Most producers can pitch. Most can package. But when you’re sitting across from a distributor — reviewing a term sheet that locks up your content for the next 15 years — knowing exactly what a content distribution deal gives you, and what it costs you, is the difference between a deal that works and one that quietly bleeds your recoupment for a decade.

Here’s the honest version. A distribution deal isn’t just about getting your film or series seen. It’s a financial structure — one that determines MG levels, P&A responsibilities, territorial splits, holdbacks, and your position in the revenue waterfall. Get those terms wrong and you’ll be watching your project generate revenue you never see. No second-guessing at the table.

This guide covers what content distribution deals are, the main types, how the money flows, which clauses actually matter, and how to find the right partner before your window closes.

Find Distribution Partners Before the Markets Open

VIQI — Vitrina’s AI intelligence engine — surfaces active distributors across 140,000+ companies by territory, genre, and deal type. Used by teams at Netflix, Warner Bros, and Paramount to track acquisition signals before they hit the trades.

No credit card required. 200 free credits.

What a Content Distribution Deal Actually Is

A content distribution deal is a licensing or acquisition agreement between a rights holder — the production company, studio, or independent producer — and a distributor, who gains the right to release, exhibit, or broadcast that content across defined platforms, territories, and time windows.

The distinction that matters: most distribution deals are licenses, not sales. You’re not handing over the IP. You’re granting a distributor the right to exploit specific rights — theatrical, streaming, broadcast, or home entertainment — for a fixed term in a defined territory. The underlying copyright typically stays with you.

But outright acquisitions do happen. Streaming platforms like Netflix and Amazon have moved toward buying content outright in some cases — taking full IP ownership in exchange for a larger upfront payment. That’s a fundamentally different deal, with different implications for backend participation, sequels, and long-term revenue. The real question? Whether the deal structure you’re accepting captures the full value of your content — or hands it to a distributor at a discount you won’t notice until the audit two years later.

Your AI Assistant, Agent, and Analyst for the Business of Entertainment

VIQI AI helps you plan content acquisitions, raise production financing, and find and connect with the right partners worldwide.

- Find active co-producers and financiers for scripted projects

- Find equity and gap financing companies in North America

- Find top film financiers in Europe

- Find production houses that can co-produce or finance unscripted series

- I am looking for production partners for a YA drama set in Brazil

- I am looking for producers with proven track record in mid-budget features

- I am looking for Turkish distributors with successful international sales

- I am looking for OTT platforms actively acquiring finished series for the LATAM region

- I am seeking localization companies offer subtitling services in multiple Asian languages

- I am seeking partners in animation production for children's content

- I am seeking USA based post-production companies with sound facilities

- I am seeking VFX partners to composite background images and AI generated content

- Show me recent drama projects available for pre-buy

- Show me Japanese Anime Distributors

- Show me true-crime buyers from Asia

- Show me documentary pre-buyers

- List the top commissioners at the BBC

- List the post-production and VFX decision-makers at Netflix

- List the development leaders at Sony Pictures

- List the scripted programming heads at HBO

- Who is backing animation projects in Europe right now

- Who is Netflix’s top production partners for Sports Docs

- Who is Commissioning factual content in the NORDICS

- Who is acquiring unscripted formats for the North American market

The 5 Main Types of Content Distribution Deals

Not all distribution deals work the same way. The structure varies depending on platform, territory, and how much of the rights package the distributor wants.

1. Theatrical Distribution Deals

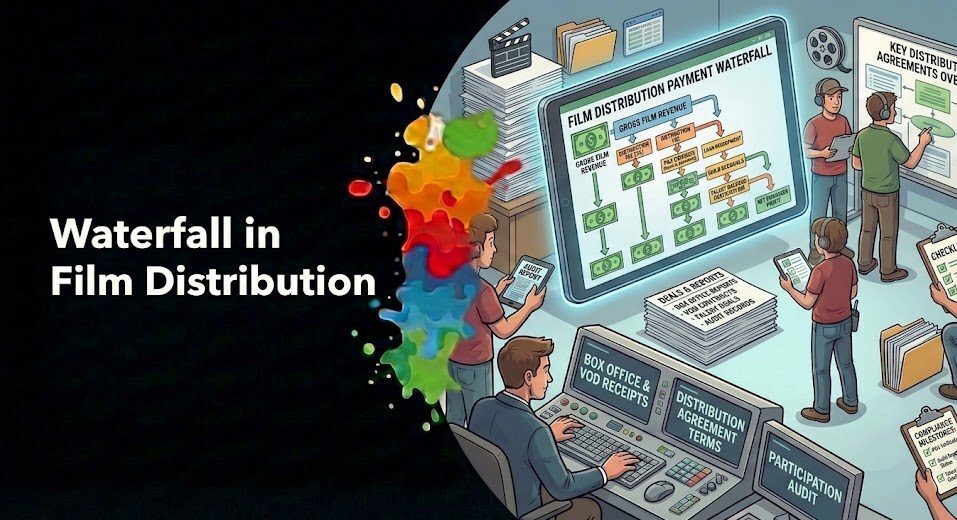

A theatrical distributor handles the physical and digital release into cinemas. They typically take a distribution fee — 30-35% of box office receipts — plus they recoup P&A costs before the producer sees a dollar. These deals cover a fixed theatrical window, typically 45-90 days, before content moves into subsequent windows. Structured correctly, that’s real revenue — but the P&A recoupment position means net profits rarely arrive when producers expect them.

2. Streaming / SVOD Licensing Deals

Netflix, Amazon Prime Video, Apple TV+, and regional platforms license content for defined periods — typically 2-5 years — in exchange for a fixed fee or an advance against royalties. The windowing structure has compressed fast. What used to be an 18-month gap between theatrical and streaming is now often 45 days for major releases. And for some content, it’s simultaneous.

3. Broadcast TV Deals

Free-to-air and pay TV channels license film and series for broadcast rights — usually territory-specific, with exclusivity windows. A single counterparty. An entire regional rights block. Rolla Karam, Senior Vice President of Content Acquisition at OSN, describes their platform as covering 23 countries across MENA simultaneously — meaning one broadcast deal can close a significant portion of a regional rights map in a single negotiation. In markets like the UK, a BBC or Channel 4 license can anchor an entire financing structure.

4. Output Deals

An output deal is a standing agreement where a studio or production company commits to deliver a slate of titles to a distributor over time — and the distributor commits to licensing everything in that slate. NBCUniversal and Sony maintain output deals across multiple territories. These de-risk distribution for the producer but often compress per-title MG values, since the distributor is buying volume, not individual upside.

5. Digital / VOD and AVOD Deals

TVOD, AVOD, and FAST channel deals have grown fast as streaming revenues fragment. As Phil Hunt, founder of Head Gear Films — who has financed 550+ movies since 2002 — has described the post-digital shift, traditional pay-one and pay-two television windows once represented 75% of a film’s total value over its commercial life. That revenue now “dribbles in a few dollars here, a few dollars there.” Smart distribution strategies stack multiple digital windows to reconstruct what the broadcast waterfall used to deliver in fewer, larger payments.

Phil Hunt discusses how the collapse of traditional distribution windows is reshaping independent film economics — and what it means for how you structure deals today:

Phil Hunt (Founder & CEO, Head Gear Films) — “The Big Crunch: Why Film Finance is Harder Than Ever” | Vitrina LeaderSpeak

Track Active Distribution Deals Across 400,000+ Projects

Vitrina gives acquisition teams and producers real-time visibility into who’s buying what — by genre, territory, and platform. Teams at Warner Bros, Paramount, and Google TV use Vitrina to track deal flow and surface acquisition targets before deals are announced.

Get started with 200 free credits. No credit card required.

How the Money Works: MGs, Advances, and Revenue Splits

The financial mechanics of a content distribution deal break down into three core components: the Minimum Guarantee, the distribution fee, and the revenue waterfall.

The Minimum Guarantee (MG) is the upfront commitment a distributor makes to the rights holder — regardless of how the content performs. Structurally, 10% is paid on deal signature and 90% on delivery of the completed film or series. For independent producers, that MG functions as collateral for production financing. Banks typically lend 70-90% of the MG’s face value against confirmed distribution contracts. That’s how presale-backed financing works: you’re building your capital stack on the distributor’s commitment, not the box office. And that distinction matters enormously when you’re closing a gap loan.

The distribution fee — typically 20-35% of gross revenues — is the distributor’s first cut before any recoupment begins. Then P&A costs are recouped. Then the MG itself. Then, if there’s anything left, net profits start flowing toward the producer. That’s the waterfall. Your position in it determines how much of your content’s commercial success you actually capture.

For a full breakdown of how MG terms are negotiated and what fair market value looks like by territory, see our guide to minimum guarantees in distribution deals.

One more thing to factor: standard license terms run 15-20 years for territorial distribution rights. 15-20 years. Think about the streaming environment you’ll be operating in by 2040 — and whether the deal structure you’re signing today will still be working for you. Shorter terms are negotiable, but distributors resist them hard because they need the recoupment runway to justify the MG commitment.

Territorial Rights: Who Gets What, and Where

Territory rights determine which distributor can exploit your content in which geography. Major markets — the US, UK, Germany, France, Japan, and Australia — command premium MG values and are typically sold individually to maximize total guarantee. Mid-tier markets (Spain, South Korea, Scandinavia, Benelux) sit below them. Smaller markets are often bundled into regional packages for efficiency.

The Fragmentation Paradox™ — Vitrina’s framework for how rights get siloed across 600,000+ companies globally — is most acute in distribution. A single film can have 30 different territorial rights holders, each with their own license term, exclusivity window, and payment schedule. 30 distributors. One title. Tracking that across your distribution rights portfolio is operationally intensive and commercially critical.

Sales agents handle territory-by-territory deal-making at markets like Cannes, AFM, and Toronto. Their commission runs 10-15% of total sales, with recoupable expenses typically capped at $50-75K per project. That’s the cost of the infrastructure that actually closes territory deals. For producers who don’t have direct relationships with 30+ territorial distributors, a strong sales agent isn’t optional — it’s the mechanism.

How Streaming Changed the Distribution Deal Structure

The traditional theatrical-to-broadcast-to-home-video waterfall that defined distribution economics for four decades doesn’t hold the same way anymore. Streaming platforms compressed windows, bought content direct, and bypassed distributors in some markets altogether.

Here’s what’s actually happening: streamers like Netflix don’t just license content — they structure deals covering global rights packages, with terms of 2-7 years, and in some cases, full IP acquisition. As Variety has covered extensively, Netflix’s direct licensing approach has shifted how independent producers think about territorial deal sequencing. A single platform commitment can replace 10-15 separate territory negotiations — but at the cost of all future windowing revenue from theatrical, broadcast, and home entertainment.

Sound familiar? It’s the same trade-off every producer making a streaming-first deal faces. According to reporting from Deadline, festival titles going direct to streaming platforms are increasingly structured as global rights deals rather than territory-by-territory sales — which simplifies the deal process but fundamentally changes the backend economics. Neither approach is universally better. It depends on your recoupment timeline, capital stack, and long-term IP strategy.

There’s also a growing category worth understanding: co-distribution structures, where two distributors share rights across territories or platforms. You can see how those work in our breakdown of co-distribution deal structures.

The Key Clauses That Define the Deal

Every content distribution deal has boilerplate. But these six clauses determine whether the economics actually work in your favor — and they’re the ones that get negotiated hard in every serious deal room.

License term: How long the distributor holds rights. Standard is 15-20 years for territorial deals; streaming tends toward 2-5 years. Think carefully before signing a 20-year broadcast deal for a project where your recoupment window is 3 years.

Exclusivity and holdback: Can you sell the same rights to another platform in the same territory? Holdback clauses restrict you from competing with your own distributor — even on a different platform — for a defined period. Why does this matter? Because a 2-year holdback on digital VOD while your theatrical window underperforms is real lost revenue.

P&A commitment: What’s the distributor obligated to spend on marketing and release? Deals without a minimum P&A commitment give you no leverage if they choose to bury your release. That’s not a theoretical risk — it happens regularly on smaller titles.

Audit rights: Your right to independently verify the revenue figures the distributor reports. Without this, you’re trusting their accounting on a 15-year deal. That’s not a position any serious rights holder should accept.

Delivery requirements: The specific technical deliverables — IMF, DCP, subtitle tracks, M&E, metadata — that trigger the 90% MG payment. Miss one spec item and the payment clock doesn’t start. Know exactly what’s required before you sign, not after.

Reversion clauses: Conditions under which rights revert to you if the distributor fails to perform — doesn’t release the film, goes insolvent, or misses distribution benchmarks. Protect yourself here. These clauses are your safety net if the counterparty stops performing mid-term.

For a broader view of how distribution fits into the full financing structure, see our guide on how film and TV financing works.

Structure Your Distribution Strategy with Expert Support

Vitrina’s Concierge team works directly with producers and distributors to map territory opportunities, identify active buyers, and de-risk content deals before negotiations begin. Trusted by teams working with Netflix, Warner Bros, and companies across 140,000+ global entertainment businesses.

No commitment required to start the conversation.

How to Find the Right Distribution Partner

The real dynamic in distribution sourcing is that the best deals don’t get made at markets — they get structured in the months before you arrive. By the time a title is announced in the trades, the deal is usually done.

Strategic players understand this. They’re tracking acquisition signals — which platforms are buying which genres in which territories — 6-8 weeks before markets open. They’re approaching counterparties with data, not cold pitches. And they’re identifying which distributors have gaps in their current slates that your specific content fills.

That’s the practical application of Vitrina’s Smart Pairing intelligence — mapping 140,000+ companies across the global supply chain against 400,000+ active projects to surface distribution matches by genre, territory, and acquisition appetite. It’s how Netflix UK identified production partners in 48 hours through Vitrina. Before your window closes.

The Fragmentation Paradox™ doesn’t disappear. But with the right intelligence layer, you can navigate it without spending 18 months and three markets finding deals that are already looking for you.

The Bottom Line on Content Distribution Deals

A content distribution deal is how your film or series reaches audiences — and how you capture, or lose, the financial value of that reach. The deal type, MG structure, territorial scope, and key clauses all interact in a waterfall that either works for you or doesn’t. Understanding those mechanics before you sign protects your recoupment and your IP for the full term of the agreement.

Key takeaways:

- Distribution deals are typically licenses, not IP sales — the rights holder retains copyright unless it’s a full acquisition structure

- MGs work as production finance collateral: 10% on signature, 90% on delivery, with banks lending 70-90% of face value against confirmed deals

- Distribution fees run 20-35% of gross revenues before the producer recoupment waterfall even begins

- Standard license terms are 15-20 years — negotiate reversion clauses, P&A minimums, and audit rights before signing

- The best distribution partners are found through market intelligence 6-8 weeks ahead of markets, not through cold introductions on the floor

Join 140,000+ Companies Tracking Global Distribution Deals

Vitrina is the intelligence platform for the global film and TV supply chain. Discover active distributors, track project deals, and connect with the right partners — before the markets open. Netflix, Paramount, and Google TV are already on the platform.

Start free. 200 credits. No credit card required.

Frequently Asked Questions About Content Distribution Deals

What is a content distribution deal?

A content distribution deal is a licensing or acquisition agreement that grants a distributor the right to release, broadcast, or stream a film or TV series across defined platforms, territories, and time windows. The rights holder — typically the production company or studio — receives an upfront Minimum Guarantee or revenue share in exchange. Most distribution deals are licenses, not outright IP transfers, meaning the producer retains copyright ownership throughout the term of the agreement.

What’s the difference between a distribution deal and a licensing deal?

Most distribution deals are licensing deals — you’re licensing specific exploitation rights (theatrical, streaming, broadcast) for a defined period and territory. An outright acquisition is different: the buyer purchases the underlying IP itself, not just the right to distribute it. Netflix and Amazon have moved toward full acquisitions for certain content, but the majority of distribution arrangements globally are structured as time-limited licenses where the rights revert to the producer after the term expires.

How does a Minimum Guarantee work in a content distribution deal?

A Minimum Guarantee (MG) is a fixed upfront payment a distributor commits to paying for the right to distribute your content in a specific territory — regardless of how the content performs commercially. The standard payment structure is 10% paid on deal signature and 90% on delivery of the completed film or series. For independent producers, MGs serve as collateral for production financing: banks typically lend 70-90% of the MG’s face value against confirmed distribution contracts. This is the mechanism that makes presale-backed production financing work.

How long do content distribution deals typically last?

Standard license terms run 15-20 years for theatrical and broadcast distribution deals. Streaming deals tend to be shorter — typically 2-5 years per platform cycle — because platforms want renegotiation leverage as viewership data accumulates. For independent productions, 15-year minimum terms are common for territory deals. Shorter terms are negotiable but come with lower MG values, since distributors need the long window to recoup P&A costs and earn their distribution fee across the full commercial life of the content.

What is the typical distribution fee in a content distribution deal?

Distribution fees — the percentage of gross revenues the distributor takes before any recoupment — typically run 20-35%. Theatrical distributors in major markets trend toward 30-35%. Streaming platforms often structure deals as flat license fees with no ongoing revenue share. Sales agents handling territory-by-territory deal-making typically charge 10-15% commission on total sales, with recoupable expenses capped at $50-75K per project. P&A costs are recouped separately, on top of the distribution fee, before net profits flow to the producer.

What territories are most valuable in international content distribution?

Major markets — the US, UK, France, Germany, Japan, and Australia — command premium MG values and are typically sold individually to maximize total guarantee. Mid-tier markets (Spain, South Korea, Scandinavia, Benelux) are often grouped for regional packaging. Genre affects territory value: action and thriller content commands strong international MG premiums, while comedy deals are typically weaker outside domestic markets due to cultural specificity. MENA has emerged as a significant regional block — OSN’s 23-country platform covers the territory through a single distribution relationship.

How has streaming changed content distribution deals?

Streaming has compressed distribution windows, bypassed traditional intermediaries, and in many cases replaced multi-territory deals with single global licensing arrangements. Platforms like Netflix structure deals covering global rights simultaneously — which simplifies the rights map but removes the windowing revenue that once represented 60-75% of a film’s total commercial value. For independent producers, higher upfront streaming fees often come at the cost of all future theatrical, broadcast, and home entertainment exploitation revenue. The trade-off is real capital now versus backend participation later.

How do I find the right distribution partner for my film or series?

The most efficient approach is market intelligence — tracking which distributors are actively acquiring your genre in your target territories and approaching them with data before markets open. Vitrina’s platform covers 140,000+ companies across the global film and TV supply chain, including active distributors mapped by genre, territory, and acquisition signals. Teams using Vitrina have identified qualified distribution partners in 48 hours, reducing the 6-18 month market-attendance cycle typically required to generate equivalent deal flow through traditional methods.