| Topic | Strategic Insight |

|---|---|

| The 25% TTC Anchor | A transferable credit with no annual cap, applicable to all qualified DR-based spend including ATL and BTL labor. |

| VAT (ITBIS) Exemption | Immediate 18% VAT exemption on qualified goods and services, significantly improving front-end cash flow. |

| Qualification Floors | Requires a minimum local spend of USD $500,000 and a 25% Dominican crew/cast quota. |

| Vitrina Relevance | Access the project tracker to see how 2024–2025 tentpoles (e.g., Road House) utilized DR incentives. |

Table of Content

The Mechanics of Law 108-10: More Than Just a Subsidy

The Dominican Republic Film Incentive is anchored by Article 39 of Law 108-10, a legislative framework designed to transform the nation into a global hub for cinematographic production. Unlike “rebate” systems found in other LATAM territories, which can be subject to government budget cycles and delayed disbursements, the DR’s Transferable Tax Credit (TTC) operates as a market-driven asset.

For C-suite executives, the primary appeal is the breadth of the qualified spend. According to data from DGCINE, the credit applies to 25% of all expenses incurred in the Dominican Republic that are directly related to pre-production, production, and post-production. This includes not just BTL (Below-the-Line) services but also ATL (Above-the-Line) payroll for foreign talent, provided the proper withholding protocols are followed.

Insider Intelligence

The DR incentive has no per-project cap. This makes the territory uniquely suited for high-budget studio tentpoles that would exceed the fiscal ceilings of competing islands like Puerto Rico or the US Virgin Islands.

Navigating the Qualification Funnel: DGCINE and SIRECINE

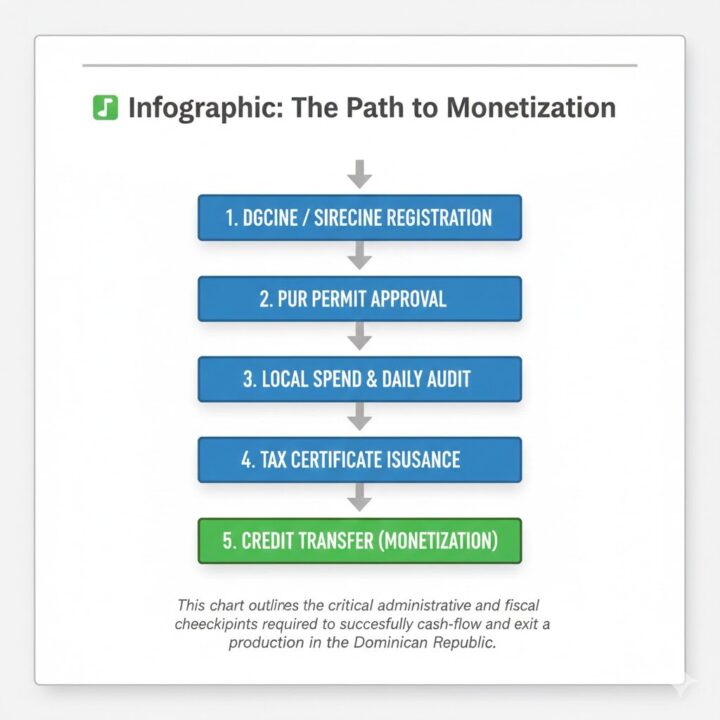

Success in the Dominican Republic is predicated on early-stage administrative precision. Every production seeking the 25% TTC must interface with two primary entities: the Dominican Film Commission (DGCINE) and the National Registry of Cinematographic Agents (SIRECINE).

The first hurdle is the “Single Shooting Permit” (PUR). Issued by DGCINE, this permit validates the project’s eligibility under Law 108-10. To obtain this, foreign producers must either establish a local company or, more commonly, enter into a production services agreement with a registered local partner. This partner serves as the fiscal bridge, ensuring all local expenses are tracked through SIRECINE-registered vendors.

The “25% Rule” for labor is a critical compliance metric. At least 25% of the total crew and cast must be Dominican nationals or residents. In the 2024–2025 production cycle, the DR has significantly expanded its skilled labor pool, allowing productions to meet this quota with high-level technical department heads rather than just entry-level assistants.

Transferability and Monetization: Turning Credits into Cash

The “Transferable” aspect of the Dominican Republic Film Incentive is what attracts sophisticated film financiers. Since a foreign production company likely has zero tax liability in the DR, the 25% credit is sold (transferred) to local Dominican taxpayers—typically large banks or conglomerates like Banco Popular or Grupo Corripio—who use the credit to offset their own corporate income tax.

Here is the strategic play: The market for these credits is highly liquid. Credits are generally sold at a slight discount (e.g., 90–95 cents on the dollar), providing the production with immediate cash liquidity upon the issuance of the final tax certificate. Furthermore, up-front monetization solutions (bridge financing) are available through local institutions, allowing producers to cash-flow the incentive during principal photography.

According to reports from Lantica Studios, the monetization process has become remarkably streamlined. By utilizing pre-approved auditing firms, the timeframe between the “wrap” and the “cash-out” has been reduced, de-risking the capital stack for international investors.

Find production service companies in the Dominican Republic with tax incentive expertise ➝

The Infrastructure Edge: Lantica Studios and Beyond

An incentive is only as valuable as the infrastructure that supports it. The Dominican Republic’s “Hero Project” record is anchored by Lantica Studios (Pinewood Dominican Republic), which offers a world-class water tank (Horizon Water Tank) and 60,500 sq. ft. of soundstage space.

Productions like The Lost City and Nyad utilized the combination of the 25% TTC and Lantica’s specialized facilities to execute complex aquatic sequences that would have been cost-prohibitive elsewhere. The presence of such facilities ensures that the “Qualified Spend” remains high, as complex post-production and stage work can be kept within the country to maximize the tax credit.

Beyond the stages, the DR offers diverse topography—from the colonial architecture of Santo Domingo to the jungles of Samaná—all accessible within a short flight from Miami. This logistical efficiency, paired with the 18% VAT exemption on local logistics and rentals, creates a “multiplier effect” on the production budget.

Compliance and Auditing: Avoiding the 1.5% Withholding Pitfall

The most common point of failure for international productions in the DR is a lack of rigorous local auditing. To claim the Dominican Republic Film Incentive, every single invoice must be issued by a SIRECINE-registered vendor and verified by a local CPA firm approved by DGCINE.

A critical nuance is the “Foreign Payroll Withholding.” While foreign talent spend is eligible for the 25% credit, it is subject to a 1.5% withholding tax if the hiring is managed through a local production company with a special ruling from the Tax Department. Failing to structure these contracts correctly can lead to the 27% standard income tax withholding, effectively neutralizing the benefit of the incentive.

Why does this matter? Because the DR incentive is “audit-heavy.” You cannot simply submit a ledger at the end of the year; compliance is a day-to-day operation. Executives should prioritize partners who have a proven track record of “clean audits” and successful credit transfers.

Strategic FAQs: Dominican Republic Film Incentives

What is the minimum spend to qualify for the Dominican Republic film tax credit?

To access the 25% Transferable Tax Credit (TTC), a production must incur a minimum expenditure of USD $500,000 within the Dominican Republic. This spend must be directly related to pre-production, production, or post-production and processed through registered local vendors.

Can the 25% tax credit be used for foreign cast and crew salaries?

Yes, Above-the-Line (ATL) and Below-the-Line (BTL) foreign payroll is eligible for the 25% credit. However, to qualify, productions must comply with local withholding taxes, which can be as low as 1.5% when managed through a qualified local production service company.

Is there a cap on the Dominican Republic film incentive?

Unlike many other jurisdictions, the Dominican Republic does not currently have a project cap or an annual aggregate cap on the 25% Transferable Tax Credit. This makes it a premier destination for large-scale blockbusters and high-end episodic series with substantial budgets.

How long does it take to monetize the film tax credit in the DR?

The timeline for monetization depends on the audit speed, but the credit market is highly liquid. Upon issuance of the tax certificate by the authorities, credits can be sold to local taxpayers almost immediately, with bridge financing options available to cover the gap during production.