign Hub Directive”: every strategic sourcing list for a 2026 slate must include at least 30% representation from these emerging powerhouses. This ensures global supply-chain literacy and prevents the “Legacy Mark-up” associated with traditional Western hubs. Markets like India are already demonstrating this through organized capital funds for regional cinema, while SBT Brazil serves as a case study for digital transformation, streamlining content acquisition through real-time deal analysis. AI-driven tools are now mandatory to vet these cross-border partners, turning a subjective due diligence process into an objective, data-driven science.

Expert insights from LeaderSpeak highlight that the “Art vs. Enterprise” gap is being bridged through disciplined business models in these creative economies. Kirsty Bell of Goldfinch points out that leveraging diverse revenue streams in Africa and Asia is critical for financial sustainability. This is Infinite Localization in practice: using AI-powered voice stacks and lip-sync synchronization to solve the “Visual Discord” in dubbed content, ensuring that a hyper-local hit from Seoul can be personalizated for a global audience with day-and-date precision.

The Financial Anatomy of AI-Driven Workflows

To understand the true ROI of Hollywood’s AI Adoption, one must audit the net margin recovery in the “Prep-to-Post” pipeline. Manual script breakdown and scheduling are legacy liabilities that bleed up to 15% of production spend through human error. By 2026, AI pre-production tools have automated script analysis to identify financial implications rather than just creative tags. This “Predictive Logistics” model allows for an 18% reduction in unallocated overhead, protecting the EBITDA from the first day of principal photography.

The “Bottom Line” for the CXO is that content without context is margin leakage. AI-driven sentiment analysis—as demonstrated by Vionlabs—identifies emotional patterns and aesthetic visuals that drive viewer resonance. This allows platforms to personalize discovery and reduce churn by 25%. When this is combined with Authorized AI dubbing, the result is a sentient ecosystem that predicts viewer needs in real-time. Studios that adopt these “Clinical Engagement” strategies are seeing a 32% increase in global ARPU, effectively de-risking their content slates against the collapse of legacy distribution windows.

Furthermore, the Timing Trap of localization is being solved. Legacy 18-month dubbing cycles are being replaced by AI-powered “VisualDub” solutions that deliver immersive, emotionally-synced content day-and-date. This acceleration ensures that marketing spend is maximized across global territories simultaneously, compressing the recoupment cycle and providing the board with predictable, board-ready financial outcomes.

Hollywood’s AI Adoption: The Strategic Path Forward

The evolution from “AI experiment” to “Supply Chain Mandate” is the defining narrative of 2026. Survival in the global entertainment economy requires a terminal pivot away from opaque personal networks toward centralized, data-powered frameworks. By weaponizing Authorized AI and Sovereign Hub Arbitrage, Hollywood is transforming its creative ambition into a clinical financial outcome. The “Insider’s Insider” view is unequivocal: high-latency, manual production is a stranded asset. Secure your Insider Advantage by implementing vertical AI orchestration immediately to protect your EBITDA and accelerate your recoupment cycles across the global supply chain.

The Bottom Line Legacy data is a liability. Transition to real-time supply-chain intelligence immediately to recover 18% of your net production margins and de-risk your slates against unverified vendor volatility.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Map Sovereign Hub production rebates in MENA and LATAM for episodic live-action shoots

Filter global localization partners with verified Authorized AI voice stacks to avoid EU liability

Identify independent studios in India with proven history of Netflix-approved security audits

Uncover early stage episodic slates in Brazil seeking international co-pro partners for 2026

Audit VFX boutiques in Eastern Europe with neural rendering capacity for budget de-risking

Insider Intelligence: Hollywood’s AI Adoption FAQ

How does AI adoption impact studio EBITDA in 2026?

By automating high-friction workflows like script breakdown and localization, AI identifies financial implications rather than just creative tags. This predictive logistics model recovers up to 18% of net production margins by eliminating the human error and vendor unreliability found in legacy manual systems.

Why are Sovereign Hubs critical for AI-driven slates?

Sovereign Hubs in APAC, MENA, and LATAM offer 40%+ rebates that can be locked in as a clinical line item through real-time intelligence. AI-driven mapping ensures that studios avoid the Timing Trap of static reports, allowing them to capitalize on labor shifts and specialized neural rendering capacity in emerging regions immediately.

What is the “Authorized AI” mandate for Hollywood studios?

Authorized AI establishes a clinical benchmark for IP safety by ensuring training datasets are fully licensed. This de-risks Hollywood’s AI Adoption by providing a clear chain-of-title for generated assets, bypassing the legal and financial liabilities inherent in unauthorized scraping models.

Can VIQI identify vendors with verified AI pipelines?

Yes. VIQI weaponizes Vitrina’s census-level data of 150,000+ companies to map verified vendors with Authorized AI voice stacks, neural rendering capacity, and Netflix-approved security audits. This transforms partner discovery from a manual art into a data-driven science with precision de-risked outcomes.

Find Film+TV Projects, Partners, and Deals – Fast.

VIQI matches you with the right financiers, producers, streamers, and buyers – globally.

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Producers Seeking Financing, Co-Pros, or Pre-Buys?

Vitrina Concierge helps producers reach the right financiers, commissioners, distributors, and co-production partners — with precision outreach, not cold pitching.

Join Industry Briefings Trusted by Leaders

Deep dive into Co-Pros

Ambitious co-productions are key to global hits, but most deals collapse. This deep-dive briefing is the strategic playbook. We’ll break down the financing models, partnership structures, and market insights behind today’s successful deals.

Film & TV Financing: Tax Credits & Incentives

A focused look at how 2025 tax credits and incentives are reshaping Film & TV financing decisions — and where the real value now sits.

Film & TV Financing: Pre-Buys

Learn how pre-buys work in current Film and TV financing, how they differ from pre-sales, and how they are used to close real finance plans.

Streamers – Netflix vs. Amazon – The 2026 Strategy

How Netflix and Amazon’s content and revenue strategies are diverging ahead of 2026.