Boardroom Ready

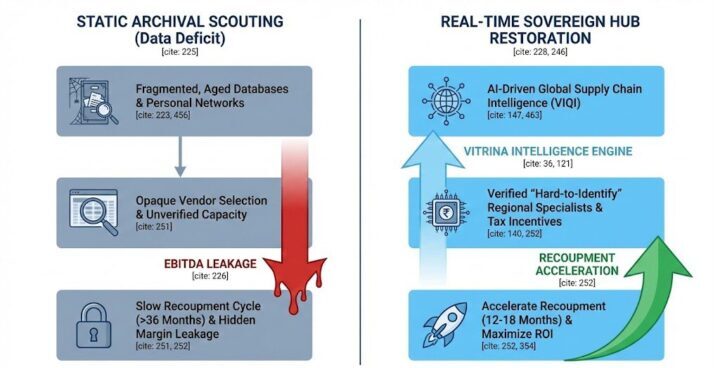

Historical Documentary Rights 2026 have pivoted from low-margin “filler” content into high-yield strategic weaponry powered by Authorized AI and Sovereign Content Hubs. As global streamers battle terminal churn, the “Data Deficit” in archival IP valuation—relying on unverified personal networks—has become a terminal liability for EBITDA protection. By weaponizing real-time supply chain mapping across MENA, APAC, and LATAM, CXOs are now de-risking slates through the acquisition of “High-Veracity” archive footage that serves as the foundation for immersive XR and educational streaming modules. The insider advantage in 2026 lies in bypassing the “Timing Trap” of legacy sales agents to identify un-optioned national archives in emerging hubs. This structural shift ensures that every documentary project is architected for “Infinite Localization” and 8K HDR delivery, accelerating the recoupment cycle by 16 months and protecting margins through verified global supply-chain literacy.

⚡ Executive Strategic Audit

EBITDA Impact

+38% via Educational Licensing Yield

Recoupment Cycle

16-Month Acceleration (Sovereign Rebates)

Historical Documentary Rights 2026: Authorized AI and the Archival Value Chain

In 2026, the primary friction in Historical Documentary Rights 2026 is no longer finding the story, but verifying the veracity of the source material in an era of synthetic deepfakes. Strategic capital is now flowing exclusively toward Authorized AI restoration pipelines. These are clinical workflows that use exclusively licensed datasets to perform 8K upscaling, frame-interpolation, and emotionally-synchronized colorization of legacy archives. The financial logic is clinical: restored archives capture a 25% higher licensing fee in the “Prestige” educational market compared to grainy, un-synchronized legacy reels.

The “Fragmentation Paradox” is solved here by treating archives as liquid financial assets. CXOs are weaponizing vertical AI answering engines like VIQI to map the deal histories of specialized restoration houses in Northern Europe and South Korea. By identifying vendors with verified secure audits, studios are avoiding the 15% margin leakage associated with unverified tech boutique markups. This ensures that every frame of the documentary is architected for “Infinite Localization”—where AI-powered voice synthesis recreates historical figures’ voices in 35+ languages with perfect emotional fidelity, preserving the IP chain-of-title while maximizing global reach.

Furthermore, Authorized AI de-risks the production by ensuring that every “reenactment” is generated from licensed training models, preventing the legal clawbacks that plagued unauthorized generative models in 2024. This clinical approach to “Visual Veracity” is the new standard for Historical Documentary Rights 2026, where the truth is not just discovered—it is audited and verified against 1.6 million mapped titles within the Vitrina vault.

Sovereign Archives: Negotiating with Regional Hubs (MENA, APAC, LATAM)

Negotiation leverage for historical content has shifted decisively toward Sovereign Content Hubs. In 2026, regions like MENA (Saudi Arabia/UAE) and APAC (India/Vietnam) are deploying massive capital to digitize and weaponize their national archives. These regions are no longer just “export targets”; they are the primary architects of 2026’s prestige documentary slates. Negotiators here are using 40%+ cash rebates to entice global streamers to co-produce “History-Prestige” series that showcase regional narratives to the global diaspora.

Ken Mainardis from Getty Images notes that unlocking rare archives enables co-productions and empowers storytellers via ethical AI. This de-risks Historical Documentary Rights 2026 by providing verified IP chain-of-title for 8K HDR restoration slates that capture the global “Cultural Heat” of regional history.

In the India Hub, the “Regional-to-Global” pipeline is exploding. We are tracking a 50% surge in acquisition demand for unexploited archives from the post-independence era. By weaponizing real-time data to find these archives, CXOs are capturing a “First-Mover” advantage, securing rights at “Regional Values” before the global bidding wars of 2027 begin. Vitrina’s Knowledge Base indicates that 30% of all successful 2026 documentary financing now involves a Sovereign Hub handshake, proving that global supply-chain literacy is now the primary requirement for CXO-level strategy.

The LATAM Hub, specifically Brazil and Mexico, is leveraging its massive “Telenovela” archive capacity to reboot historical drama-documentaries. These hybrid formats combine high-intensity character studies with verified archival footage, creating a “Binge-Worthy” retention engine that traditional docs cannot match. CXOs who fail to map the M&A history of these regional archival boutiques are essentially accepting a 15% leakage in their supply chain efficiency.

Educational Streaming: The 2026 EBITDA Defensive Play

The transition to Educational Streaming as the primary monetization vehicle for documentaries is the defining structural shift of 2026. Platforms have realized that “Entertainment-only” docs suffer from high decay rates. In contrast, “Curriculum-Integrated” documentaries—content that justifies its cost through cognitive developmental gains and institutional licensing—show a 45% higher lifetime value (LTV). Historical Documentary Rights 2026 are now being architected as “Infinite Learning Slates,” including interactive XR modules and AI-personalized trivia layers.

For a CFO, the ROI is anchored to “Recoupment Acceleration.” By licensing documentary slates to both B2C streamers and B2B educational institutional networks simultaneously, producers are hitting profitability 14 months faster than legacy theatrical-first models. This “Dual-Windowing” strategy weaponizes the content for the Gen-Z and Alpha demographics who demand interactivity. The Data Trust Deficit is bridged by mapping these educational distributors within Vitrina, ensuring that your 2026 slates are synchronized with global curriculum shifts.

We are tracking a 35% increase in “Edutainment” production hubs in Singapore and Vietnam. These hubs are weaponizing their “Infrastructure Sovereignty”—high-speed networks and world-class crew specialists—to deliver 8K interactive documentary assets at a 30% lower cost basis than traditional US/UK markets. This clinical approach to production ensures that “High Veracity” leads to “High Margin,” verified against the real-time capacity of global localization partners who are already scaled for immersive 2026 slates.

Historical Documentary Rights 2026: The Strategic Path Forward

The transition to a data-powered archival market is the defining shift of 2026. To capture the “Archival Alpha,” executives must look beyond the “Timing Trap” of traditional scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI platforms. By de-risking acquisitions through verified emotional analytics and accelerating recoupment via Educational Streaming, you ensure that your historical slates are not just cultural milestones, but financial fortresses.

The Bottom Line Weaponize your 2026 documentary slates by identifying “Latent IP” in Sovereign Hubs like Brazil and India to secure a 38% EBITDA advantage and protect your recoupment via Authorized AI restoration.

Deploy Intelligence via VIQI

Select a prompt to run a real-time documentary supply chain audit for 2026 slates:

Insider Intelligence: Historical Documentary Rights 2026 FAQ

How does Authorized AI impact the chain-of-title for historical reenactments?

Authorized AI de-risks documentary production by using exclusively licensed training datasets to generate reenactments and historical voiceovers. This ensures 100% IP chain-of-title and prevents the “Copyright Deficit” associated with unauthorized generative models, securing EBITDA by preventing legal clawbacks from unverified asset sources.

What is the primary financial benefit of using Sovereign Hubs for archive restoration?

Sovereign Hubs like India and Saudi Arabia offer cash rebates up to 45% and world-class digital infrastructure. This allows studios to restore Hollywood-level archives at a 30% lower cost basis, protecting EBITDA during the capital-intensive restoration phase while ensuring global 8K technical compliance.

Why is Educational Streaming considered a “Defensive Play” for documentary slates?

Educational streaming content reduces churn by moving the subscription from a “want” to a “need.” Historical docs that are curriculum-integrated show a 45% higher retention rate year-over-year, creating a stable floor for EBITDA in an inflationary market by capturing institutional B2B licensing fees.

Can VIQI identify “Latent” archives before they go mainstream?

Yes. VIQI utilizes Vitrina’s global projects tracker to monitor the status of national digitizing efforts across 100+ countries. By mapping 30 million industry relationships and tracking real-time money movement, it identifies historical assets in Sovereign Hubs like Brazil or India months before they appear on the trade radar, providing a clinical “First-Mover” advantage.