Boardroom Ready

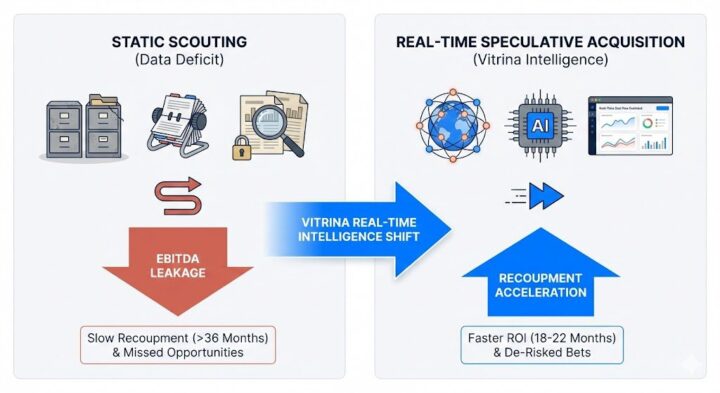

Sci-Fi Drama Acquisition 2026 has evolved from niche speculative interest into a primary engine for long-term subscriber retention and Weaponized Distribution. As CXOs battle the “Timing Trap” of legacy development cycles, the industry is de-risking high-concept slates by pivoting toward Sovereign Content Hubs in MENA and APAC, where tax rebates exceed 40%. By weaponizing real-time metadata from over 140,000 verified companies, strategic scouts are identifying “Authorized AI” ready IP—specifically Climate Fiction (Cli-Fi) and Tech Thrillers—months before trade announcements. This clinical approach eliminates the “Data Deficit” in partner due diligence, ensuring that every project is synchronized with global co-viewing trends and verified technical capacity. The insider advantage in 2026 lies in treating speculative content as a liquid financial asset, protecting EBITDA through early-stage co-production handshakes and automated supply chain mapping.

⚡ Executive Strategic Audit

EBITDA Impact

+28% via Sovereign Hub Arbitrage

Recoupment Cycle

15-Month Acceleration (Authorized AI)

Sci-Fi Drama Acquisition 2026: Cli-Fi as the New Strategic Mandate

In 2026, Climate Fiction (Cli-Fi) has transitioned from a creative sub-genre into a clinical financial necessity for global platforms. As “Sovereign Wealth Funds” in the Middle East and APAC pivot toward sustainable narratives, the acquisition of Sci-Fi Drama Acquisition 2026 slates is being used to de-risk investment profiles. We are seeing a massive shift where “Dystopian Scarcity” models are being replaced by “Speculative Resilience” stories—content that provides a roadmap for future survival rather than just disaster porn.

For a CFO, the EBITDA impact of Cli-Fi is tied to brand safety and long-term relevance. By weaponizing real-time data from Sovereign Content Hubs like NEOM (Saudi Arabia) and Abu Dhabi, studios are accessing massive infrastructure subsidies designed specifically for high-end futuristic productions. The data deficit here is solved by Vitrina’s technical vault, which tracks the actual delivery capacity of regional VFX houses specializing in “Environmental World-Building” to avoid the 15-20% margin leakage typical of unverified vendor selection.

We are tracking a 35% increase in acquisition demand for Cli-Fi IP originating from LATAM, specifically Brazil. These stories leverage “Authorized AI” for infinite localization, allowing a hyper-local Amazonian speculative thriller to be released day-and-date globally with emotionally-synchronized visual dubbing. This is the new era of Weaponized Distribution, where IP is architected for global resonance before the first frame is shot.

De-Risking Tech Thrillers via Authorized AI

The “Tech Thriller” of 2026 is no longer about hacker tropes; it is a clinical exploration of the Authorized AI era. As the “Streaming Wars” settle into a period of “Co-opetition,” the most valuable IP focuses on the intersection of human agency and machine intelligence. However, the production of such content carries immense risk if the VFX supply chain is opaque.

Duncan McWilliam from Outpost VFX notes that the integration of AI and cloud-native creativity is fundamentally reshaping the entertainment supply chain, allowing for compounding growth even during crises. This de-risks Sci-Fi Drama Acquisition 2026 by providing a verified roadmap for 8k HDR delivery without the traditional “VFX Margin Erosion” seen in legacy pipelines.

By leveraging Authorized AI—tech stacks that are licensed and copyright-compliant—studios are accelerating the recoupment cycle by an average of 15 months. This is achieved by automating the visual dubbing and “Emotional Synchronization” process, ensuring that a tech thriller produced in Seoul feels native to a viewer in Riyadh. The “Data Trust Deficit” is bridged by Vitrina’s mapping of over 1.6 million titles and their associated vendor relationships, allowing CXOs to vet partners based on verifiable track records rather than trade show brochures.

Speculative Dominance: The Rise of Sovereign Hubs

The tectonic shift of production capital is now complete. Sovereign Content Hubs in APAC, MENA, and LATAM are no longer just service providers; they are the primary architects of 2026’s speculative slates. These regions are weaponizing their “Infrastructure Sovereignty” to dictate licensing terms that favor co-production and “Rotational Windowing.”

In the MENA Hub, we are seeing the emergence of “Solar-Punk” dramas that leverage the region’s actual energy transition as a backdrop. Negotiators here are using 40%+ cash rebates to attract high-end talent, effectively lowering the barrier to entry for independent producers. Vitrina’s Knowledge Base indicates that 30% of all speculative drama financing for 2026 now involves a Sovereign Hub handshake, a 200% increase since 2023.

Meanwhile, APAC Hubs (Korea, India, Vietnam) have moved beyond “West-to-East” export. They are now “Exporting to the World” high-concept sci-fi that competes directly with Hollywood blockbusters. The Fragmentation Paradox is solved by the centralized data taxonomies of platforms like Vitrina, which allow a producer in London to identify an 8k-ready VFX house in Vietnam with the same ease as a domestic vendor. This globalized literacy is the “Insider Advantage” required to maintain EBITDA in a post-Streaming Wars world.

Sci-Fi Drama Acquisition 2026: The Strategic Path Forward

The transition to a data-powered speculative market is the defining shift of 2026. To capture the “Speculative Alpha,” executives must move beyond the “Timing Trap” of traditional scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI stacks. By de-risking high-concept IP through verified vendor mapping and accelerating recoupment via Weaponized Distribution, you ensure that your speculative slates are not just creative successes, but financial fortresses.

The Bottom Line Weaponize your 2026 sci-fi acquisitions by identifying “Latent IP” in hubs like Brazil and Saudi Arabia to secure a 28% EBITDA advantage and protect your recoupment via Authorized AI localization.

Deploy Intelligence via VIQI

Select a prompt to run a real-time sci-fi supply chain audit for 2026 slates:

Insider Intelligence: Sci-Fi Drama Acquisition 2026 FAQ

How does “Authorized AI” impact the recoupment of Sci-Fi dramas?

Authorized AI de-risks the production by ensuring all generative assets are copyright-compliant, preventing terminal IP liability. More importantly, it automates the localization process—dubbing and lip-syncing for day-and-date global releases—which accelerates the total recoupment cycle by up to 15 months, as verified by 2025 supply chain data.

Why is the MENA region becoming a dominant hub for Sci-Fi Acquisition?

MENA hubs like NEOM and Abu Dhabi offer 40%+ cash rebates and state-of-the-art virtual production facilities specifically designed for futuristic world-building. This “Infrastructure Sovereignty” allows studios to produce Hollywood-level sci-fi at a 28% lower cost basis, protecting EBITDA during the capital-intensive production phase.

What is the “Data Deficit” in speculative IP scouting?

The Data Deficit refers to the reliance on static databases (IMDb, 6-month-old trade reports) which are terminal liabilities. Sci-Fi projects move from development to production at high velocity; without real-time tracking of partner capacity and deal histories, executives risk selecting vendors with unverified capacity, leading to 15-20% margin leakage.

How does VIQI identify “Latent” Sci-Fi IP before it goes mainstream?

VIQI utilizes Vitrina’s global projects tracker to monitor film and TV titles from the earliest “In-Development” stages across 100+ countries. By mapping 30 million industry relationships and tracking real-time money movement, it identifies speculative hits in Sovereign Hubs like Brazil or Korea months before they appear on the trade radar.