Deal Overview

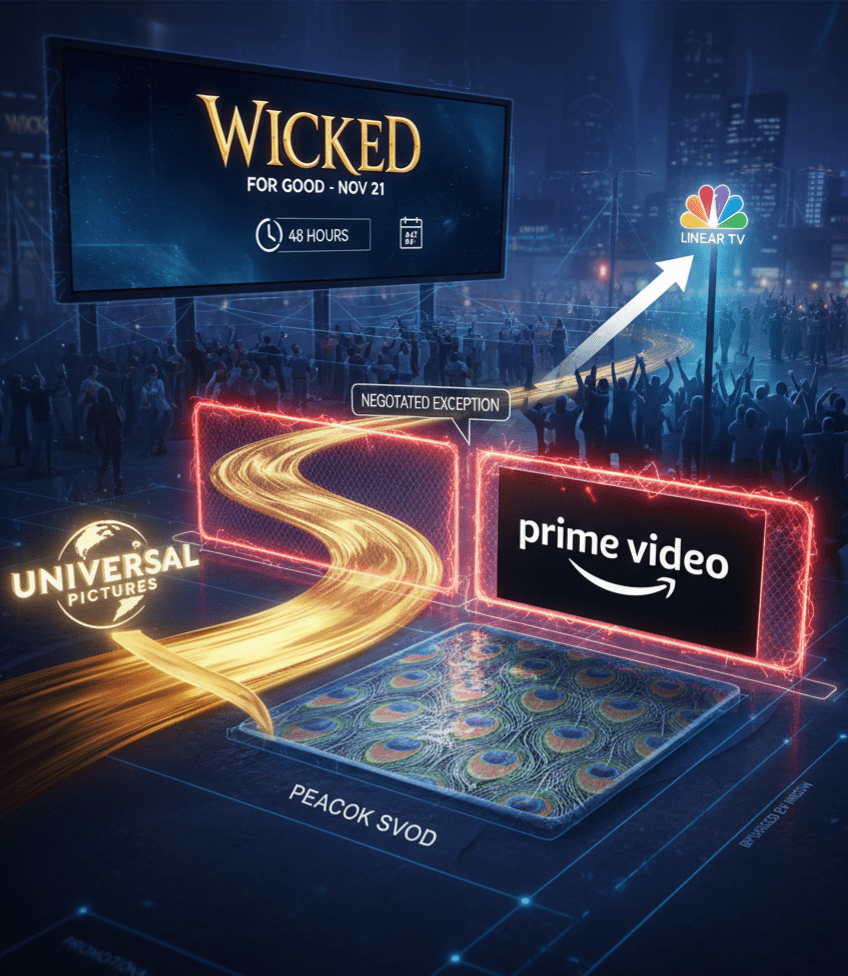

Universal Pictures is executing a highly accelerated internal licensing/carveout deal to broadcast its 2024 film, Wicked, on the NBC linear network. The deal is purely promotional for the theatrical sequel, Wicked: For Good. The film’s windowing utilized a bifurcated Pay-One SVOD model: four months on Peacock, followed by a ten-month exclusive window on Amazon Prime Video. The one-time, exclusive linear broadcast window on NBC (Wednesday, November 19, 2025) required a specific negotiation with Pay-One licensee Amazon to secure the carveout during their exclusive streaming period. This action overrides traditional windowing protocols for a targeted mass-reach event. The scope covers the full-length feature film, and the geography is the United States.

Parties & Dealmakers

This transaction is an advanced demonstration of vertical integration. It was coordinated between Universal Pictures (Content Supplier/Original Distributor) and NBC (Broadcast Network/Platform), both divisions of NBCUniversal. The execution required a key negotiation with the external Pay-One licensee, Amazon Prime Video. The film was produced by Marc Platt and David Stone (Producers). This corporate maneuver, driven by NBCUniversal’s executive-level strategy, prioritizes maximizing the franchise’s theatrical revenue over the scheduled exclusivity of the Pay-One agreement.

Advantages, Uniqueness, Competition

The critical advantage for NBCUniversal is gaining a massive, free promotional vehicle on its owned linear network just 48 hours before the sequel’s theatrical debut. This utilizes NBC’s vast reach to maximize Wicked: For Good‘s opening weekend. Amazon Prime Video benefits from a coordinated marketing campaign; the platform is simultaneously offering exclusive early theatrical screenings of the sequel for Prime members. The transaction is unique because it involves a formal, temporary override of an active, exclusive Pay-One SVOD licensing deal to facilitate an early linear window. The tactic of using a linear broadcast network for streaming/theatrical promotion is precedented (e.g., Paramount airing Tulsa King on CBS). Competitive implications: This move raises the stakes for franchise strategy. Rivals must now consider whether their licensing agreements are robust enough, or if they too need similar carveouts to defend theatrical releases. Expect major studios to proactively write explicit promotional window exceptions into future output deals.

Supply-Chain Impact

The strongest operational impact is the redefinition of the linear broadcast window’s priority. It is no longer just a late-cycle revenue stream; it is now an accelerated, high-impact marketing utility for the most valuable asset (the theatrical franchise). The requirement to negotiate an exemption from Amazon for a single airing confirms the legal and commercial complexity introduced by bifurcated Pay-One windows, but also demonstrates a method for overriding them when vertical synergy requires it. The concurrent use of a second NBC/Peacock special (Wicked: One Wonderful Night) highlights the stacking of owned platforms to mitigate dependence on external partners.

Vitrina Perspective

This coordinated, cross-platform media maneuver establishes a blueprint for future tentpole launches. While the strategy of using pre-release exposure to boost box office is a proven tactic employed historically, the execution here represents a significant evolution. The use of a “super-promo” window just before release will become a standard defensive measure for major sequels. This aggressive, time-sensitive strategy dictates that studio distribution and licensing departments must increasingly view their agreements not as fixed rules, but as fluid, leverage-based tools. Agreements which are rigid and watertight from a legal construct perspective can still be bent a little bit through executive intervention in the case of an urgent tactical opportunity.