A data-backed review of 2025’s global production landscape, analyzing the real hits, misses, and IP strategies that defined the year.

Global Production 2025: The “Strategic Efficiency” Pivot

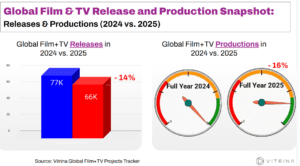

The 2025 global content engine signals a definitive shift from “Volume at Any Cost” to “Strategic Efficiency.” While the broader market undergoes a necessary correction—with Global Releases down 14% and Productions down 16%—the Americas region has successfully decoupled from this trend to become the global outlier, posting a resilient 1% growth in production volume. This stability, however, masks a fundamental restructuring of capital, particularly within the US market: growth is now driven entirely by a 15% surge in Medium and Low-Budget projects, effectively offsetting a parallel 15% contraction in High-Budget commissions. This data confirms a new industry reality where volume is sustained not by tentpole blockbusters, but by a calculated pivot toward cost-efficient, mid-tier IPs that balance the supply chain

Welcome to the Annual edition of Vitrina’s global tracking of Film and TV production trends, providing insights across Movies and Feature Films, TV series, Animations, Documentaries, Scripted, and Unscripted projects.

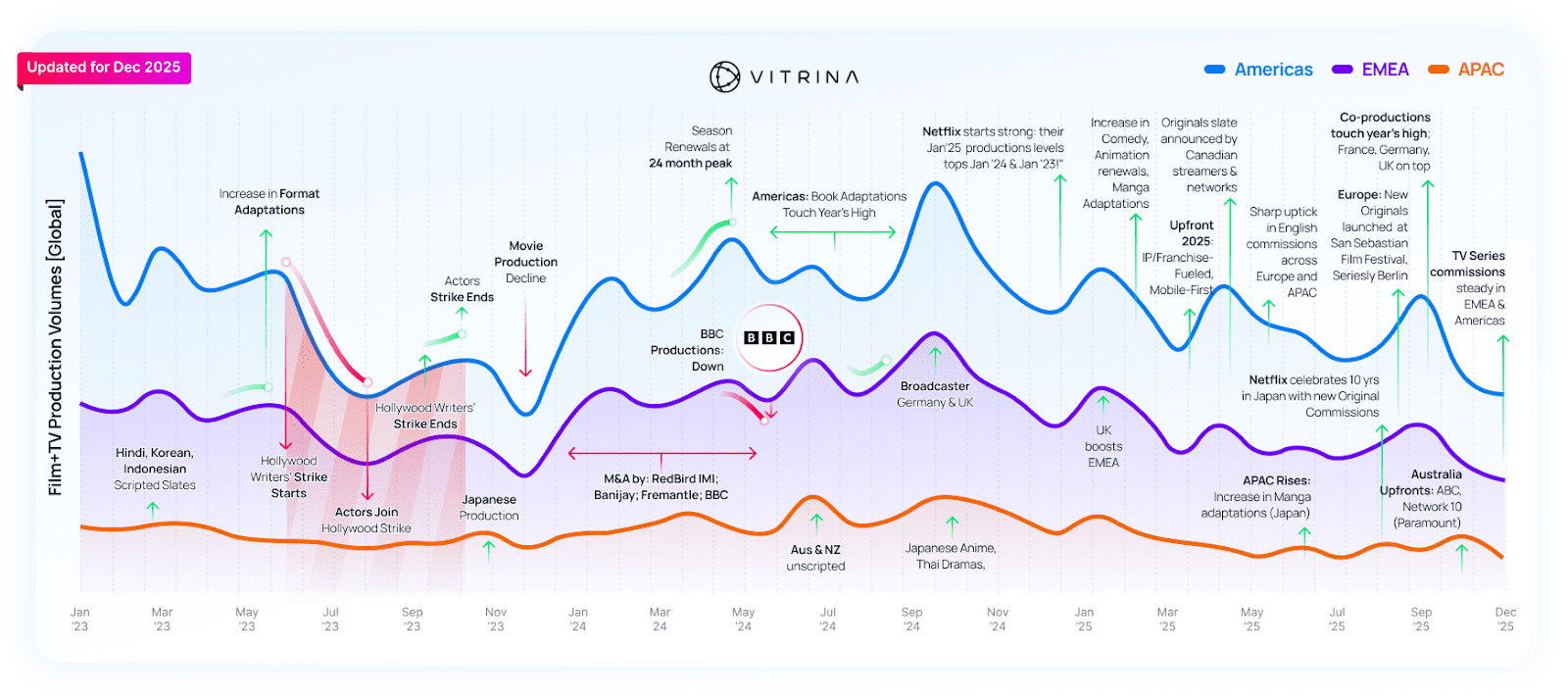

Before we dive into Year 2025 metrics, let’s recap the key Film and TV production trends driving the industry over the last 36 months.