Syndication agencies are no longer mere middlemen; they are critical nodes in a global supply chain that moves 1.6 million titles across 100+ countries.

For Media CXOs, syndication represents the most efficient path to maximizing ROI on library assets through localized licensing and regional windowing.

As the industry shifts toward “Weaponized Distribution,” identifying agencies with verified track records in specific territories has become a competitive necessity.

This guide explores how to leverage vertical AI to eliminate the “data deficit” and partner with syndication experts who can turn regional IP into global phenomena.

While legacy syndication relied on fragmented personal networks, modern acquisition leads are adopting data-powered frameworks to map 600,000+ companies.

We provide a strategic roadmap for navigating agency selection, territorial intelligence, and competitive licensing slates.

Table of Contents

Key Takeaways for Acquisition Leads

-

Global Reach via Specialization: Syndication agencies are essential for accessing fragmented regional markets where direct-to-consumer platforms lack cultural penetration.

-

Weaponized ROI: Licensing “sunk assets” through specialized agencies to rival platforms maximizes content value without impacting core subscriber bases.

-

Data-Driven Vetting: Move beyond personal referrals by using vertical AI to track 30 million relationships and verify an agency’s historical deal success.

The Strategic Rebirth of Syndication Agencies

The entertainment industry is undergoing a structural metamorphosis, moving from an opaque, relationship-driven ecosystem to a centralized, data-powered framework. Syndication agencies, once viewed as secondary sales channels, have emerged as strategic engines for global monetization. In a landscape comprising over 600,000 companies, these agencies act as the “last mile” connectors between premium IP and regional audiences.

Today’s CXOs are re-evaluating syndication not as a one-off sale, but as a recurring revenue discipline. By partnering with specialized agencies, studios can ensure their content finds life on local linear networks, FAST channels, and regional streamers. This approach is fundamental to a borderless market strategy where theatrical release is only the first step in a multi-year value chain.

Find syndication agencies with specific regional expertise:

Bridging the Data Deficit in Agency Sourcing

The primary friction in global distribution is the “fragmentation paradox.” While there are hundreds of thousands of potential partners, the data required to vet them is often trapped in spreadsheets or behind paywalls. This “data deficit” leaves acquisition leads vulnerable to financial risk when entering unfamiliar territories. Traditional networking provides only a surface-level view of an agency’s capabilities.

To solve this, industry leaders are utilizing vertical AI to map the entire entertainment ecosystem. By analyzing verifiable deal histories and reputation scores for 140,000+ companies, CXOs can qualify syndication agencies based on real performance metrics. This transforms partner discovery from a manual, high-risk art into a data-driven science, ensuring that every licensing deal is backed by territorial intelligence.

Analyze the track record of global syndication partners:

Expert Perspective: Financing and Sourcing Global IP

Industry Expert Perspective: Goldfinch’s Strategy for Creative Economies

Kirsty Bell, founder of Goldfinch, discusses bridging the gap between art and enterprise. Her journey highlights the importance of diversified revenue streams and global creative economies—key components of a successful syndication strategy.

Bell explores how disciplined business models can sustain independent filmmaking by leveraging brand integration and global creative economies across the Middle East, Africa, and Asia—territories where syndication agencies play a vital role.

Syndication as a Catalyst for Weaponized Licensing

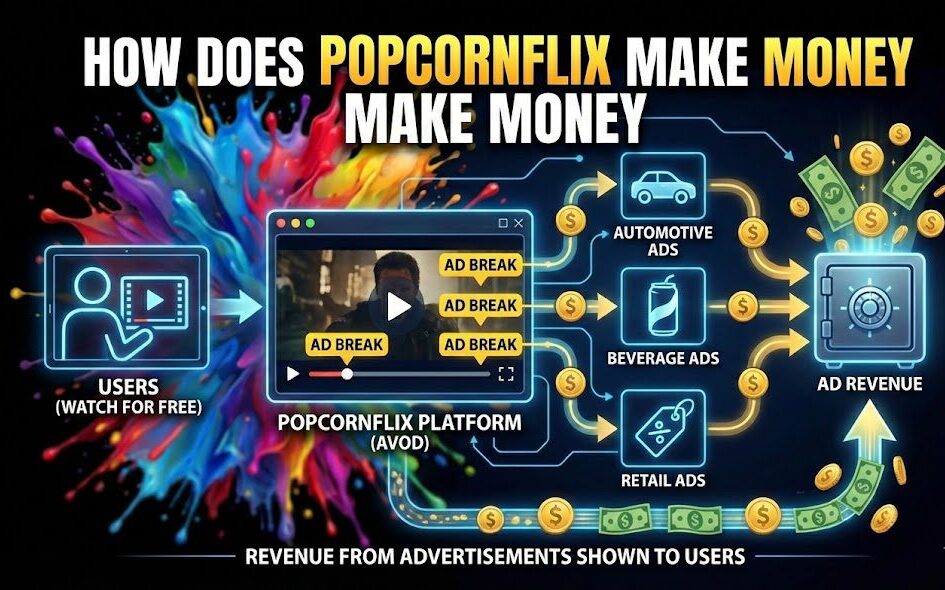

The emergence of “Weaponized Distribution” represents a strategic pivot for major studios. Rather than keeping all content behind a single subscription wall, CXOs are licensing older or non-core assets to rival platforms to drive ROI. Syndication agencies are the primary catalysts for this strategy, as they specialize in negotiating “rotational window” deals that maximize a title’s footprint.

A “weaponized” syndication strategy prioritizes Average Revenue Per User (ARPU) by monetizing library content that has already reached its saturation point on its home platform. For example, licensing a scripted series to a regional streamer in Southeast Asia through a local agency provides immediate cash flow while building a global fanbase for the franchise. This model requires real-time monitoring of competitive slates and licensing trends to identify the best “frenemy” partners.

Access intelligence on competitive licensing slates:

CXO Strategy: The Localized Hub Approach

Major studios like Disney and Warner Bros. Discovery are increasingly using specialized agencies to manage regional hubs. Instead of a centralized global team handling every territory, they utilize agencies that possess deep, verified relationships within specific “hot spots” like Riyadh or Seoul.

Strategic Value: This decentralized model reduces overhead and allows for “precision outreach” to the top 100 high-value targets in a region, helping studios secure pre-sales or co-production deals faster than through traditional sales markets.

Frequently Asked Questions

Essential insights for mastering global content syndication.

What is the role of a syndication agency in 2025?

How do I vet a syndication agency’s reputation?

What is “Weaponized Distribution” in syndication?

How many global distributors and agencies are tracked?

Why is territorial intelligence important?

How can AI help identify “unreleased” project opportunities?

What is a “reputation score” in the entertainment supply chain?

Can I integrate syndication data into my CRM?

Moving Forward

Content distribution is no longer a localized game of handshakes. It is a high-stakes, borderless operation that requires centralized supply chain intelligence to manage 1.6 million titles across 600,000 global companies. Syndication agencies have become the primary vehicles for navigating this complexity, acting as the strategic architects of content ROI.

As you scale your global footprint, the ability to eliminate the “data deficit” and identify verified territorial partners will determine your competitive advantage. Transforming syndication from an opaque sales function into a data-driven science is not just an option—it is the mandate for every Media CXO in 2025.

Outlook: The next 12 months will see a surge in specialized syndication agencies utilizing vertical AI to automate project discovery, making data integration a critical requirement for any global studio.

“The global syndication market is moving from a ‘search-and-find’ model to a ‘predict-and-partner’ model. Companies that leverage vertical AI to map relationships and deal histories are securing territorial hits with 70% higher precision than those relying on legacy networking.”

About the Author

Written by the Vitrina Strategic Intelligence Team, specialized in mapping the global entertainment supply chain. Our analysts provide CXOs with the data needed to bridge the deficit between content creation and worldwide monetization. Connect with us at Vitrina.