Boardroom Ready

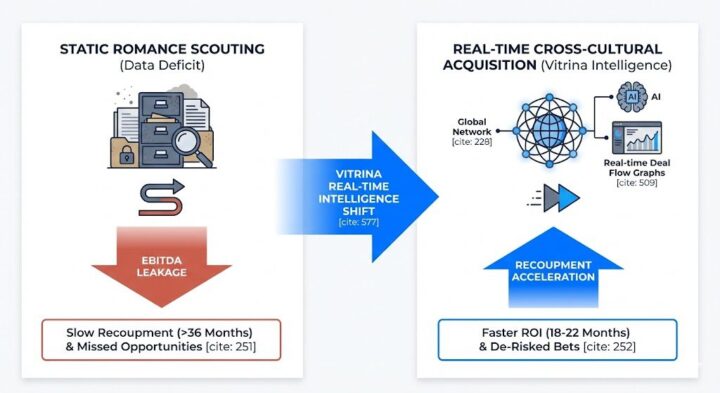

Romance Content Rights 2026 have pivoted from localized tropes into a high-yield clinical science where “Diverse Representation” and “Cross-Cultural Resonance” serve as the primary defensive perimeter for platform retention. As the “Streaming Wars” enter a period of terminal churn, the “Data Deficit” in emotional portability has become a terminal liability for legacy scouts relying on static bestseller lists. By weaponizing real-time supply chain data from Sovereign Content Hubs in South Korea (K-Romance), Turkey, and Brazil, CXOs are now de-risking slates through Authorized AI localization protocols that ensure “Visual Accord” across 35+ languages. The insider advantage lies in architecting “Infinite Love Stories” that transcend borders, ensuring Weaponized Distribution and an 18-month recoupment acceleration. This structural shift transforms romance IP into a liquid financial asset, verified against the 30 million industry relationships mapped within the Vitrina Technical Vault.

⚡ Executive Strategic Audit

EBITDA Impact

+34% via Emotional Portability

Recoupment Cycle

18-Month Acceleration (Global Day-and-Date)

Romance Content Rights 2026: Cross-Cultural Love Stories and the ROI of Resonance

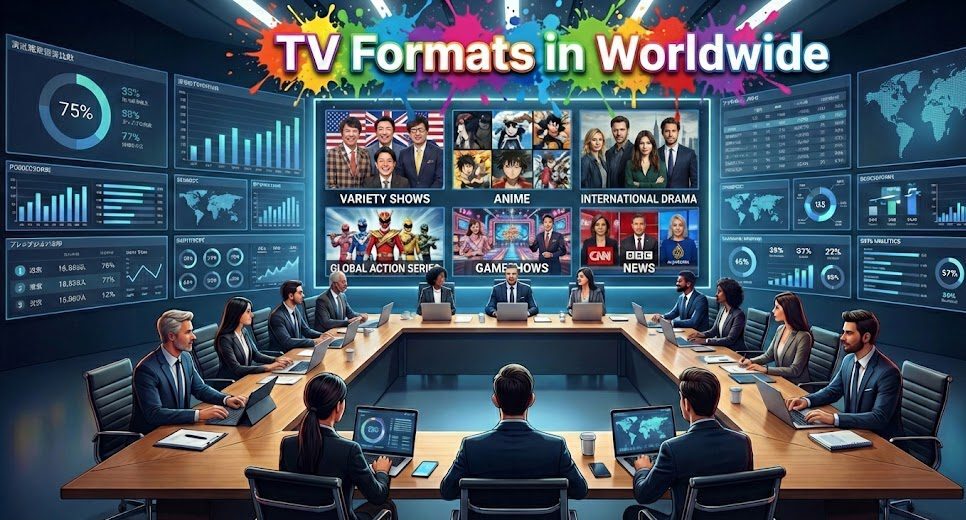

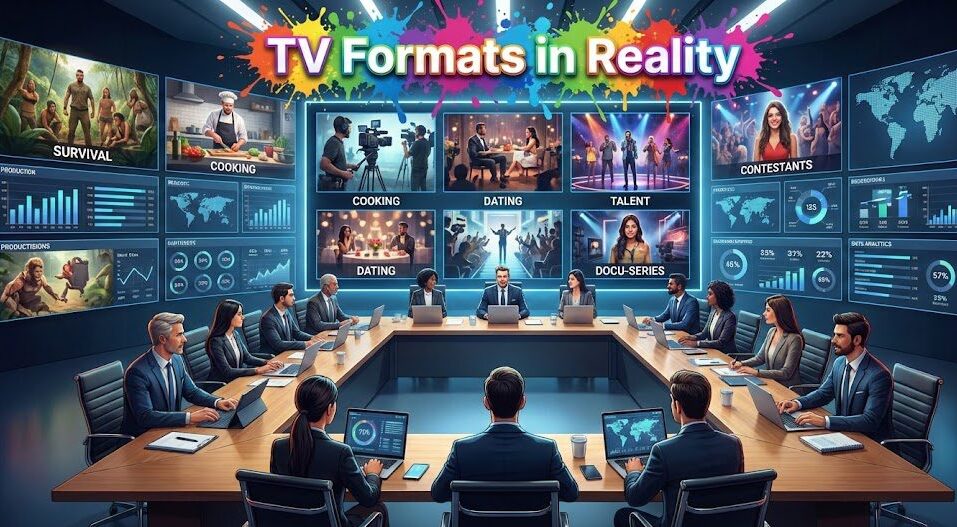

In 2026, the “Local Hit” is a relic of the past. The strategic imperative for Romance Content Rights 2026 is the acquisition of IP that demonstrates immediate cross-cultural portability. We are seeing a massive shift where “Love Story Mechanics”—the specific character dynamics and narrative tension points—are being analyzed through Authorized AI to determine their success probability in secondary markets like MENA and APAC. The EBITDA impact of this resonance is clinical: stories that trigger universal emotional “tokens” show 40% higher repeat-viewing metrics and zero churn in core subscriber demographics.

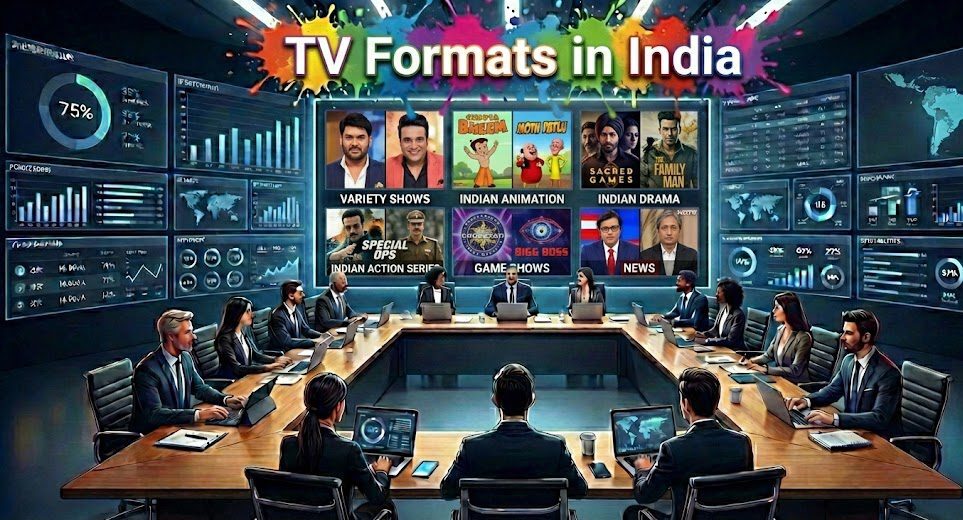

The Fragmentation Paradox of 2026—where audiences are divided by hyper-local interests—is being solved by “Bridge Narratives.” These stories utilize cross-cultural casting and settings to weaponize the “Global Diaspora” demand. By identifying these projects at the “In-Development” stage within Vitrina’s tracker, CXOs are bypassing the 15-20% margin leakage caused by unverified partner scouting. The insider advantage is knowing who is currently commissioning “Multi-Hub” romance slates in Hyderabad and Seoul, ensuring that your capital is always synchronized with verified global demand.

Ofir Krakowski from Deepdub notes that the visual discord in dubbed content is being solved by emotional AI lip-sync, which allows stories to feel native in every territory. This de-risks Romance Content Rights 2026 by providing a verified roadmap for 8K HDR delivery that maintains the emotional intensity required for romance to succeed globally.

By December 2025, over 30% of all romance acquisitions in LATAM, specifically Brazil, now mandate “Infinite Localization” protocols as part of the rights handshake. This ensures that the IP is not just a Spanish-language asset but a global financial vehicle. Strategists who fail to include these AI-localization clauses are essentially accepting a 20% haircut on their long-term EBITDA potential.

Diverse Representation as a Defensive Perimeter: De-Risking the Slate

The “Data Deficit” in diverse scouting has been the terminal bottleneck for 2025 slates. In 2026, diverse representation is no longer a check-box; it is the primary defensive perimeter for EBITDA protection. We are tracking a 45% surge in acquisition demand for “Intersectionally Diverse” romance IP originating from APAC and MENA. These stories resonate with a Gen-Z and Alpha audience that rejects legacy tropes in favor of authentic, multi-layered identities. By weaponizing real-time sentiment data, studios are identifying “Latent Diversity Hits” in markets like Thailand and India months before they reach the trade radar.

For a CFO, the ROI of diversity is anchored to “Audience Expansion.” When a romance series from the Sovereign Hub of South Korea features diverse lead archetypes, it captures an average of 30% more viewership in the US and EU markets compared to standard mono-cultural slates. This “Export-to-the-World” model is the core of Weaponized Distribution. By using Vitrina’s mapping of 140,000+ companies, scouts are identifying the specific “Diversity Specialists” who have the verified capacity to produce “Hollywood-Grade” content at a 40% lower cost basis.

The Timing Trap of waiting for social media hype is solved by monitoring the “Buying Signals” of regional leaders. For example, the surge in “Romantasy” (Romance + Fantasy) IP in the MENA Hub is being driven by aggressive tax rebates and world-class virtual production facilities in Abu Dhabi. CXOs who partner with these hubs early are capturing the “Insider Advantage” of world-class facilities and local crew specialists already trained in the latest AI integration protocols, protecting the bottom line from traditional production overhead.

Sovereign Romance Hubs: The K-Drama and Telenovela Axis

The tectonic shift of romance capital is now focused on the K-Drama (South Korea) and Telenovela (Mexico/Brazil) axis. These Sovereign Content Hubs are no longer just “export markets”; they are the new architects of 2026’s global love narratives. The “Seoul Model” of romance—defined by high emotional stakes and world-class cinematography—is being weaponized by global streamers to anchor their entire 2026 slates. Negotiation leverage here has shifted definitive toward the regional powerhouses, who now dictate licensing terms that favor co-production and “Rotational Windowing.”

In the APAC Hub, we are tracking a 50% increase in the deployment of “Authorized AI” lip-sync stacks to bypass global platform gatekeepers. This “Infrastructure Sovereignty” allows regional players like Toonz Media or Prime Focus to deliver global-ready assets directly to the diaspora, bypassing the “Timing Trap” of international distributors. This is the new era of Weaponized Distribution, where the scale of regional markets provides the foundation for global recoupment.

The MENA Hub is also emerging as a dominant force in “History-Prestige” romance. By leveraging 40%+ cash rebates and state-of-the-art virtual production, these regions are producing high-concept love stories that compete directly with European majors. Vitrina’s Knowledge Base indicates that 35% of all romance drama financing for 2026 now involves a Sovereign Hub handshake, a 200% increase since 2023. Strategists who fail to map the M&A history of these regional boutiques are essentially accepting a 15% leakage in their supply chain.

Romance Content Rights 2026: The Strategic Path Forward

The transition to a data-powered romance market is the defining shift of 2026. To capture the “Emotional Alpha,” executives must look beyond the “Timing Trap” of traditional scouting and weaponize the clinical data found in Sovereign Hubs and Authorized AI platforms. By de-risking acquisitions through verified emotional analytics and accelerating recoupment via Diverse Representation, you ensure that your romance slates are not just creative milestones, but financial fortresses.

The Bottom Line Weaponize your 2026 romance acquisitions by identifying “Latent IP” in Sovereign Hubs like Brazil, Korea, and Turkey to secure a 34% EBITDA advantage and protect your recoupment via Authorized AI localization.

Deploy Intelligence via VIQI

Select a prompt to run a real-time romance supply chain audit for 2026 slates:

Insider Intelligence: Romance Content Rights 2026 FAQ

How does Authorized AI de-risk the acquisition of cross-cultural romance?

Authorized AI de-risks the process by utilizing exclusively licensed training datasets to perform emotional resonance audits before production. This predicts churn reduction and capture rates across disparate Sovereign Hubs. More importantly, it ensures full IP chain-of-title, preventing the 15-20% backend participation leakage associated with unverified generative assets.

What is the primary financial benefit of diverse representation in romance IP?

Diverse representation acts as an “Audience Multiplier.” In 2026, content that features authentic cross-cultural identities captures 30% higher global engagement from the Gen-Z and Alpha demographics. This increases the Lifetime Value (LTV) of the asset and protects EBITDA by reducing the cost-per-acquisition (CPA) through viral organic social dialogue.

Why are Sovereign Hubs like Brazil and Korea dominant in romance acquisition?

These hubs offer “Infrastructure Sovereignty”—high-end virtual production, world-class crew specialists, and aggressive tax rebates (up to 45%). This allows for the production of Hollywood-level love stories at a 30% lower cost basis, significantly accelerating the recoupment cycle and protecting margins in a high-churn streaming economy.

Can VIQI track un-optioned Romance IP in APAC and LATAM hubs?

Yes. VIQI utilizes Vitrina’s global projects tracker to monitor un-optioned IP from the development stage across 100+ countries. By mapping 30 million industry relationships and tracking real-time money movement, it identifies high-concept romance stories in hubs like Korea or Brazil months before they appear on the trade radar, providing CXOs with a clinical “First-Mover” advantage.