The biggest movie production companies in the world are currently defined by the “Big Five” major studios—Walt Disney Studios, Warner Bros. Pictures, Universal Pictures, Sony Pictures, and Paramount Pictures—which together control over 80% of the global box office.

This dominance is maintained through massive vertical integration, extensive IP catalogs, and global distribution networks that reach every corner of the entertainment supply chain.

According to industry data, the global media and entertainment market encompasses over 600,000 companies, yet the consolidation of high-value IP remains concentrated within these top-tier entities.

In this guide, you will learn how these giants are evolving through M&A, weaponized distribution, and the strategic integration of authorized generative AI to maintain market leadership.

While most lists focus solely on revenue and blockbuster titles, they often overlook the tectonic shifts in the supply chain that are forcing traditional studios to become tech-first entities. This lack of technical depth leaves executives without a roadmap for navigating a borderless, data-driven market.

This analysis fills those gaps by exploring the operational metamorphosis of major studios—from legacy theatrical models to “Weaponized Distribution” frameworks and AI-authorized data markets.

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

Producers Seeking Financing & Partnerships?

Book Your Free Concierge Outreach Consultation

(To know more about Vitrina Concierge Outreach Solutions click here)

Table of Contents

- 01

What Are the Biggest Movie Production Companies Today? - 02

How is Streaming Transforming the Major Studios? - 03

The Rise of Weaponized Distribution and Co-opetition - 04

M&A Consolidation: The Netflix-WBD Paradigm Shift - 05

AI and the Business of Authorized Visual IP - 06

Future Trends in Film Production and Global Sourcing - 07

Key Takeaways - 08

FAQ

Key Takeaways for Strategy Officers

-

Weaponized Distribution: Major studios are abandoning “walled garden” exclusivity in favor of licensing high-value content to rivals to maximize ROI post-release.

-

Authorized AI Markets: Disney’s $1B deal with OpenAI signals the transition of generative AI from threat to authorized monetization channel for legacy IP.

-

Data Intelligence Moats: Leading production companies are using vertical AI platforms like Vitrina to map over 140,000 global companies and discover regional co-production hubs.

What Are the Biggest Movie Production Companies Today?

The landscape of the biggest movie production companies in the world is dominated by the “Big Five” major studios. These entities—Disney, Warner Bros., Universal, Sony, and Paramount—function as massive conglomerates with interests spanning production, distribution, and theme parks. They represent the apex of the global entertainment supply chain, controlling the most valuable Intellectual Property (IP) in cinematic history.

Walt Disney Studios currently leads the market, leveraging its acquisitions of Pixar, Marvel, and Lucasfilm to create a franchise-heavy slate that consistently dominates the global box office. Universal Pictures follows closely, capitalizing on its diverse portfolio that includes DreamWorks Animation and the Fast & Furious franchise. Warner Bros. Pictures, recently emboldened by its Netflix merger, remains a powerhouse with the DC Universe and Harry Potter franchises.

Identify active projects at major studios:

How is Streaming Transforming the Major Studios?

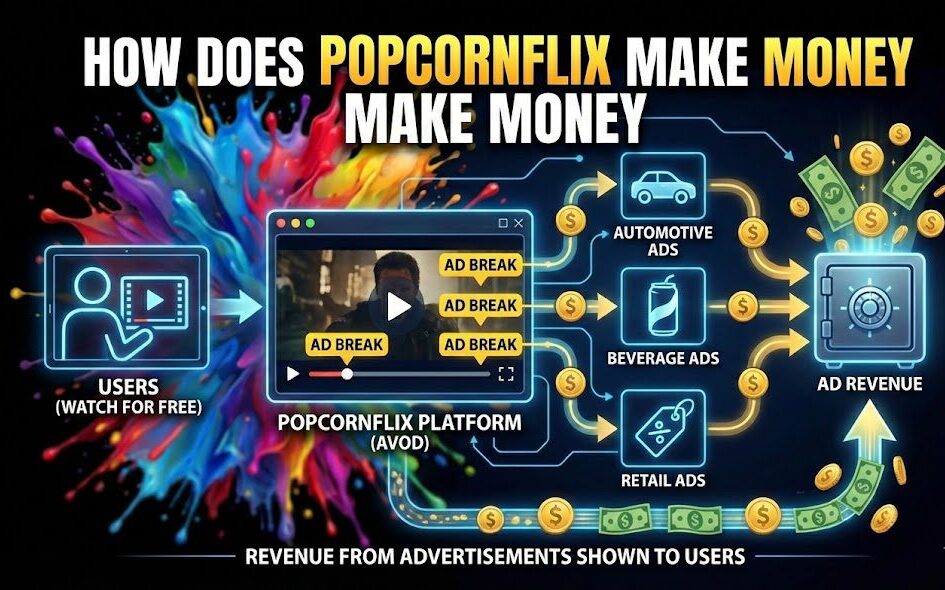

The “Streaming Wars” have officially transitioned into an era of “Weaponized Distribution.” For years, traditional studios built “walled gardens,” keeping their premium content exclusively on their own platforms (e.g., Disney+ or Max). However, the massive capital requirements of original production have led to a shift toward ROI-centric licensing.

Netflix’s content strategy serves as a blueprint for this evolution. By prioritizing local-language content and leveraging global data, Netflix transforms regional hits like Squid Game or Money Heist into international phenomena. Major studios are now mimicking this “Global Domination” pillar, investing heavily in regional hubs in Brazil, India, and the MENA region to diversify their portfolios and capture borderless audiences.

Industry Expert Perspective: The Big Crunch: Phil Hunt on Film Finance

Phil Hunt, CEO of Head Gear Films, provides a critical overview of the challenging independent film landscape and the industry’s shift away from pre-sales in a fragmented market.

Key Insights

Hunt discusses Head Gear Films’ journey from a production studio to a leading film lender. He highlights the collapse of traditional revenue windows and the increasing demand for high-concept, low-cost genres like thrillers and horror in today’s digital revolution.

The Rise of Weaponized Distribution and Co-opetition

In 2025, the industry has embraced “Co-opetition”—a model where platforms collaborate to maximize market efficiency. The “Frenemy Pact” between Amazon and Netflix is the defining example: Amazon MGM Studios licenses iconic franchises like James Bond to Netflix, while Amazon Ads provides programmatic access to Netflix’s ad inventory.

This strategy, known as “Weaponized Distribution,” involves licensing high-value content to rivals 18-24 months post-release. This rotation priorities recouping production costs over rigid exclusivity, allowing “sunk” assets to generate new revenue streams. For executives, this means that the “biggest” production companies are no longer just content creators; they are sophisticated rights-management machines.

Discover available licensing rights:

M&A Consolidation: The Netflix-WBD Paradigm Shift

The $72 billion acquisition of Warner Bros. Discovery’s studio and streaming assets by Netflix in late 2025 marked the end of the traditional studio era. This deal brought iconic IP like Harry Potter and the HBO library under Netflix’s control, creating a vertical powerhouse that threatens traditional theatrical exhibition business models.

For competitors, this consolidation increases the urgency of data-driven intelligence. Identifying independent studios for acquisition or monitoring the state of global productions has become a boardroom priority. Platforms like Vitrina AI provide the strategic lighthouse needed to track money movement, M&A activity, and emerging financial models in real-time.

AI and the Business of Authorized Visual IP

Generative AI is no longer a theoretical tool; it is a core business strategy. Disney’s $1 billion investment in OpenAI established the first “Authorized Data” market. Under this deal, users of OpenAI’s Sora can access Disney-owned characters and props in a controlled environment, creating a safe space for fan-driven short-form content.

This shift differentiates “Authorized AI” from the unauthorized usage currently being litigated in cases like Disney v. Google. For major production companies, the goal is to protect their IP while simultaneously unlocking rare archives and enabling ethical AI-driven co-productions. This technological enablement is critical for delivering high-quality, localized content at scale.

“The integration of authorized AI is transforming our archives into active, revenue-generating assets. It’s about empowering storytellers while respecting the ethical boundaries of talent likeness.”

Future Trends in Film Production and Global Sourcing

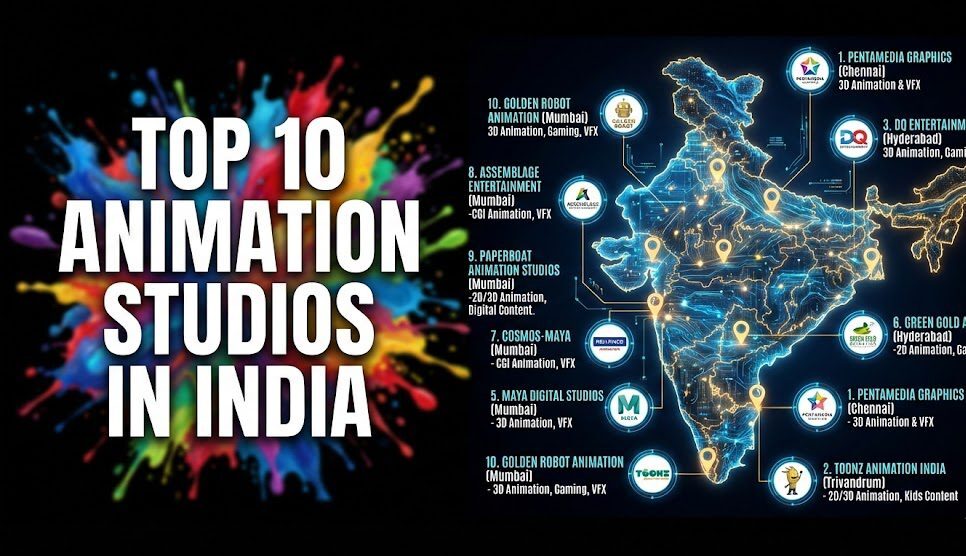

As the supply chain globalizes, the “biggest” production hubs are shifting. Companies like Warner Bros. Animation and Netflix are identifying new production centers in Brazil, South Korea, and the Middle East to take advantage of local tax incentives and creative talent.

Tools like Vitrina’s Global Projects Tracker enable financiers and service providers to monitor these shifts in real-time, tracking 1.6 million titles across four stages of production. This visibility allows studios to find co-production partners and qualify them based on verifiable deal history, transforming partner discovery from a manual art into a data-driven science.

Find co-production partners in emerging markets:

Moving Forward

The transformation of the world’s biggest movie production companies from legacy studios to data-powered tech giants is complete. This evolution addresses the “data deficit” that previously left executives vulnerable to missed opportunities in a hyper-competitive market.

Whether you are a Strategy Officer identifying acquisition targets or a Content Buyer sourcing regional hits, the principle remains: actionable supply chain intelligence drives deal velocity.

Outlook: Over the next 18 months, expect to see “Authorized AI” become a standard line item in production budgets as studios formalize their visual IP markets.

Frequently Asked Questions

Quick answers to the most common queries about the global production landscape.

Who are the Big Five movie studios?

What is “Weaponized Distribution”?

How does AI affect movie production companies?

About the Author

Atul Phadnis is a media-tech veteran and CEO of Vitrina AI. With over two decades of experience at Gracenote and Sony, he specializes in building data-powered ecosystems for the entertainment supply chain. Connect on Vitrina.