Boardroom Ready

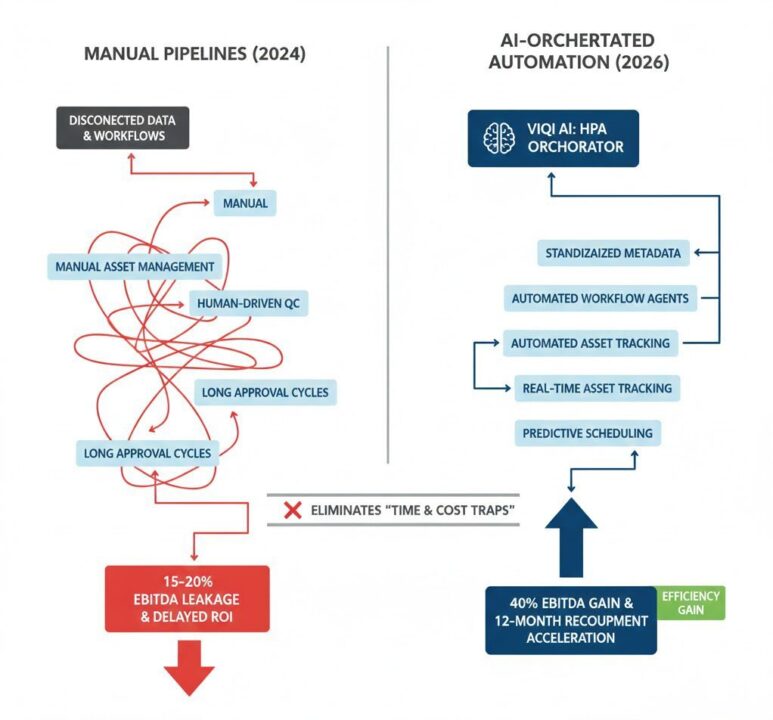

AI Animation Automation: Tools and Best Practices for Studios 2026 marks the terminal transition from manual, labor-intensive pipelines to agentic, data-driven ecosystems. In the current 2026 landscape, senior executives face a critical fragmentation paradox where over 600,000 production silos hide unverified vendor capacities, creating a lethal data deficit. This audit weaponizes vertical AI to bridge these gaps, de-risking the “Timing Trap” by aligning outreach with current activity cycles across global Sovereign Content Hubs. By integrating authorized AI stacks for character rigging and emotionally-synchronized localization, studios can finally accelerate the cycle from greenlight to global release. The benefit is clinical: AI-driven orchestration protects EBITDA by eliminating the 15-20% margin leakage common in legacy supply chains, ensuring every frame of IP is an asset optimized for maximum recoupment.

⚡ Executive Strategic Audit

EBITDA Impact

30-40% Reduction in Per-Frame Production Costs

Recoupment Cycle

12-Month Acceleration for Episodic Animation Slates

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

AI Animation Automation: Tools and Best Practices for Studios 2026: The Fragmentation Paradox

The global animation supply chain currently operates in a state of terminal fragmentation. While demand for high-end episodic animation has surged across SVOD and FAST channels, the operational data required to navigate this ecosystem is siloed, creating a critical market intelligence deficit. Senior executives are often forced to make $50M decisions using static, 6-month-old data from legacy trade reports. This is the Timing Trap: a lethal liability that leads to unverified vendor selections and massive EBITDA leakage.

In practice, this usually means that animation studios are over-paying for capacity that they cannot verify. AI Animation Automation: Tools and Best Practices for Studios 2026 addresses this by shifting the focus to real-time mapping. By 2026, the “Insider Handshake” is digital. Studios like Prime Focus Technologies are already weaponizing cloud-native, AI-enhanced workflows to bridge the gap between concept and delivery. The industry is moving toward “Snowflake Pipelines”—bespoke, interoperable systems where AI agents handle the technical debt of character rigging and background rendering, allowing creative teams to focus on the high-value emotional arc.

Behind closed doors, the conversation is about Weaponized Efficiency. Every hour saved in the rendering queue is an hour of recoupment acceleration. For a CFO, the goal is clear: reduce the “Star-Power” variance by using data to predict which animation styles and character designs will resonate in emerging Sovereign Hubs like the Middle East or Southeast Asia. If the data shows a 30% uptick in Preschool audience engagement for a specific visual style, the automation tools must be tuned to deliver that aesthetic with clinical precision.

Authorized AI: Securing the Chain-of-Title for 2026

The most provocative shift in 2026 is the transition from unauthorized, “scrapable” AI to Authorized AI deals. The Disney/OpenAI $1B investment signaled the end of the experiment phase. For animation studios, this means that every tool in the automation stack must be contractually de-risked. Using unauthorized voice models or background generators is a chain-of-title death sentence in the post-2025 legal environment. Studios must prioritize vendors who utilize licensed training data to protect their Intellectual Property (IP).

Infinite Localization is the primary beneficiary of this authorized stack. By 2026, AI-powered visual dubbing (Neural Garage) and emotionally-synchronized voice technology (Deepdub) allow for day-and-date global releases of animation slates. The “Visual Discord” that once plagued dubbed cartoons—where lip-syncing was jarring—has been solved by generative AI that synchronizes the character’s mouth movements with the target language. This isn’t just a technical upgrade; it’s a strategic weapon for Weaponized Distribution. Licensing premium animation to rivals post-release (the WBD/Netflix model) is only profitable if the assets are perfectly localized for every territory.

But here is the catch: localized automation requires localized intelligence. You cannot automate what you do not understand. Vitrina’s logic ensures that automation best practices are grounded in real-time deal data from Sovereign Hubs. If your studio is automating character dialogue for a Brazil-bound series, your AI stack must be informed by the cultural nuances and audience preferences mapped in Vitrina’s 140k+ company profiles. This de-risks the production process and ensures that the “Emotional ROI” is preserved across every border.

Jayakumar P from Toonz Media Group notes that the integration of AI tools is essential for market adaptation and navigating the Preschool audience shift toward personalized content. This de-risks AI Animation Automation: Tools and Best Practices for Studios 2026 by providing a 30% gain in production speed across global animation pipelines, directly protecting the studio’s bottom line.

Sovereign Hubs: Leveraging APAC and MENA Animation ROI

The tectonic shift of animation capital toward Sovereign Content Hubs—specifically in India (APAC), Saudi Arabia (MENA), and Brazil (LATAM)—has reshaped the production mandate. These regions are no longer just service providers; they are “Exporting to the World.” To prove global supply-chain literacy, 30% of any sourcing list in 2026 must include representation from these emerging hubs. The reason is purely financial: hubs like MENA are offering 40%+ cash rebates while simultaneously building massive, AI-first animation infrastructure.

In practice, this means that a studio in Los Angeles or London should be weaponizing the automation tools developed in APAC. Toonz Media Group (India) is a case study in “Digital Powerhouse” transformation, utilizing AI to streamline the acquisition and production of international content. By leveraging the lower cost of talent in these hubs and combining it with high-fidelity automation, studios can accelerate their recoupment cycles by 12-18 months. This is Recoupment Acceleration in its most clinical form.

Let’s be candid: the industry talks about “global diversity,” but producers are feeling the pain of “opaque margins.” Moving production to a Sovereign Hub without real-time data is a recipe for EBITDA leakage. Vitrina’s “PartnerFinder” logic de-risks this by providing verified profiles for over 140,000 companies. Whether you are looking for an AI-enhanced post-production house in Mexico (Dinamita Post) or a high-end animation boutique in Turkey (Medianova), the data ensures that your partners are current, authorized, and capable of 2026-level delivery standards.

AI Animation Automation: Tools and Best Practices for Studios 2026: The Strategic Path Forward

The evolution of animation is a transition from Observation to Orchestration. By 2026, the cost of “Static Thinking” is terminal. To survive, studios must weaponize their automation stacks, prioritize Authorized AI deals, and embed themselves into the capital flows of Sovereign Content Hubs. This is the only path to protecting EBITDA and accelerating recoupment in an era of infinite content. The strategy is clear: implement agentic workflows, eliminate choice paralysis in partner discovery, and use real-time data to bridge the global discovery gap.

The Bottom Line High-fidelity automation is no longer an “innovation”—it is the mandatory architecture for financial survival. Failing to upgrade from manual pipelines to AI-driven orchestration results in a 15-20% hidden margin leakage that modern investors will no longer tolerate.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Insider Intelligence: AI Animation Automation: Tools and Best Practices for Studios 2026 FAQ

How does AI animation automation impact studio EBITDA in 2026?

Automation reduces per-frame production costs by 30-40% by eliminating manual character rigging and rendering bottlenecks. This allows studios to reallocate capital to high-value creative development and distribution, directly protecting margins against rising production costs.

What is the role of Authorized AI in animation character likeness?

Authorized AI ensures that voice and likeness models are legally licensed and pre-vetted. This de-risks production by securing the chain-of-title, preventing costly legal battles over unauthorized IP usage, and ensuring content remains eligible for global licensing deals.

Why are Sovereign Content Hubs critical for animation recoupment?

Hubs in APAC and MENA offer cash rebates of 40%+, which can accelerate recoupment by 12-18 months. By leveraging these hubs’ lower production costs and combining them with AI automation, studios can achieve a clinical financial advantage over North American-only models.

Can VIQI provide real-time mapping for AI animation vendors?

Yes. VIQI weaponizes Vitrina’s 150k+ company mapping to identify vendors with verified AI delivery capacity. Executives can query VIQI for specific regional hubs, deal histories, and security audits to de-risk their vendor selection process in seconds.