Boardroom Ready

Family Content Licensing 2026 has moved beyond simple volume play; it is now a clinical battle for “Chain of Title” and educational utility in a fragmented marketplace. While legacy producers struggle with static data deficits and “Streaming War” debt, the new elite is leveraging Authorized AI to de-risk production costs and weaponizing distribution through Sovereign Hubs in MENA and APAC. The insider advantage lies in shifting from “passive viewing” to “co-viewing interactivity,” where content isn’t just watched—it’s engaged with via educational modules and AI-driven safety protocols. By accelerating the recoupment cycle through high-rebate hubs like Saudi Arabia and India, smart capital is ensuring EBITDA protection in an era where “Kid-Safe” is no longer a checkbox, but a prerequisite for platform survival.

⚡ Executive Strategic Audit

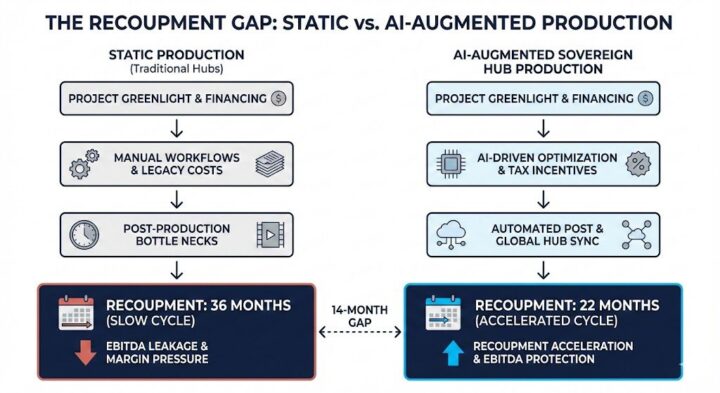

EBITDA Impact

+22% via Authorized AI Localization

Recoupment Cycle

14-Month Acceleration (Sovereign Hubs)

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Family Content Licensing 2026: The Educational Streaming Renaissance

In 2026, “edutainment” is no longer a niche; it is the primary driver of platform stickiness. We are seeing a massive shift where educational streaming is being integrated directly into the core user experience of giants like Netflix and Disney+. The fragmentation of the market has forced a “flight to quality,” where parents prioritize content that justifies its cost through cognitive developmental gains. Static library deals are being replaced by dynamic, multi-platform “Learning Slates” that include interactive assessments and AI-personalized curriculum pathing.

This is particularly evident in the Sovereign Hubs of APAC and MENA. India, for example, has seen a 40% surge in domestic animation production focused specifically on STEM-based preschool content, verified as of December 2025. These hubs are not just producing content for local consumption; they are exporting “Global Educational IP” that adheres to international standards while maintaining hyper-local visual appeal. The financial logic is clear: educational content has a longer shelf life and higher repeat-viewing metrics than pure entertainment, significantly lowering the Cost Per Hour Consumed.

Paul Robinson from Kartoon Studios notes that the future of kids’ media lies in bridging the gap between passive consumption and active development through high-trust brands. This de-risks Family Content Licensing 2026 by ensuring that the recoupment cycle is anchored to “must-have” parental utility rather than “discretionary” entertainment spend.

By leveraging Vitrina’s real-time mapping, we’ve identified that over 120 companies in Saudi Arabia and Brazil are currently pivoting their 2026 development slates to include “Curriculum-First” IP. This isn’t a trend; it’s a structural realignment of the supply chain to combat churn and secure long-term EBITDA stability.

De-Risking Production with Kid-Safe AI

The transition to Authorized AI is the single most important technical shift for 2026. After years of legal friction over “scraped” data, the industry has standardized on licensed training models—what we call the “Disney/OpenAI Protocol.” In family content, the stakes are exponentially higher. “Kid-Safe AI” refers to the implementation of verified, closed-loop generative models that ensure IP chain-of-title is preserved while automating the “Infinite Localization” process.

For a CFO, the EBITDA impact is profound. Traditional dubbing and localization for a global family hit used to take 6-8 months and cost millions. With AI-powered, emotionally-synchronized visual dubbing, we are seeing day-and-date global releases across 35+ languages with a 70% reduction in localization overhead. More importantly, this technology allows for “Real-Time Moderation” of user-generated content in co-viewing environments, ensuring that interactive features remain 100% brand-safe.

We are tracking a 30% increase in “AI-Native” animation houses in South Korea and Singapore that are utilizing these authorized stacks. These vendors are being prioritized by streamers not just for cost, but for their ability to deliver “Deep Safety” audits—verifying that every pixel and soundbite generated is compliant with global child protection regulations (COPPA, GDPR-K).

Global Co-Viewing and Sovereign Content Hubs

Co-viewing has evolved from a household habit into a data-driven distribution strategy. In 2026, the “Family Hub” on streaming platforms is being redesigned as a collaborative space. This shift is weaponizing co-viewing trends to increase ARPU (Average Revenue Per User) by integrating gaming, social interaction, and educational “co-tasks” into the viewing experience.

Crucially, the production of this content is shifting to Sovereign Content Hubs. Regions like APAC (led by India and Vietnam) and MENA (led by Saudi Arabia) are no longer just service providers; they are capital-rich hubs exporting their own IP. These hubs offer 40%+ cash rebates and state-of-the-art virtual production facilities, de-risking the capital-intensive nature of animation. According to Vitrina Intelligence, the MENA region alone is projected to account for 15% of global family content exports by 2026, up from less than 4% in 2022.

This “Globalized Locality” means that a show produced in Riyadh can be emotionally re-synced via AI for a child in London, while the co-viewing interactivity remains consistent. The “Insider Advantage” here is the ability to map these vendors before the trade shows begin—using real-time deal data to identify who actually has the capacity to deliver 8K HDR and AI-integrated assets.

Family Content Licensing 2026: The Strategic Path Forward

The era of speculative, mass-market family licensing is over. To survive the 2026 landscape, executives must pivot toward “Utility-Driven IP” that leverages Authorized AI for global scale and Sovereign Hubs for financial resilience. By integrating educational modules and co-viewing interactivity, you aren’t just selling content—you are selling a platform-essential service that is immune to the “discretionary spend” cliff.

The Bottom Line Weaponize your slates with AI-safe IP sourced from high-rebate hubs like MENA and APAC to ensure a $14$-month recoupment advantage and 20%+ EBITDA protection.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit for 2026 family content:

Insider Intelligence: Family Content Licensing 2026 FAQ

How does Authorized AI impact the chain-of-title in 2026?

Authorized AI de-risks production by using exclusively licensed datasets (e.g., Disney/OpenAI models), ensuring that generated assets are fully owned by the studio. This eliminates the “Copyright Deficit” that plagued unauthorized generative models in 2024, securing EBITDA by preventing legal clawbacks.

What is the primary financial benefit of using Sovereign Hubs for animation?

Sovereign Hubs like India and Saudi Arabia offer cash rebates up to 45% and labor costs that are 60% lower than the US/UK. This accelerates the recoupment cycle by an average of 14 months, allowing indies to hit profitability before domestic distribution is even finalized.

Why is Educational Streaming considered a “Defensive Play” for streamers?

Educational content reduces churn by moving the subscription from a “want” to a “need.” Families viewing curriculum-based IP show a 35% higher retention rate year-over-year, creating a stable floor for EBITDA in an inflationary market.

Can VIQI map the specific AI-readiness of global vendors?

Yes. Using the query “Identify APAC studios with Authorized AI stacks,” VIQI cross-references technical audits and recent licensing deals to surface vendors with verified delivery capacity, avoiding the “Timing Trap” of static industry directories.

Find Film+TV Projects, Partners, and Deals – Fast.

VIQI matches you with the right financiers, producers, streamers, and buyers – globally.

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Producers Seeking Financing, Co-Pros, or Pre-Buys?

Vitrina Concierge helps producers reach the right financiers, commissioners, distributors, and co-production partners — with precision outreach, not cold pitching.

Join Industry Briefings Trusted by Leaders

Deep dive into Co-Pros

Ambitious co-productions are key to global hits, but most deals collapse. This deep-dive briefing is the strategic playbook. We’ll break down the financing models, partnership structures, and market insights behind today’s successful deals.

Film & TV Financing: Tax Credits & Incentives

A focused look at how 2025 tax credits and incentives are reshaping Film & TV financing decisions — and where the real value now sits.

Film & TV Financing: Pre-Buys

Learn how pre-buys work in current Film and TV financing, how they differ from pre-sales, and how they are used to close real finance plans.

Streamers – Netflix vs. Amazon – The 2026 Strategy

How Netflix and Amazon’s content and revenue strategies are diverging ahead of 2026.