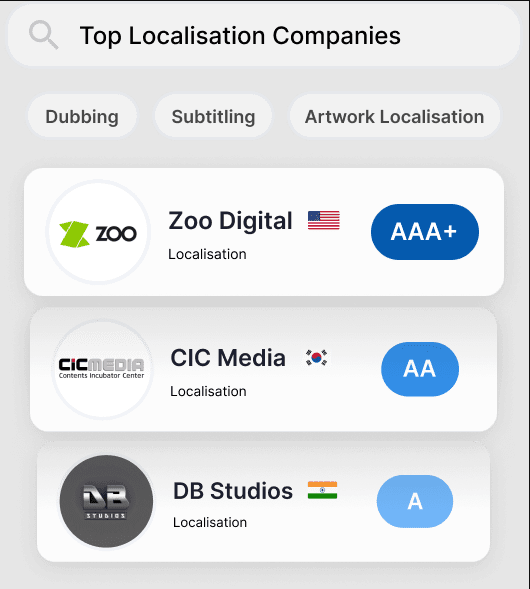

Top Film Localization Companies in Ireland are specialized vendors providing dubbing, subtitling, and cultural adaptation services to ensure content resonates with global audiences.

This involves managing linguistic nuance, voice talent casting, and technical synchronization for film, television, and digital platforms.

According to recent industry analysis, the global localization market has reached 6.5 billion USD, with Ireland emerging as a key hub for high-quality English and multi-language post-production services.

In this guide, you will learn how to identify elite Irish localization partners, evaluate technical infrastructure, and leverage supply chain intelligence to compress your distribution timelines.

While traditional directories offer surface-level listings, they often fail to provide the verified track records and real-time project visibility that acquisition leads require to mitigate risk in 2026.

This comprehensive guide addresses those gaps by mapping the Irish localization landscape through the lens of verified performance and advanced supply chain tracking.

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Table of Contents

Key Takeaways for Acquisition Leads

-

Verified Intelligence Advantage: Using supply chain platforms like Vitrina helps buyers identify Irish vendors with proven track records in global distribution.

-

Infrastructure Matters: Elite Irish companies offer TPN-certified secure workflows, critical for high-value intellectual property protection in the streaming era.

-

Cultural Nuance Discovery: Localization involves more than translation; it requires cultural adaptation, a specialty for Irish vendors targeting both US and EU markets.

What is Film Localization in the Irish Context?

Film localization in Ireland refers to the technical and creative process of adapting audiovisual content for international markets using Irish-based infrastructure and talent. This encompasses dubbing, subtitling, closed captioning, and audio description services. Ireland has uniquely positioned itself as a bridge between North American and European markets, offering linguistically versatile talent pools and state-of-the-art post-production facilities.

The process involves deep cultural analysis to ensure that humor, idioms, and narrative tone translate effectively across borders. In 2026, Irish localization companies are increasingly integrating AI-enhanced workflows to manage high-volume subtitling while maintaining the artistic integrity required for premium theatrical and SVOD releases.

Find verified film localization partners in Ireland:

Why Do Content Buyers Hire Irish Localization Partners?

Ireland offers a compelling value proposition for content buyers focused on European market entry. Beyond the shared language with major English-speaking markets, the country provides significant tax incentives and a robust regulatory environment for data protection. For acquisition leads, hiring an Irish partner means accessing high-end creative talent without the bureaucratic friction often found in larger European territories.

Industry Expert Perspective: Micro Series and Macro Trends: TransPerfect’s Take on Localization

As content acquisition strategies move toward regional hubs, understanding the role of AI and cultural nuances in localization becomes paramount for global scaling.

Asher Loy discusses the evolution of localization in the media industry, highlighting AI’s transformative role, cultural nuances in streaming, and trends like micro-series in dynamic markets.

Top Film Localization Companies in Ireland to Watch

The Irish localization market is characterized by a mix of specialized boutique studios and large-scale global networks with a presence in Dublin. Below are key vendors currently shaping the supply chain.

1. Engage Dubbing and Subtitling Networks

The Challenge: Managing large volumes of episodic content for multiple European territories often leads to inconsistencies in tone and quality. Traditional methods rely on disparate vendors, creating management overhead.

The Approach: Leading Irish vendors utilize centralized project management systems that integrate with the global media supply chain. This allows for real-time tracking of asset delivery and quality control.

2. Leverage Cultural Adaptation Specialists

The Challenge: High-concept scripts often contain regional humor or cultural references that do not translate literally. Failure to adapt these elements results in low audience engagement in target markets.

The Approach: Irish localization boutiques often specialize in “transcreation,” employing writers who rewrite dialogue to preserve narrative impact while ensuring cultural relevance.

Analyze Irish localization vendor specialties:

How to Evaluate Localization Vendors Effectively?

When hiring localization companies in Ireland, acquisition leads must look beyond basic translation capabilities. The evaluation should focus on three core pillars: security compliance, technical scalability, and verified relationship mapping.

- TPN Certification: Verify that the studio adheres to Trusted Partner Network standards to prevent leaks of unreleased content.

- Voice Library Quality: For dubbing, evaluate the diversity and professional experience of the Irish voice talent pool.

- Supply Chain Integration: Does the vendor use API-ready feeds to push metadata directly into your content management system?

Moving Forward

The Irish film localization market has transitioned from a supporting role to a critical strategic hub for global content distribution. By addressing the gaps in verified data and cultural adaptation, this guide empowers acquisition leads to build resilient partnerships that drive ROI.

Whether you are an acquisition lead looking to secure European rights, or a production head trying to manage a global slate, localized intelligence is your greatest asset.

Outlook: Over the next 18 months, expect Irish vendors to lead the adoption of ethical AI dubbing tools that maintain high emotional fidelity for global streamers.

Frequently Asked Questions

Quick answers to help you navigate the Irish localization landscape.

Who are the top film localization companies in Ireland?

What services do Irish localization companies provide?

Is Irish language dubbing necessary for global content?

How much does film localization in Ireland cost?

How long does the localization process take?

Do Irish localization vendors handle SVOD delivery?

How can I vet a localization partner’s track record?

Are there tax incentives for localization in Ireland?

“The ability to discover regional localization hubs like Ireland through data-driven supply chain platforms is the single biggest advantage for acquisition leads in today’s borderless content market.”

About the Author

Sourced by the Vitrina Intelligence Team, specializing in entertainment supply chain dynamics and global vendor discovery for media executives. Connect on Vitrina.