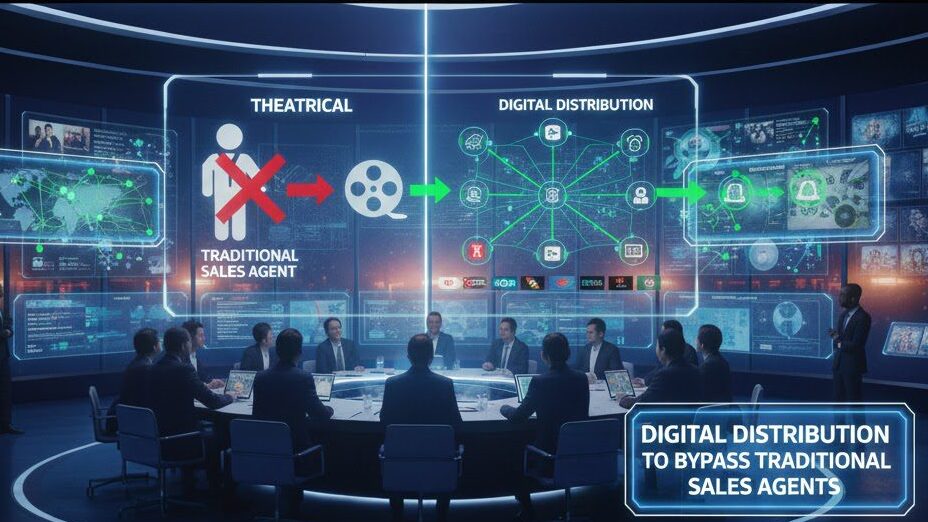

The Aggregator Model: Using Digital Distribution to Bypass Traditional Sales Agents

About This Guide: Digital aggregators serve as technology-enabled intermediaries that connect content creators directly with streaming platforms, VOD services, and digital distributors worldwide. This analysis examines how the aggregator model is transforming independent distribution, drawing insights from Vitrina’s database of digital distribution deals, platform relationships, and aggregator performance data to provide strategic intelligence for producers navigating this evolving landscape.

Understanding the Digital Aggregator Model

Digital aggregators function as technology platforms that streamline the complex process of delivering content to multiple digital distribution channels simultaneously. Unlike traditional sales agents who focus on relationship-based deal-making, aggregators emphasize automated delivery, standardized contracts, and transparent reporting systems.

The model emerged from the proliferation of digital platforms and the need for efficient content delivery systems that could handle hundreds of distribution channels without the overhead of traditional sales operations. Aggregators typically charge flat percentage fees of 10-20% compared to traditional sales agent commissions of 20-35%.

Key advantages include faster time-to-market, transparent reporting, lower costs, and access to platforms that might not work directly with individual producers. However, the model also involves trade-offs in terms of deal customization, relationship management, and strategic positioning.

Digital Aggregator Landscape & Key Players

Major Aggregator Categories:

The digital aggregator market has evolved into distinct segments serving different content types and distribution strategies. Understanding these categories helps producers select optimal partners for their specific needs and objectives.

Premium Aggregators:

Premium services like Filmhub, Distribber, and Quiver Digital offer comprehensive global distribution with enhanced marketing support and platform relationships. These aggregators typically charge 15-25% commissions but provide additional services including metadata optimization, marketing consultation, and performance analytics.

• Filmhub: 200+ platforms, 15% commission, strong international reach

• Distribber: Focus on major platforms, 20% commission, marketing support included

• Quiver Digital: Premium positioning, 25% commission, enhanced platform relationships

• FilmTrack: Technology-focused, 15% commission, advanced analytics dashboard

Volume Aggregators:

High-volume aggregators like Filmless, Seed&Spark, and IndieFlix focus on efficient processing of large content volumes with standardized services and competitive pricing. These services work well for producers prioritizing cost efficiency over customized service.

Specialized Aggregators:

Niche aggregators serve specific content categories or geographic markets. Documentary aggregators, foreign language specialists, and genre-focused services often provide better platform relationships and marketing support for their target segments.

• Documentary Specialists: Enhanced relationships with educational and documentary platforms

• Genre Aggregators: Horror, sci-fi, and other genre-specific platform access

• Regional Specialists: Focus on specific geographic markets with local platform relationships

• Format Specialists: Short-form, series, or specific format expertise

Platform-Owned Aggregators:

Some major platforms operate their own aggregation services, providing direct access while maintaining quality control. These services often offer preferential placement and marketing support but may limit distribution to competing platforms.

Technology-First Aggregators:

Emerging aggregators emphasize advanced technology platforms with AI-driven optimization, automated marketing, and sophisticated analytics. These services appeal to tech-savvy producers seeking data-driven distribution strategies.

Cost-Benefit Analysis vs. Traditional Sales

Commission Structure Comparison:

Traditional sales agents typically charge 20-35% commissions plus expenses, while digital aggregators charge 10-20% flat fees with transparent cost structures. This difference can significantly impact net revenue, particularly for lower-budget independent content.

• Traditional Sales Agent: 25-35% commission plus 5-10% expenses

• Premium Aggregator: 15-25% flat commission, no additional expenses

• Volume Aggregator: 10-15% flat commission, minimal additional costs

• Platform Direct: 0% commission but limited platform access

Speed to Market Analysis:

Aggregators typically deliver content to platforms within 2-6 weeks compared to 3-6 months for traditional sales processes. This acceleration can significantly impact revenue timing and cash flow management.

The faster delivery enables producers to capitalize on marketing momentum, seasonal opportunities, and trending topics that might be missed through slower traditional sales cycles.

Revenue Transparency Benefits:

Digital aggregators provide real-time reporting and transparent revenue accounting compared to traditional sales agents who may provide quarterly or semi-annual statements with limited detail.

• Real-Time Reporting: Daily or weekly revenue updates vs. quarterly statements

• Platform-Specific Data: Detailed performance by platform and territory

• Transparent Accounting: Clear fee structures vs. complex expense allocations

• Audit Access: Direct platform reporting vs. agent-controlled information

Market Access Comparison:

Aggregators often provide access to 100-300+ platforms compared to traditional sales agents who might focus on 20-50 key relationships. However, traditional agents may have stronger relationships with premium platforms and better deal negotiation capabilities.

The breadth of aggregator access can be particularly valuable for niche content that might not interest traditional sales agents or for producers seeking to test multiple platforms simultaneously.

Service Level Differences:

Traditional sales agents provide personalized service, strategic consultation, and relationship management, while aggregators offer standardized, technology-driven services with limited customization.

• Traditional Agent Services: Personal relationships, strategic advice, custom deal negotiation

• Aggregator Services: Automated delivery, standardized contracts, technology platforms

• Support Quality: High-touch vs. self-service with technical support

• Strategic Value: Industry expertise vs. operational efficiency

Total Cost of Ownership:

Comprehensive cost analysis must consider not just commission rates but also time investment, opportunity costs, and additional service requirements. Aggregators often provide better total cost efficiency for independent producers with limited resources.

Platform Access & Revenue Optimization

Global Platform Reach:

Leading aggregators provide access to major global platforms including Netflix (in some regions), Amazon Prime Video, Apple TV+, Google Play, and hundreds of smaller platforms worldwide. This reach enables producers to test multiple markets simultaneously without individual platform negotiations.

Platform access varies significantly between aggregators, with premium services often maintaining relationships with higher-value platforms that may not accept content from volume aggregators.

Revenue Optimization Strategies:

Sophisticated aggregators employ data analytics and AI-driven optimization to maximize revenue across multiple platforms. This includes optimal pricing strategies, release timing, and platform-specific marketing approaches.

• Dynamic Pricing: Automated pricing optimization based on platform performance data

• Release Timing: Strategic timing across platforms to maximize total revenue

• Platform Prioritization: Focus on highest-performing platforms for specific content types

• Geographic Optimization: Territory-specific strategies based on local platform performance

Platform Relationship Quality:

The strength of aggregator-platform relationships significantly affects content placement, marketing support, and revenue potential. Premium aggregators often secure better positioning and promotional opportunities through established relationships.

Some aggregators maintain preferred partner status with major platforms, enabling faster approval processes, enhanced marketing support, and priority placement in platform algorithms.

Performance Analytics and Optimization:

Advanced aggregators provide comprehensive analytics that enable producers to understand audience behavior, optimize content strategy, and improve future distribution decisions. This data-driven approach often yields better results than traditional relationship-based distribution.

• Audience Analytics: Detailed viewer demographics and engagement metrics

• Platform Performance: Revenue and viewership data by platform and territory

• Content Optimization: Insights for improving metadata, artwork, and positioning

• Trend Analysis: Market trends and opportunities for future content development

Niche Platform Access:

Aggregators often provide access to specialized platforms that traditional sales agents might overlook, including educational platforms, genre-specific services, and emerging international platforms. This access can be particularly valuable for documentary, educational, or niche content.

Revenue Diversification:

The multi-platform approach enables revenue diversification that reduces dependence on any single distribution channel. This diversification can provide more stable income streams and reduce market risk compared to traditional exclusive distribution deals.

Technology Advantages & Operational Efficiency

Automated Delivery Systems:

Digital aggregators employ sophisticated technology platforms that automate content delivery, metadata management, and quality control processes. This automation reduces human error, accelerates delivery timelines, and ensures consistent technical standards across platforms.

Modern aggregator platforms can process and deliver content to hundreds of platforms simultaneously, with automated format conversion, subtitle integration, and compliance checking that would require significant manual effort through traditional distribution.

Real-Time Reporting and Analytics:

Technology-enabled reporting provides producers with unprecedented visibility into content performance across multiple platforms and territories. This transparency enables data-driven decision-making and rapid strategy adjustments.

• Live Dashboards: Real-time revenue and performance tracking

• Automated Alerts: Notifications for significant performance changes or opportunities

• Comparative Analysis: Performance comparison across platforms and content

• Predictive Analytics: AI-driven forecasting for revenue and audience growth

Metadata Optimization:

Advanced aggregators use AI and machine learning to optimize content metadata, artwork, and positioning for maximum discoverability across platforms. This optimization can significantly impact content performance without additional marketing investment.

Automated A/B testing of titles, descriptions, and artwork enables continuous optimization based on actual performance data rather than subjective creative decisions.

Quality Control and Compliance:

Automated quality control systems ensure technical compliance across multiple platform requirements, reducing rejection rates and delivery delays. These systems can identify and correct technical issues before content reaches platforms.

Scalability and Efficiency:

Technology platforms enable aggregators to handle large content volumes efficiently, providing cost advantages that translate to lower commission rates and faster processing times for producers.

The scalability of technology-driven operations allows aggregators to serve thousands of producers simultaneously while maintaining consistent service quality and competitive pricing.

Integration Capabilities:

Modern aggregator platforms integrate with production management systems, accounting software, and marketing tools, creating seamless workflows that reduce administrative overhead for producers.

• Production Integration: Direct integration with post-production and delivery systems

• Financial Integration: Automated revenue reporting and accounting system integration

• Marketing Integration: Coordination with social media and marketing automation platforms

• Analytics Integration: Data export capabilities for comprehensive business intelligence

Limitations & Strategic Challenges

Relationship and Negotiation Limitations:

Digital aggregators typically offer standardized contracts and limited negotiation flexibility compared to traditional sales agents who can customize deals based on content quality, market conditions, and strategic relationships.

This standardization can disadvantage premium content that might command better terms through personalized negotiation, while benefiting lower-budget content that might not receive attention from traditional sales agents.

Strategic Positioning Challenges:

Aggregators focus on operational efficiency rather than strategic positioning, potentially missing opportunities for awards campaigns, festival strategies, or premium platform placement that traditional sales agents might pursue.

• Limited Strategic Consultation: Minimal guidance on release strategy and positioning

• Standardized Approach: One-size-fits-all distribution vs. customized strategies

• Reduced Industry Relationships: Less access to key industry decision-makers

• Marketing Limitations: Basic marketing support vs. comprehensive campaign management

Platform Relationship Depth:

While aggregators provide broad platform access, they may lack the deep relationships that traditional sales agents maintain with key platform executives and programming teams. These relationships can be crucial for securing premium placement and marketing support.

Quality Control and Curation:

The high-volume, automated approach of many aggregators can result in platform oversaturation and reduced content discoverability. Traditional sales agents provide curation and selective distribution that may achieve better results for quality content.

Revenue Optimization Limitations:

Standardized revenue splits and limited deal customization may not optimize returns for content with unique characteristics or market positioning opportunities that skilled sales agents could exploit.

Market Intelligence Gaps:

Traditional sales agents provide valuable market intelligence, industry relationships, and strategic advice that aggregators typically don’t offer. This guidance can be particularly valuable for producers developing long-term careers and business strategies.

Platform Algorithm Challenges:

The volume of content distributed through aggregators can make it difficult for individual titles to gain algorithmic visibility on major platforms, potentially reducing discoverability compared to curated traditional distribution.

Limited Recourse and Support:

Aggregators typically provide limited customer support and recourse options compared to traditional sales agents who maintain ongoing relationships and advocacy for their clients’ interests.

Hybrid Strategies & Best Practices

Selective Distribution Approaches:

Sophisticated producers increasingly employ hybrid strategies that combine traditional sales agents for premium territories and platforms with aggregators for secondary markets and digital platforms. This approach optimizes both revenue potential and operational efficiency.

A typical hybrid strategy might involve traditional sales for North America, UK, Germany, and France while using aggregators for smaller territories and digital-first platforms. This combination can increase total revenue by 15-25% while reducing overall distribution costs.

Platform-Specific Strategies:

Different platforms may warrant different distribution approaches based on their business models, content preferences, and relationship requirements. Premium platforms might require traditional sales agent relationships, while volume platforms work well through aggregators.

• Premium Platforms: Traditional sales for Netflix, Amazon Prime, Disney+ deals

• Volume Platforms: Aggregators for Tubi, Pluto TV, and smaller streaming services

• International Platforms: Regional specialists for local streaming services

• Niche Platforms: Specialized aggregators for documentary, educational, or genre platforms

Timing and Sequencing Optimization:

Strategic timing of different distribution approaches can maximize total revenue while maintaining operational efficiency. This might involve traditional sales for initial premium releases followed by aggregator distribution for secondary windows.

Technology Integration Benefits:

Producers can leverage aggregator technology platforms for operational efficiency while maintaining traditional sales relationships for strategic guidance and premium opportunities. This hybrid approach combines the best of both models.

Performance Monitoring and Optimization:

Comprehensive performance tracking across both traditional and aggregator distribution enables continuous optimization of the hybrid approach based on actual results rather than assumptions.

• Revenue Comparison: Track performance across different distribution methods

• Cost Analysis: Monitor total costs including commissions, expenses, and time investment

• Platform Performance: Analyze results by platform type and distribution method

• Strategic Adjustment: Modify approach based on performance data and market changes

Relationship Management:

Successful hybrid strategies require careful relationship management to avoid conflicts between traditional sales agents and aggregators while maximizing the benefits of both approaches.

Future-Proofing Strategies:

The distribution landscape continues evolving rapidly, requiring flexible approaches that can adapt to new platforms, technologies, and market conditions. Hybrid strategies provide the flexibility to adjust distribution methods as the market evolves.

Best Practice Implementation:

• Clear Strategy Definition: Establish clear criteria for when to use each distribution method

• Performance Metrics: Develop comprehensive metrics for evaluating distribution effectiveness

• Regular Review: Conduct quarterly reviews of distribution strategy performance

• Market Intelligence: Stay informed about platform changes and new distribution opportunities

• Professional Advisory: Engage experienced consultants for strategic guidance and optimization

Conclusion

The digital aggregator model represents a fundamental shift in entertainment distribution, democratizing access to global platforms while challenging traditional sales agent relationships. For many independent producers, aggregators offer compelling advantages including lower costs, faster delivery, transparent reporting, and broader platform access.

However, the choice between aggregators and traditional sales agents isn’t binary. The most successful distribution strategies increasingly employ hybrid approaches that leverage the operational efficiency of aggregators while maintaining the strategic value and relationship benefits of traditional sales representation.

The key lies in understanding that different content types, budget levels, and strategic objectives may warrant different distribution approaches. Premium content with significant commercial potential may benefit from traditional sales agent expertise, while volume content and niche productions often achieve better results through aggregator efficiency.

The future belongs to producers who can navigate both traditional and digital distribution channels effectively, leveraging technology for operational efficiency while maintaining strategic relationships for premium opportunities and market intelligence.

Frequently Asked Questions

Digital aggregators typically charge 10-20% flat commissions with no additional expenses, while traditional sales agents charge 20-35% plus expenses of 5-10%. However, traditional agents may achieve higher gross revenues through better platform relationships and deal negotiation, potentially offsetting the higher commission rates.

Most aggregators can deliver content to platforms within 2-6 weeks compared to 3-6 months for traditional sales processes. However, platform approval and live dates depend on individual platform review processes, which can add additional time regardless of distribution method.

Generally no – aggregators focus on operational efficiency and provide basic marketing support like metadata optimization and platform placement. Traditional sales agents offer comprehensive marketing consultation, campaign development, and industry relationship leverage that aggregators typically don’t provide.

Yes, many producers employ hybrid strategies using traditional sales agents for premium territories and platforms while using aggregators for secondary markets and digital platforms. However, this requires careful coordination to avoid conflicts and ensure optimal revenue optimization across all channels.