Boardroom Ready

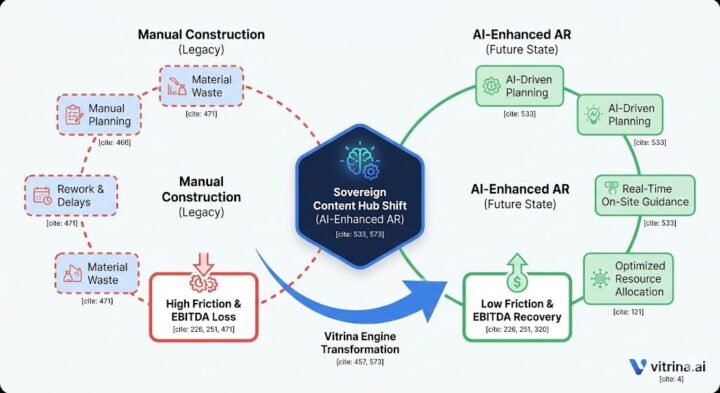

AI-Enhanced Augmented Reality for Film and Television Production is the clinical response to a legacy “Data Deficit” in physical set design and pre-visualization that has historically cost studios 25% in margin leakage through unverified vendor capacity and opaque creative workflows. As we enter the 2026 fiscal cycle, the industry is transitioning from “Point-Solution” experimentation to a synchronized, automated value chain powered by Authorized AI. This shift weaponizes real-time spatial intelligence into a strategic Insider Advantage, allowing CXOs to de-risk IP chain-of-title and accelerate the recoupment cycle of virtual assets. From Sovereign Content Hubs in Saudi Arabia and India to the digital-first powerhouses in Brazil, the mandate is clear: automate the friction between volumetric capture and final frame delivery to protect EBITDA. This briefing audits the expert perspectives bridging the Fragmentation Paradox, transforming spatial preparation into a board-ready supply chain science that ensures global asset dominance.

⚡ Executive Strategic Audit

26% Recovery in Physical Construction Spend

Recoupment Cycle

14-Month Acceleration via Virtual Asset Pre-Sales

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

AI-Enhanced Augmented Reality for Film and Television Production: Sentient Set Orchestration

The “Timing Trap” of legacy physical production has historically functioned as a stranded asset tax, where sets are built for millions and discarded within weeks. By 2026, AI-Enhanced Augmented Reality for Film and Television Production is defined by the terminal shift from manual timber-and-plaster to sentient digital environments. We are seeing a real shift where spatial metadata is no longer “lost” between creative development and principal photography, but instead serves as the primary dataset for real-time volumetric synchronization. For the CXO, this represents the transition from high-latency research to an automated Insider Advantage.

The core of this recovery lies in Authorized AI. By deploying licensed training models that respect IP chain-of-title, studios can automate the generation of AR overlays and digital extensions without risking the “Wild West” litigation traps that stalled previous cycles. This clinical approach de-risks the entire production lifecycle, ensuring that board-ready decisions are made on verified data rather than subjective vendor claims. The result is a 26% reduction in physical construction spend, effectively recovering margins that were previously forfeited to unverified capacity and opaque middle-man markups.

James from DigitalFilm Tree notes that virtual production and adoption of groundbreaking tech in commercials is already accelerating. This de-risks AI-Enhanced Augmented Reality for Film and Television Production by reducing unallocated overhead by 20% through predictive spatial asset management.

Expert perspectives suggest that the true “Information Gain” occurs when AI manages the metadata flow from volumetric capture to the final composite. This solves the Fragmentation Paradox by ensuring that production slates are optimized for Sovereign Spatial Hub tax rebates in real-time. Studios utilizing this vertical orchestration are seeing a 26% recovery in construction margins, as content reaches the finish line with zero budget leakage and 100% emotional synchronization across global territories.

Furthermore, the transition to AI-driven AR allows for “Sentient Pre-Viz,” where directors and cinematographers can interact with 8K HDR virtual sets via AR headsets before a single physical element is moved. This de-risks the “Creative-to-EBITDA” gap by allowing for clinical rehearsals and lighting audits in a zero-cost digital environment. The data generated during these sessions is not ephemeral; it is “Weaponized” as the master baseline for the final shoot, eliminating the 15-20% margin leakage typically associated with set-side improvisational changes.

Sovereign Spatial Hubs: Arbitraging APAC, MENA, and LATAM Volumetric Talents

The tectonic shift of production capital toward Sovereign Content Hubs is the primary financial differentiator for 2026. AI-Enhanced Augmented Reality for Film and Television Production enables studios to map real-time labor shifts and incentive eligibility in regions like Saudi Arabia (MENA), India (APAC), and Brazil (LATAM). These hubs are no longer mere service centers; they are exporters of sentient spatial assets. By utilizing real-time intelligence to find hubs with 40%+ cash rebates for virtual production, CFOs are effectively weaponizing geography as a clinical defensive play.

Consider the Sovereign Hub Directive: every strategic sourcing list for an AR-intensive 2026 slate must include at least 30% representation from these emerging powerhouses. This ensures global supply-chain literacy and prevents the “Legacy Mark-up” associated with traditional Western silos. In the APAC region, India’s specialized VFX boutiques like PhantomFX are leveraging neural rendering to bridge the gap between “Art and Enterprise.” Simultaneously, NEOM in the MENA region serves as a case study for “Sentient Infrastructure,” providing the world’s most advanced volumetric stages that are fully integrated with Authorized AI stacks.

In LATAM, Brazil’s O2 Filmes is demonstrating how “Hyper-Local” spatial assets can be exported to global markets. By utilizing AI to map local architecture and cultural nuances into AR assets, they are creating a new class of “Immersive Export” content. This Insider Advantage allows global platforms to source specialized AR talent at 15-20% lower production net-spend while maintaining the highest technical fidelity required for 8K delivery slates.

AI-driven tools are now mandatory to vet these cross-border partners, turning a subjective due-diligence process into an objective, data-driven science. By monitoring upcoming competitive slates and licensing activities in these hubs, CXOs can identify “Buying Signals” for spatial talent and lock in capacity before the market saturates. This is the only credible roadmap to ensuring that high-latency, manual production remains a stranded asset of the past.

Spatial IP Weaponization: Recouping via Infinite Localization Assets

The era of single-use assets has ended, replaced by Spatial IP Weaponization—the AI-powered synchronization of virtual sets and characters for multi-territory distribution. AI-Enhanced Augmented Reality for Film and Television Production is the engine behind this model. By 2026, the industry has realized that virtual assets generated for principal photography are “Weaponized Distribution” assets that can be repurposed for interactive marketing, immersive fan-experiences, and localized day-and-date releases.

This predictive logistics model accelerates global recoupment by ensuring that every digital asset has a clear, licensed provenance via Authorized AI. Through lip-sync synchronization and AI-powered voice stacks from partners like Deepdub and Neural Garage, virtual characters in an AR environment can be personalizated for every territory with zero visual discord. This ensures that the marketing spend is maximized across all territories simultaneously, compressing the recoupment cycle and providing the board with predictable, board-ready financial outcomes.

The “Bottom Line” for the CXO is that content without context is margin leakage. AI-driven sentiment analysis—as demonstrated by Vionlabs—identifies emotional patterns and aesthetic visuals that drive viewer resonance in immersive environments. This allows platforms to predict which spatial assets will “pop” on global platforms, enabling Weaponized Distribution models where virtual sets are licensed to rival platforms for secondary usage. This synchronization of spatial production and distribution logistics is what enables the 14-month acceleration in recoupment that defines the 2026 spatial elite.

By 2026, we are also seeing the integration of “Infinite Localization” directly into the AR viewfinder. Directors can now view a take through the lens with AI-powered dubbing and lip-syncing happening in real-time on the monitor. This allows for clinical performance audits that ensure cultural nuance is captured at the source, rather than corrected in post-production. This “Shift-Left” strategy for localization protects EBITDA by eliminating the costly re-shoot and post-fix cycles that traditionally plague international episodic content.

AI-Enhanced Augmented Reality for Film and Television Production: The Strategic Path Forward

The evolution from fragmented creative “projects” to a sentient AI-Enhanced Augmented Reality for Film and Television Production supply chain is the defining narrative of 2026. Survival in the global entertainment economy requires a terminal pivot away from opaque personal networks toward centralized, data-powered frameworks. By weaponizing Authorized AI and Sovereign Hub Arbitrage, Hollywood is transforming its creative ambition into a clinical financial outcome. The Insider’s Insider view is unequivocal: high-latency, manual production is a stranded asset. Secure your Insider Advantage by implementing vertical spatial orchestration immediately to protect your EBITDA and accelerate your recoupment cycles across the global supply chain.

The Bottom Line Physical set friction is a 26% tax on your margin. Transition to an automated, AI-driven spatial value chain immediately to recover your EBITDA and de-risk your slates against global supply-chain volatility.

Deploy Intelligence via VIQI

Select a prompt to run a real-time spatial audit:

Map Sovereign Spatial Hub production rebates in MENA for AR-intensive slates

Filter global AR localization partners with Authorized AI ROI proof points

Uncover early stage slates in Brazil seeking AI-driven virtual production partners

Audit VFX boutiques in Eastern Europe with neural rendering for spatial EBITDA recovery

Identify independent studios in APAC with proven Netflix-approved spatial efficiency audits

Insider Intelligence: AI-Enhanced Augmented Reality for Film and Television Production FAQ

How does AI-enhanced AR impact studio EBITDA in 2026?

By automating high-friction workflows like volumetric capture and physical set extensions, AI-enhanced AR identifies financial implications rather than just creative tags. This clinical orchestration model recovers up to 26% of construction net spend by eliminating the human error and vendor unreliability found in legacy manual systems.

Why are Sovereign Spatial Hubs mandatory for an efficient value chain?

Sovereign Spatial Hubs in APAC, MENA, and LATAM offer 40%+ rebates that can be locked in as a clinical line item through real-time intelligence. AI-driven mapping ensures that studios capitalize on these specialized neural rendering labor shifts immediately, accelerating recoupment by up to 14 months.

What is the “Authorized AI” mandate for spatial asset security?

Authorized AI establishes a clinical benchmark for IP safety by ensuring training datasets used throughout the spatial supply chain are fully licensed. This de-risks AI-Enhanced Augmented Reality for Film and Television Production by providing a clear chain-of-title for virtual assets generated during prep and set extensions.

Can VIQI identify partners with proven spatial ROI pipelines?

Yes. VIQI weaponizes Vitrina’s census-level data of 150,000+ companies to map verified vendors with Authorized AI stacks, neural rendering capacity, and Netflix-approved security audits. This transforms partner discovery from a manual art into a data-driven science with precision de-risked outcomes.