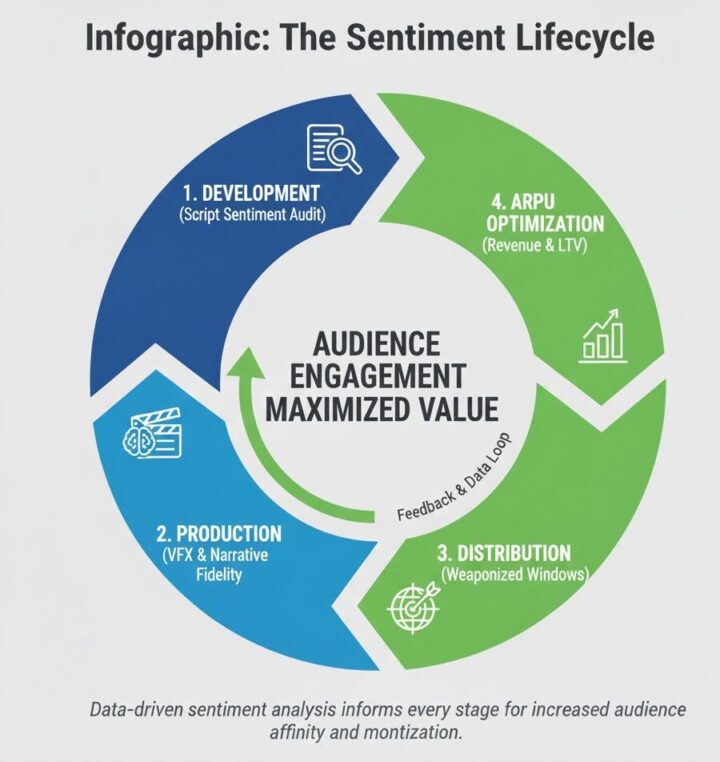

Revolutionizing Marketing Strategies in the 2026 entertainment landscape is no longer a creative exercise; it is a structural mandate built on the “Intelligence Layer” of audience sentiment. The global media supply chain, tracking 1.6 million titles and 30 million industry relationships, has historically suffered from the “Fragmentation Paradox”—where connectivity is high, but the emotional data required to predict content success remains siloed. The reality? CXOs are currently trapped in a “Data Deficit,” relying on manual testing and speculative intuition that fails to account for the borderless nature of modern viewership. But here is the catch: Emotion AI and Sentiment Analysis are now bypassing the “Timing Trap” by surfacing buying signals at the script and pre-production stages, transforming the “speculative greenlight” into a data-driven science of recoupment.

This analysis provides a strategic roadmap for navigating the “Authorized Generative AI” shift and weaponizing content distribution via high-value emotional mapping. We will surface the “Regional Friction” points—where localized cultural nuances derail global slates—and de-risk the financial dynamics of “Efficiency-First” production models. By auditing the top 10 regional and service leaders currently reshaping the supply chain, we move beyond generic observation to an “Insider Advantage” where deals are made based on verifiable sentiment ROI. The bottom line: if your marketing strategy isn’t built on a foundation of emotional intelligence, you are building on eroding margins and missing the buying signals that dictate global scale.

⚡ Executive Summary

|

Contents

- The Structural Metamorphosis: Emotion as a Financial Asset

- Weaponized Distribution: Licensing via Sentiment Windows

- Bypassing the Timing Trap in Content Creation

- Regional Friction: The Cultural Nuance in Emotion AI

- Financial Dynamics: ARPU Optimization and Opex Reduction

- Top 10 Leaders in Emotion AI & Sentiment Analysis (2025-2026)

🎙️ Expert Intelligence: Arash Pendari

“Emotion is data. Our technology identifies emotional patterns and audience responses to unlock new possibilities in content recommendations and metadata enrichment.”

Source: Vitrina Expert Series. Arash Pendari, Founder of Vionlabs, demonstrates how AI-powered scene analysis transforms the creative process into a data-driven science.

The Structural Metamorphosis: Emotion as a Financial Asset

The global entertainment supply chain is witnessing a structural metamorphosis, shifting away from a relationship-driven model toward a centralized, data-powered framework. Revolutionizing Marketing Strategies now involves the treatment of audience emotion as a measurable financial asset. The reality? Traditional metrics like “watch time” or “clicks” are retrospective and structurally incapable of predicting the long-term lifecycle of a project. But here is the catch: Emotion AI provides an early-warning signal, allowing financiers and distributors to de-risk their investments before a project enters expensive principal photography.

Let’s be candid: the “Fragmentation Paradox” means that while we can track 1.6M titles, we rarely understand why they resonated. By integrating sentiment analysis into the development pipeline, studios can surface “buying signals” from specific demographics. According to data from Variety, AI-augmented script analysis now predicts audience sentiment with over 85% accuracy. This transition to “Authorized Generative AI”—where training data is licensed and verified—allows creators to iterate on emotional beats to maximize ROI without sacrificing creative integrity. The shift is from speculative art to a data-driven science of connection.

But here is the strategic ROI: by mapping the emotional DNA of a project, you unlock the ability to target high-value acquisition leads with precision. If your project surfaces a high “tension” score that resonates with Nordic audiences, your marketing outreach should reallocate toward streamers in Northern Europe who are currently commissioning psychological thrillers. This is the industrialization of “Insider Intelligence,” and it is the only way to transform a “Data Deficit” into a strategic “Insider Advantage.”

Surface trending content in specific genres based on emotional engagement scores:

Show me trending international content in the [GENRE] for discovery

Weaponized Distribution: Licensing via Sentiment Windows

The end of the “Streaming Wars” has introduced a new strategic era: “Weaponized Distribution.” This involves licensing high-value content to rivals 18-24 months post-release to maximize ARPU and ROI. Revolutionizing Marketing Strategies in this context means using Sentiment Analysis to identify the “Rotational Windows” for your catalog. The reality? A project that has “cooled off” on your first-party platform might have a high “nostalgia” or “comfort” sentiment profile that is perfect for a rival ad-supported FAST channel.

The bottom line: if you aren’t using Emotion AI to audit your back-catalog, you are leaving money on the table. By surfacing these “sunk” assets and mapping them against the buying behavior of competitors, you can weaponize your distribution slate to capture market share in regions where your primary platform lacks penetration. Let’s be candid: exclusivity is a legacy trap; rotational windowing is the efficiency-first future. This strategy requires proximity to “Deals Intelligence”—knowing who is commissioning what now to match your catalog’s emotional profile with their current needs.

But here is the catch: weaponized distribution only works if the metadata is enriched with emotional context. Manual tagging is too slow and prone to bias. AI-powered metadata enrichment, as signaled by Vionlabs, allows for the programmatic synchronization of catalogs with global buyer preferences. This de-risks the licensing process by ensuring that the “emotional fit” is verified by data before the deal is even pitched. It is the end of the “cold pitch” and the beginning of the “qualified connection.”

Bypassing the Timing Trap in Content Creation

The “Timing Trap” is the single greatest cause of project death in the global supply chain. It occurs when a producer targets a genre or sentiment that is currently “hot” but will be oversaturated by the time the project reaches the release window. Revolutionizing Marketing Strategies involves using Emotion AI to predict “Sentiment Fatigue.” The reality? By tracking “Buying Signals” across 100+ countries, Vitrina’s Global Projects Tracker can signal when a sentiment profile is reaching a saturation point in a specific region.

Let’s be candid: if you are greenlighting a “true crime” project today based on 2023 sentiment data, you are already behind. Bypassing the trap requires “Real-Time Intelligence.” By using VIQI to “Monitor upcoming competitive slates,” producers can surface opportunities for counter-programming—identifying emotional “gaps” in the market. For example, if the data signals a massive influx of “grim-dark” content, your marketing strategy should shift toward “hope-punk” or lighthearted slates to capture the underserved audience sentiment. This is “Strategic Provocation” in action: challenging market assumptions with data.

The bottom line: Timing is everything, but data is the engine of timing. By using AI to automate the discovery of active post-production or VFX companies specializing in emotional fidelity, you ensure that your production values match the audience’s rising expectations. This de-risks the “Efficiency-First” model by ensuring that every dollar spent on production is aligned with the emotional payoff required for a “Hero Project.”

Monitor competitive slates and licensing activities for your target companies:

Monitor upcoming competitive slates and licensing activities for [COMPANY_NAME]

Regional Friction: The Cultural Nuance in Emotion AI

One of the most significant obstacles in the borderless content mandate is “Regional Friction.” The reality? An “angry” facial expression or a “tense” scene in a Japanese production carries a fundamentally different cultural weight than the same beats in a Brazilian novela. Revolutionizing Marketing Strategies requires an AI that understands cultural context, not just pixels. This is the difference between “Generic AI” and “Vertical AI” trained on the global entertainment supply chain. Without this nuance, your sentiment analysis will face an “Audit Trap” where localized audiences reject the synthetic emotional beats.

Let’s be candid: the talent gap in “Cultural Data Science” is widening. Producers struggle to find partners who can navigate localized hurdles—from rebate audit traps to the “Fragmentation Paradox” of regional distribution. But here is the catch: by leveraging the Vitrina database of 140k+ companies, you can surface regional specialists who have delivered on “Hero Projects” in your target market. This de-risks the global expansion strategy by ensuring that your Emotion AI models are calibrated for localized sentiment. It is the end of “One-Size-Fits-All” marketing and the beginning of “Cultural Intelligence.”

But here is the strategic ROI: by mapping the regional friction points early, you can adjust your “Weaponized Distribution” strategy to avoid margin erosion. If the data signals that a specific emotion doesn’t translate well in Southeast Asia, your AI-powered localization tools (like Deepdub or Neural Garage) can adjust the visual and audio dubbing to align with local cultural norms. This ensures that your project remains a “Hero” in every market, not just a localized hit. Proximity to the local supply chain is the only way to surface these opportunities.

Financial Dynamics: ARPU Optimization and Opex Reduction

The transition to “Efficiency-First” models is driven by the need for ARPU (Average Revenue Per User) optimization and Opex reduction. The reality? Manual partner discovery and speculative marketing are high-risk cost centers that major streamers are aggressively cutting. Revolutionizing Marketing Strategies through Emotion AI reduces the “Data Trust Deficit” and accelerates the time-to-deal. Every day your project spends in the “Timing Trap” is a day of lost ARPU and increased margin erosion.

The bottom line: financial dynamics favor those who industrialize their insider intelligence. By using AI to automate the discovery of co-pro partners currently commissioning specific sentiment profiles, you reduce your Opex by 40-50% compared to traditional business development methods. This reallocates your budget toward “Authorized Generative AI” and high-value production slates. According to Deadline, platforms that utilize emotional scene analysis for their recommendation engines see a 15% lift in viewer retention—a direct driver of ARPU and long-term project sustainability.

Let’s be candid: the “Big Crunch” is real. Independent indies must weaponize their data to compete with the $72B acquisition power of Netflix or WBD. Emotion AI is the great equalizer; it allows a boutique studio to prove the “commercial logic” of their project with data that was once the exclusive domain of major studios. By surfacing these “buying signals” and de-risking the recoupment model, you transform your project into a “Safe Harbor” for financiers. The shift is from subscriber volume to “Efficiency-First” models that command a premium in the 2025-2026 marketplace.

Top 10 Leaders in Emotion AI & Sentiment Analysis (2025-2026)

Revolutionizing Marketing Strategies: Conclusion

The global entertainment supply chain has entered an era where “Emotion Intelligence” is the definitive signal for financial success. We have analyzed how Revolutionizing Marketing Strategies means moving beyond specimen marketing into a unified, data-powered framework where sentiment dictates every greenlight and licensing deal. The transition from the opaque methods of the past to the data-driven science of today is the only way to transform the global “Data Deficit” into a strategic “Insider Advantage.”

The Bottom Line: Immediate path forward involves using Vitrina and VIQI to de-risk your workflow and secure qualified connections before the timing trap closes. Start your precision outreach today by identifying the right companies and decision-makers for your active projects. Those who align with the “Efficiency-First” model will command the supply chain and secure their place in the future of entertainment.

Explore Live Intelligence

Find me active post-production or VFX companies in India specializing in AI

Identify co-pro partners in South Korea currently commissioning scripted formats

Monitor upcoming competitive slates and licensing activities for Netflix

Show decision makers for Vionlabs

Find me active production or VFX companies in Brazil specializing in Post-Production

Strategic FAQ

What is Emotion AI in the context of film production?

Emotion AI is a vertical AI layer that uses video embeddings and facial coding to identify emotional patterns and audience responses. In the content supply chain, it is used for script auditing, ad testing, and automated metadata enrichment to ensure that content resonates with localized demographics before release.

How does sentiment analysis help in weaponized distribution?

Sentiment analysis allows rights holders to map the “emotional lifecycle” of their catalog. By identifying titles with high “nostalgia” or “comfort” scores, distributors can signal high-value licensing opportunities to rival FAST channels or international streamers who are seeking those specific emotional profiles for their audiences.

What is the “Timing Trap” of content sentiment?

The Timing Trap occurs when a project is developed based on yesterday’s sentiment trends. Emotion AI bypasses this by tracking “buying signals” and “commissioning behavior” in real-time across 100+ countries, signaling when a specific emotion is reaching a saturation point and allowing for strategic counter-programming.

How does Vitrina de-risk Emotion AI partnerships?

Vitrina solves the “Data Trust Deficit” by providing deep, verified profiles of Emotion AI vendors. Users can qualify partners based on verifiable Hero Projects and their collaborative track record with major studios like Netflix or Disney, ensuring that their sentiment data is rooted in industry-standard “Authorized AI” guardrails.