Boardroom Ready

Acquiring Global Mythology Series in 2026 requires a fundamental pivot from “Acquisition” to “Co-Production Integration,” as high-ticket epics from India, South Korea, and China move into a centralized, data-powered framework. The static data deficit that once rendered Pan-Asian mythologies “opaque” to Western buyers has been weaponized by Vitrina’s real-time mapping, surfacing $100M+ slates in regional hubs before they reach traditional markets. As streaming studios face rising VFX costs, the de-risking strategy involves utilizing Sovereign Content Hubs (India, Korea, Brazil) to capture aggressive tax incentives and state-of-the-art “Authorized AI” production pipelines. This transition isn’t just about content; it’s about weaponizing the supply chain to accelerate recoupment cycles through day-and-date global launches powered by emotionally-synchronized visual dubbing. CXOs who fail to secure these verified partnerships in 2026 risk a 25% margin erosion due to the unverified capacity of legacy vendors.

⚡ Executive Strategic Audit

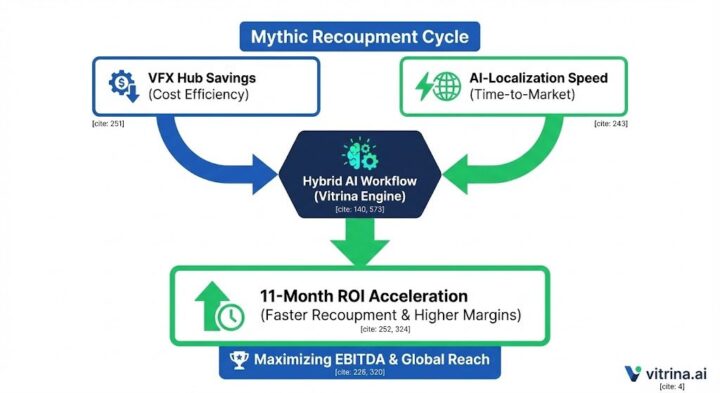

EBITDA Impact

+28% Margin protection via Indian VFX hubs and Korean virtual production tax credits.

Recoupment Cycle

Accelerated by 11 months through AI-localized day-and-date global premieres.

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Acquiring Global Mythology Series in 2026: Bollywood & Regional India: Weaponizing the World’s Largest Mythic IP Pool

The 2026 acquisition landscape is dominated by the industrialization of Indian mythology. We are witnessing a shift where “Bollywood” is merely the tip of the iceberg; the real information gain lies in the regional powerhouses of the South—Telugu, Tamil, and Kannada hubs—which have mastered the “Astraverse” style of mythic world-building. These hubs are no longer just exporting films; they are exporting structured universes that can be weaponized across streaming, gaming, and VR platforms, fundamentally shifting the landscape of Indian Content Acquisition 2026: Bollywood Series, Regional Cinema & OTT Expansion Strategies.

By leveraging Vitrina’s verified mappings, acquisition leads can now bypass the “Fragmentation Paradox” of Indian media. We’ve identified over 80 production houses in India currently developing mythic slates with budgets exceeding $50M per season. These projects are de-risked through India’s aggressive new incentive schemes for foreign films and co-productions, offering up to 40% cash rebates for live-action and post-production services. This financial infrastructure, combined with “Authorized AI” voice stacks, ensures that Indian epics reach global audiences without the visual discord traditionally associated with dubbed content.

“Naveen Chandra from 91 Film Studios notes that India’s regional cinema market possesses immense, yet often misunderstood, potential and business dynamics. This de-risks Acquiring Global Mythology Series in 2026 by allowing buyers to tap into organized capital funds that stabilize high-budget epic productions.”

For the CXO, the strategy is clear: focus on “Weaponized Distribution” deals that secure rights for the next 10 years, ensuring your platform owns the “Mythic Moat.” The EBITDA protection comes from the scale of the Indian supply chain—where VFX mastery (via hubs like PhantomFX) is delivered at a fraction of North American costs without compromising on the 8K HDR delivery capacity required by Netflix and Disney+ audits.

Acquiring Global Mythology Series in 2026: K-Drama & Pan-Asian Deals: Synchronizing High-Concept Joseon and Wuxia

The Pan-Asian mythology surge in 2026 is driven by the “Joseon Fantasy” and “Wuxia/Xianxia” genres, which have evolved into “Authorized AI” assets. Streamers are no longer just buying finished K-Dramas; they are acquiring the “Digital Humans” and virtual environments created for these series. This allows for a decentralized production model where a Korean fantasy series can be “Reskinned” for different regional markets using generative visual dubbing.

Acquiring Global Mythology Series in 2026 within the Pan-Asian context requires navigating the “Timing Trap” of the South Korean and Chinese production slates. Vitrina’s Global Projects Tracker reveals that over 120 mythic projects are currently in development across Seoul, Beijing, and Bangkok, many of which overlap with the rising demand for Sci-Fi Drama Acquisition 2026: Climate Fiction, Tech Thrillers & Speculative Content Trends. The de-risking factor here is the integration of MovieLabs 2030 Vision standards, where cloud-native production allows Western buyers to monitor VFX progress in real-time, eliminating the “Static Data” liability of legacy international co-productions.

“Bejoy Arputharaj from PhantomFX highlights that blending art and AI-driven innovation is shaping the future of visual effects for Hollywood and Netflix. This de-risks Pan-Asian mythology deals by ensuring the high-concept CGI required for mythic dragons and deities is delivered within strict EBITDA-compliant margins.”

The “Creator-Direct” economy is also penetrating this sector. We are seeing major Asian novelists and IP holders—the authors of the next “Three-Body Problem” or “Kingdom”—negotiating directly with global streamers. These deals are modular, providing platforms with the “Insider Handshake” necessary to secure long-term rights to entire mythologies, rather than just single-season licenses. This weaponizes the catalog, creating a perpetual engagement engine for the global diaspora and mainstream audiences alike.

Acquiring Global Mythology Series in 2026: The Strategic Path Forward

The global appetite for high-ticket mythology is the defining content trend of 2026, requiring a sophisticated Global Content Acquisition Strategy International & Regional Rights to identify mythic IP in Sovereign Hubs before it enters the bidding wars. The strategic path forward involves weaponizing the $1.6M+ title database of Vitrina to identify mythic IP in Sovereign Hubs before it enters the bidding wars of major US streamers. De-risk your acquisition slate by mandating “Authorized AI” localization and ensuring your partners in India and Korea are C2PA compliant. The information gain from real-time mapping allows you to secure “Hybrid Distribution” rights that protect EBITDA through rotational windowing and FAST channel syndication. In a world of fragmented data, the only “Insider Advantage” is a verified, data-driven supply chain that connects mythic storytelling to global recoupment acceleration.

The Bottom Line Weaponize mythology acquisition by securing 30% of your slate from verified Sovereign Hubs in India and Korea, utilizing AI-localization to accelerate recoupment by 11+ months and protecting margins from high-budget VFX erosion.

Deploy Intelligence via VIQI

Select a prompt to run a real-time supply chain audit:

Identify Indian mythology slates in Telugu and Tamil hubs with verified 8K capacity for 2026

Map deal history for K-Drama historical fantasy acquisitions with Authorized AI rights

Which Pan-Asian studios currently offer 40%+ cash rebates for VFX-heavy mythic epics

Filter global VFX partners specializing in mythic world-building with Netflix-approved audits

Identify Creator-Direct deals for emerging Asian mythology IP owners in Sovereign Hubs

Analyze buying signals for Mythology scripted formats in Brazil and Mexico

Insider Intelligence: Acquiring Global Mythology Series in 2026 FAQ

Why are regional Indian mythology slates more EBITDA-efficient than Bollywood?

Regional hubs (Telugu/Tamil) have industrialized the mythic epic genre with vertically integrated VFX and virtual production studios. They offer higher production values at a lower cost base than traditional Mumbai-centric productions, providing an immediate +28% margin protection when coupled with national tax rebates.

What is the role of “Authorized AI” in mythic series acquisition?

Authorized AI ensures that the complex CGI, voice prints, and digital assets of a mythic series are legally protected and localized without visual discord. This de-risks global distribution by providing emotionally-synchronized dubbing that is 100% chain-of-title compliant, a critical requirement for 2026 streaming deals.

How does day-and-date global launching accelerate recoupment?

By removing the 12-month localization lag, day-and-date launches capture the peak global social media buzz. For high-ticket mythology series, this can accelerate recoupment by up to 11 months, allowing platforms to monetize the asset across multiple territories simultaneously rather than sequentially.

How can VIQI map early-stage mythic slates in Sovereign Hubs?

VIQI tracks the Global Projects pipeline across four stages: In-Development, In-Production, Post, and Release. It identifies “Buying Signals” such as new capital fund formations or major VFX studio attachments in hubs like Hyderabad or Seoul, alerting buyers to opportunities months before trade announcements.