Buying the rights to a TV show typically costs between $5,000 for niche library titles to over $3 million per episode for premium global streaming franchises.

This investment involves securing specific permissions—such as licensing, distribution, or syndication rights—across defined territories and platforms.

According to recent industry data, streaming rights for high-demand genres like drama and unscripted formats have seen a 15% valuation increase in 2025 as platforms shift toward “weaponized distribution” models.

In this guide, you’ll learn detailed cost breakdowns, the difference between licensing and assignment, and strategic negotiation tactics to maximize your content ROI.

While legacy resources focus on broad estimates, they often overlook the technicalities of “chain of title” and the impact of regional licensing fees in fragmented markets like Southeast Asia or MENA.

This comprehensive guide addresses those gaps by providing an authoritative framework for content buyers—from initial discovery to final deal closure.

Table of Contents

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

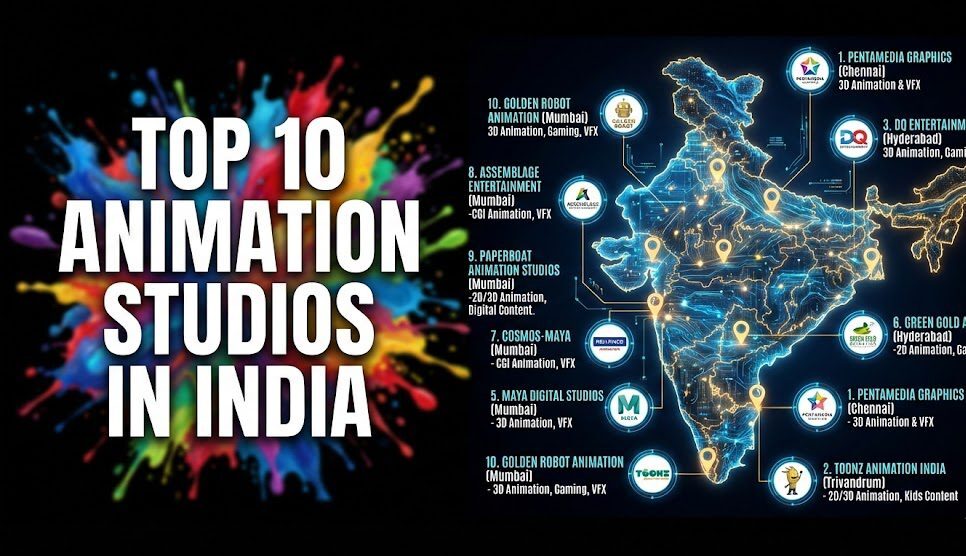

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Key Takeaways for Content Buyers

-

Cost Variance: Library titles may cost as little as $5,000, while premium streaming hits command over $3M per episode in global rights fees.

-

Licensing Nuance: Distinguish between exclusive and non-exclusive rights; exclusivity often doubles the cost but secures your platform’s competitive advantage.

-

Territorial Impact: Global rights provide broad reach but carry 5-10x the price tag of single-territory domestic rights for the same content.

What are TV Show Rights?

TV show rights represent the legal permission granted by a creator or production company to a third party to exhibit, distribute, or monetize a specific audiovisual work. In the entertainment supply chain, these rights are divided into specialized categories: licensing (temporary permission), distribution (control over release), and syndication (long-term second-window usage).

Acquiring these rights is a multi-step process that requires verifying the “chain of title”—the documentation proving the seller owns all necessary IP components, including scripts and music. Without this, buyers face significant legal and financial risk.

Find distributors for library TV titles in your region:

Detailed Cost Breakdowns: From Indie to Blockbuster

How much does it cost to buy the rights to a TV show? The answer varies based on genre, popularity, and rights type. For older, out-of-print library titles, options can start as low as $5,000 for a multi-year domestic license. Conversely, current premium drama or sitcom rights for global SVOD platforms often range from $500,000 to over $3 million per episode.

- Niche/Documentary Content: $5,000 – $50,000 (Domestic License)

- Mid-Tier Reality/Unscripted: $50,000 – $250,000 per episode (Global Rights)

- Premium Scripted Series: $500,000 – $3M+ per episode (Exclusive SVOD Rights)

Factors like the age of the content and existing talent participation agreements (residuals) heavily influence these numbers. As the industry moves into 2025, buyers are increasingly looking for “authorized” rights data to prevent legal disputes over AI training and derivative works.

Industry Expert Perspective: The Big Crunch: Phil Hunt on Why Film Finance is Harder Than Ever

Phil Hunt, CEO of Head Gear Films, provides a critical reality check on the current financing landscape, highlighting how the digital revolution has collapsed revenue windows and made rights acquisition more challenging for independent players.

Phil Hunt discusses the industry’s shift away from traditional pre-sales and the demand for low-cost, high-concept genres. He emphasizes the current market’s demand for action, thriller, and horror, which often dictate rights pricing and acquisition strategy.

Licensing Models: Fixed Fees vs. Revenue Share

The financial structure of a TV rights deal is rarely a simple one-off payment. Professional acquisition leads typically utilize three primary models:

1. Fixed License Fee: A flat amount paid upfront for a specific term (e.g., 2 years). This is common for Netflix and other SVOD platforms where revenue performance isn’t shared with the producer.

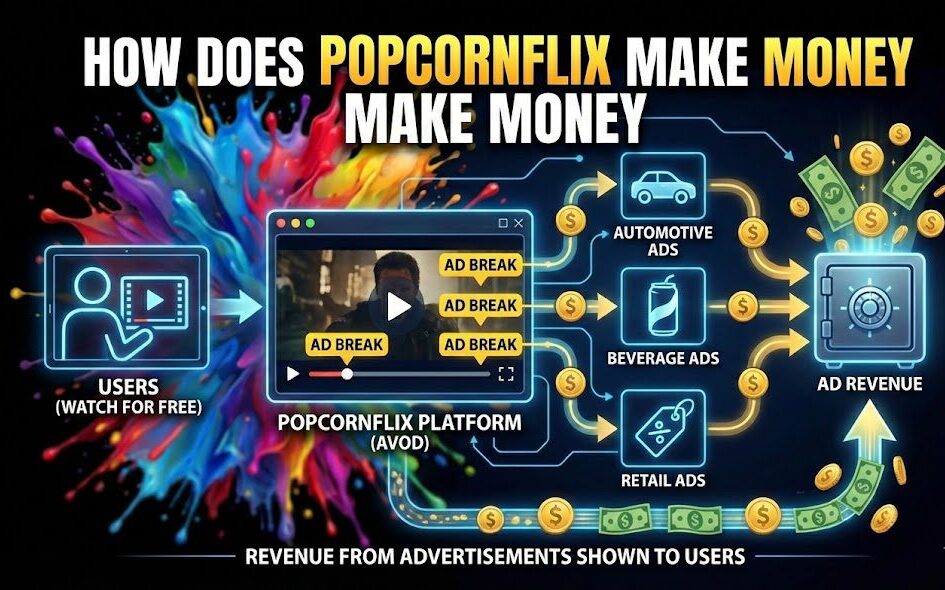

2. Revenue Share (AVOD/FAST): Increasingly popular in 2025, this model involves sharing advertising revenue with the content owner. It reduces upfront risk for the platform but requires granular tracking systems like Vitrina’s Deals Intelligence.

3. MG + Rev Share: A “Minimum Guarantee” is paid upfront, with additional “back-end” payments triggered if the show hits specific viewership or revenue milestones.

Analyze content acquisition and licensing trends for Q4 2024:

Global vs. Domestic Rights: Pricing the Territory

A significant portion of the cost of buying TV rights is determined by geography. Global rights allow a platform to distribute content in every country, which is ideal for “borderless” hits like Squid Game or Bridgerton. However, global exclusivity can cost 10 times more than a single-territory deal.

Domestic rights are often the strategic choice for regional platforms. For example, a broadcaster in Brazil might only license the Brazilian rights for an American sitcom. This “rotational window” strategy allows platforms to manage budgets effectively while creators maximize ROI by selling the same content to different buyers across various regions.

Expert Negotiation Strategies for 2025

In 2025, negotiation isn’t just about the lowest price—it’s about maximizing the value of the bundle. Strategic buyers now negotiate for additional data access, flexible release windows, and cross-platform rights.

- Volume Drivers: Bundle multiple titles from the same media group to reduce per-unit costs.

- Flexible Windows: Negotiate for shorter exclusivity periods in exchange for lower license fees.

- Data Leverage: Use real-time viewing data and competitive benchmarks to justify price concessions.

According to Vitrina’s market intelligence, teams leveraging verified supply-chain data secure deals 40% faster by identifying the right decision-makers and bypassing generic gatekeepers.

Legal Frameworks and Chain of Title

The “Chain of Title” is the most critical legal element in any rights acquisition. It is a documented history of ownership for every creative element in the show—from the script to the incidental music. A break in this chain can halt distribution and lead to expensive lawsuits.

Furthermore, 2025 has brought intense focus on “Authorized AI” data markets. As seen in Disney’s actions against Google, platforms must ensure their licensed content is legally secured for all intended uses, including emerging technologies. Working with a verified supply chain platform like Vitrina ensures that you are dealing with legitimate, vetted partners.

Moving Forward

Acquiring TV show rights in a post-peak TV era requires a shift from gut-feeling deals to data-powered intelligence. By understanding the granular cost factors and territory dynamics, buyers can secure premium content while maintaining healthy profit margins.

Whether you are an acquisition lead looking to diversify your regional library, or a strategy officer trying to identify the next global franchise, the key is actionable supply-chain intelligence.

Outlook: Over the next 12-18 months, expect a “weaponized distribution” surge where premium IP rotates through more platforms than ever before, creating more buying opportunities—and more competition for the best rights.

Frequently Asked Questions

Quick answers to common queries about TV show rights acquisition.

How much does it cost to buy the rights to a popular TV show?

What is the difference between exclusive and non-exclusive TV rights?

How can I verify the rights for a TV show before buying?

What is weaponized distribution in TV rights?

“The industry has shifted from opaque, relationship-driven dealmaking to a centralized, data-powered framework. Professionals who don’t embrace this data-first approach risk overpaying for content or missing emerging regional hits entirely.”

About the Author

The Vitrina Content Team specializes in global entertainment supply chain intelligence, mapping over 140,000 companies and 5 million professionals to bring transparency to the industry. Connect on Vitrina.