The aggregator model for film distribution is a service-based pathway that allows independent creators to place content directly onto global digital platforms like Apple TV, Amazon Prime, and Google Play without a sales agent.

This process involves paying an upfront fee or a small percentage of revenue to a licensed aggregator who handles technical encoding, delivery, and reporting to major VOD storefronts.

According to industry reports from Ampere Analysis, the direct-to-digital market has grown by 40% as traditional theatrical windows collapse and platforms prioritize diverse, regional content.

In this guide, you will learn how to evaluate aggregators, navigate the technical submission process, and retain 100% of your rights while maximizing global visibility.

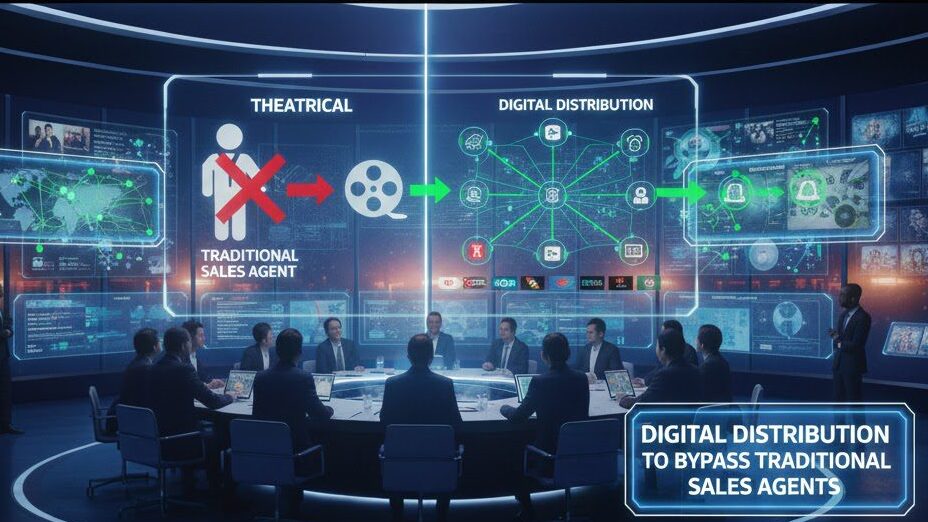

While traditional sales agents have historically acted as the “gatekeepers” to the industry, the digital revolution has rendered many of their legacy methods inefficient for mid-tier projects. Most resources today focus on high-budget theatrical models, leaving independent producers with limited knowledge on how to navigate the complex world of digital delivery and metadata requirements.

This comprehensive guide addresses these critical gaps by providing a step-by-step framework for bypassing traditional sales agents through strategic aggregator partnerships.

Table of Contents

- 01

What is the Aggregator Model for Independent Film Distribution? - 02

How Does the Aggregator Submission Process Work? - 03

Aggregators vs. Sales Agents: Strategic Considerations - 04

Costs and Revenue Retention in Digital Models - 05

Identifying Global Aggregators with Vitrina AI - 06

Key Takeaways - 07

FAQ - 08

Moving Forward

Key Takeaways for Independent Producers

-

Rights Retention: Aggregators typically act as service providers, allowing you to retain 100% of your IP and domestic/territorial rights.

-

Direct Pipeline: By bypassing sales agents, you gain direct access to global storefronts like Apple TV and Amazon with faster release timelines.

-

Cost Transparency: The model replaces opaque “marketing expenses” with clear upfront service fees, ensuring better financial control for indie projects.

-

Data Intelligence: Platforms like Vitrina AI allow producers to identify verified aggregators based on real-time deal history and platform specialization.

What is the Aggregator Model for Independent Film Distribution?

The aggregator model refers to a distribution strategy where filmmakers hire a third-party company to act as a technical and logistical bridge to digital platforms. Unlike traditional sales agents who negotiate licenses in exchange for a percentage (often 15-30%) and territorial control, aggregators function as service providers. They possess the direct encoding pipelines required by major tech giants like Apple, Google, and Amazon.

This model is particularly valuable for independent films that may not fit the “theatrical-first” mandate of traditional agencies. It democratizes access, allowing a filmmaker in South Korea or Brazil to place their content on North American digital storefronts without needing a Hollywood-based representative. The primary focus is on volume and accessibility rather than exclusive, high-stakes negotiation.

Find active digital aggregators for your genre:

How Does the Aggregator Submission Process Work?

The journey from a finished master file to a global streaming platform follows a rigorous technical workflow. First, the filmmaker selects an aggregator and provides a high-quality master (usually ProRes 422 HQ). The aggregator then performs a “Quality Control” (QC) check to ensure the file meets the strict frame rate, audio leveling, and subtitle standards of platforms like Netflix or Amazon.

Once the technical specs are cleared, the filmmaker submits “metadata”—the posters, trailers, synopsis, and cast lists that drive platform search algorithms. The aggregator packages this data and “delivers” it to the selected storefronts. Within 30 to 90 days, the title goes live globally, and the filmmaker begins receiving monthly or quarterly royalty reports directly from the aggregator’s dashboard.

Industry Expert Perspective: The Big Crunch: Phil Hunt on Why Film Finance is Harder Than Ever

Phil Hunt, CEO of Head Gear Films, discusses how the digital revolution has collapsed traditional revenue windows. This shift makes the aggregator model essential for creators who need to reach audiences directly when traditional financing and sales structures fail to provide a clear path to market.

Phil Hunt highlights the industry’s shift away from pre-sales and the collapse of revenue windows due to the digital revolution. He notes that the current market demands low-cost, high-concept content, where digital distribution becomes the primary vehicle for monetization.

Aggregators vs. Sales Agents: Strategic Considerations

Choosing between a sales agent and an aggregator is a decision about control versus connections. A sales agent is an active partner who travels to markets like Cannes or TIFF to secure “minimum guarantees” (advances) for your film. In exchange, they take a significant commission and often bundle your movie with other titles. For a blockbuster, this is often the best route to ensure high-value theatrical releases.

Conversely, an aggregator is a passive service. They won’t “sell” your film; they “place” it. This requires the filmmaker to handle their own marketing and PR. However, for indie projects with a niche audience or a strong social media following, bypassing the agent means keeping 100% of the revenue after the storefront’s cut. In a market where digital represents the lion’s share of long-tail revenue, this retention is often the difference between profit and loss.

Compare distribution partners for your project:

Identifying Global Aggregators with Vitrina AI

The greatest challenge in the aggregator model is vetting partners. Without the “brand name” of a major sales agency, independent producers often struggle to distinguish between high-volume, authorized aggregators and low-tier distributors. This is where Vitrina AI transforms the search process.

By leveraging the Global Film+TV Projects Tracker, which monitors over 1.6 million titles, producers can see exactly which aggregators delivered similar films to specific platforms. Vitrina tracks 140,000+ companies, mapping their verified deal history and specialization. For a producer, this means you can identify an aggregator that has a proven track record of placing “Action Thrillers” on “Amazon Prime UK” in under five minutes using the VIQI AI Assistant.

Moving Forward

The independent distribution landscape has shifted from relationship-dependent gatekeeping to data-driven technical placement. By adopting the aggregator model, filmmakers are reclaiming financial control and intellectual property ownership in an era where digital shelf space is the most valuable asset.

Whether you are an independent producer looking to secure global VOD placement, or a sales agent trying to optimize a catalog for digital platforms, the principle remains: actionable intelligence drives deal velocity.

Outlook: Over the next 18 months, we expect to see a surge in “hybrid” models where producers use agents for theatrical territory deals while reserving digital rights for direct aggregator placement to maximize global ARPU.

Frequently Asked Questions

What is the average cost of using a digital aggregator?

Do I lose my film rights when using an aggregator?

Which platforms can I reach through an aggregator?

How long does the digital submission process take?

Why should I use Vitrina AI to find an aggregator?

“The aggregator model is not just a secondary option anymore; it is the primary strategy for the modern independent filmmaker who understands that data transparency and rights retention are the pillars of long-term sustainability.”

About the Author

Vitrina Editorial Team specializes in mapping the global entertainment supply chain. With decades of experience across major studios and AI research labs, we provide data-driven insights for the modern media executive. Connect with us on Vitrina.